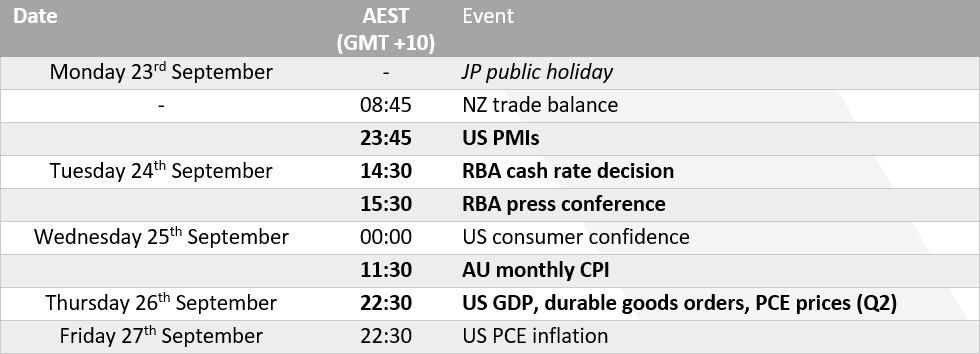

The RBA are likely to hold their cash rate at 4.35% on Tuesday. We will of course look for any clues that the RBA have removed their hawkish bias. But given their August minutes highlighted that the cash rate seemed likely to remain elevated compared with market pricing, they seem likely to sound dovish given market pricing is more dovish than it was a month ago. Markets have fully priced in four 25bp cuts by July, which seems far-fetched given the relatively high levels of inflation and decent employment figures in place. With that said, the monthly inflation report is also out on Wednesday, which the RBA are likely to want to see before unveiling a dovish pivot.

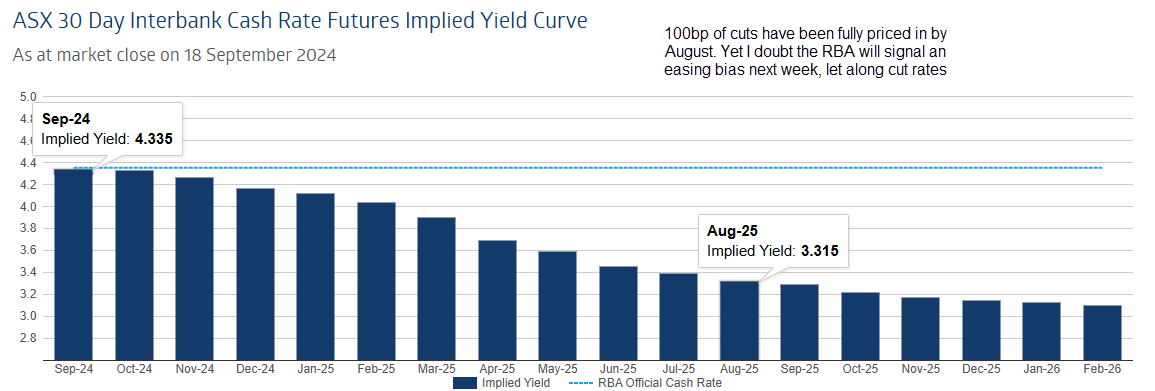

US flash PMIs and the Q2 GDP report are the warm-up act for Friday’s US PCE inflation. I have a sneaking suspicion data could surprise to the upside overall, given that is exactly what we have seen in recent CPI, NFP and ISM reports. It might not take much of an upside surprise from PCE inflation to further derail USD short bets, which would likely be bearish for AUD/USD if it does. With that said, are in all-out easing mode and the debate is over how fast they will cut (not if), which means upside pressures for AUD/USD persist overall, which is why I continue to favour a bullish breakout above 70c in Q4.

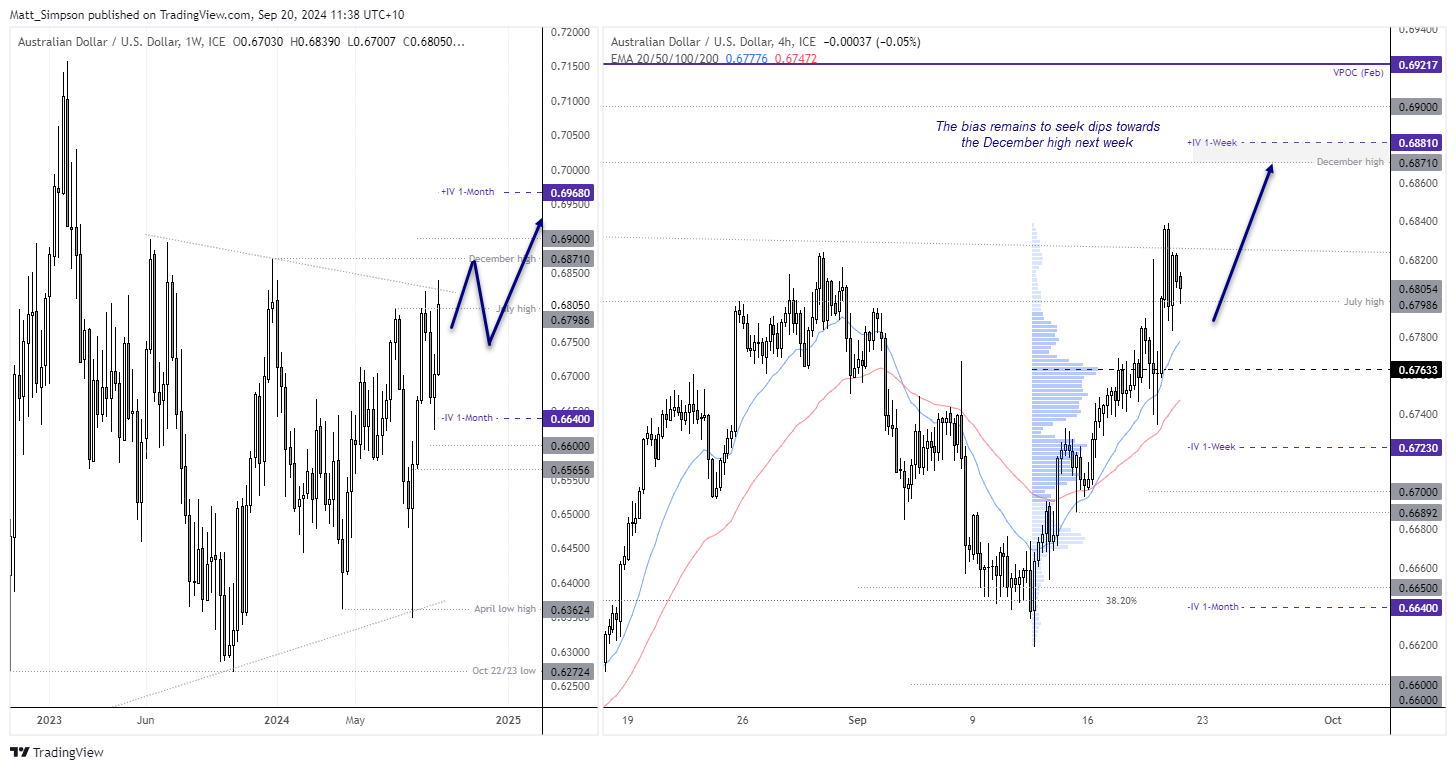

AUD/USD technical analysis

I have previously outlined my bias prices to eventual the upside of the multi-month triangle. I am now questioning whether it may happen sooner than later. Prices are on track for their most bullish week in four, although yet to close above the July high. But prices also have the December high to contend with as a likely resistance level at 0.6810.

For now, I suspect prices want to head for the December high, but we’d need to see a sustained break below 100 on the US dollar index to assume continued gains on AUD/USD. Therefore, bulls could seek dips on lower timeframes but prepare to remain nimble, in case momentum turns higher for an arguably oversold US dollar. I also assume resistance at 69c may trigger a pullback initially.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge