- Australian inflation undershot market expectations in February

- The result has seen AUD/USD slide to test long running uptrend support

- A break lower opens the door for a retest of 2024 YTD lows

- Market volatility may increase heading towards Easter

The overview

Australia’s inflation report undershot market expectations in February, although there’s still evidence of stickiness in underlying price measures. Markets have reacted by bidding Australian government bonds which has pressured the AUD/USD, seeing it test uptrend support. A break could see the Aussie revisit its 2024 lows.

The background

Disinflationary pressures in Australia paused in February with the ABS monthly inflation indicator showing a year-on-year increase of 3.4%, unchanged from January. The result was below the 3.6% level expected by markets, with the increase in February standing at 0.16%.

Of what would be of more importance to the Reserve Bank of Australia (RBA), measures of underlying price pressures showed signs of stickiness with inflation ex-volatile items and holiday travel rising 0.66% and 3.9% over the year, the latter accelerating from the levels reported in January.

This underlying measure sits closer to the midpoint of the RBA’s 2-3% inflation target band on a three and six-month annualised basis but extrapolating short-term trends can deliver false impressions on the inflation picture. Just remember what the headlines were saying about US inflation trends late last year.

While an incomplete picture, services inflation declined 0.26% after falling 0.59% in January, a promising sign that heat in services inflation is moderating. The full slate of services prices will be available in the March quarter inflation report.

AUD/USD eased lower following the report while 3-year Australian government bond yields – which are sensitive to changes in RBA interest rate expectations – slid four basis points. While the monthly results should be interpreted with caution, it must be acknowledged the RBA Board often points to trends in the inflation indicator in its policy statements, likely explaining today’s market reaction.

It’s worth repeating the RBA’s preferred inflation gauge is the ABS quarterly trimmed mean measure. That can and has meaningfully moved Australian financial markets previosuly. It’s doubtful this report will do that beyond the short-term.

The trade setup

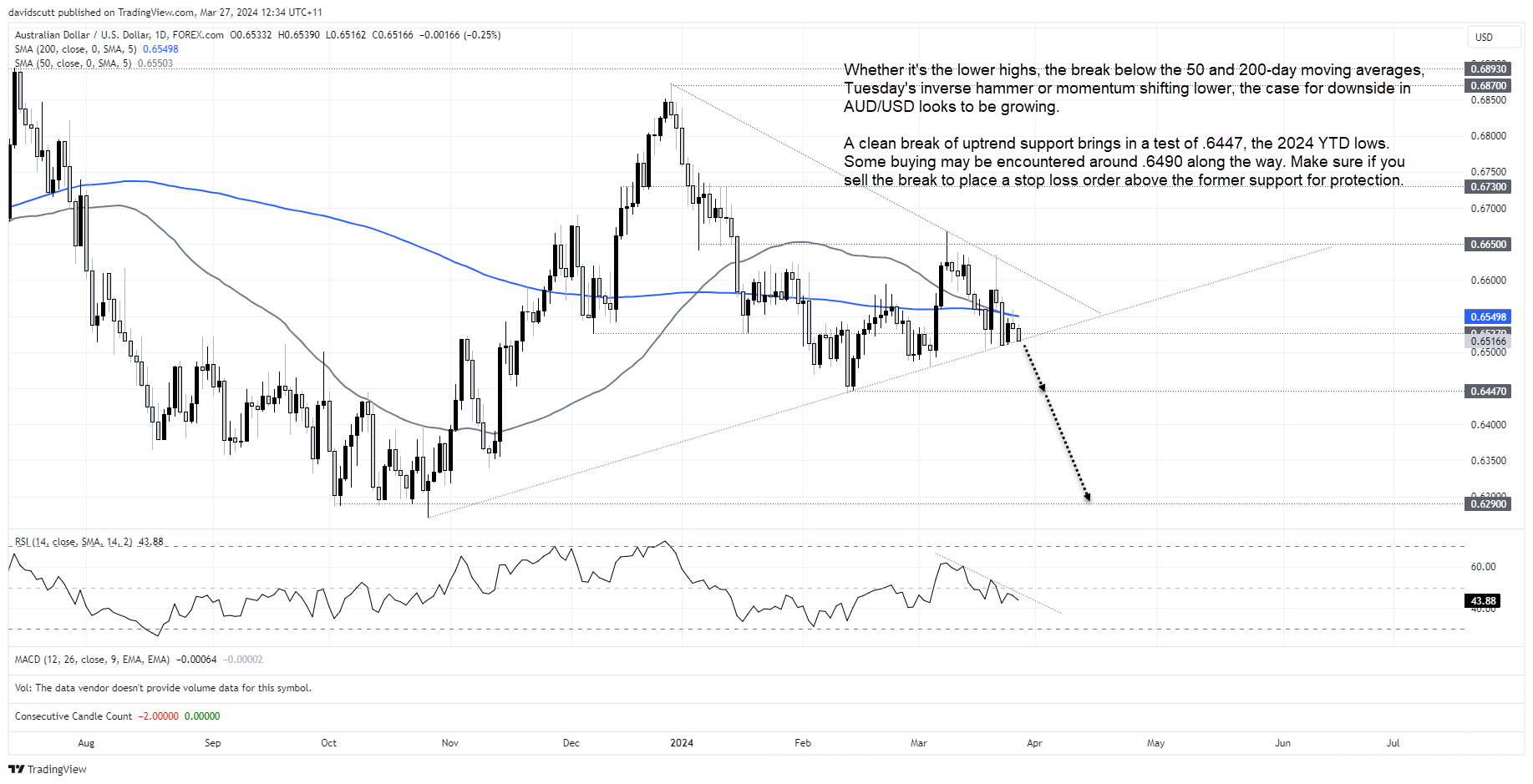

While its debatable how long the impact of the inflation report will last, AUD/USD looks vulnerable on the daily chart, testing uptrend support in what looks to be a bear pennant pattern. It’s successfully bounced from this level on seven separate occasions, but with a series of lower highs, momentum indicators pointing lower and having broken below its 50 and 200-day moving averages, the risk of downside break appears to be growing.

Should support give way, it’s plausible we could see AUD/USD retest the February lows around .6450. Aside from a bit of activity around .6350, there’s not a lot of visible support evident until below .6300 on the charts. For those considering initiating shorts on a clean break of the uptrend, remember to place a stop loss order above the level for protection.

The wildcards

AUD/USD has been sensitive to short-term movements in the USD/CNY cross recently, making that one area for traders to watch. If the CNY suddenly strengthens it’s likely AUD will too, and vice versus.

It’s also the last week of the quarter heading into Easter, so whippy and violent price moves may occur with market liquidity likely to decline. With the US core PCE deflator released on Easter Friday, the Fed’s preferred underlying inflation measure could deliver some unusually wild price action.

-- Written by David Scutt

Follow David on Twitter @scutty