A fully vaccinated traveller returning from South Africa to the US tested positive upon arrival to the states, just hours after airlines were told to provide names of passengers from southern Africa who had known Omicron outbreaks. According to the World Health Organisation (WHO) the variant has now spread to 29 countries.

US equities were predictably lower, with the Russel 2000 and Dow Jones transportation stocks leading the way and the VIX rising to just shy of 30, its highest level since March. The Dow Jones is below its 200-day SMA for the first time since June 2020 and the Nasdaq 100 has formed a head and shoulders top on the daily chart.

Supply chain issues persist in US manufacturing

The ISM report reiterated what we have come to expect, with the manufacturing sector remaining within a “demand-driven, supply-constrained environment” with slight improvements in labour and supplier deliveries. Record-long lead times for raw materials and capital equipment and high commodity prices continue to dampen all sub-sectors.

Nice. And there is little chance of this improving with the new variant making its rounds and forcing tighter restrictions the globe over. And whilst prices paid moved lower we need to factor in this survey doesn’t capture the potential impact of Omicron so inflation is not looking very transitory right now, not that it ever was really.

113 remains an important battleground for USD/JPY

Equities lower, yen higher remains to be the theme of the week. 113 remains an important battleground on USD/JPY as price action has whipsawed violently around it over the past 48 hours. Yet its inability to close to new lows should not go unnoticed, whilst a daily close above it this week may result in a strong reaction like seen on November 10th the last time 113 was a battle ground. We just need risk-off to ease a little and yield differentials should support it once more.

NZD/CAD coils up into a potential bearish wedge ahead of OPEC

The commodity FX cross is coiling up on the four-hour chart into a potential bearish wedge formation. It saw an aggressively bearish move into the pattern, hence the bias for an eventual downside breakout from it. Such patterns can continue to grind away before breaking out suddenly to the red lines need to be taken with a pinch of salt and adjusted accordingly, but we’d be interested in short opportunities below the resistance zone.

Commodities lower on demand concerns

With rising cases comes concerns of travel restrictions and lockdowns. And with that comes demand concerns, which has weighed broadly on commodities. The Thomson Reuters CRB index fell to a 6-week low of 218 and is now down around -9.5% from its highs.

WTI failed to retest $70 before giving way to the downside and is holding just above Tuesday’s low ahead of today’s OPEC meeting. There is a decent chance OPEC will hold off from increasing their oil output and traders could even be prepared for the chance of a cut, in hopes of supporting prices.

Gold appears confused as it makes mild attempts to behave as a safe-haven with its marginal gains, yet concerns over the economic recovery and hawkish comments from the Fed mean investors may be selling their gold to fund losses elsewhere or simply move to cash.

ASX 200 Market Internals:

ASX 200: 7235.9 (-0.28%), 01 December 2021

- Materials (0.57%) was the strongest sector and Consumer Staples (-1.87%) was the weakest

- 8 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 41 (20.50%) stocks advanced, 149 (74.50%) stocks declined

- 55% of stocks closed above their 200-day average

- 31% of stocks closed above their 50-day average

- 23% of stocks closed above their 20-day average

Outperformers:

- + 3.97%-South32 Ltd(S32.AX)

- + 3.11%-Waypoint REIT Ltd(WPR.AX)

- + 2.71%-Lynas Rare Earths Ltd(LYC.AX)

Underperformers:

- -7.58%-GUD Holdings Ltd(GUD.AX)

- -7.39%-Pro Medicus Ltd(PME.AX)

- -6.00%-IDP Education Ltd(IEL.AX)

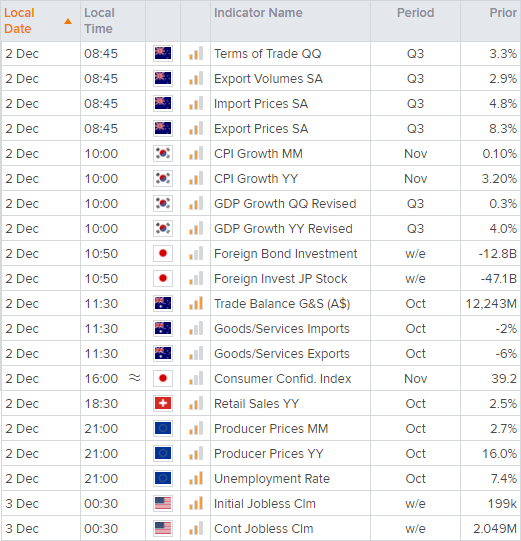

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.