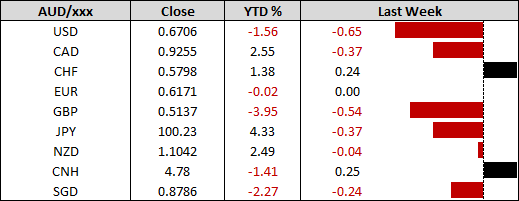

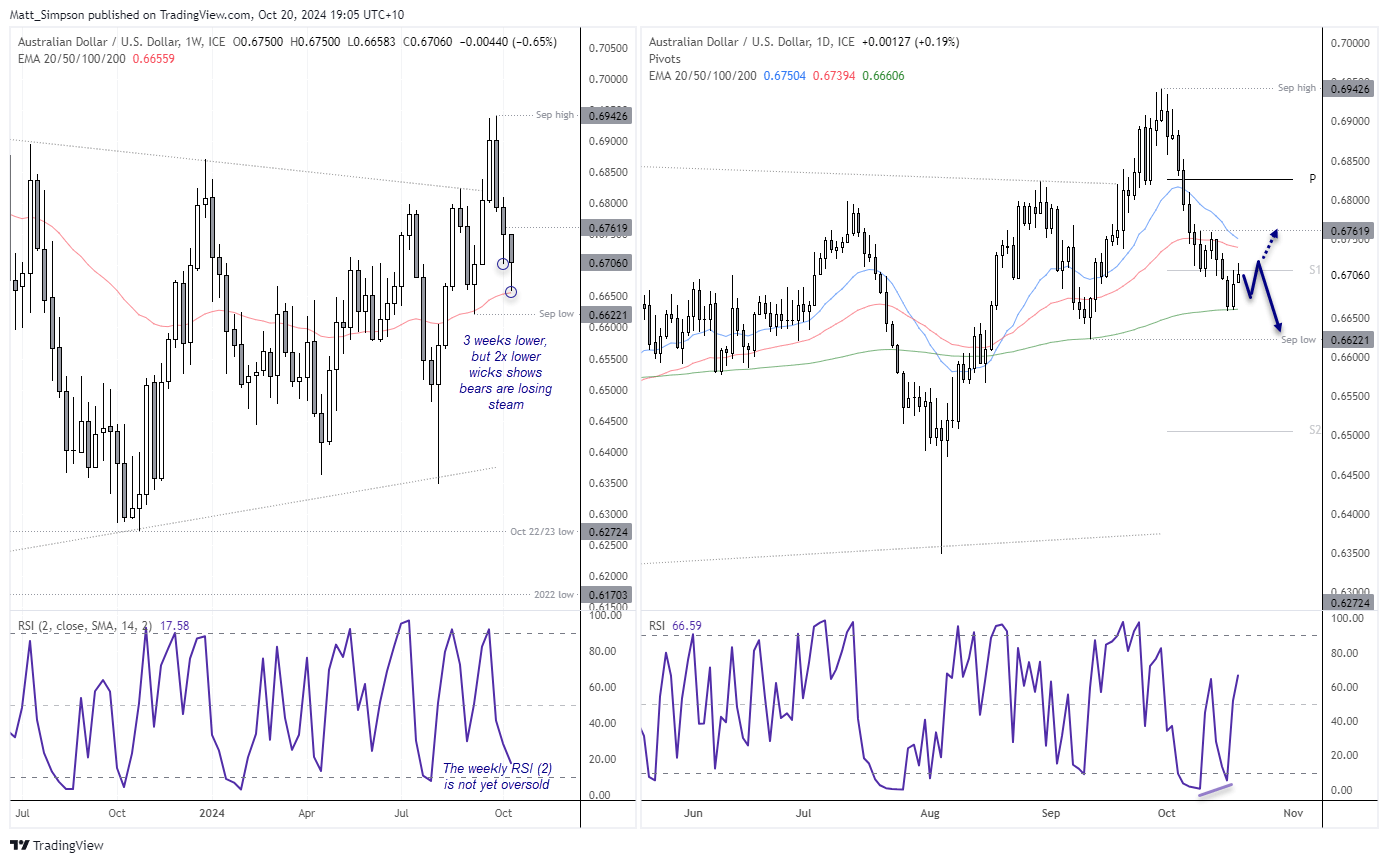

- AUD/USD closed lower for a third week

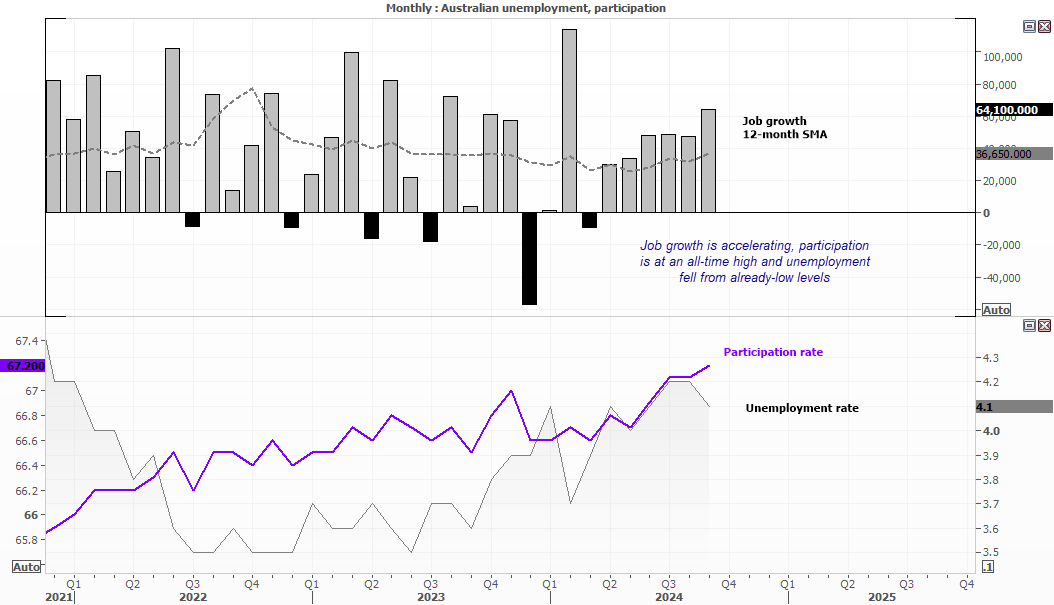

- Another strong employment report killed hopes of a rate cut from the RBA

- This helped it bounce form its 200-day exponential average

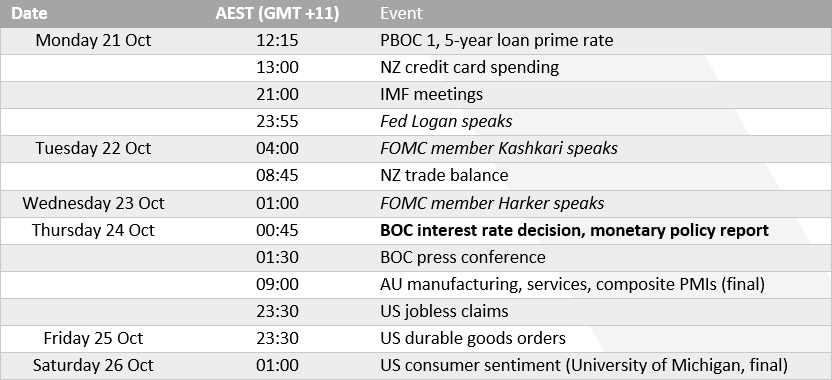

- A quiet week for domestic data

- Yield differentials remain a key driver

Australia’s employment report delivered another blow to anyone hoping for lower rates. There are now calls that they will not be able to cut rates at all next year, despite RBA futures still fully pricing in a 25bp cut in May.

As depressing as that may be for those in need of lower rates, it shows a strong economy despite pockets of weakness elsewhere. Over 60k jobs were added (over 50k of which were full time), participation reached a record high and unemployment remained at a healthy 4.1%. Inflation is slowing but not at a rate which allows the RBA to contemplate cuts. And when combined with such employment reports, keeps hikes on the table as well – despite other central banks cutting from (higher) interest rates.

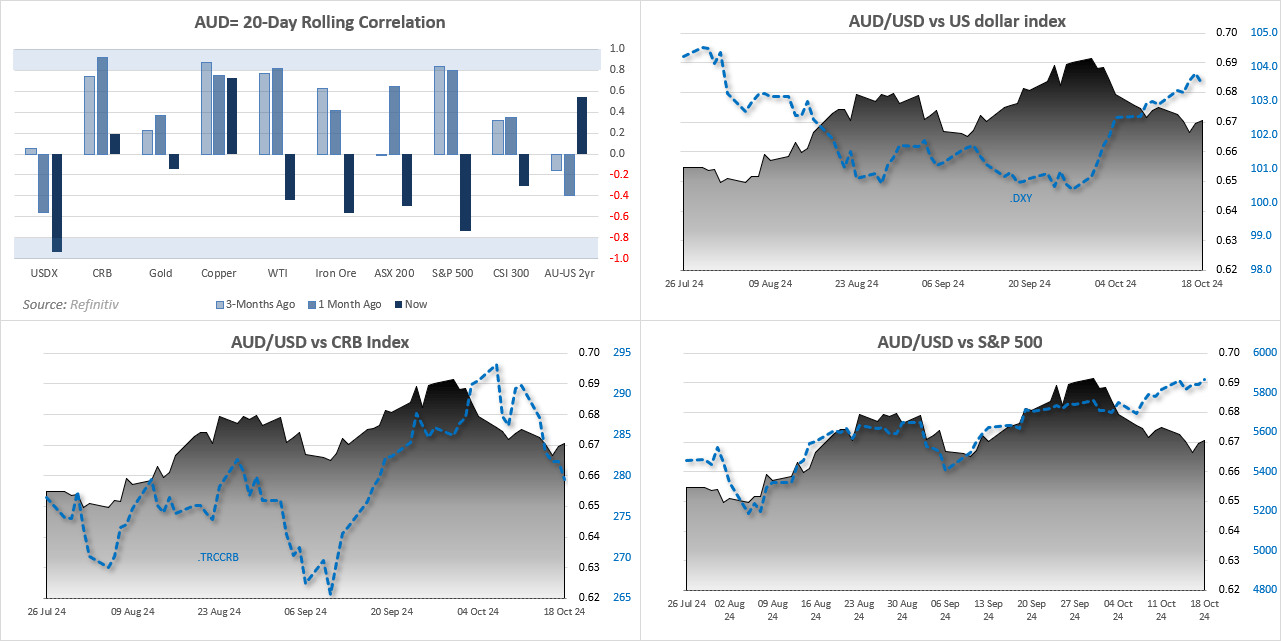

AUD/USD 20-day rolling correlation

- Yield differentials appear to be the main driver for AUD/USD at the moment, with US yields rising due to less-dovish-than-expected Fed comments

- This has seen AUD/USD break its tight relationship with risk, and therefore Wall Street indices which remain elevated

- The 20-day rolling correlation with commodities has also broken down (represented by the CRB index)

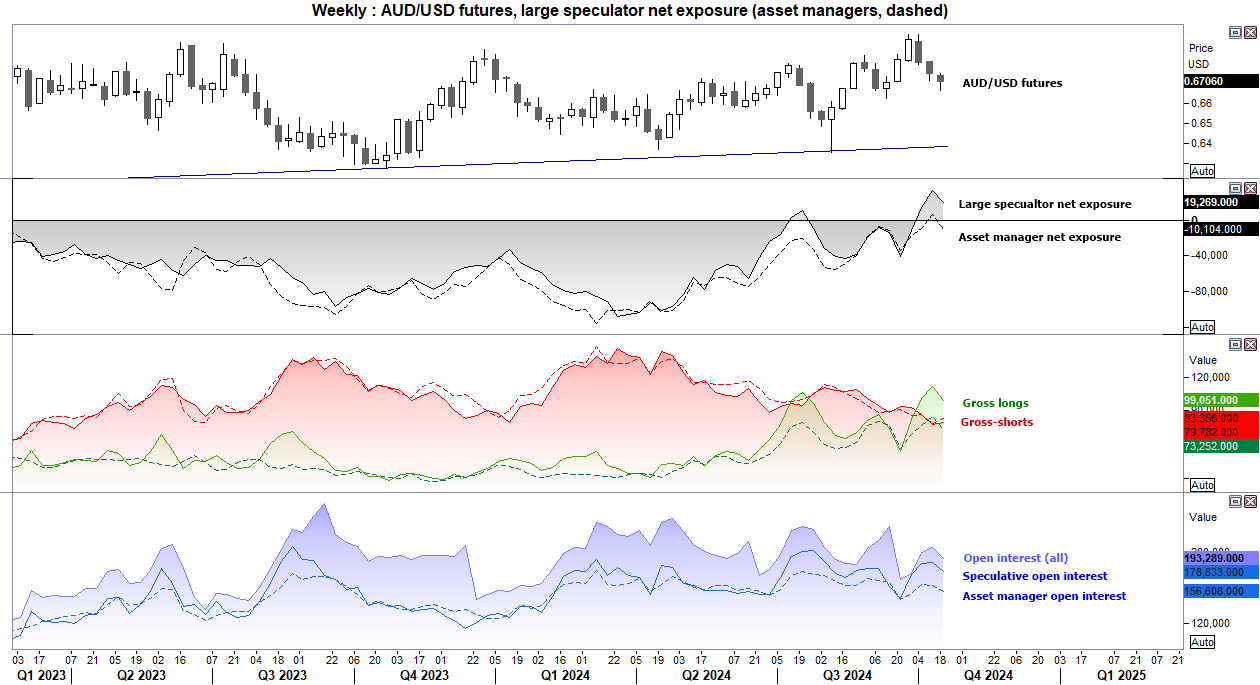

AUD/USD futures – market positioning from the COT report:

- Asset managers reverted to net-short exposure after being net-long by just one week

- They reduced longs by 11.6k contracts and increased shorts by 4.8k contracts

- While large speculators remained net-long for a third week, it was reduced by -14.2 contracts (down from 33.4k)

- However, we may find that some short bets were closed by the next COT report, given the strong figures in the labour report

AUD/USD technical analysis

While AUD/USD closed lower for a third week, around half of the week’s earlier losses were recouped on Thursday and Friday. This is the second week with a lower wick, which shows bears are losing steam. The week’s low also found support at the 200-day EMA and 50-week EMA.

However, an upper wick formed on Friday and prices closed beneath the monthly S1 pivot. This suggests upside potential for AUD/USD could be limited over the near-term, or even prone to a small pullback at the beginning of the week.

I suspect prices will hold above last week’s low / 200-day EMA in the first half of the week. But if US data continues to outpace expectations, a move towards the September low just above 66c could be on the cards. Fed members will likely continue to push back against oversized cuts, but it could take a weak jobless claims report for AUD/USD to stand any chance of heading for 0.6750.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge