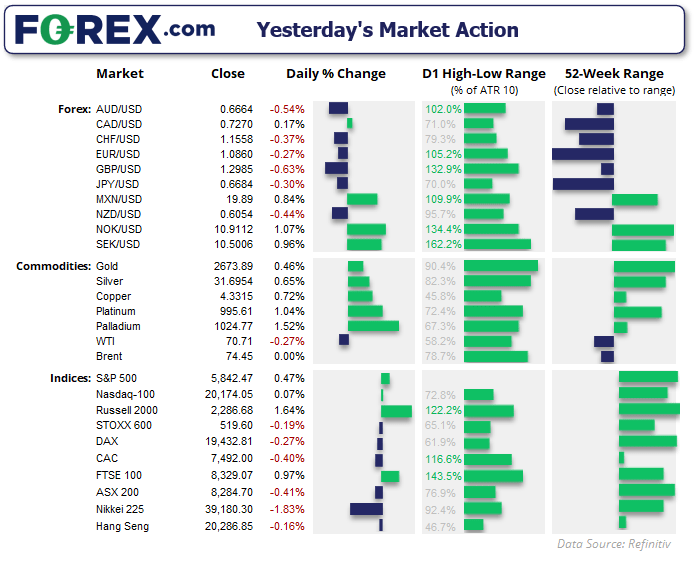

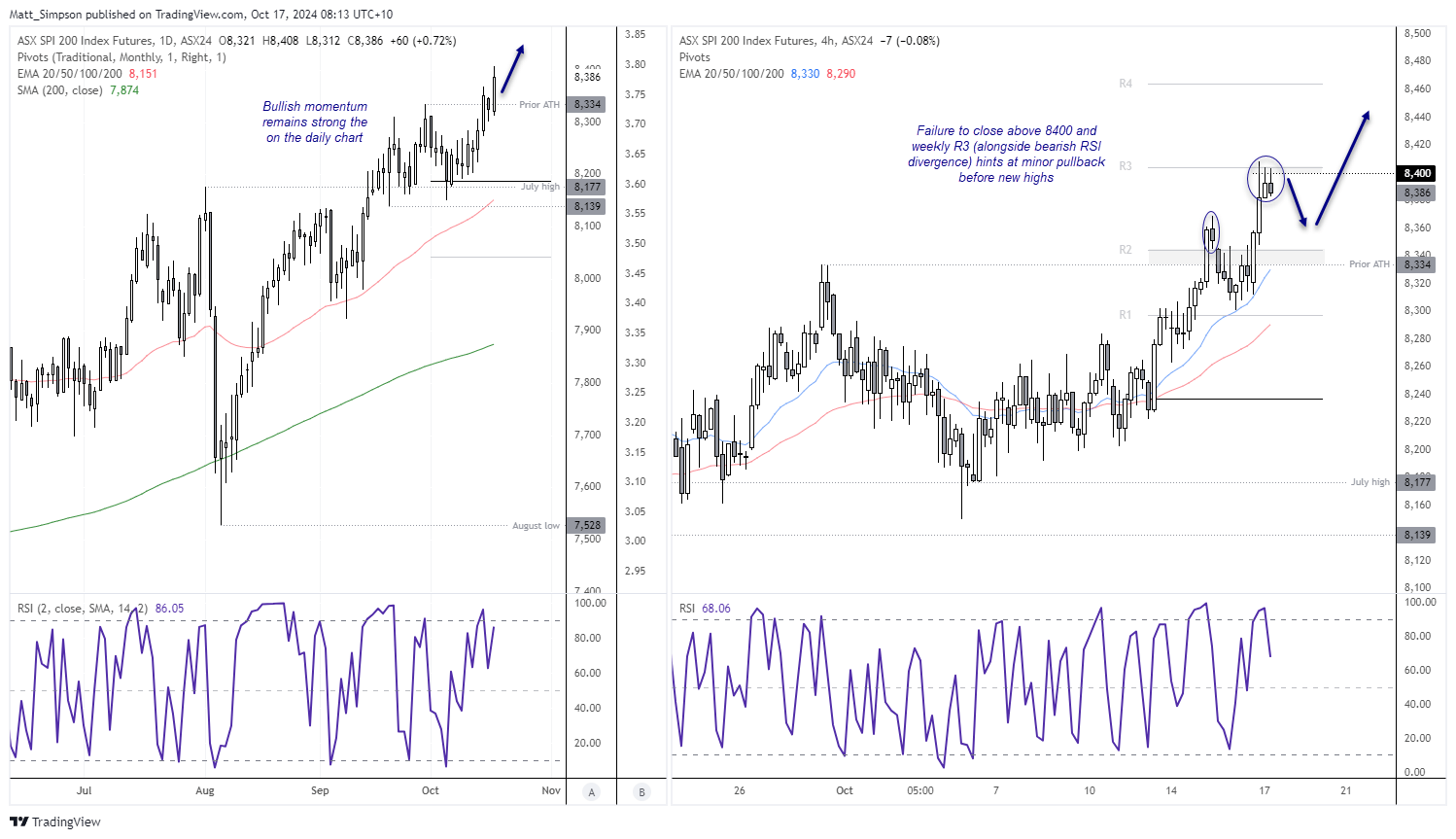

The Dow Jones record a new all-time high (ATH) for a third consecutive session, helping ASX 200 futures reach 8400 for the first time on record overnight. The S&P 500 formed a small bullish inside day to close just -0.3% beneath its own record high and the Nasdaq 100 formed a small bullish hammer to both show these markets are not ready to roll over just yet. But with earnings season in full swing and a key US retail sales and jobless claims report, this really could go either way by Thursday’s close.

Gold futures reached 2700 in line with yesterday’s bullish bias and now trades within east reach of its own record high of 2708.7. A softer set of US figures could prompt a daily close above this key levels on bets of a less-dovish Fed next year.

WTI crude oil prices were lower for a fourth day, but support has been found around $70, suggesting a cheeky bounce could be on the horizon.

GBP/USD was the weakest FX major, fell to an 8-week low and closed beneath 1.3 on renewed bets of BOE cuts. CPI was 1.7% y/y was much lower than expected, and down from 2.2% previously. Money markets are now pricing in a 90% chance of two 25bp cuts by the end of the year.

Events in focus (AEDT):

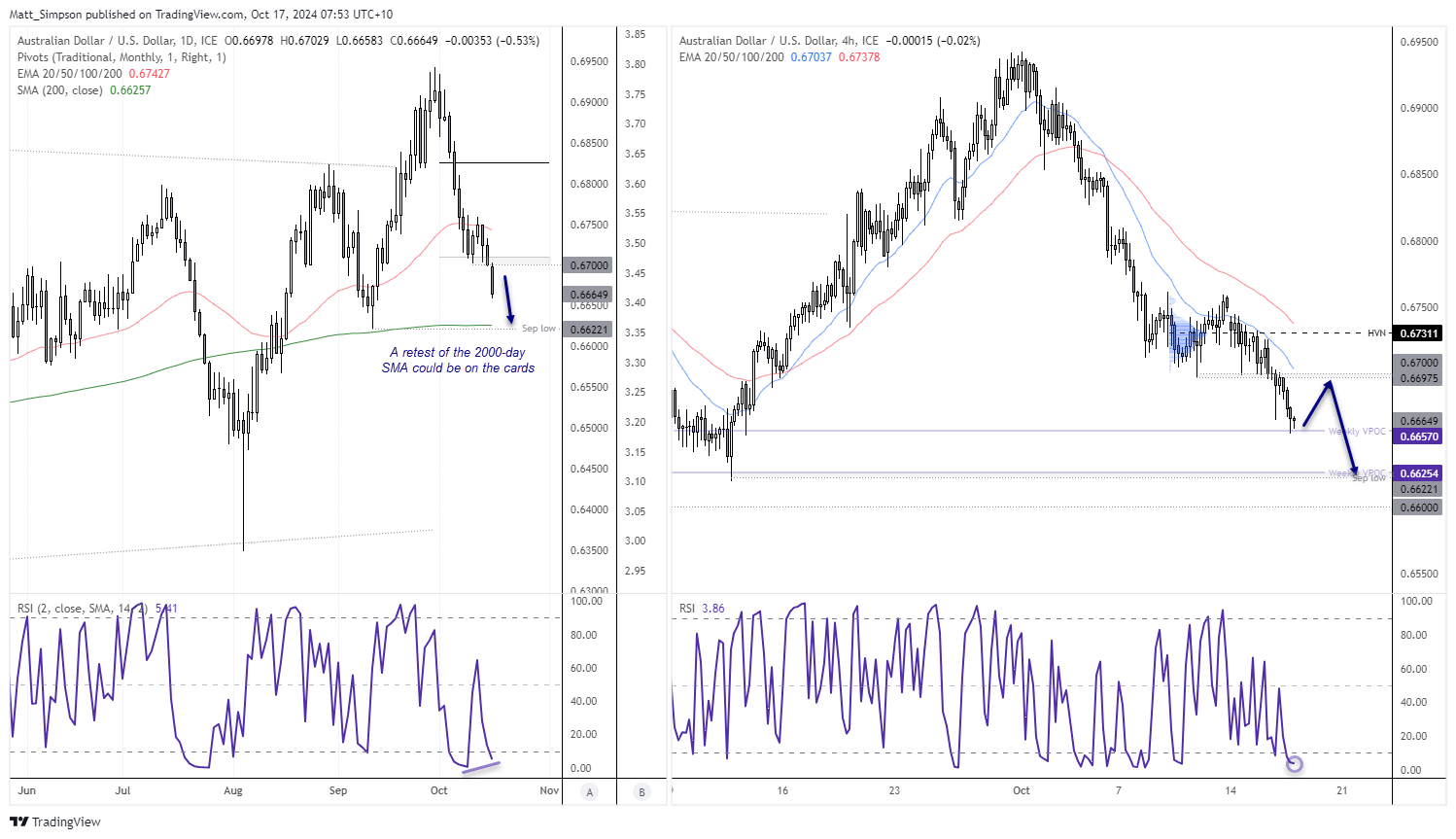

Australia’s employment report is the main event in Asia, although even then it is debatable as to whether it moves the dial for the RBA. Doves really need to see job growth and the participation rate falter alongside rising unemployment, yet a robust jobs market (alongside quarterly CPI that remains “too high” remains a thorn in their side. Therefore, another decent set of figures today could help AUD/USD lift itself back towards 67c for a cheeky bounce, even if it now looks like momentum wants to drag it back down to its 200-day MA.

The ECB are expected to cut their interest rate by 25bp, so they may need to deliver a dovish cut for euro to continue lower without the aid of USD strength. Or it could bounce sharply if they surprise without cutting at all. Regardless, traders will also keep an eye on the press conference for any forward guidance, but my guess is there won’t be any as the ECB still have disagreement among its members over policy.

In between these events sits key US data. The devastation of Hurricane Milton could weigh further on jobless claims, which spiked at its highest rate in over two years last week. If this were to be coupled with a surprise miss on US retail sales, it could shake some USD bulls out of their positions. But if recent data is anything to go by, consumers seem more likely to have kept shopping and traders may look through weakness of jobless claims if it is deemed temporary due to the hurricane. And strong US data coupled with a dovish ECB cut could send EUR/USD further down the rabbit hole.

11:30 – AU employment

11:30 – SG non-oil exports

15:30 – JP tertiary industry activity

19:15 – ECB McCaul speaks

20:00 – EU CPI

23:15 – ECB interest rate decision

23:30 – US jobless claims, retail sales, Philly Fed manufacturing

23:45 – ECB press conference

AUD/USD technical analysis:

The 2-day pullback on AUD/USD was shallow and short-lived, with bulls failing to take the daily close above the 50-day EMA and prices now well below 76c. Perhaps another strong employment report could slow the bleeding and produce a minor bounce, but with momentum clearly favouring bears it seems the market really wants to head the 200-day SMA (0.6625), just above the September low (0.6621).

The 1-hour chart shows prices found support at a weekly VPOC (volume point of control). Should we see a bounce, bears could seek signs of weakness around the 0.6697 low or 20-hour EMA around the 67c handle. A break beneath Wednesday’s low brings the September low into focus, near the next lower weekly VPOC.

ASX 200 futures technical analysis:

We saw the initial false break of the prior ATH discussed on Monday, and bulls have since re-entered to drive the ASX futures market to a fresh record high. Yet with Wall Street indices not fully in sync with their all-time highs, and inability for ASX futures to close above 8400, I suspect some mean reversion is once again on the cards. And it really depends on where US data lands tonight as to whether the ASX 200 can extend its rally from here. But for now, a minor pullback is preferred and for retests of the ATH to fail.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge