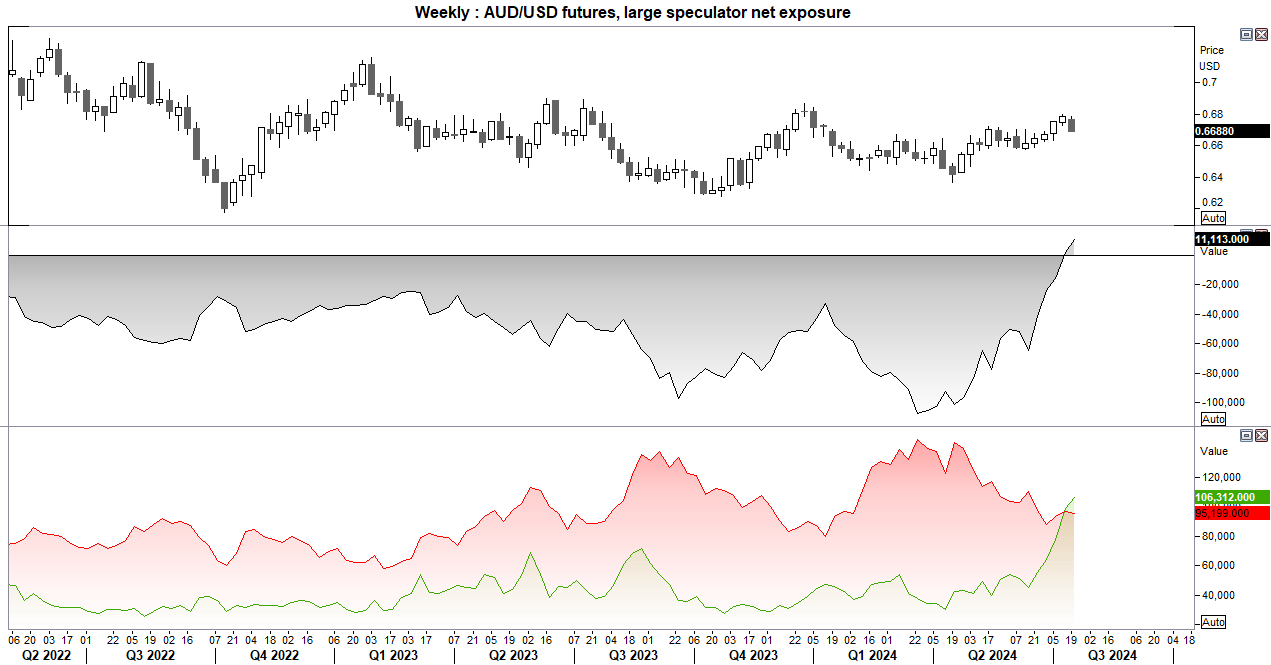

Politics is continuing to make its mark on sentiment, and I suspect it will continue to do so as we head towards the November elections. I think there is a real chance Biden could pull out, given he was diagnosed with covid less than a day after publicly saying he would consider not running if he was sick. Kamala Harris is in the pole position to take the reins, but Trump remains the firm favourite to win according to bookies. So from a trader's perspective, any policy hints from Trump, or comments that could stir concerns of another trade war could weigh on sentiment – and therefore AUD/USD.

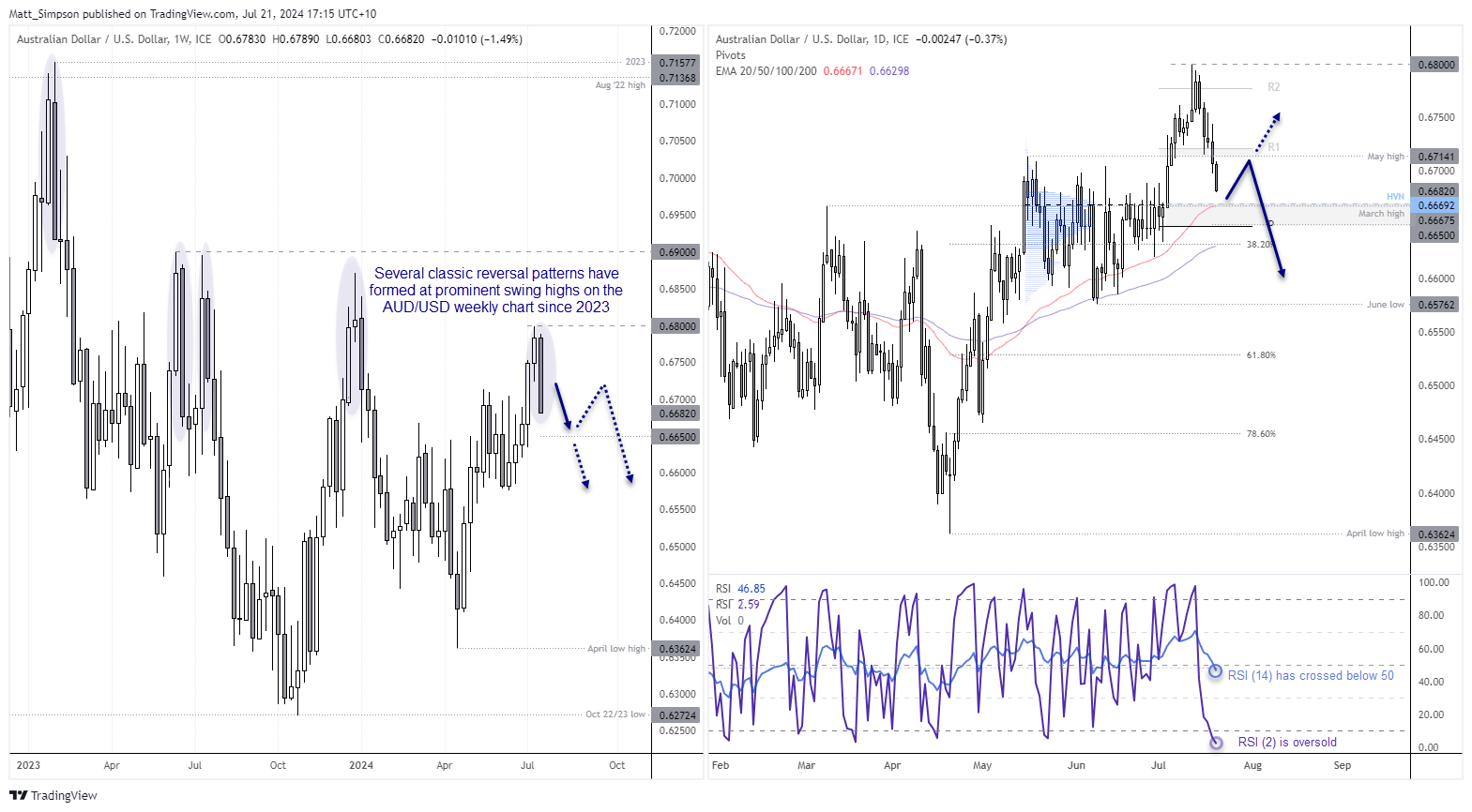

It is not a big week for domestic data in Australia. The PMIs released on Wednesday tend not to be a market mover for AUD/USD, and the report would have to deliver some seriously bag figures before traders could overlook the strong employment figures delivered last week.

Area of interest include the Bank of Canada’s (BOC) policy meeting on Wednesday, to see if their expected -25bp rate cut is accompanied with a dovish meeting. A weak NZ credit card spending report could back up the RBNZ’s dovish tone delivered at their recent meeting, which helps contain expectations of an RBA hike. But in reality it is second-tier data.

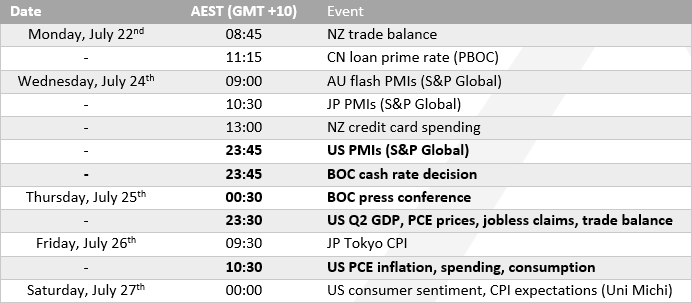

AUD/USD 20-day rolling correlation

- Yield differentials are back in fashion, with the 2-year AU-US spread correlating nicely with AUD/USD

- Positive correlation remain in play with gold, copper and iron ore, although to lesser degrees as we get through that list

- The US dollar index continues to share an inverted correlation with AUD/USD at -0.75

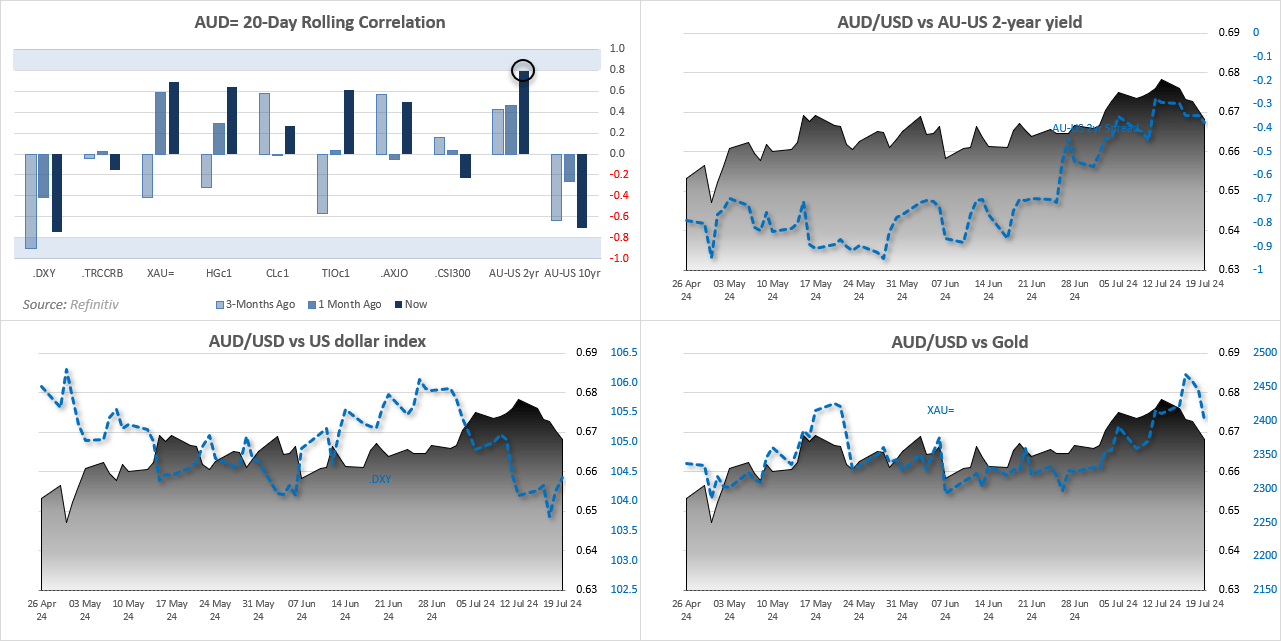

AUD/USD futures – market positioning from the COT report:

Commitment of traders data (COT) is only captured up to the prior Tuesday. Therefore, it does not include the change of exposure between Wednesday to Friday while AUD/USD futures prices continued to decline. In a nutshell, AUD/USD snapped a 5-week bullish streak, yet positioning shows that gross longs increased for a fifth week among large speculators and net-long exposure rose for a second. Sentiment has clearly changed. And while net-long exposure is nowhere near a sentiment, extreme, the surge in gross longs (green. Lower chart) may well be, having reached a 5.5-year high.

I suspect we’ve entered a phase where sentiment carries more weight than classic technical analysis. And with the VIX rising alongside political uncertainty, volatility could favour bears over the coming months as we head towards the US elections, with APAC leaders keeping a close eye on any comments from Trump regarding trade.

AUD/USD technical analysis

68c is clearly a strong resistance level, given AUD/USD suffered its worst week in fourteen, opened near the high of the week and closed at the low. And as significant swing highs formed in January, June and December 2023 under similar technical circumstances, we should be on guard for further losses.

However, AUD/USD also fell for five consecutive days last week, the daily RSI (2) is oversold. Support likely resides around 0.6670 as it coincides with the March high and high-volume node (HVN) from the prior consolidation. And monthly pivot point also resides at 0.6650, making 0.6650/70 a potential support zone for bears to target and bulls to consider re-entering.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge