The RBA are extremely unlikely to change their cash rate today, given quarterly CPI and PPI data was above expectations last week. Besides, their statement retained their slight hawkish undertone in September, and if it is to be revised there is a case it could be slightly more hawkish. And that could further support AUD/USD which remains oversold to my eyes.

But of course, the real market driver today and tomorrow will be the US election. That could see volatility subside as we approach the big event, before it rises as some of the earlier results pour in. But there is a decent chance that we won’t know the winner by tomorrow and that it could drag on for a few days into the FOMC meeting.

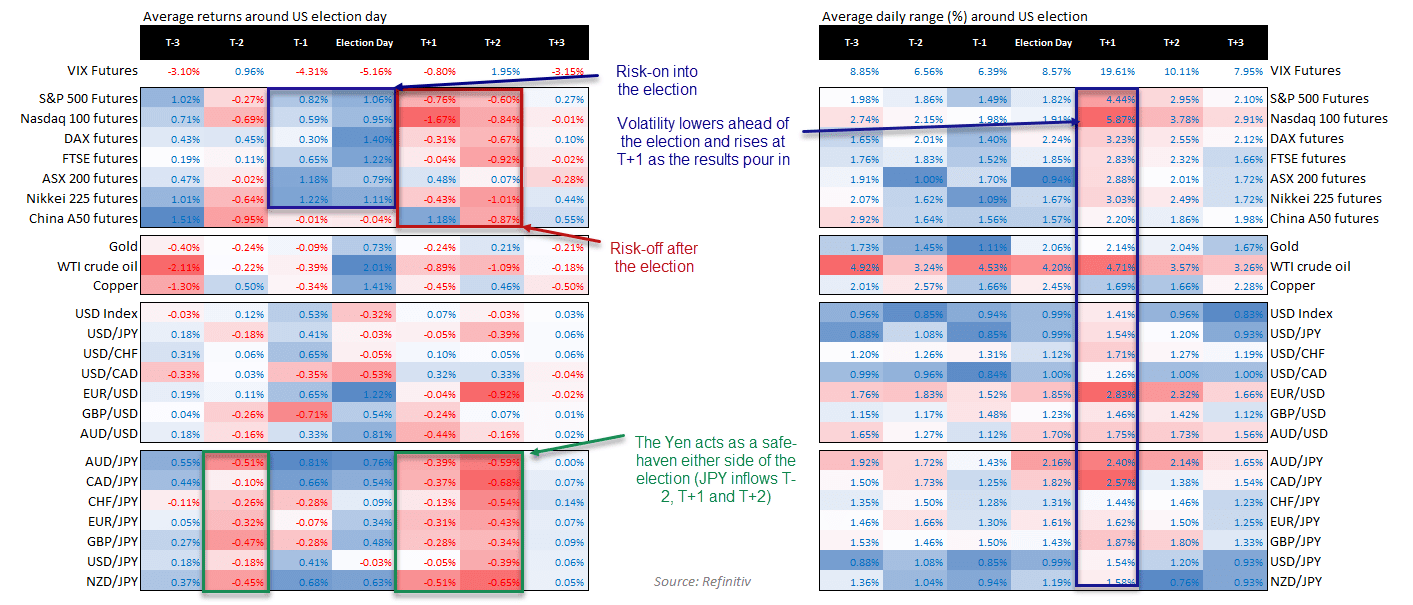

As a reminder, below are average returns for key markets either side of the election, which could point towards a rise for US indices into Tuesday’s close if history copies its tracks its historical average. But it should be remembered that no two elections are the same.

Economic Calendar (times in AEDT, GMT+11)

- 09:00 – AU services PMI (Markit Economics)

- 09:00 – RBNZ Orr speaks

- 11:00 – NZ commodity price index

- 14:30 – RBA interest rate decision (no change expected)

- 16:00 – SG retail sales

- 21:00 – US presidential election

My basic playbook for the election is as follows:

- Trump leading: Long USD, long JPY, short commodities, commodity FX, short Wall Street

- Harris leading: Short USD, short JPY, long commodities, long commodity FX, long Wall Street

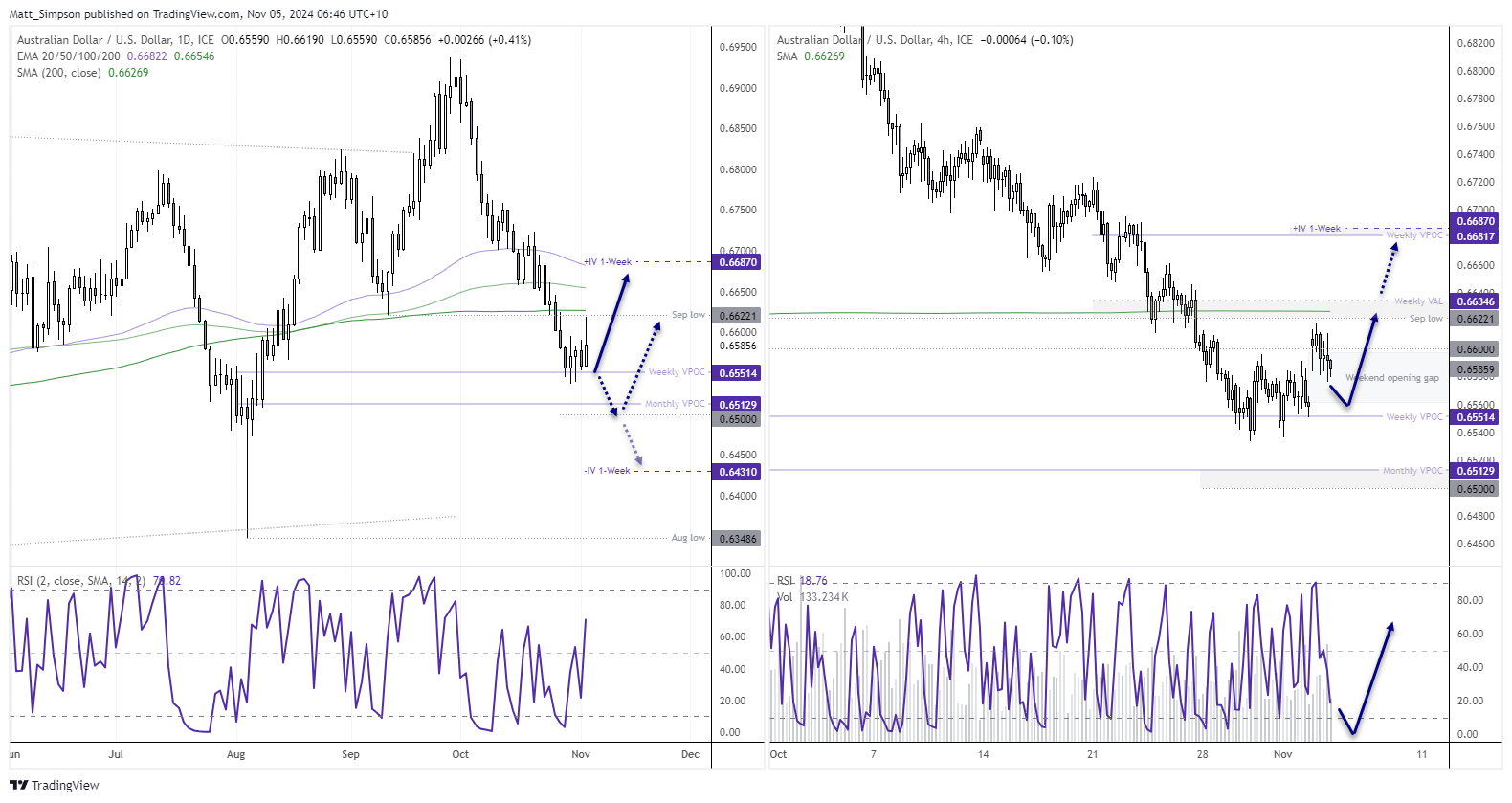

AUD/USD technical analysis:

Mean reversion kicked in on Monday with a large bullish opening gap above 66c, just shy of the 200-day average. I continue to suspect that the selloff is overdone and that we could eventually see a move towards 0.6680, near its 100-day EMA, upper 1-week implied volatility band and weekly VPOC (volume point of control).

The 4-hour chart shows prices are trying to fill the opening gap. It also shows the recent cycle lows found support around a weekly VPOC (0.65514) so any low-volatility retracements towards it could appeal to bullish swing traders.

Of course, the US Presidential election will be in full swing over the next 24-48 hours, which can bring pockets of undesirable volatility and fickle price action along the way. So extra caution may be required.

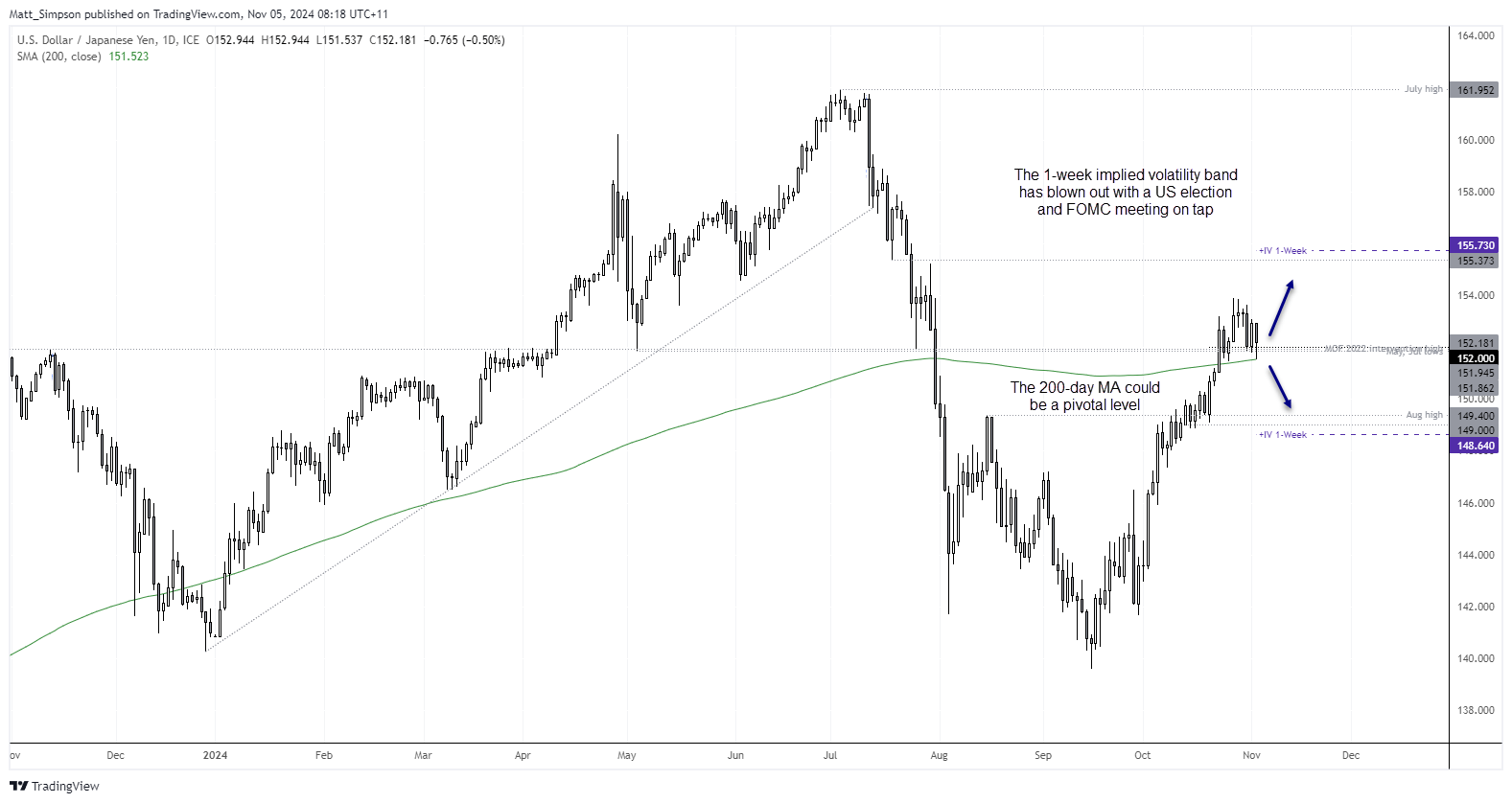

USD/JPY technical analysis:

The daily chart remains in an established uptrend, although it has failed to extend its rally to 154 and price action has becomes choppy. Over the past three days we have seen a bearish outside bar and a 2-bar bearish reversal (dark cloud cover), but the 200-day SMA has so far provided support.

The 200-day SMA is likely to be a pivotal level going forwards. Also note the cluster of support around 152 which includes historical lows and thew 2022 MOF intervention level, also making it an area of interest for traders. The 1-week implied volatility band has also blown out with a US election and FOMC meeting on tap.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge