- Australian underlying inflation undershot market expectations in the June quarter

- Australian rates markets now see the next move from the RBA being a cut, not a hike

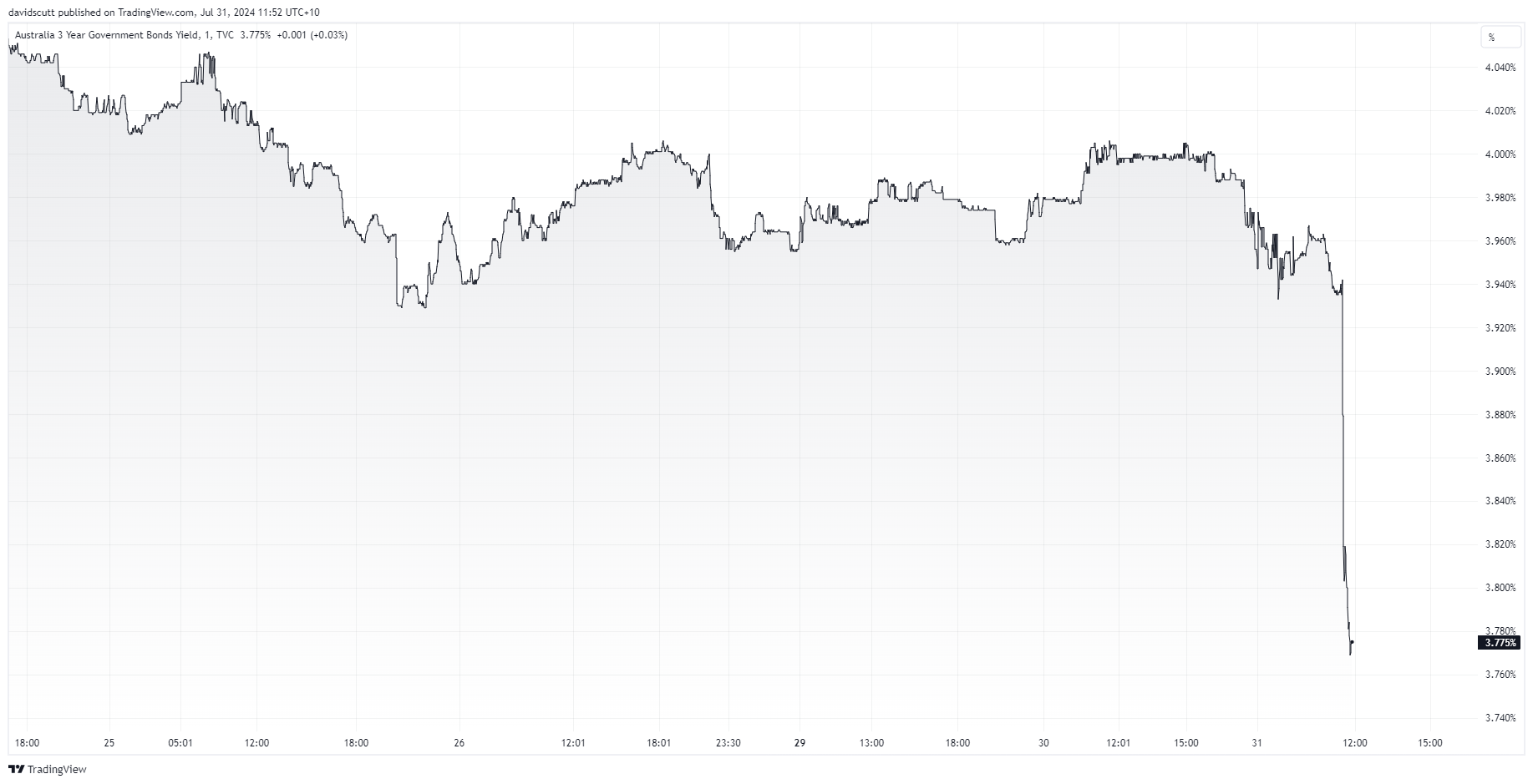

- Australian 3-year bond yields tumble, signaling major turning point

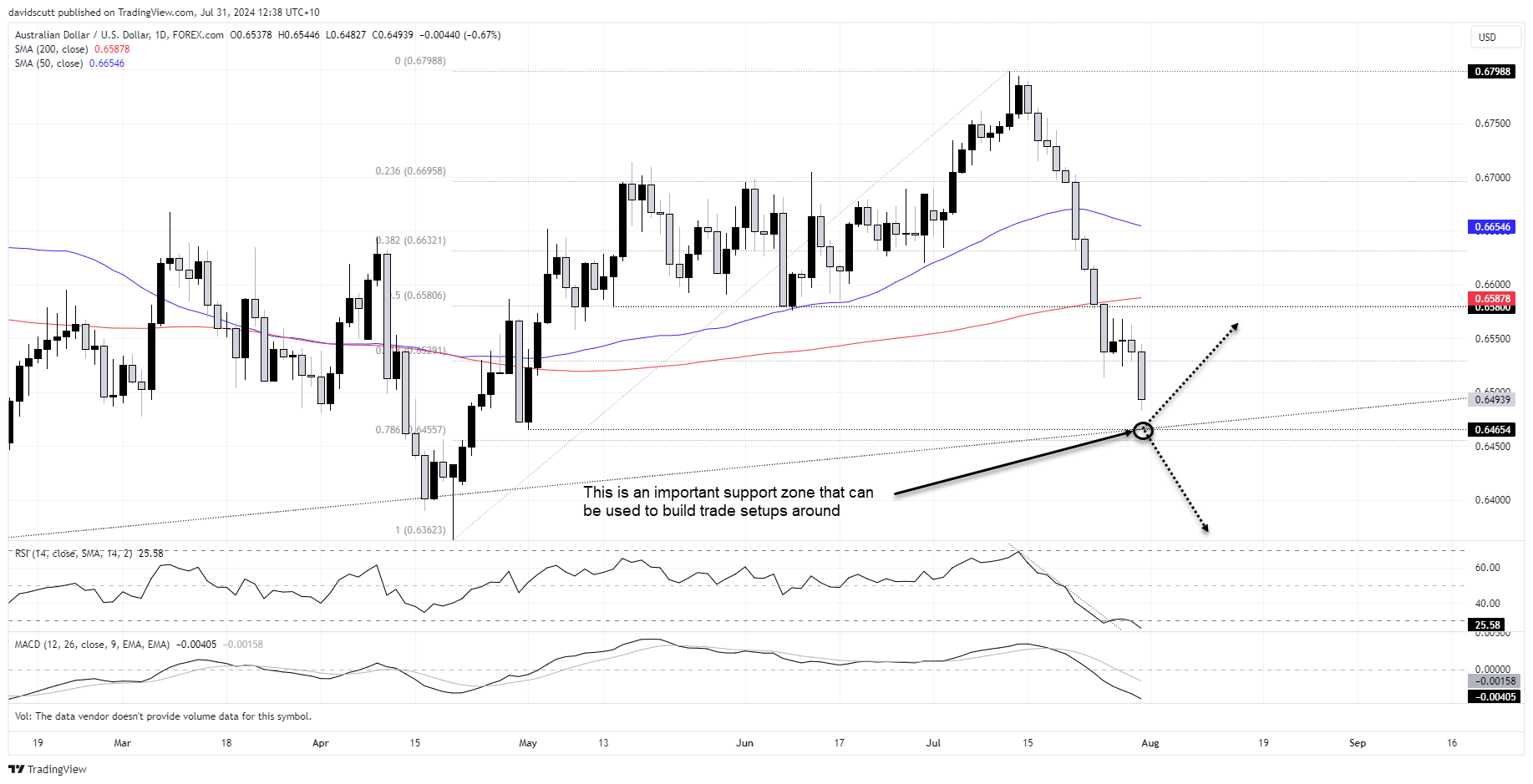

- AUD/USD hits multi-month lows, risk appetite to direct near-term direction

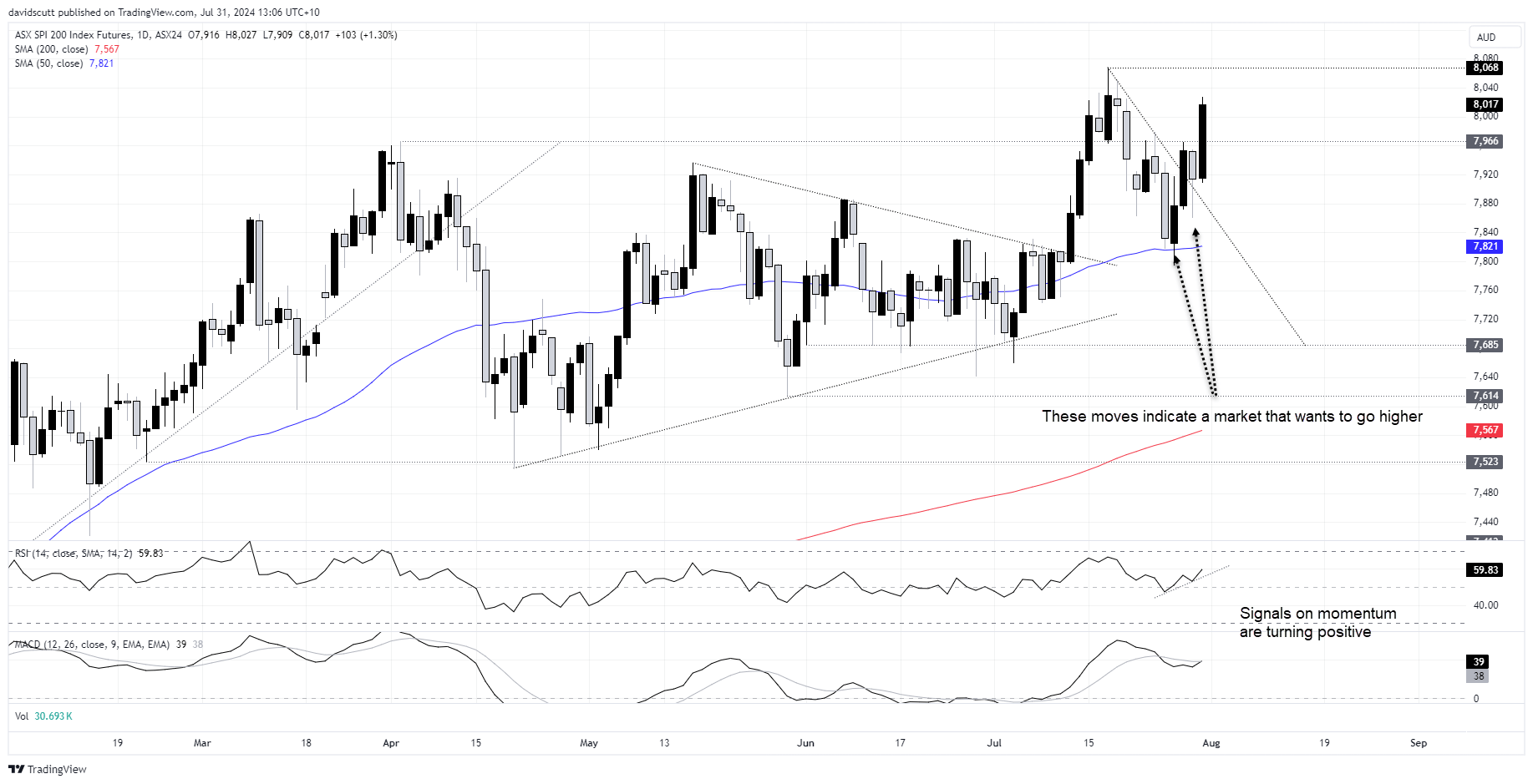

- ASX 200 SPI futures eyeing break of record highs

AUD/USD is under pressure while ASX 200 SPI futures are flying following Australia’s Q2 CPI report, reflecting surprisingly modest underlying inflationary pressures that all but extinguish the risk of another RBA rate hike this cycle. But don’t go rushing to place imminent rate cut bets, nor expect the moves we’re seeing to continue beyond the short-term. The inflation report is just one of multiple major risk events traders need to navigate on Wednesday.

Inflation report detail

Headline CPI rose 1.0% over the quarter and 3.8% over the year, in line with what markets and the RBA were expecting. Importantly, the trimmed mean inflation measure rose 0.8% over the quarter and 3.9% over the year, two and one tenth respectively below what markets were expecting.

The undershoot in this measure – which the RBA watches to gauge underlying inflationary trends – was important, even if the annual rate was a tenth above what the RBA forecast in May. With the weighted median measure – another underlying inflation reading – rising 0.8% for the quarter, it builds confidence that inflationary pressures are no longer accelerating, negating the need for the RBA to lift the cash rate beyond 4.35%.

Aussie rates stage significant pivot

The reaction in Australian rates markets was significant, suggesting expectations among traders were skewed towards a hot inflation print.

Australian three-year government bond yields slumped 20 basis points as markets swung from pricing the next move in the cash rate from being a hike to cut. Moves of this magnitude are rare and usually seen around important turning points when it comes to the policy outlook.

The next move from the RBA will almost certainly be a cut. But it’s unlikely to come soon without a significant macro event abroad given signs that consumer spending is holding up well despite higher interest rates.

Released alongside the inflation report, Australian retail sales rose 0.5% in June after a 0.6% lift in May, confounding expectations for a smaller increase of 0.2%. While retail volumes fell 0.3% in the quarter and will detract from GDP in Q2, demand is still holding up with unemployment remaining low at 4%.

Markets favour December rate cut

Right now, Australian overnight index swaps favour a rate cut from the RBA by December with a full 25 basis point cut price by February. Looking further ahead, three full cuts are price by the end of 2025. Prior to the inflation report, the risk of a 25 basis point hike in August was deemed a one-in-five chance.

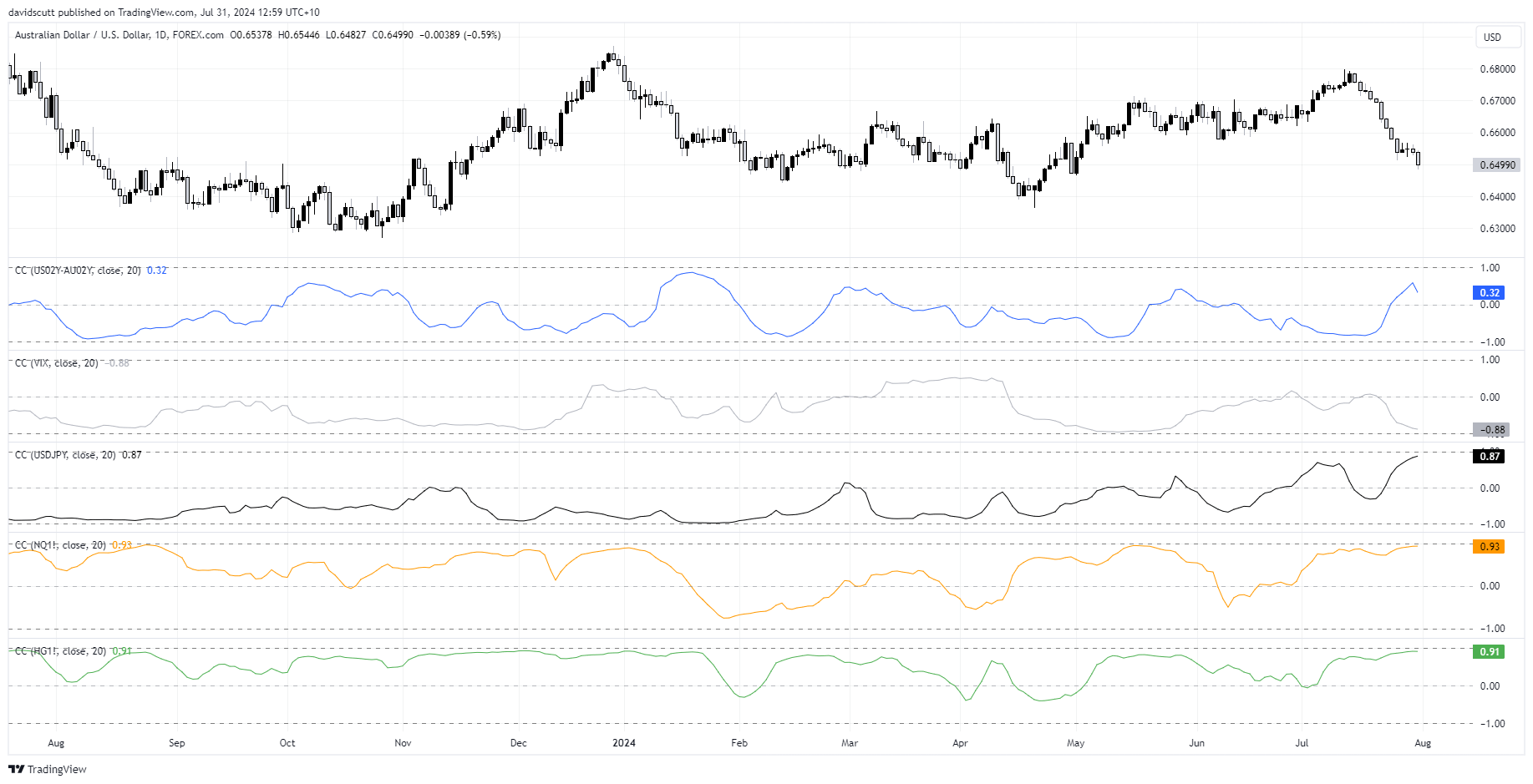

AUD/USD to take cues from risk assets, not rates

The shift in RBA rates pricing hammered AUD/USD lower, widening yield differentials between the US and Australia after a long period of compression. H

owever, as seen in this chart tracking the rolling daily correlation between AUD/USD with a variety of indicators over the past month, the relationship with US-Australia two-year yield spreads sits at 0.31, far weaker than other markets such as US stock market volatility, Nasdaq and copper futures, along with USD/JPY.

That’s important if you’re trading AUD/USD as the effect of Australia’s inflation report disappears into the distance, replaced by a focus on the BoJ and Fed meetings, along with US tech earnings. They are likely to dictate direction from here, not interest rate differentials.

AUD/USD holds above key support

AUD/USD tumbled to the lowest level since early May on the inflation report, triggering stop loss orders beneath the 61.8% Fibonacci retracement of the May-July move. Importantly, the price remained above key uptrend support dating back to the pandemic lows around .6465. That’s the level to build trade setups around, especially with minor horizontal support intersecting at the level.

Below, the April 19 low of .63623 would be the next downside target with major support at .6290 the next after that. On the topside, gains were capped below .6570 earlier this week. Beyond, .6580 and 200-day moving average at .65878 would be a tough resistance zone to crack without a significant improvement in risk appetite.

ASX 200 SPI futures near record highs

With the threat of a RBA rate hike off the table, Australian ASX 200 SPI futures surged on the inflation report, breaking through resistance at 7966, leaving a retest of the record highs at 8068 on the cards.

The bounce off the 50-day moving average late last week, and the recovery off the lows seen on Tuesday, is indicative of a market that wants to go higher. With MACD and RSI providing bullish signals on momentum, and the Fed likely to signal a rate cut in September later in the session, bulls will be eyeing off a break of the record highs. Below, 7966 may now act as support with the 50-day moving average the next after that.

-- Written by David Scutt

Follow David on Twitter @scutty