Market drivers for AUD/USD, AUD/JPY, ASX 200

|

Date |

AEDT (GMT +11) |

Event |

|

Monday |

- |

US public holiday (Washington’s birthday) |

|

Tuesday, Feb 20 |

11:00 |

Westpac Leading Index |

|

Tuesday, Feb 20 |

11:30 |

RBA Minutes of the Feb 2024 Monetary Policy Meeting |

|

Wednesday, Feb 21 |

06:00 |

FOMC Minutes |

|

Wednesday, Feb 21 |

11:30 |

Wage price index |

|

Wednesday, Feb 21 |

11:30 |

Updated employee earnings and hours |

|

Thursday, Feb 22 |

11:30 |

Judo Bank PMI (manufacturing, services, composite) |

|

Thursday, Feb 22 |

11:30 |

Average Weekly Earnings |

|

Thursday, Feb 22 |

11:30 |

Labour Force, Detailed |

|

Friday, Feb 23 |

01:45 |

S&P Global US PMIs (manufacturing, services, composite) |

RBA minutes:

On Tuesday the RBA will release the minutes of their first meeting of the year. We know from their recent statement that they still deem inflation as “too high”, and that “a further increase in interest rates cannot be ruled out”. So if the minutes are to serve any real purpose, it is to help us decipher how real the threat of another hike may be.

The December minutes cited upside risks to wage growth, but we’ll need to wait until Wednesday’s wage price index to see if wage pressures persist. And what might take the sting out of the minutes tail is that they will not capture the RBA’s thoughts on the latest employment report, which saw unemployment rise to the three-year high of 4.1%. If this is to be coupled with softer wages, then it’s possible the minutes can be all but forgotten.

FOMC minutes:

The Fed have been busy pushing back on rate cut expectation. Yet even though CPI data came in hotter than expected, markets are still trying to price in a cut as soon as May. I’d like to say that the FOMC minutes will put to bed any expectations of a cut in H1, yet traders seem highly focussed on any shred of evidence that suits their dovish market pricing. And if they think they have found what they want in next week’s FOMC minutes, that could weigh on the US dollar and propel risk higher, taking AUD/USD (and Australian dollar pairs in general) with it.

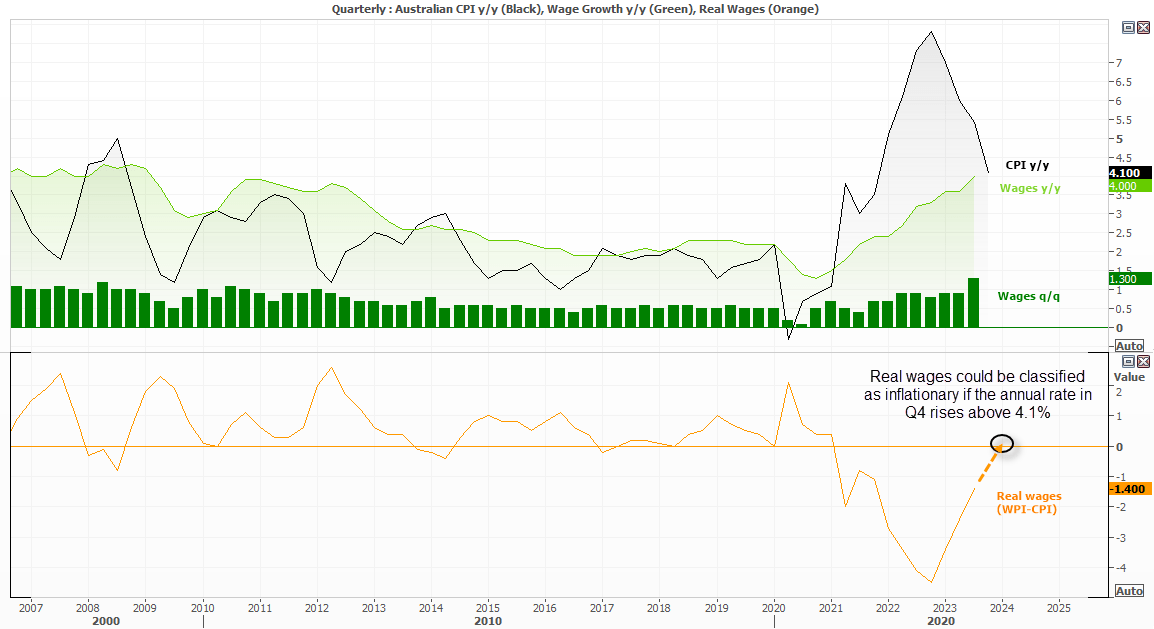

Australian wage price index:

Wages are a key inflationary input, which is why the RBA watches it closely. The wage price index (WPI) rose at a record pace of 1.6% q/q in Q3, although its momentum is not expected to be sustained as a sharp rise in minimum wages was the main culprit.

Still, for anyone wanting to see lower rates, weaker wages could help. But is debatable if they will simply roll over. And if wages remain sticky it again reduces the odds rate cuts coming sooner than later. Furthermore, CPI y/y fell to 4.1% in Q4, which means that if the annual rate of wages rises above 4.1% next week then it means ‘real’ wages have increased, which is another reason for the RBA to defer any dovish tones.

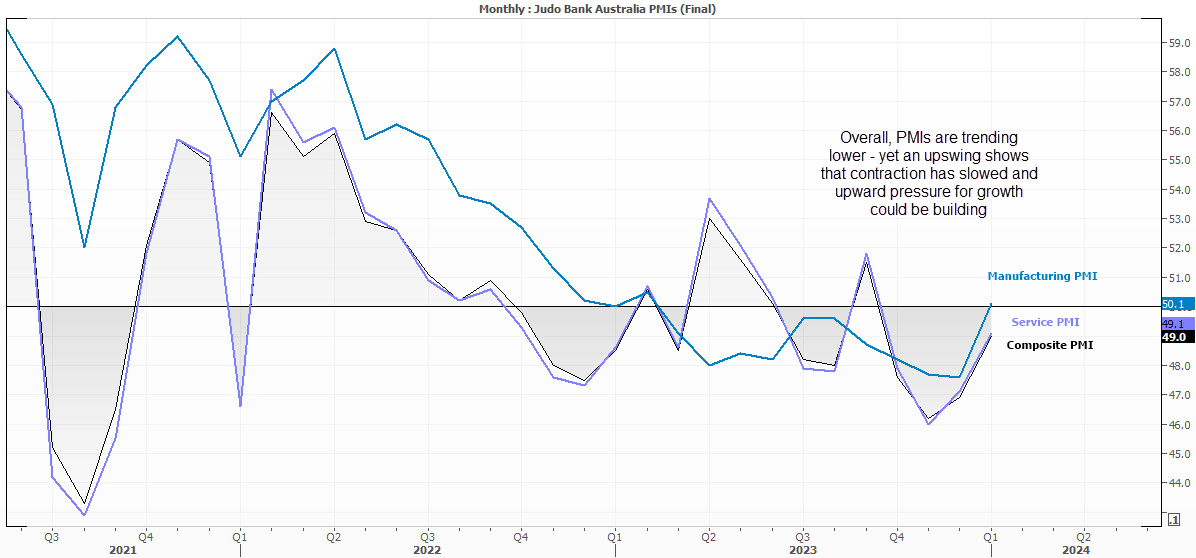

Australian flash PMIs:

The monthly PMIs provide a lead on where official growth figures are headed. And whilst growth is hardly accelerating, its decline has slowed. Manufacturing etched out a slight expansion of 50.1 in January, and the services and composite indices are not far behind at 49.1 and 49 respectively. Admittedly, Australian PMIs are rarely a market-moving event, but if they show that growth is accelerating, it provides less of a reason to be excited about a dovish RBA pivot later this year.

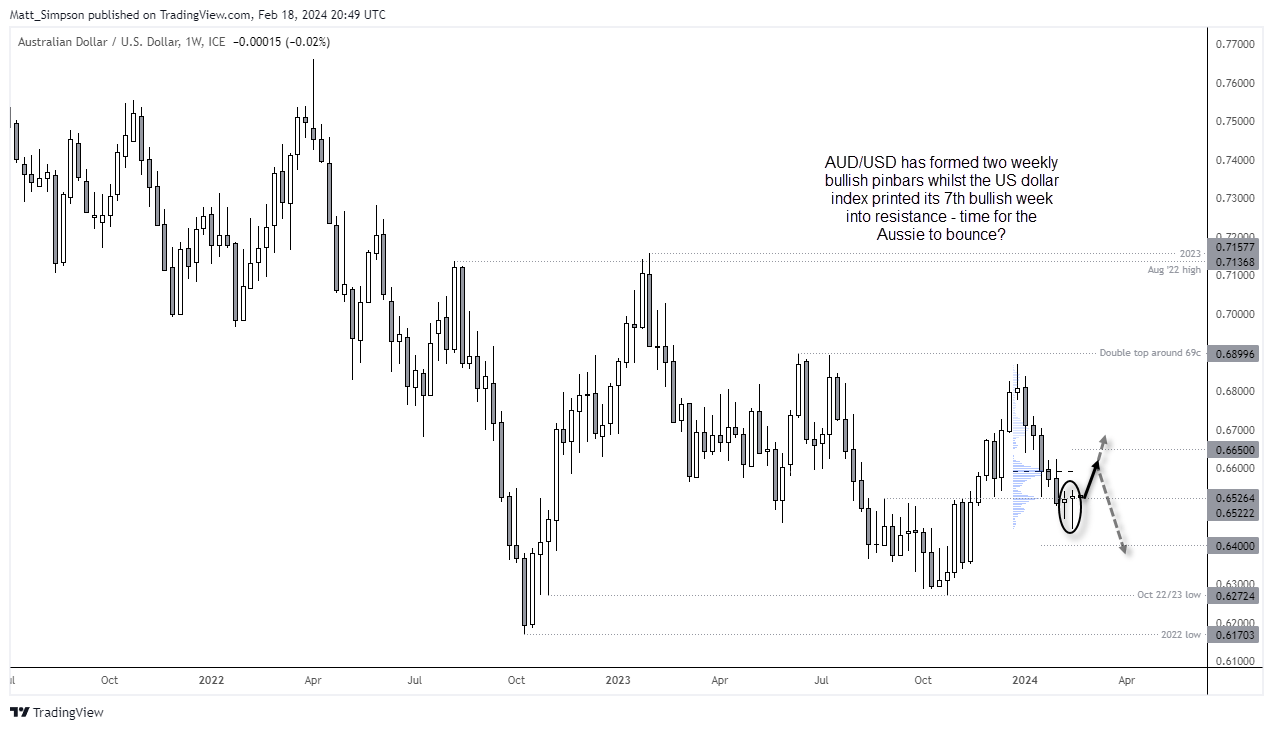

AUD/USD technical analysis (weekly chart):

The Australian dollar has printed two bullish pinbars over the past two weeks, which shows a reluctance for it to move immediately lower on this timeframe. And as the US dollar index has just posted its seventh consecutive bullish week but faltered at resistance around 105, it paves the way for AUD/USD to potentially bounce – but driven by US dollar weakness as opposed to AUD strength.

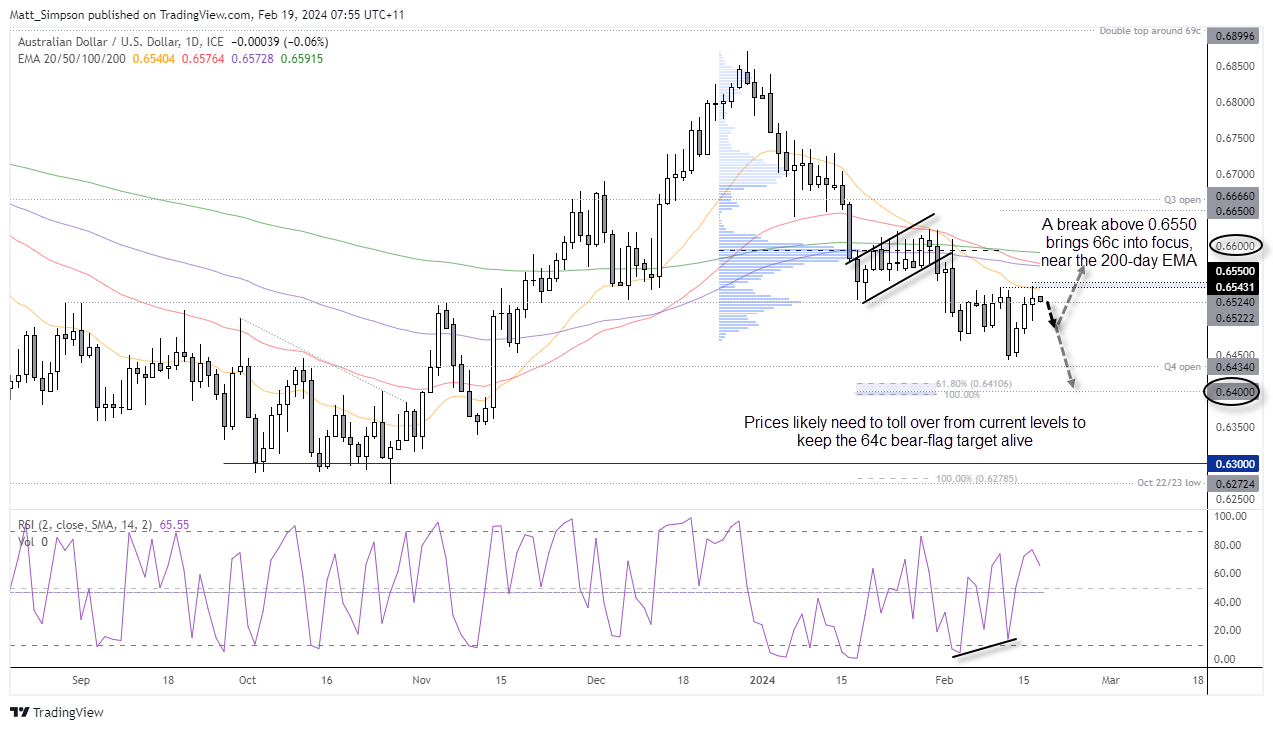

AUD/USD technical analysis (daily chart):

But first, I see the potential for a pullback from last week’s highs given its 3-day rally finished with a Spinning top doji around resistance (weekly high, 10-day EMA). And that could favour bears on intraday timeframes over the near-term. A break above 0.6550 brings the 66c handle into focus, near the 200-day EMA. Yet such a move would invalidate the 64c bear-flag target bias outlined last week.

For the original bear-flag target of 64c to remain intact, we likely need to see prices remain beneath last week’s high and roll over directly from here.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge