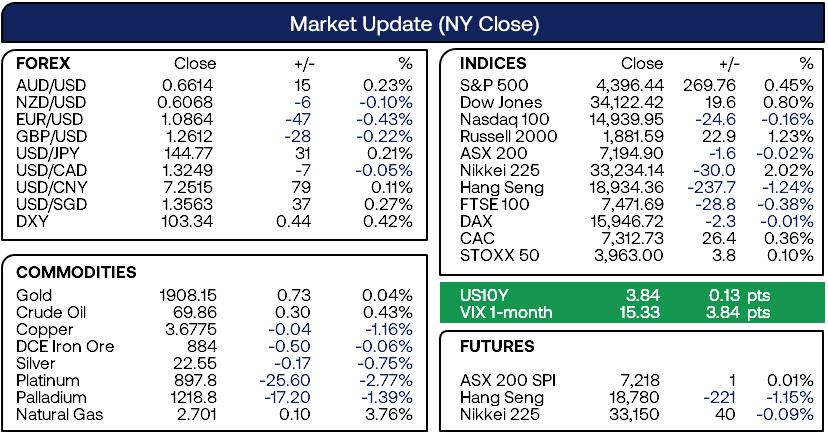

Market summary

- The euro popped higher at the start of the European session following stronger than expected inflation from Spain and Germany, which suggests eurozone’s CPI data today could come in hotter than liked

- Yet strong economic data and further hawkish comments form Jerome Powell saw the US dollar rise against all except AUD/USD, which rose a modest 0.13% from its cycle lows

- US jobless claims fell at its fastest pace in 20-months, serving as a stark reminder that UYS employment remain tight which paves the way for further Fed hikes

- Wall Street continues to look past the Fed’s hawkishness with the S&P 500 and Dow Jones rising to a 7-day high, although the Nasdaq 100 formed a small bearish inside day

- Gold spiked below $1900 before recovering and closing the day with a bullish pinbar day

- WTI crude oil spiked above $70 before pulling back below that key resistance level, $68.95 is a key support level for bulls to defend today

- Australian job vacancies declined 2% q/q (its fourth quarter lower) yet still remain 89.3% above pre-pandemic levels, serving as a reminder of Australia’s tight labour market (and potential for the RBA to keep hiking)

- Australian retail trade rose 0.7% (0.1%) although higher prices may explain much of this. Still.. trade is hardly rolling over

- It is the last trading day of the month, quarter and first half of 2023, which leaves the potential for some erratic price behaviour which can become detached from any fundamentals as money managers square up their books

Events in focus (AEDT):

- 09:30 – Tokyo’s CPI (which provides a decent lead for nationwide CPI)

- 09:50 – Japan’s unemployment, industrial production

- 11:30 – China’s PMIs (official government data)

- 22:30 – US PCE inflation

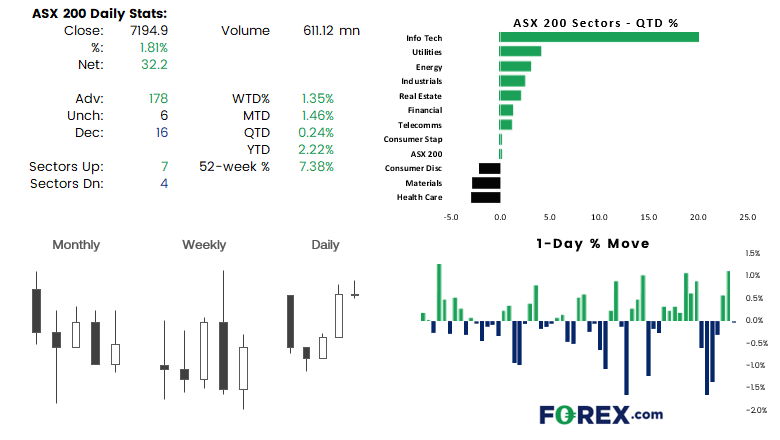

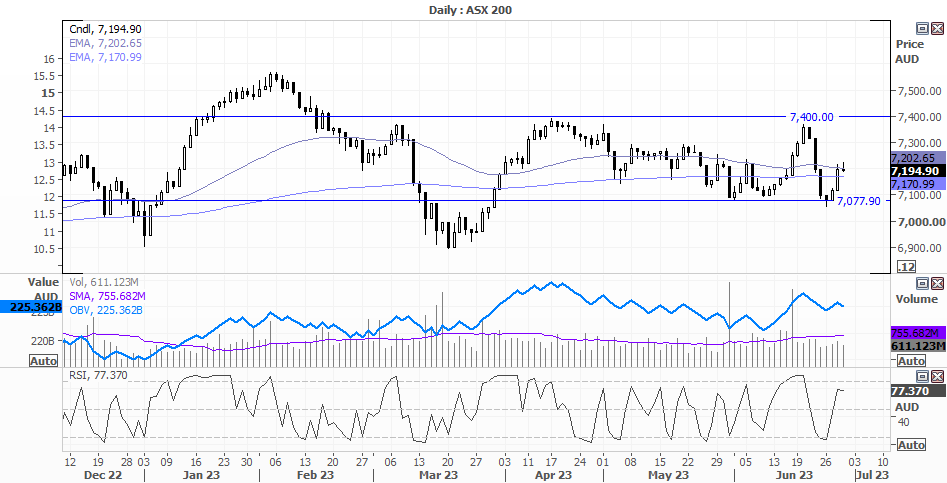

ASX 200 at a glance:

- The ASX 200 was flat and formed a small indecision candle

- It closed just beneath its 50-day EMA and above its 200-day EMA

- SPI futures are flat and Wall Street was mixed

- Given the 1-day reversal candle, perhaps we’ll see a minor pullback towards 7,170 (200-day EMA) or 7150

Soft US inflation could support equities and see the ASX potentially gap higher Monday

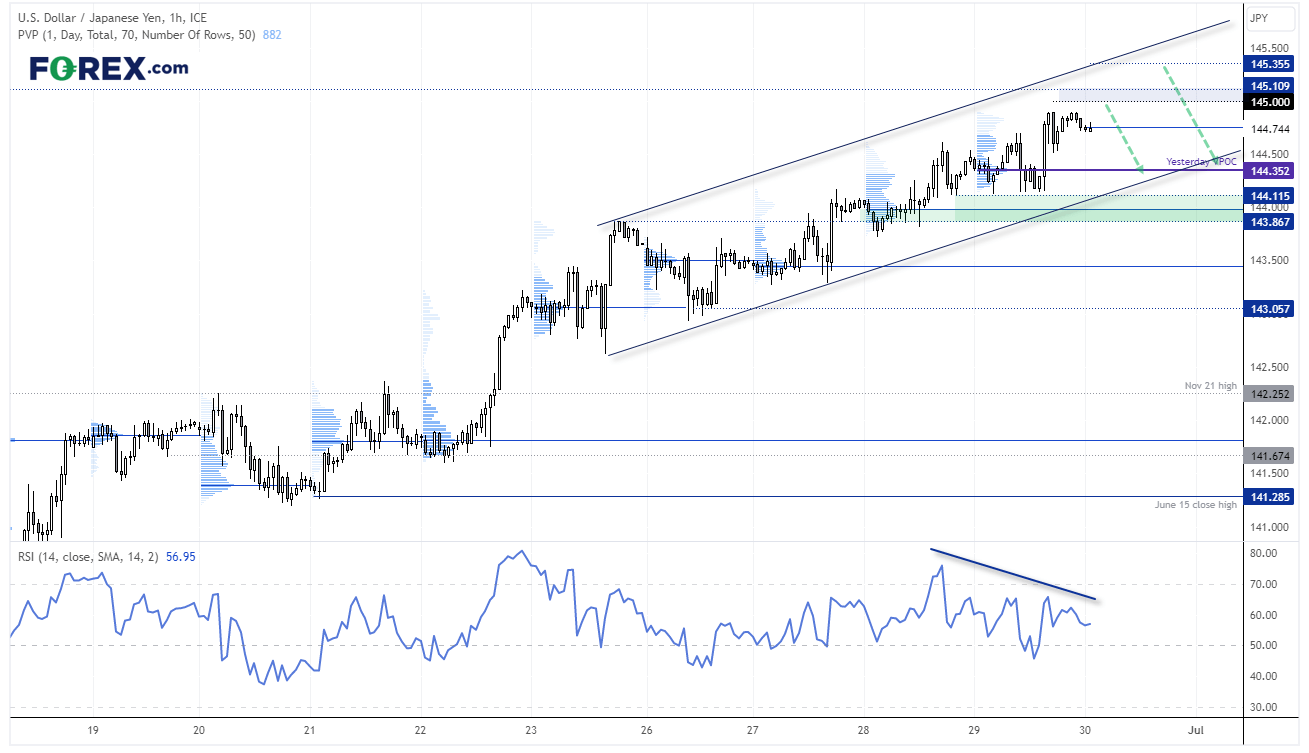

USD/JPY 1-hour chart:

The higher USD/JPY rises, the greater the odds of meaningful verbal intervention from Japan’s MOF (ministry of finance. USD/JPY is close to closing the liquidity gap we mentioned with a move to 140, and a bearish divergence is also forming on the RSI (14) to suggest momentum is waning. Whether we’ll see prices pop higher for a ‘last hurrah’ or fall if today’s Tokyo’s inflation print comes in too hot remains to be seen. But we suspect some mean reversion is due, and it could be sharp if fuelled by jawboning of hot inflation data. A combination of both would send it sharply below 144.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

Latest market news

Yesterday 08:49 PM

Yesterday 08:32 PM

Yesterday 06:30 PM

Yesterday 05:55 PM

Yesterday 05:06 PM

Yesterday 04:02 PM