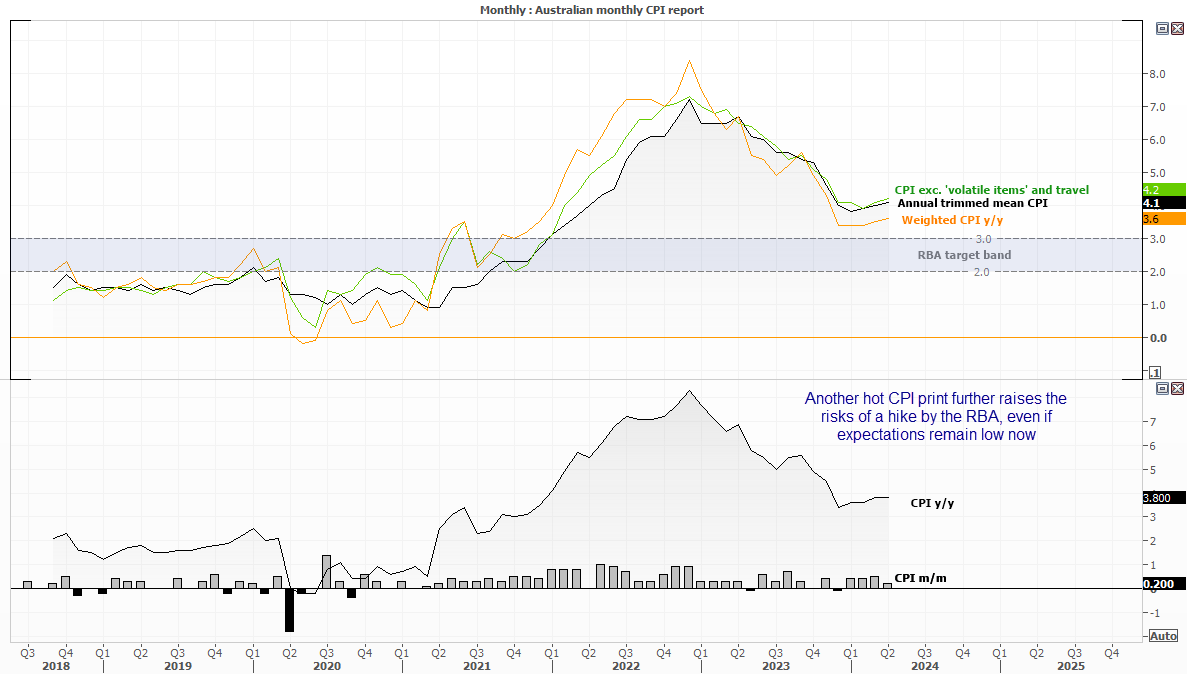

Summary of RBA minutes:

- Inflation has fallen substantially since its peak in 2022

- But the pace of decline has slowed in the most recent data

- Broader data indicate continuing excess demand in the economy

- Consumption over the past year was stronger than previously suggested

- At the same time, output growth has been subdued, and consumption per capita has been declining

- The persistence of services price inflation is a key uncertainty

- Output growth in most advanced economies appears to have troughed, with improvement in US and China’s economic outlooks and many commodity prices have picked up

- The Board expects that it will be some time yet before inflation is sustainably in the target range

- Recent data has reinforced the need to remain vigilant to upside risks to inflation

The RBA held the cash rate at 4.35% and is likely to do so for some time. However, the statement reinforced the need to be vigilant to upside risks for inflation, the decline of which has slowed. Governor Bullock reiterated that they had discussed holding or hiking at this meeting, with no mention of a cut, maintaining the slightly hawkish undertone.

The odds of the RBA hiking at their next meeting remain low at just 10%, although it has doubled from 5% ahead of the meeting. This slight increase in the possibility of a hike has also seen expectations of their first cut brought forward to April 2025 from July.

I'll stand my ground that the RBA does not want to raise rates unless absolutely necessary. Call me cynical, but it is a political nightmare for the freshly appointed RBA governor to hike rates during a cost-of-living crisis, assuming she doesn't want to be ousted like her predecessor. So at best, I suspect the 'discussion' to hike has been introduced like a bogeyman to manage inflation expectations. Still, if inflation points the wrong way next week, it certainly piles the pressure on the RBA to act and likely supports the Australian dollar in the process. This makes next week's monthly CPI report all the more important.

AUD performance by Tuesday’s close:

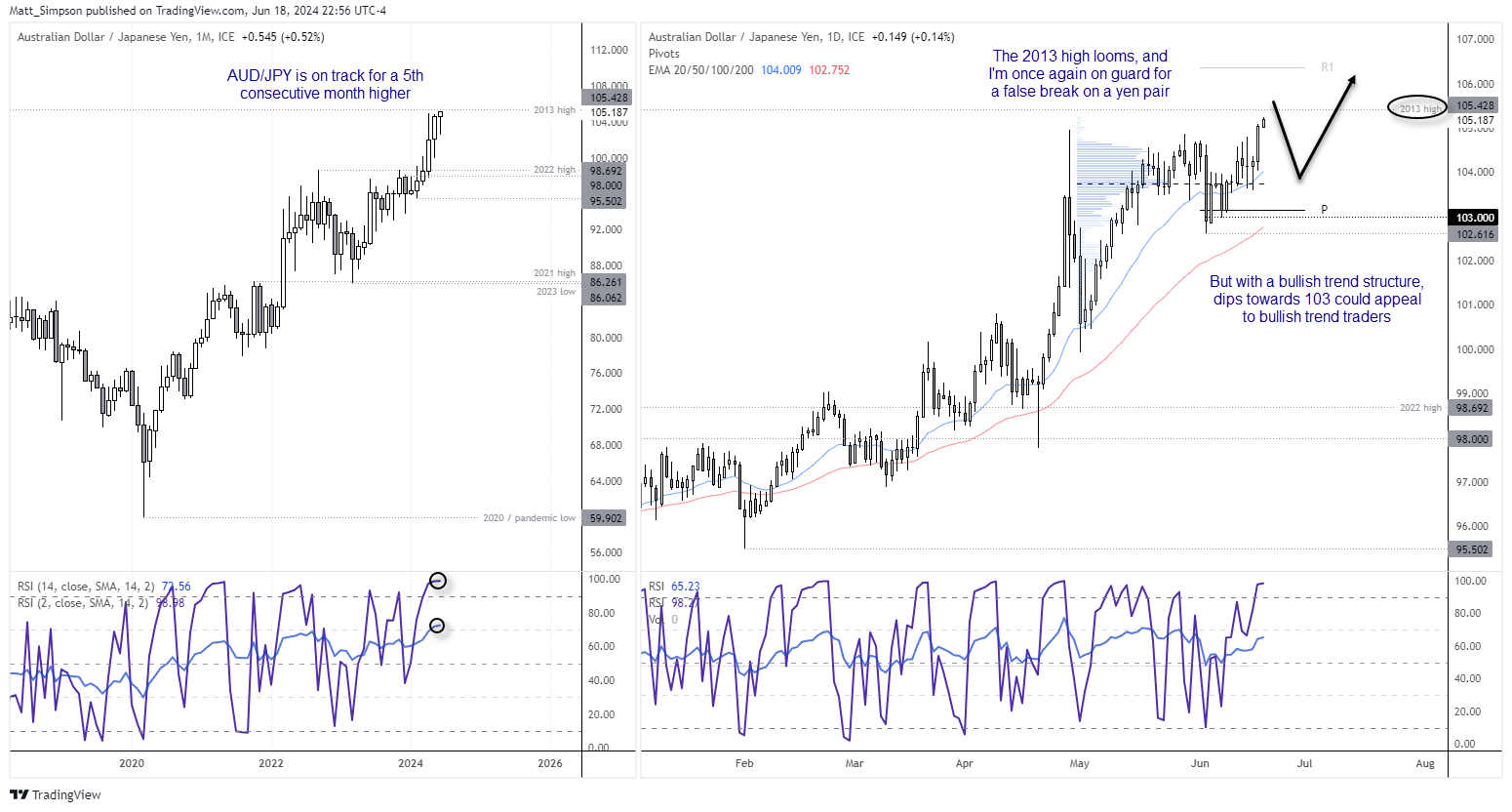

- AUD/JPY +0.8% (11-year high)

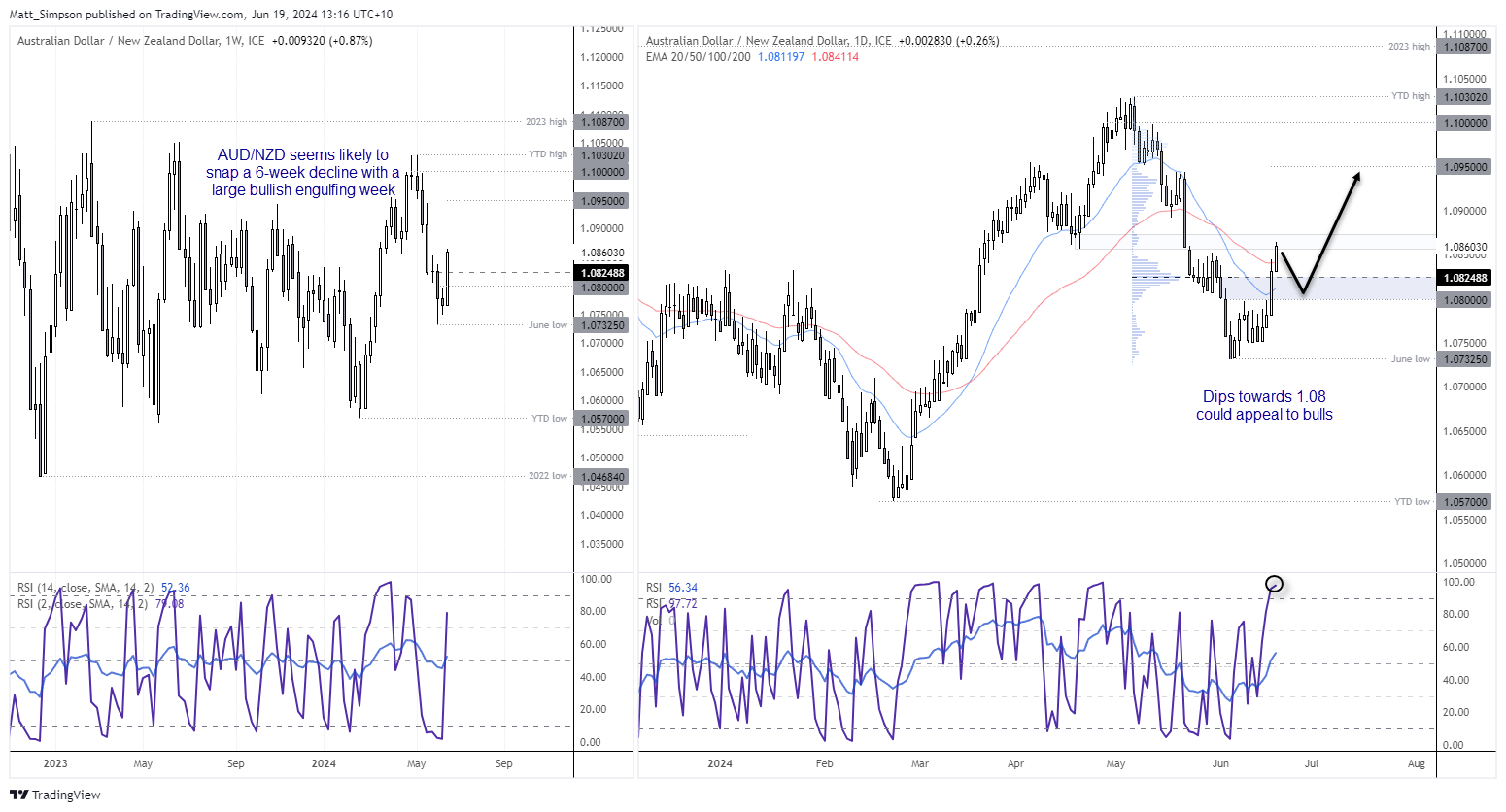

- AUD/NZD +0.5% (2-week high)

- AUD/USD +0.7% (3-day high)

- AUD/CAD +0.6% (4-day high)

- AU 2-year yield +3 basis points

AUD/JPY technical analysis:

Just over halfway through the month of June, AUD/JPY is on track for its fifth consecutive month higher. Such a bullish sequence has not been seen since April 2021, which was just ahead of its May high. And in similar fashion, upside volatility for the month is waning. If AUD/USD were to close around current levels, it would leave a hanging man reversal month to warn of a reversal.

Furthermore, the 2013 high is within close proximity. RSI (2) is overbought on the monthly and daily timeframe and a bearish divergence has formed on the weekly. RSI (14) is also overbought on the monthly, and very close to being so on the daily.

With AUD/JPY trading just 25 pips below the 2013 high, it seems likely the market could at least test this level. But as I warned on the USD/JPY chart, I am guard for false breaks and pullbacks (if not reversals) back below it. For now, the trend structure on the daily chart is firmly bullish and any dip lower is likely to appeal to bullish swing traders whilst prices remain above the 103 handle.

AUD/NZD technical analysis:

A weak service PMI report from New Zealand took the wind out of the RBNZ’s hawkish twist at their last meeting, and this has helped AUD/NZD rise to a 4week high. It is also up for a fourth consecutive session, although resistance looms.

Prices have tease the April low, and with RSI (2) overbought and the rise looking extended, I’m on guard for a period of consolidation or a retracement. Yet the strength of the move from the suggest further upside potential after the anticipated pullback.

Bulls cold seek dis towards the 1.0825 HVN or 1.08 handle with 1.09 and 1.095 now in focus for bulls.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge