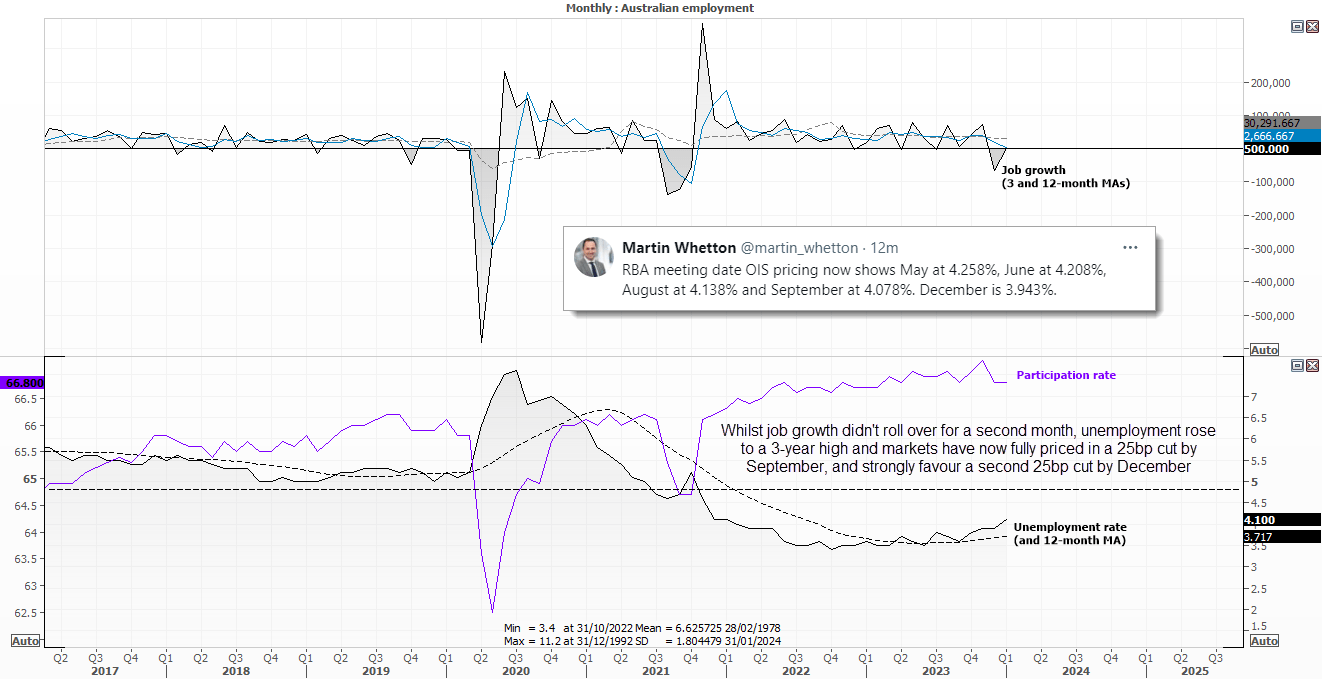

A cursory glance at Australia’s employment report suggests the -106k culling of FT jobs in December was an (un)festive blip. But the standout metric is that unemployment rose to the three-year high of 4.1%.

AUD pairs have been knocked from their perch as the higher unemployment figure brings a glimmer of hope of a dovish pivot from the RBA. Even if such a hope is futile with the Fed unwilling to ‘go first’ and signal an easing bias.

Besides, unemployment is still low by historical levels with a long-term average of 6.6%. Although it is creeping higher, so if this is to be coupled with a few chunky job loss figures, then perhaps we can talk seriously about a dovish-pivot markets so desperately want. Until then, the 4.35% cash rate is poised to stay.

Regardless, markets are once again pricing in cuts for later this year. Westpac’s Head of Market Strategy tweeted current OIS pricing to show a full 25bp cut has been priced in for September, with second 25bp cut nearly priced in for December. If correct, that could see the cash rate lowered to 3.85% just in time for Christmas.

Australian dollar pairs, ASX 200

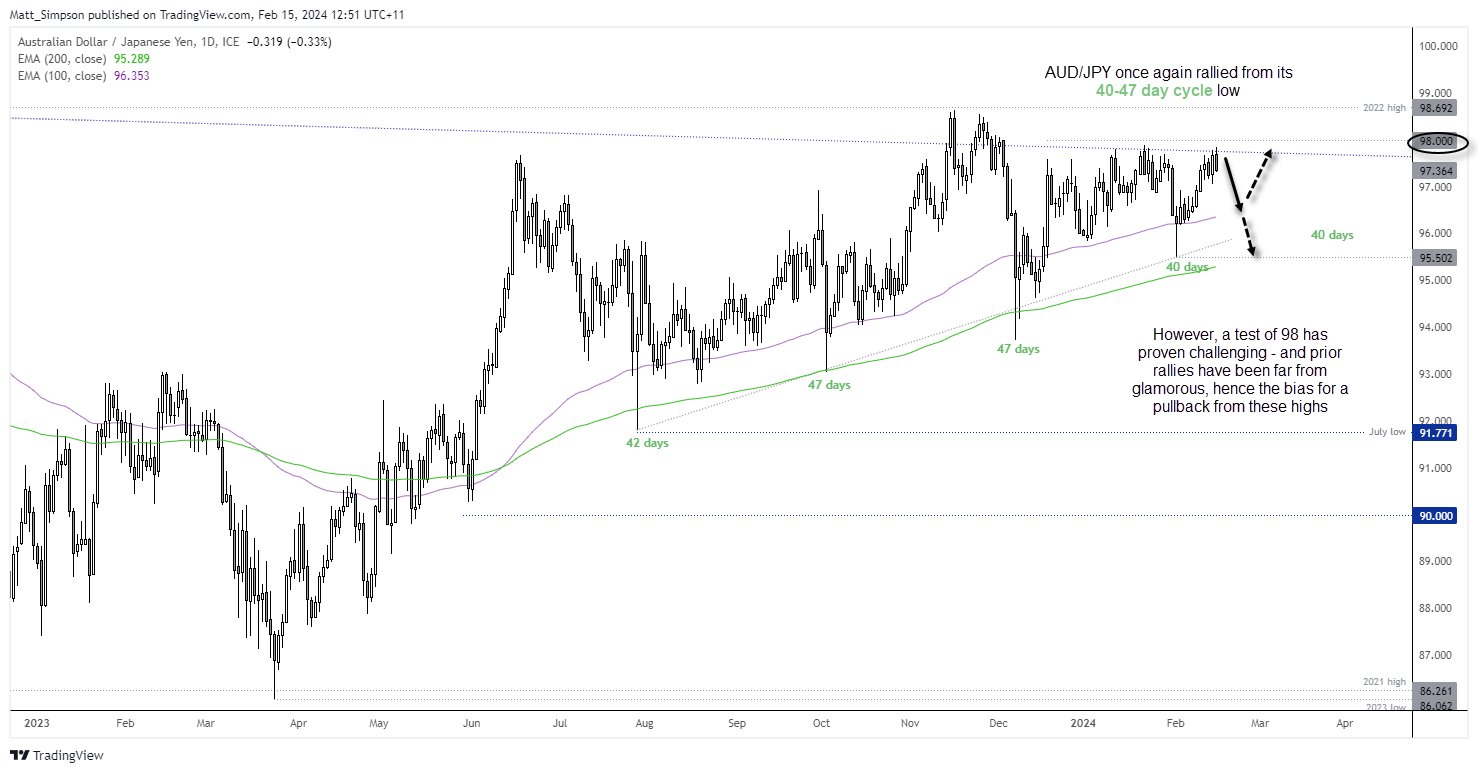

The initial reaction to the employment report was slow, but after investors dug through the weeds and saw dovish market pricing, AUD broadly weakened and formed prominent bearish engulfing candles against several FX majors. The ASX 200 isn’t quite sure what to make of the report, as traders are caught between potential rate cuts being good for sentiment versus higher unemployment being bad for the economy. But what has really caught my eye is that AUD/JPY has once again stalled at an area prone for selloffs.

AUD/JPY technical analysis:

I have previously noted that AUD/JPY has produced troughs between 40-47 days apart since June, and that each cycle low was a higher low with a prominent lower wick. I’m glad to see that AUD/JPY has risen in line with my near-term bullish bias, but now is the time to reassess.

We can see that prices have once again failed to test 98, and already AUD/JPY has handed back much of Wednesday’s gains. If it is to close the day around current levels, a 2-bar bearish reversal would form (dark cloud cover).

Furthermore, we can also see that prior rallies form their 40-47 cycle lows have not been particularly glamorous, which increases the odds of a sudden pullback. Given AUD/JPY rose 2.5% in two weeks form its cycle low and has once again stalled at resistance, a pullback now seems due.

Bears could either seek short opportunities on lower timeframes, or bulls could seek evidence of a higher low after the expected retracement. Traders would be wise to keep a general check on sentiment, because if US yields rise alongside the VIX, Wall Street could pull back further and AUD/JPY would likely track it lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge