After a busy past week, scheduled macroeconomic events in the current week slow down considerably. The focus of this week’s events will revolve around central bank activity in Australia and New Zealand. The Reserve Bank of Australia (RBA) is up first with its rate decision and statement on Tuesday in Sydney. The RBA’s monetary policy statement will then follow on Friday.

Australia’s central bank is widely expected to keep interest rates unchanged at 1.5%, especially since recent economic data has been soft, including both disappointing retail sales numbers as well as unexpectedly low inflation readings. The RBA has recently continued to harbor concerns over weak inflation, low wage growth, and the relative strength of the Australian dollar, which have combined to preclude the central bank from raising the cash rate from its current record low.

Meanwhile, the US dollar has generally continued to be supported by high expectations for rising US interest rates in December and into 2018 under the helm of newly-nominated Fed Chair Jerome Powell, as well as anticipation of impending US tax and other fiscal reform. Last week’s job report out of the US disappointed high expectations when it came out at “only” 261,000 jobs added in October. However, September’s negative reading due to the impact of hurricanes was revised up to a positive number, and August was also revised substantially higher. In addition, the unemployment rate for October dipped unexpectedly to 4.1%, its lowest level in 17 years. Therefore, on balance, the jobs report on Friday painted an optimistic picture of the US employment landscape, which has contributed to supporting the US dollar.

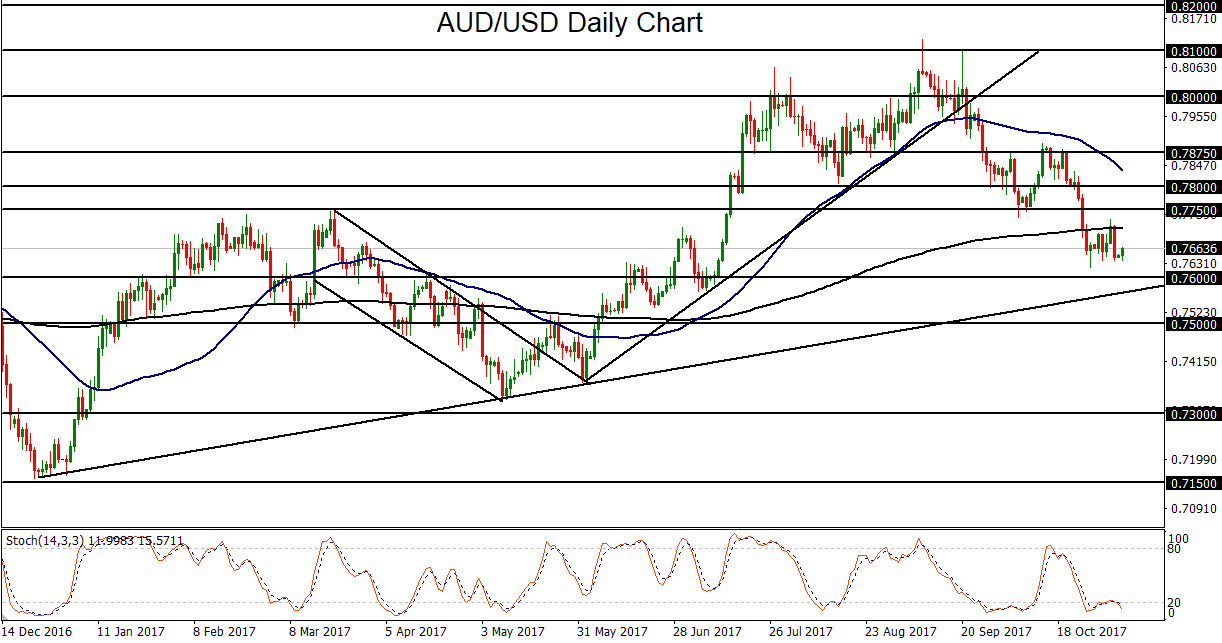

Going forward, the divergence between the current monetary policy stances of the hawkish-leaning Fed and dovish-leaning RBA is likely to continue weighing on the AUD/USD currency pair. This will especially be the case if the RBA delivers a dovish statement on Tuesday. Since early September, when AUD/USD hit a long-term high above 0.8100, the currency pair has been in a sharp decline as the US dollar has climbed in recovery mode and the Australian dollar has been pressured in part by an increasingly dovish RBA. Most recently, AUD/USD has been trading in a consolidation after having broken down below key support around 0.7750 in late October. With any further RBA-driven pressure on the Australian dollar, AUD/USD is potentially poised to extend its downside correction, with the next major downside target around the key 0.7500 support level.