Economic data in Australia is mixed. On one hand, this makes things tricky, we feverishly pour through data points to draw contrasting conclusions. On the other, it makes things easy because it means the RBA are equally as confused as we are. If there is no clear trend in the data across the board, it makes the policy path less clear. And that means they're less likely to change policy if there are too many ‘ifs and buts’.

Still, the return of rising inflation alongside the robust employment figures means there is a slight hawkish bias to the RBA's tone. And that's likely to remain in place following today's employment figures. Yes, unemployment rose to a two-year high of 4.1%. But then every other important metric also increased for this month's employment report, including job growth for full and part time workers, the participation rate and the employment to population ratio. Although one metric did tick lower, with the underemployment rate dropping to 6.5%.

And the net reaction of Australian markets has seen yields move higher and the Australian dollar move from cycle lows against various currencies, but the ASX 200 has pulled back from the day's high. This shows an increased odds of a rate hike, but we also need to factor in that yields and the Australian dollar were trading near cycle lows anyway - so I don't think it necessarily confirms a rate hike from the RBA just yet. Although it has allowed markets to mean revert higher from oversold levels.

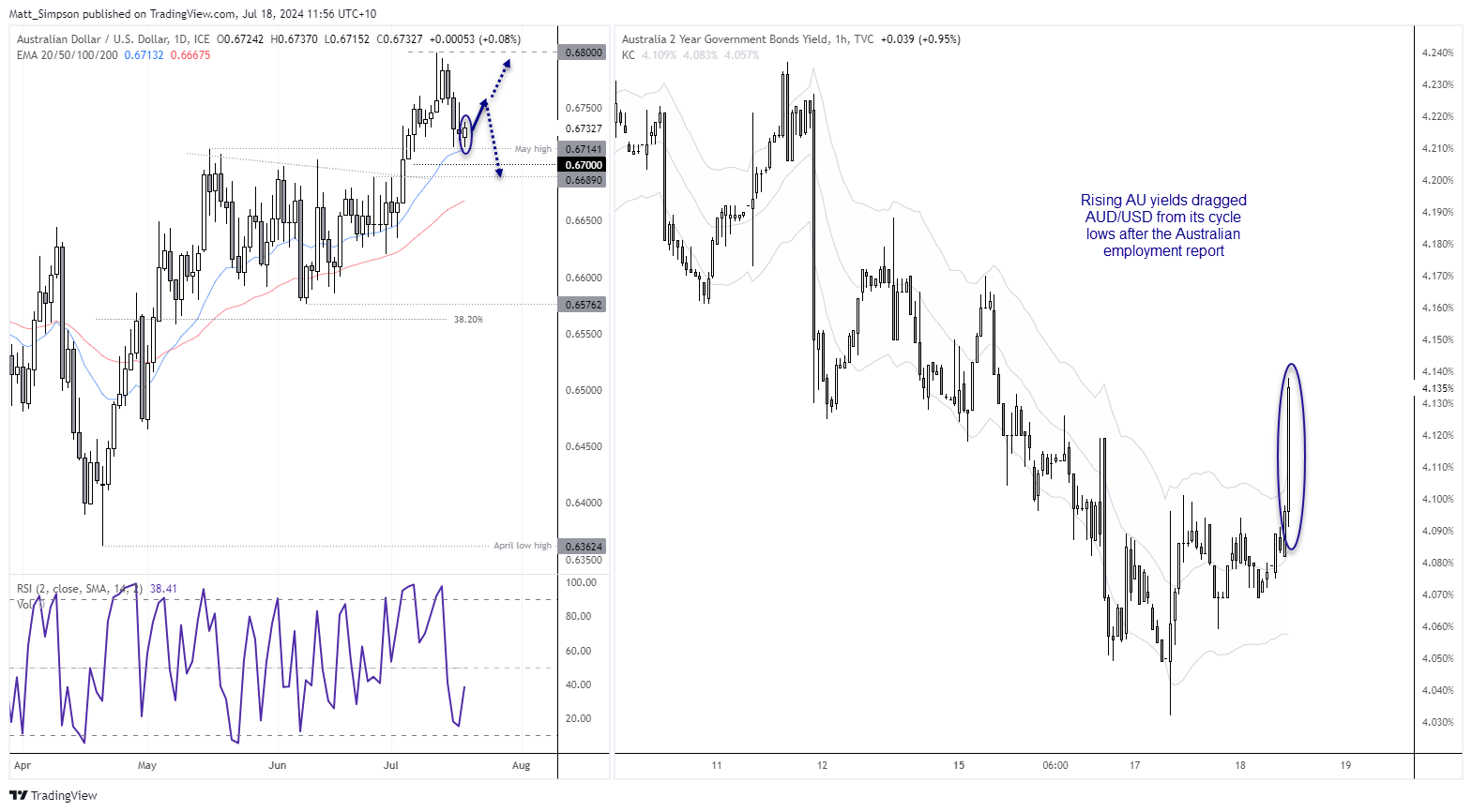

AUD/USD, AU2 year yield

The response from yields were probably the purest response from the jobs figures, as it suggests odds of an RBA hike have increased. It just so happens that AUD/USD was probing the May high for the second time this week before yields dragged it higher. Assuming today’s low remains unchallenged by the New York close, AUD/USD will close the day with a double bottom at the May high – in turn hinting at further gains, at least over the near term.

But for those seeking value, AUD/JPY may be the better choice.

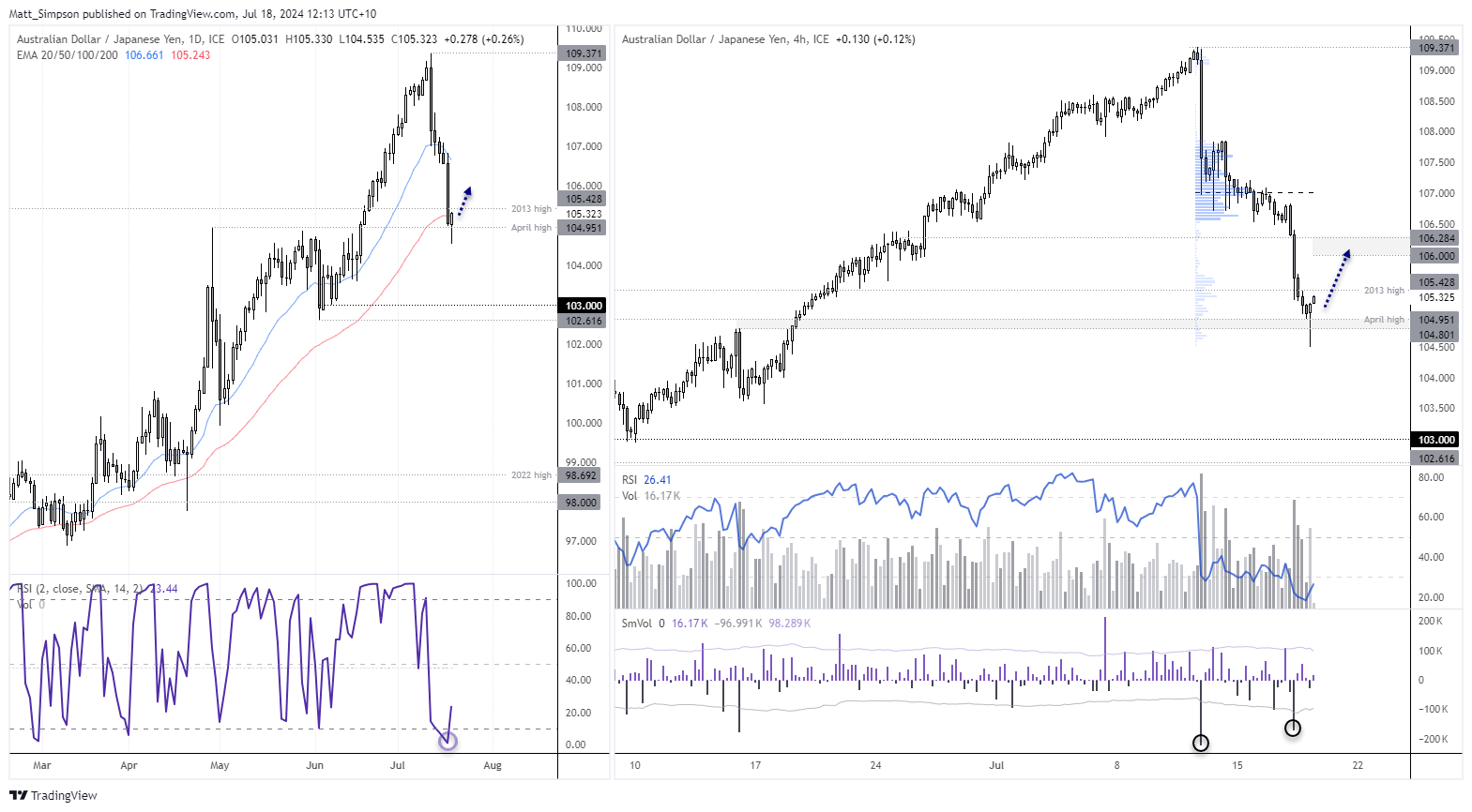

AUD/JPY technical analysis:

The cross has fallen 4.4% from the July high to today's low, and is now trying to gain some bullish traction from its lows. The daily chart shows that prices opened above the April high before an intraday break beneath it. But with momentum taking prices back above the April high, we may have seen the lower wick for the day, which marks a false breakdown. The daily RSI (2) is also moving higher after closing well into the oversold zone on Wednesday.

Yes, the MOF likely intervened on Wednesday but it already seems any nervousness of imminent intervention has passed. And that could allow the yen to drift lower and provide upside potential for AUD/JPY over the near-term as part of a counter-trend bounce. Besides, trading volumes have been relatively low near these cycle lows looking at the volume profile, and we have seen two extremely negative volume delta candles which to me suggest bears got greedy on the way down (on a relative basis).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge