Australian Technical Forecast: AUD/USD Weekly Trade Levels

- Australian Dollar rebounds off support- bulls stall at yearly moving-average

- AUD/USD February opening-range preserved into monthly close- pending breakout

- Resistance 6590, 6673-6707, 6816/18- Support 6500/25 (key), 6335, 6283

The Australian Dollar is poised for a third consecutive weekly advance with AUD/USD rebounding off a major support confluence we’ve been tracking since the start of the year. The focus remains on a breakout of the February opening-range and the battle-lines are drawn heading into the close of the month. These are the updated targets and invalidation levels that matter on the AUD/USD weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In last month’s Australian Dollar Technical Forecast we noted that a, “reversal off technical resistance is now testing support with major event risk on tap next week. From at trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to 6673 IF price is heading lower on this stretch with a close below 6500 needed to fuel the next major move in price.”

It has been nearly four-weeks and although Aussie did break below the channel, key support held with price unable to mark a weekly close below 6500. Note that the 2022 trendline (former resistance) is now offering support on this pullback. The February opening-range remains intact, and the focus is on a breakout in the weeks ahead for guidance with the broader risk still weighted to the downside.

Initial weekly resistance is eyed at the 52-week moving average (currently ~6590) and is backed by 6673-6707- a region defined by the 2008 low-week close (LWC), the 2019 low, and the 61.8% Fibonacci retracement of the December sell-off. A breach / weekly close above this threshold is needed to suggest a more significant low was registered last week and clear the way for a test of the next major technical hurdle at 6816/19.

A close below key support would threaten another accelerated sell-off with such a scenario exposing the 2023 low-week close (LWC) at 6335 and the 2023 low / 88.6% retracement at 6270/82.

Bottom line: Aussie has been testing support for three-weeks now with the recent recovery faltering into the yearly moving average. From a trading standpoint, the outlook remains unchanged, and rallies should be capped by 6673-6707 IF price is heading lower with a close below 6500 needed to mark resumption. For now, the immediate focus is on a breakout of the February opening-range (6470-6610) for further guidance on our medium-term directional bias. Review my latest Australian Dollar Short-term Outlook for a closer look at the near-term AUD/USD technical trade levels.

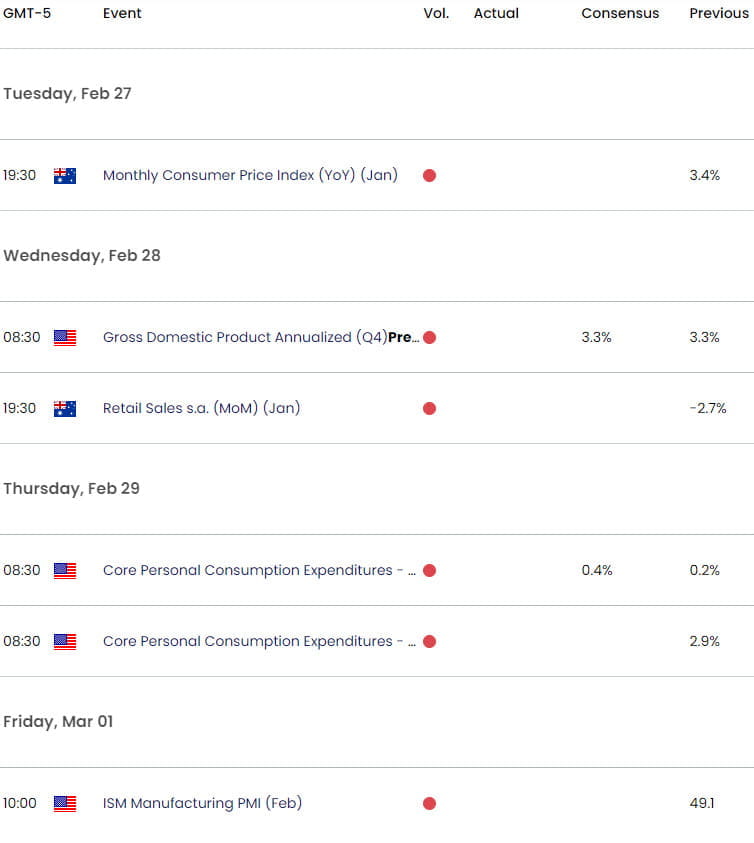

Australia / US Economic Calendar

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- US Dollar Index (DXY)

- Euro (EUR/USD)

- Japanese Yen (USD/JPY)

- Canadian Dollar (USD/CAD)

- British Pound (GBP/USD)

- Gold (XAU/USD)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex