- Australian unemployment jumped to a two-year high or 4.1% in January

- Employment grew by a paltry 500 after big job losses in December

- Broader measures of labour market slack continued to soften, bringing forward the timing and size of expected RBA rate cuts

- AUD/USD and ASX 200 futures have both softened following the release

Australia’s labour market is undeniably slowing, bringing the prospect of the Reserve Bank of Australia (RBA) leapfrogging the US Federal Reserve when it comes to which central bank will cut interest rates first.

Australian unemployment hits two-year high

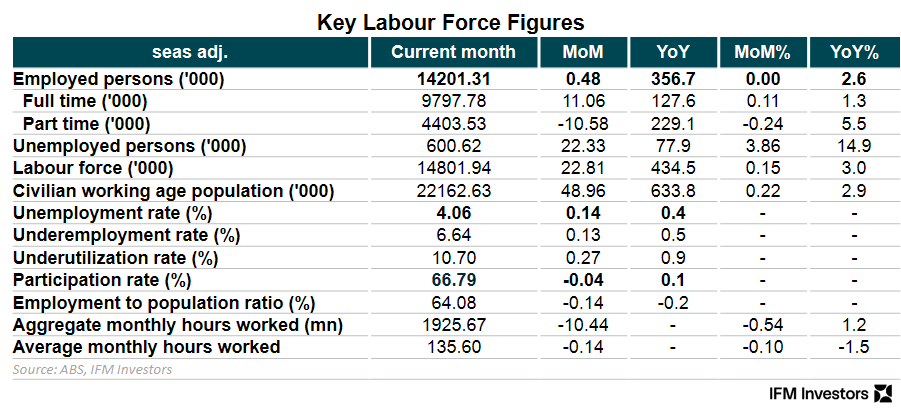

Unemployment rose to the highest level in two years in January, jumping two tenths of a percent to 4.1%. Markets were looking for a smaller increase to 4%. The increase came as employment growth stalled, recording a paltry gain of 500 workers, well below the 30,000 increase expected. The weak outcome followed an unusually large decline in employment in December. Hours worked declined sharply by 0.5%, adding to the soggy report.

Helping limit the rise unemployment, the labour force participation rate eased marginally to 66.8%, a tenth below expectations. Without a recent decline in labour force participation, the unemployment rate would be sitting in the mid-4s. The RBA’s latest forecasts have the unemployment rate sitting at 4.2% by the middle of the year.

Source: X (@IFM_Economist)

Labour market slack continues to build, limiting wage and inflation pressures

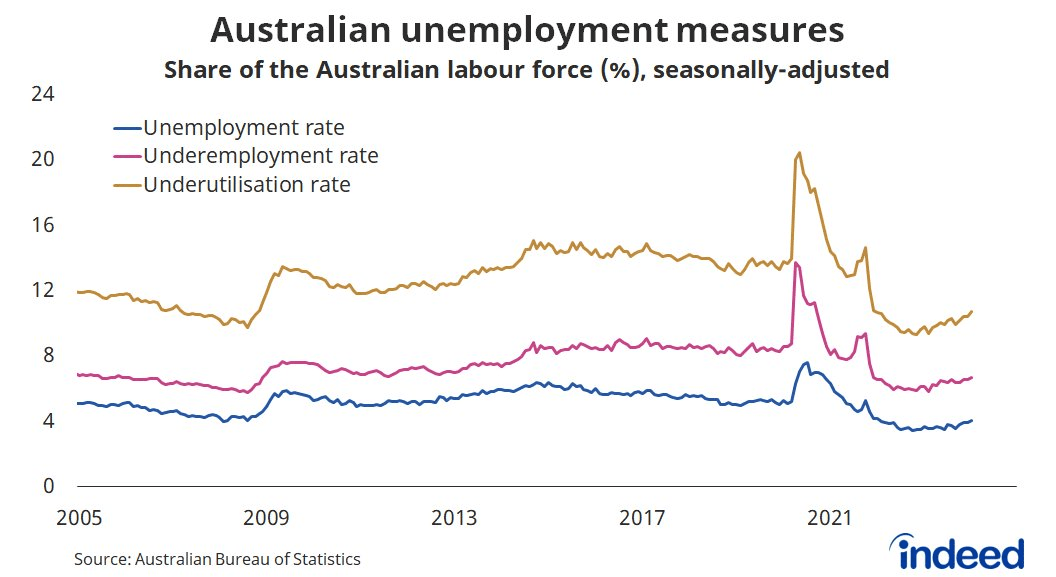

Providing a cleaner read on true labour market conditions given how quickly employment can now be found with the emergence of the gig economy, underemployment – which measures the proportion of the workforce who are employed but would like and can work more hours – ticked up a tenth to 6.6%. Labour force underutilisation – which combines unemployment and underemployment rates together – jumped three tenths of a percent to 10.7%.

Source: X (@CallamPickering)

The underutilisation rate has a decent inverse relationship with wage pressures given it provides a more encompassing view of slack in the labout market, so the continued increase points to lessening wage pressures moving forward, limiting the risk of it filtering through to stronger demand and higher inflationary pressures.

Seasonality may explain the softness

The ABS said seasonal shifts may explain some of the weakness, noting the increase in unemployment coincided with a higher-than-usual number of people who were not employed but who said they will be starting or returning to work in the future.

“While there were more unemployed people in January, there were also more unemployed people who were expecting to start a job in the next four weeks,” it said.

“This may be an indication of a changing seasonal dynamic within the labour market, around when people start working after the summer holiday period. In January 2022, 2023 and 2024, around 5 per cent of people who were not employed were attached to a job, compared with around 4 per cent in the January surveys prior to the COVID-19 pandemic.”

February jobs report will be important for RBA interest rate outlook

That sets the scene for an improvement in the data when the February report rolls around, but also leaves grounds for disappointment should the trends of the past two months be evident again. It will be an important report on the outlook for the RBA cash rate.

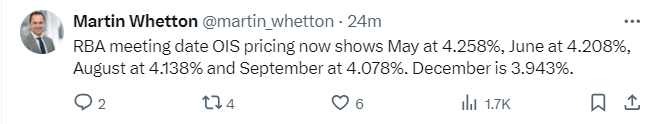

Source: X (@whetton_martin)

Right now, Australian overnight index swaps (OIS) markets are fully priced for the first RBA rate cut by September, with a move in August deemed highly probably. May also has close to 10 basis points priced in, meaning just under 40% chance of 25-pointer being delivered. The expected timing and amount of rate cuts this year was brought forward and increased in the wake of the report.

AUD/USD rally stalls

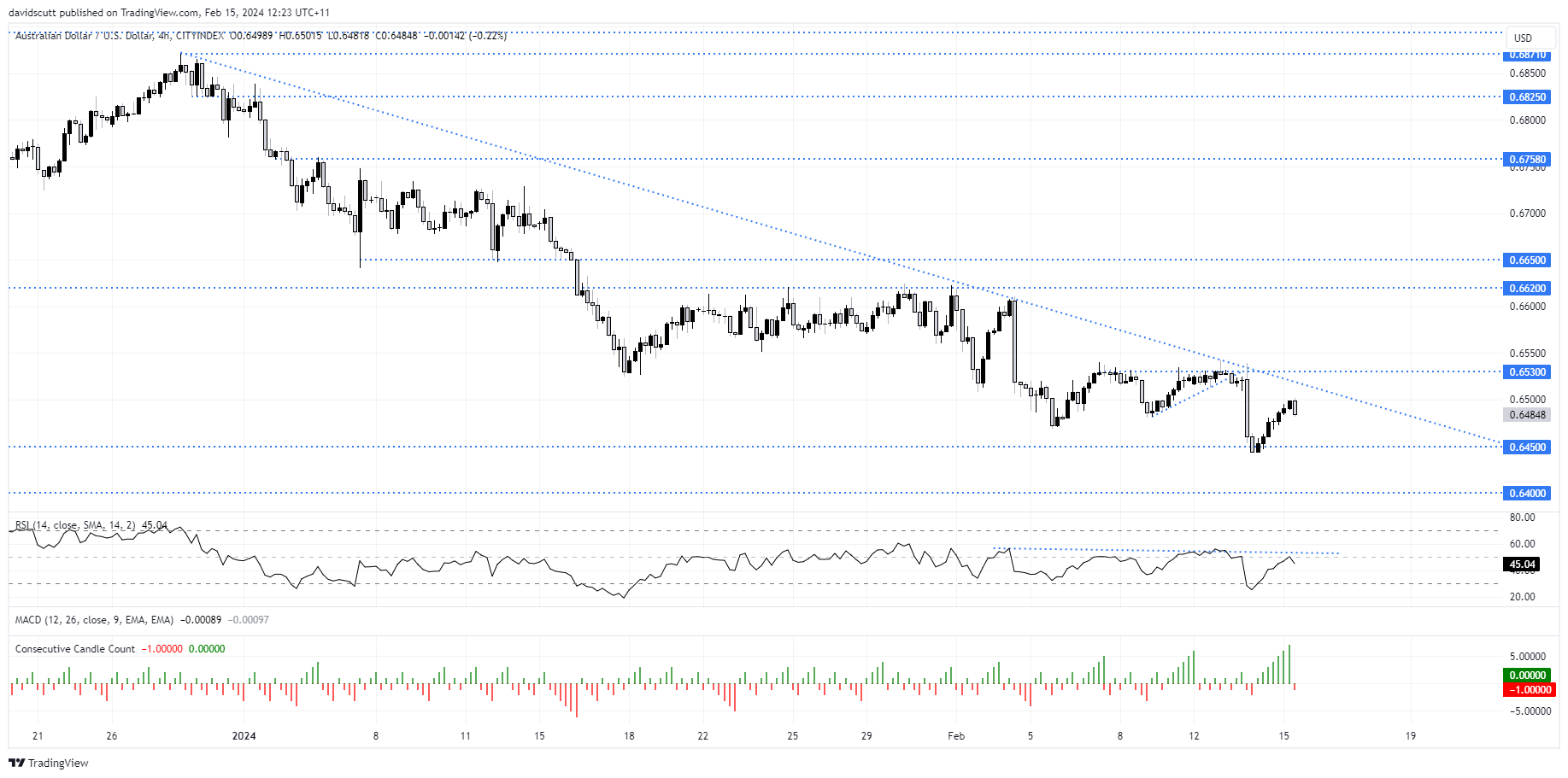

Having rallied into the report, presumably on the belief the weakness in the December report would be reversed in January, AUD/USD has eased lower in the hour since the release, potentially signalling an end to the longest consecutive up streak for the pair on the four-hourly chart since early November.

However, the lengthy list of caveats provided by the ABS on interpreting the data has ensured the reversal has been modest to this point, leaving AUD/USD stuck in the middle of the range it’s been operating in for the past two weeks. With the price and RSI still in a downtrend, the path of least resistance appears to be lower near-term, putting .6450 and .6400 in the sights of potential shorts. Above, downtrend resistance is located around .6520 with another later found ten pips higher at .6530.

Looking ahead, the big risk events are all the USD side of the currency ledger with retail sales, jobless claims and producer price inflation providing catalysts to spark volatility over the next 36 hours.

ASX 200 futures stage decent reversal

Contrary to what you’d normally expect when it comes to the prospect for earlier and larger rate cuts, Australian stocks have softened following the jobs report, printing what looks like it’ll be an ugly bearish hammer candle on the four hourly chart. Mind you, the up streak before it was the longest since mid-November. Let’s see how it finishes up, but the signs suggest sellers may be taking back the ascendancy.

Support on ASX 200 futures is located at 7520, 7490 and around 7427. It’s not shown on the chart but should the high of the latest candle be taken out, futures have struggled to push beyond 7600 recently.

-- Written by David Scutt

Follow David on Twitter @scutty