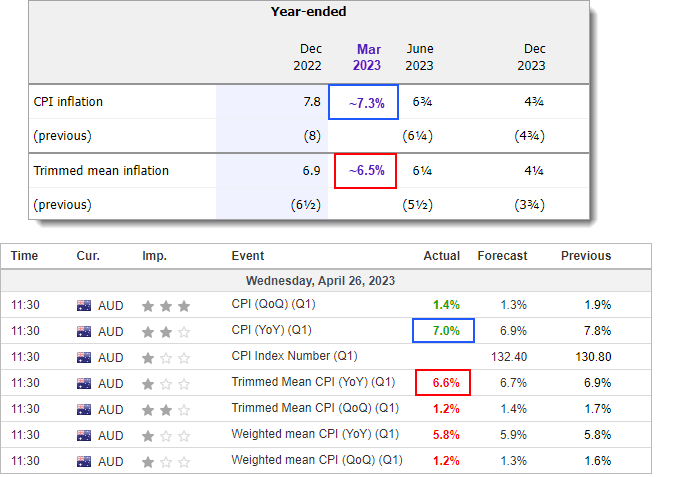

- CPI rose 7% y/y, slightly above 6.9% market consensus bit below 7.8% previous

- Inflation rose 1.4% q/q, slightly above 1.3% forecast but below 1.9% previous

- Trimmed mean and weighed measures were all below expectations, which tips the scales towards another pause next week

- But that is not to say more hikes are not due over the coming months as the fight against inflation (with relatively low rates) continues

There was a lot of anticipation for today’s inflation figures at it is the first quarterly report of the year, within weeks of the RBA holding interest rates after 11 consecutive hikes. RBA cash rate futures implied an 83% chance of a pause next week (or just a 17% chance of a 25bp increase to 3.85%), so we needed to see a hot print to convince money markets that a hike is much more likely.

As always, there’s a few ways of looking at the data set and that does leave a certain amount of ambiguity. But I suspect the data set keeps the RBA on track for a pause at their next meeting, even if inflation remains more than twice their target band.

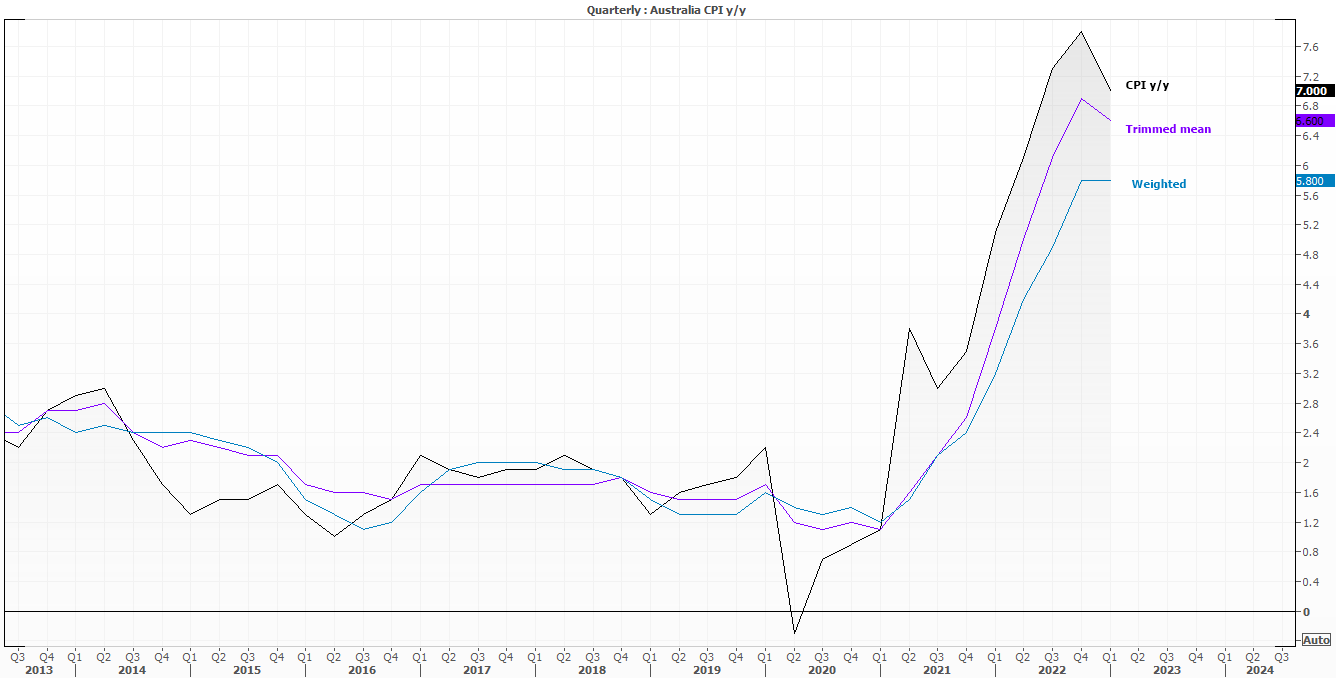

Trimmed mean inflation y/y (the RBA’s preferred inflation measure) snapped a seven-quarter rise, and it backs up the hopes that inflation has indeed topped in Australia. The quarterly measure also moved lower for a second consecutive quarter, at its fastest pace since the pandemic. And as the trajectory from Q4 2022 to Q1 2022 more than keeps them on track for their Q2 target, I suspect the RBA will be content in keeping rates on hold at next week’s meeting, especially as “inflation expectations remain well anchored”.

However, that is not to say the RBA have reached their terminal rate in the cycle, as disinflation needs to keep up the pact to justify a pause in the coming months. And we may find we’re dealing with a very different central bank if the board is given a shakeup. Dr Philip’s Lowe’s futures could be decided as early as June, and recommendations following the independent review of the RBA could see fresh faces added to the board. And in all likelihood they could be more hawkish than the current setup.

For now, markets favouring a pause with a lower Australian dollar, lower bond yields and a higher ASX 200, although volatility is on the low side all things considered.

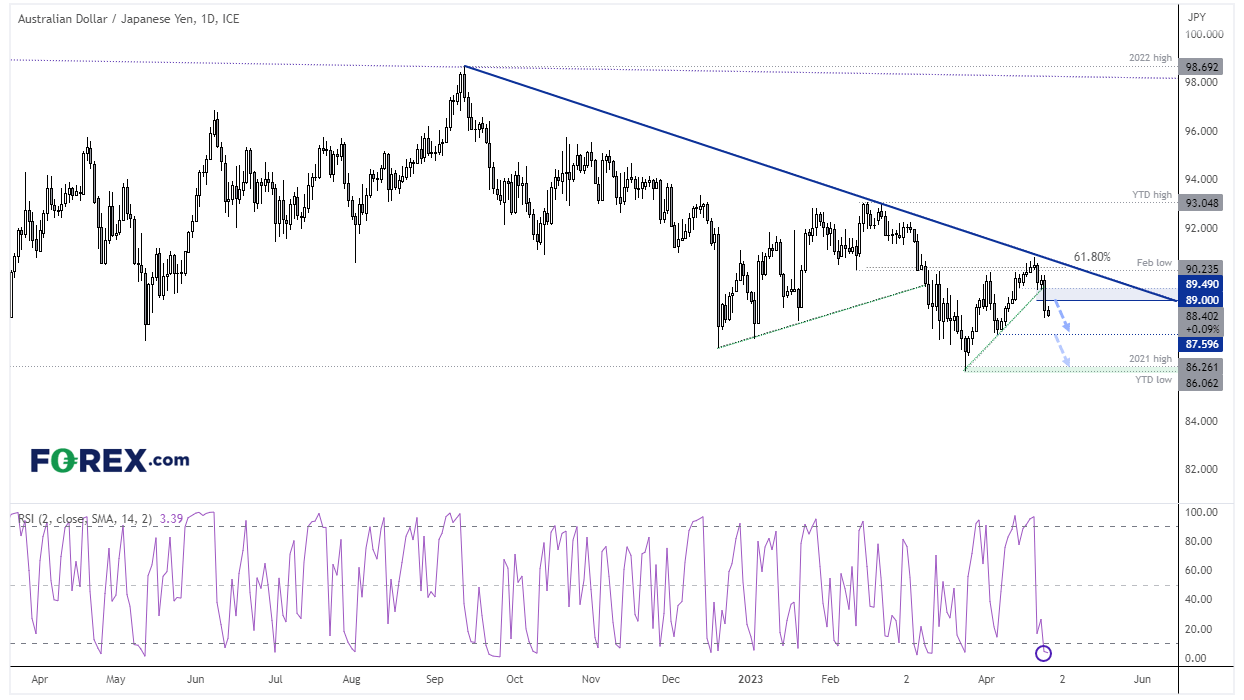

AUD/JPY daily chart:

A risk-off tone has helped AUD/JPY remain under pressure, although dovish remarks from the BOJ ahead of Friday’s BOJ meeting are likely helping to support the cross to a degree. Still, with Wall Street suffering its worst day in six weeks, perhaps the AUD/JPY has more downside potential.

Last week formed a bearish pinbar at the 20 and 50-week EMA (ad daily 200-day EMA). A swing high has formed at trend resistance and the 61.8% Fibonacci ratio, and prices are now below 89 and trend support. However, with RSI(2) oversold and prices holding above yesterday’s low, perhaps there’s room for a small bounce. From here, we’d consider bearish setups below the 89 – 89.50 resistance zone for a move down to the 87.60 and YTD lows.

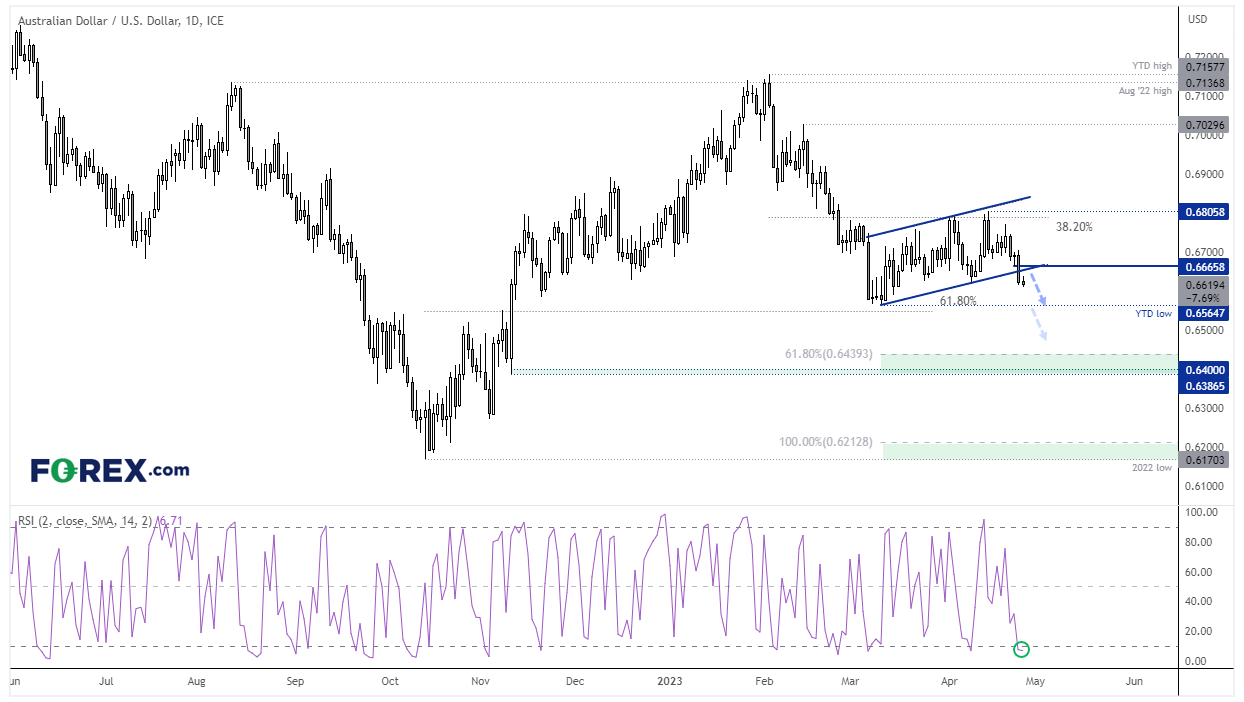

AUD/USD daily chart:

The Aussie closed below trend support to suggest a breakout from a bearish continuation pattern, and is potentially 1-2 trading days away from testing the YTD low. We made a case for a stronger US dollar last week, which could help push the Aussie lower, especially with AU yields moving lower and a risk-off tone for equity markets overall. Should we see it break to a fresh YTD low, the 0.6500 and 0.6400 handles come into focus for bears.

US inflation data on Friday, Tuesday’s RBA meeting and Wednesday’s (or Thursday AM) FOMC meeting are key market drivers to keep an eye on over the next week.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge