Looking across major indices and forex pairs, all I see is the same setup. A sudden drop of risk assets, with cautions gains now lifting them from their lows. Comments from Fed members have soothed fears of an emergency rate cut, lifting US yields to allows index futures to track them higher. The BOJ also surprised by shifting back to a dovish tone due to this week’s market turbulence, which is weakening the yen and reviving the carry trade. AUD/JPY rose over 7% from Monday’s low to Wednesday’s high and Nikkei futures rose over 18% over the same period.

But does that mean we’re back in a phase of risk on? Not necessarily. But unless we get another trigger to send yields and therefor risk assets lower, it leaves wriggle room for gains on otherwise battered markets. But the key point is that appetite for risk (or lack thereof) remains the bigger driver for markets at the moment.

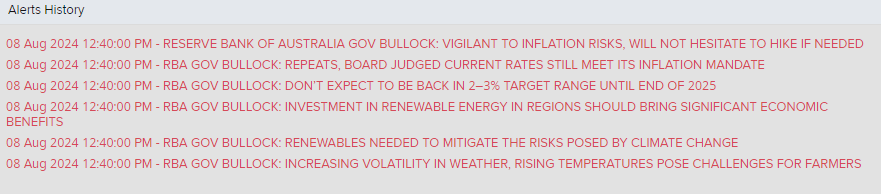

Hawkish comments from RBA Bullock lift AUD/USD (a little)

The Australian dollar is getting a tailwind from hawkish comments from RBA governor Bullock, who said the central banks “will not hesitate to hike if needed”. The RBA retained their hawkish bias despite softer inflation on the basis it remains “too high”, and bullock added today that she does not expect inflation to dip within their 1-3% target until the end of 2025. So we know that rate cuts are off the table, but I remain sceptical that the RBA will hike rates again with such a dovish Fed and RBNZ taken into consideration. Still, AUD/USD rose a further +25 pip after the comments, taking the day’s gains to 0.45% higher. Although resistance looms overhead.

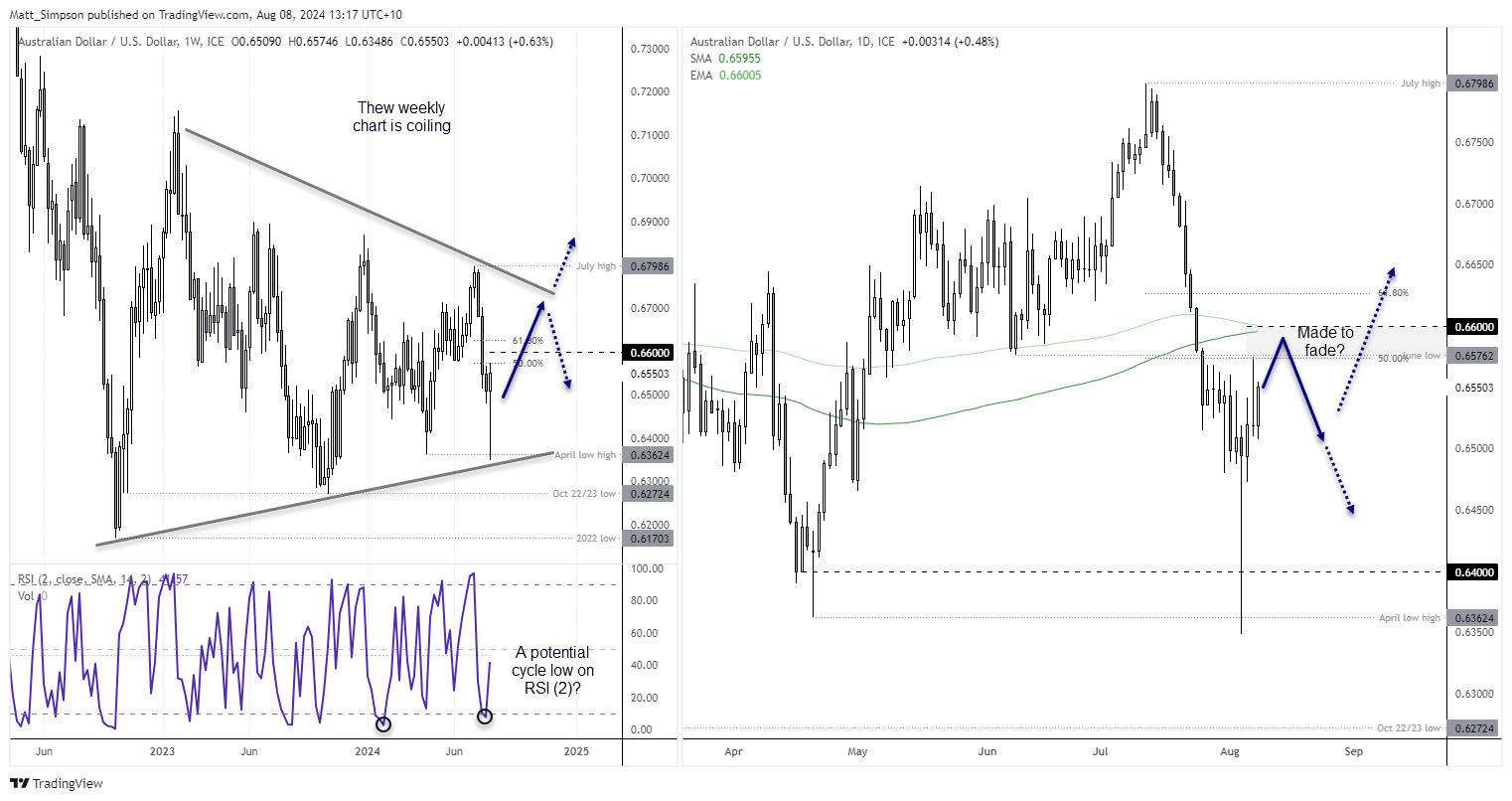

AUD/USD technical analysis:

The weekly chart has caught my eye due to the large coiling pattern. AUD/USD could carve out a bullish pinbar if it is to close the week around current levels, which would follow on from last week’s RSI (2) oversold print. Should appetite for risk return, perhaps AUD/USD could make a break for 67c or the upper bounds of the coiling pattern.

Yet the daily chart needs to clear some resistance around 66c first, which includes the 200-day MA and EMA. Also note that a 50% retracement level sits near the June low (and Wednesday’s high). So for now my bias is to fade into move towards the 0.6575 – 0.6600 zone for another dip lower (open target). But for AUD/USD to stand any chance of a decent rally, US economic data needs to weaken to reinforce dovish-Fed bets, but to to the degree it ruins the chances of a Wall Street rally.

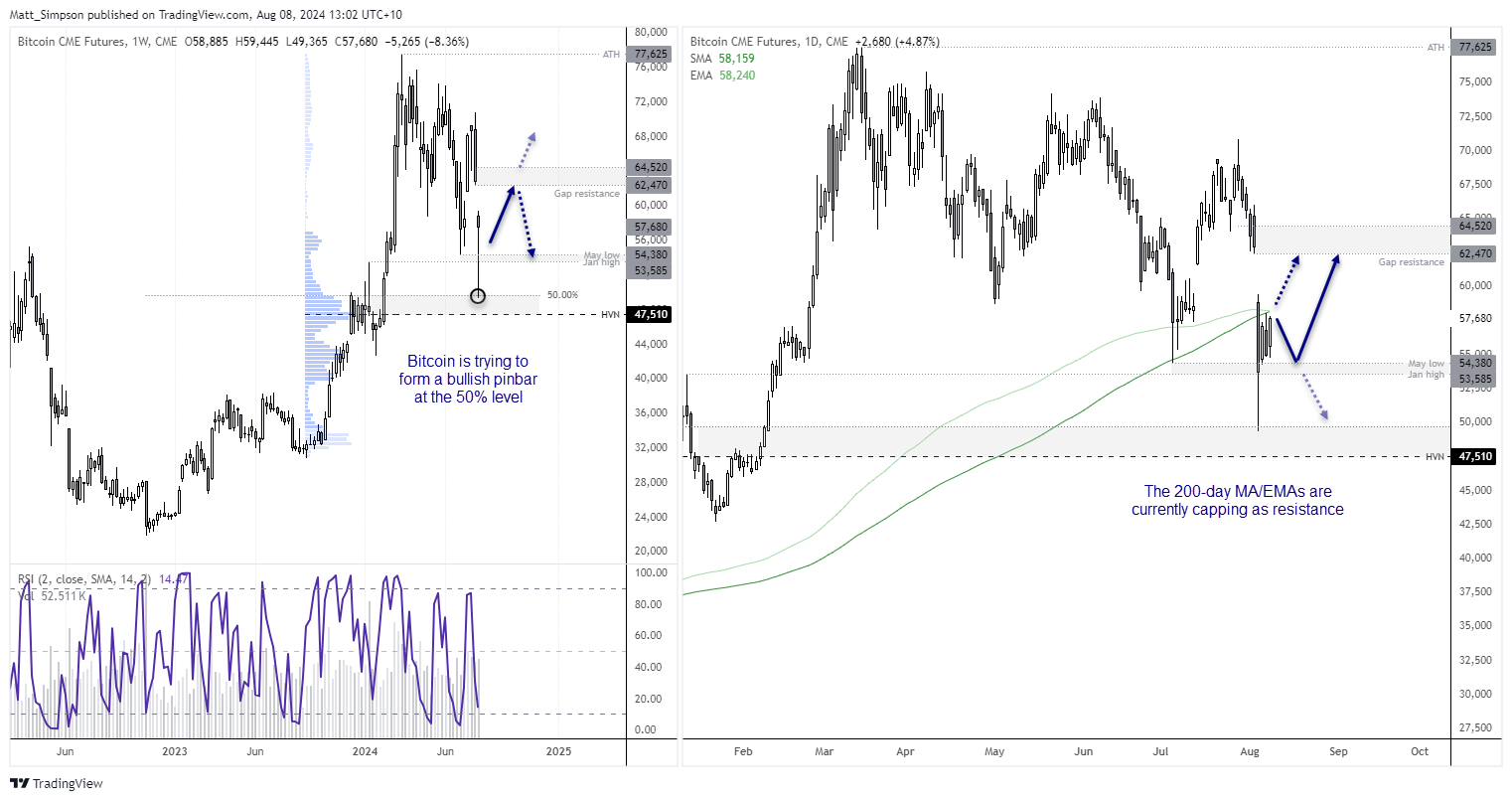

Bitcoin futures technical analysis:

Price action since the all-time high set in March appears to be corrective. The swings are volatile, frequent and overlap quite a bit, which is a clear change in character from the almost parabolic move into the record high. But that also suggests it could go on to a new record high in due course, we’re just not sure if the corrective low has been seen yet. However, a case for base is building.

This week’s low almost perfectly respected the 50% retracement level between the November low to ATH. And if it closes the week around current levels, a bullish pinbar will form and mark a false break of the January high and May low. And any moves towards the 54k area could temp bulls to load up – assuming sentiment allows. At a minimum, a move back to close the weekend gap just below $64k could be on the cards.

However, take note that the 200-day MA and EMA sit overhead and nearby at 58,159 and 58,239 respectively. A break above them is therefore required before assuming a move for $64k, along with a broader risk-on rally. Low volatility dips towards the May and Jan lows could entice dip buyers, although a break beneath them (alongside a broader risk-off rally) invalidates the near-term bullish bias.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge