- Australia’s ASX 200 is rallying for a fourth day, sending it back towards the highs hit late last year

- It has a poor track record above 7600 since 2021, failing to advance on five separate occasions

- The index is arguably priced for perfection already, meaning a potential turnaround in sentiment towards China may be required to deliver record highs

Australia’s ASX 200 is rallying for a fourth session on the back of big gains in banks, healthcare and record highs on Wall Street, seeing it approach what some may declare to be a “death zone” for bulls based on price action of recent years.

ASX 200 rallies on the back of banks, healthcare, Wall Street

As seen on the four hourly chart below, the ASX 200 is now nearing horizontal resistance located at 7534, the last level of visible note standing in the way of a retest of the highs struck in December last year. With RSI and MACD trending higher, large rate cuts from major central banks baked in the cake and local earnings risks conceivably small based on how easily most firms in the US have breezed past analyst forecasts, it’s any wonder investors are feeling bullish. Soft landing sentiment abounds!

But it’s now nearing the “death zone” for rallies

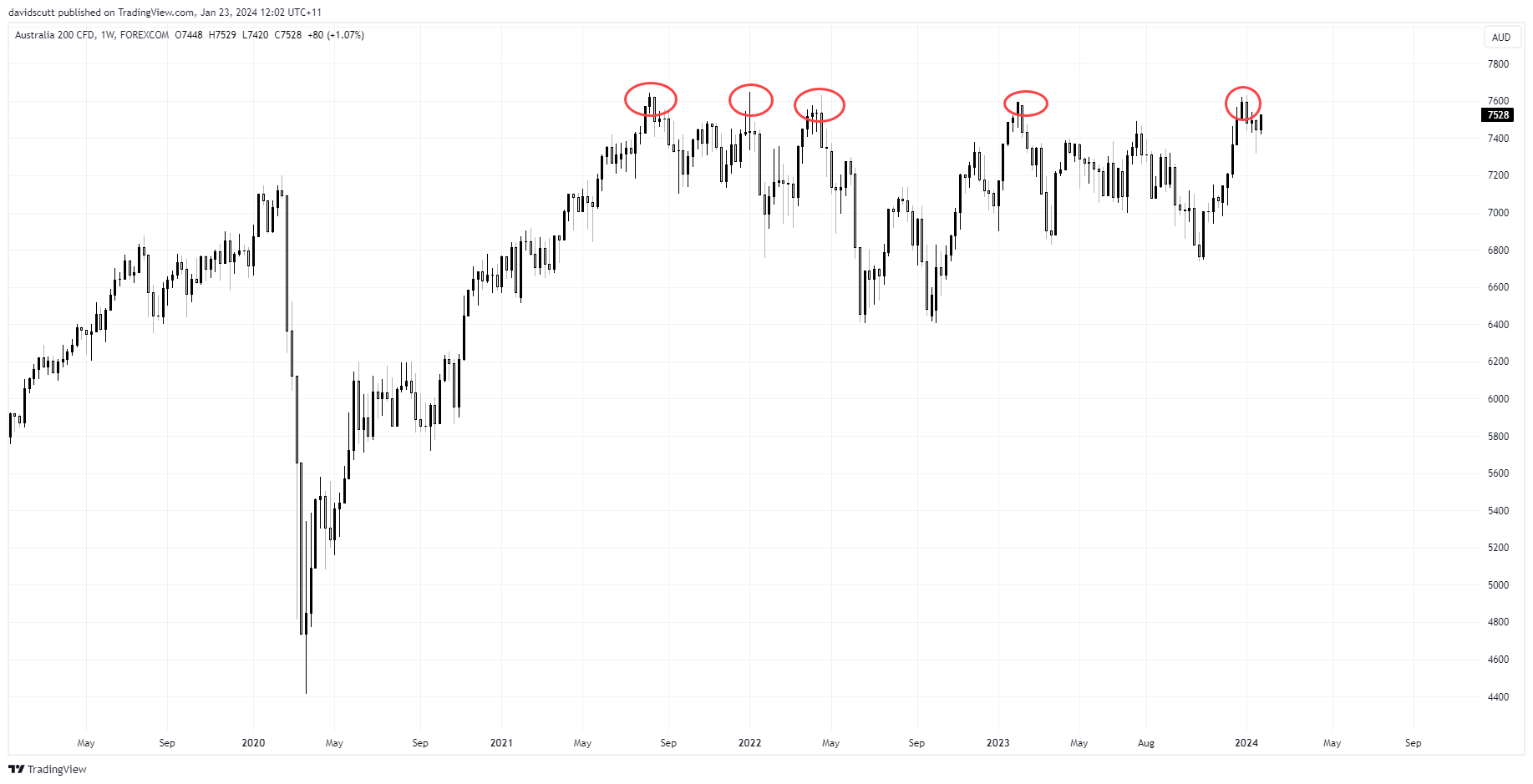

But if the bullish run is to continue, investors will need to overcome what has been a tough nut to crack for the index over the past three years: 7600

Zooming out to a weekly chart, it’s plain to see just how poorly the index has performed above this level. Starved of bulls willing to chase the index high, it has failed above this level on five separate occasions dating back to the middle of 2021, including late last year.

Other than historically large payout ratios which can limit growth in market capitalised indices, a lack of key growth sectors, especially tech, along with Australia’s heavy reliance on China in determining its economic fortunes, are just some of the fundamental factors that have capped the index at this level.

For it to crack, you’d imagine the soft landing narrative riskier assets have been rallying on will need to be delivered in reality, or acute concerns about the outlook for the Chinese economy start to dissipate.

Should resistance at 7534 break, traders will be setting their sights on record highs just above the December 2023 peak. A failure at 7534 could lead to a retracement to 7445. Near-term, the performance of Chinese equity markets may play an outsized role in dictating where the index heads, especially the miners.

-- Written by David Scutt

Follow David on Twitter @scutty