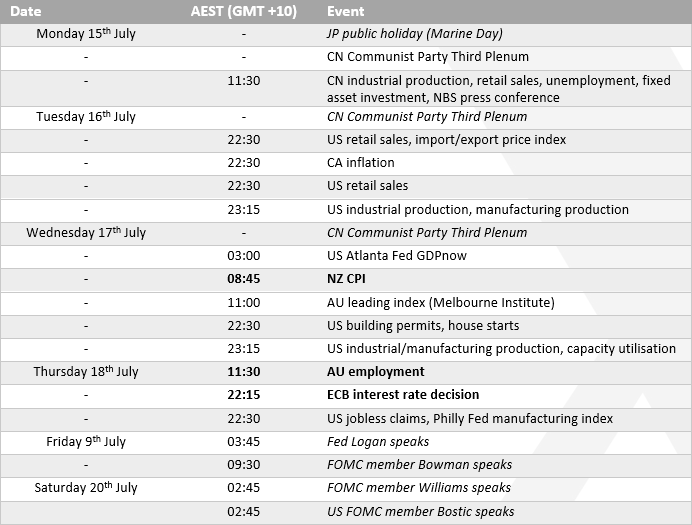

Australia’s employment report is the main domestic event. The unwelcome return of inflation has been a thorn in the side for the RBA, especially when robust employment figures were already preventing them from discussing cuts. In fact, the return of inflation forced the RBA to discuss a potential hike at the last two meetings. RBA cash rate futures currently imply ~25% chance of a hike at their next meeting – down from 44% two weeks ago. But these odds could increase and support AUD/USD should already-robust employment figures heat up.

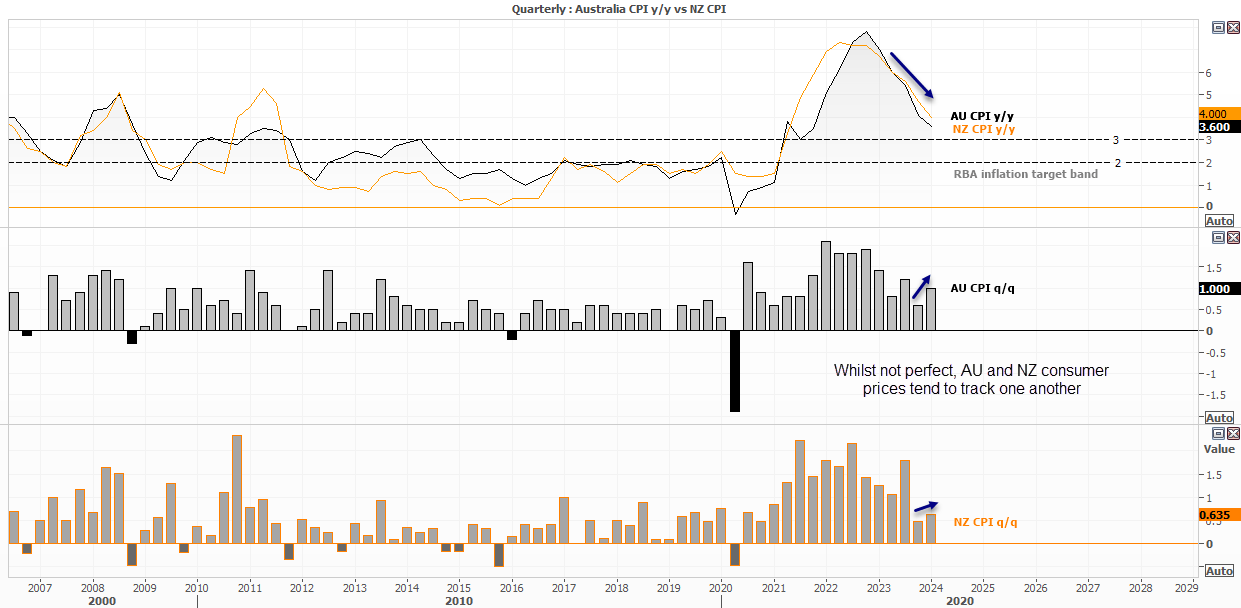

New Zealand release their Q2 inflation figures. And it will gain plenty of attention because the RBNZ now anticipated the rate of inflation to drop within their 1-3% target band by the end of the year, and Q2 data offers a basic glimpse of whether this seems feasible.

But it is also important for AUD/USD traders to track, as Australian consumer prices tend to move in tandem with Zealand’s. And with Australia’s monthly CPI figures trending higher, perhaps we should be on guard for an upside surprise in this week’s quarterly CPI report for NZ. Regardless, AUD/USD could take a directional cue from the report if NZ inflation surprises to the upside (bullish AUD/USD) or downside (bearish AUD/USD).

China’s Communist Party hold their Third Plenum, where around 400 top officials meet and Xi Jinping has the potential to unveil new policies. Expectations for adequate reforms are low, but if we are treated to an upside surprise which is deemed enough of a growth engine for the rest of the world, AUD/USD could get a tailwind from a burst of risk on.

The Fed’s media blackout period kicks in on Saturday. It’s therefore interesting to see that three Fed members have been scheduled to speak in the hours beforehand. Given the pleasantly soft CPI report, combined with soft PCE inflation, NFP, and ISM reports, it is an opportunity for them to guide market expectations towards a September cut. Whilst money markets are already pricing this in with an 84% probability, it is a step the Fed needs to make as currently, their narrative has been hinting at a December cut – if they cut at all this year.

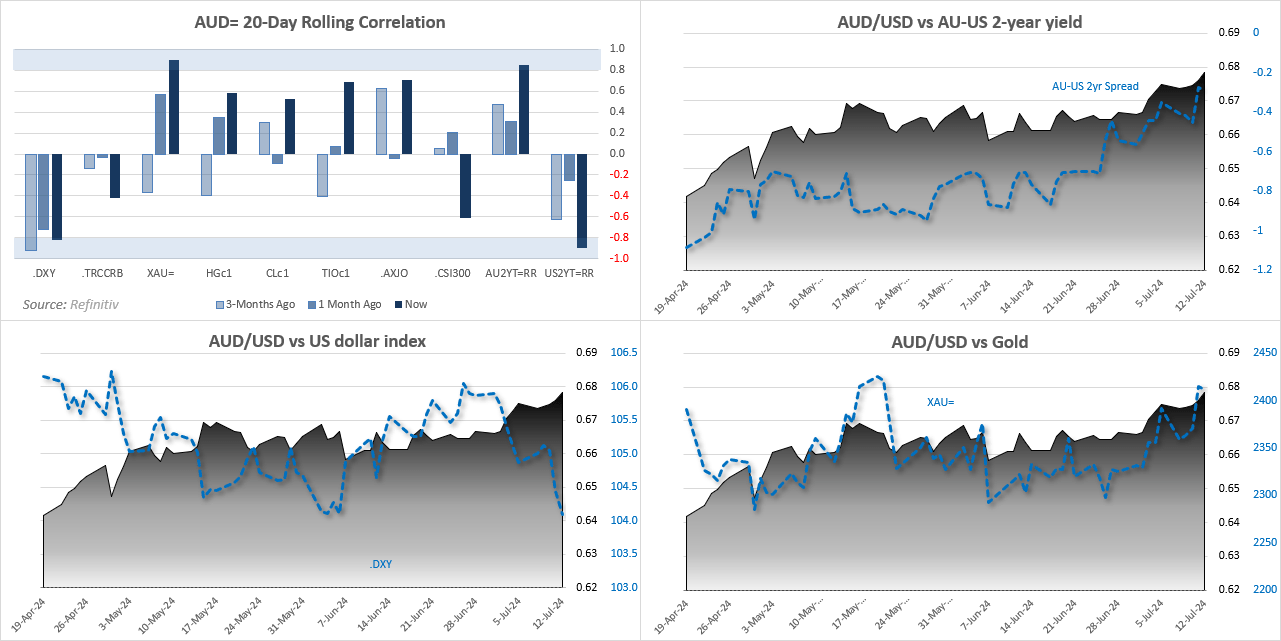

AUD/USD 20-day rolling correlation

- The Australian dollar has the strongest correlations with the US dollar, yield differentials AU-US yield differentials and gold

- The relationships with the US dollar index and 2-year spread seem likely to remain in place with traders obsession with Fed policy and the prospects of multiple cuts over the next couple of years

- Whilst AUD/USD shares a strong positive correlation with the 2-year AU-US spread, it has a negative correlation with the 10-year AU-US spread

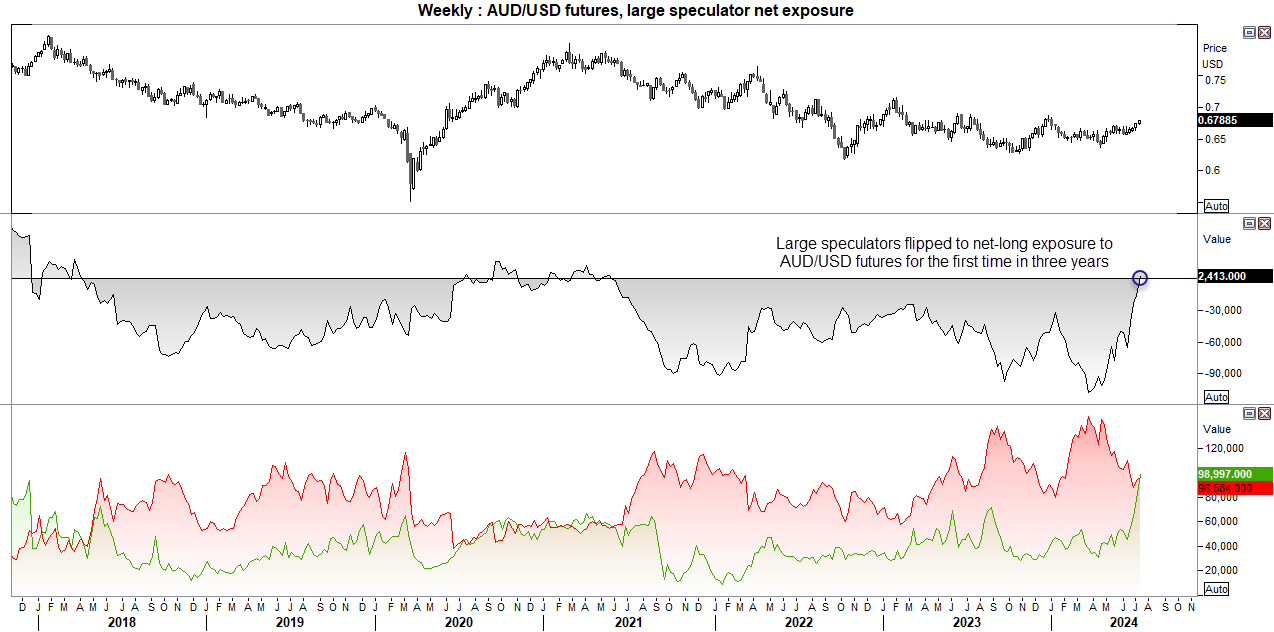

AUD/USD futures – market positioning from the COT report:

- Large speculators flipped to net-long exposure for the first time since May 2021

- Gross long exposure reached a six-year high and increased at their fastest bullish pace in nine years

- With AUD/USD reaching a YTD high last week, it seems likely that net-long exposure has only increased further

- Asset managers reduced their net-short exposure to a 1-year low of -22.6k contracts

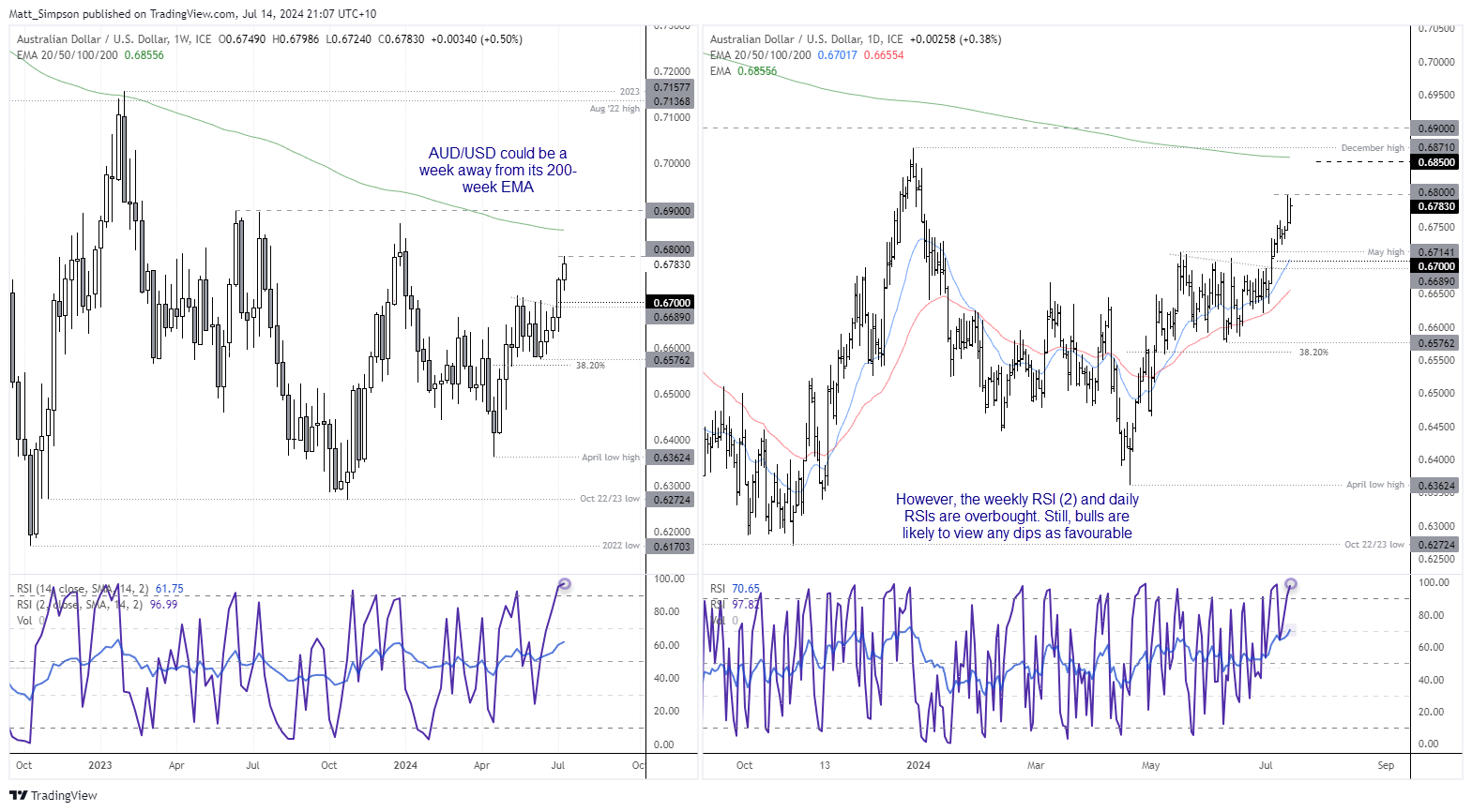

AUD/USD technical analysis

My upside target of 0.6850 remains in place, which incidentally sits near the 200-week EMA. However, AUD/USD seems hesitant to push immediately above 0.6800. Its failure to retest Thursday’s high could point to a slow start to the week and potential pullback.

The 2 and 14 period daily RSIs are overbought, and whilst the US dollar index closed at a 5-week low, it also closed on Thursday’s intraday low. Assuming the US dollar holds its ground early in the week, it points to limited upside potential for AUD/USD.

But with a solid bullish trend structure, bulls are likely to welcome dips to rejoin the rally for a move towards 0.6850 and 0.6900. Although we will also need to see the US index break beneath the June low, which is just -0.29% beneath current prices.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge