- AUD/USD briefly hit a 4-month low as building approvals fell -15.5% in April (+19.1% expected), its fastest contraction since December 2017. Service PMI contracted for a fourth month although at a slower rate of 46.5 versus 44.8 expected. AUD/USD has pared losses and now sits just shy of 0.7000.

- Markets are wary of next week’s RBA and RBNZ meetings with 1-week implied volatility for NZD and AUD have hit their highest levels since March 2018 and January 2019 respectively.

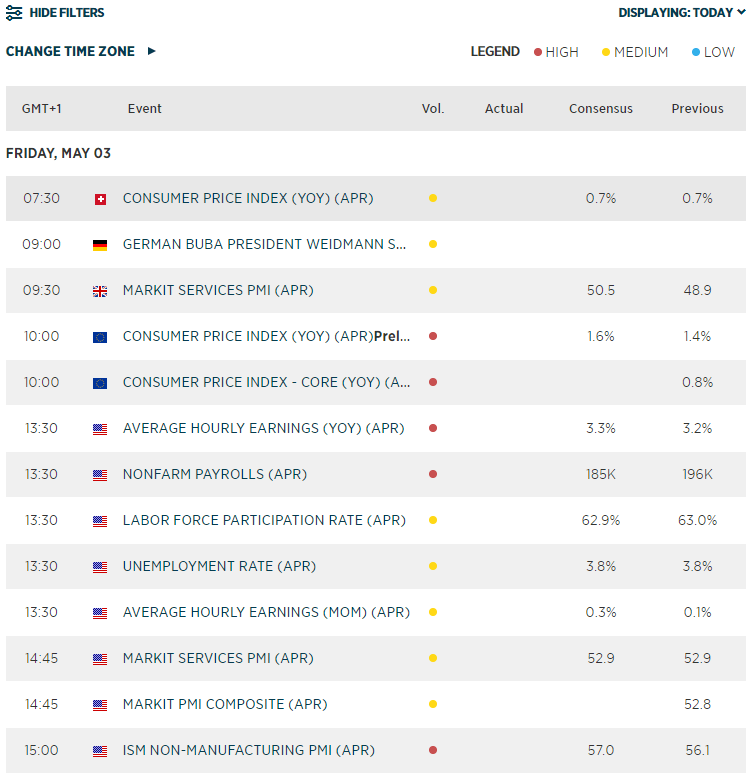

- Markets are trading in typically narrow ranges ahead of today’s NFP report. AUD has pared most losses and now sits in the middle of the pack, NZD is currently the strongest major, CHF is the weakest. Index trade cautiously higher, EUR/USD grapples with a pivotal zone around yesterday’s lows, with bears trying to force it lower in hope of a strong NFP print.

Latest market news

Today 04:56 AM

Yesterday 08:00 PM

Yesterday 08:00 PM

Yesterday 07:33 PM

Yesterday 07:16 PM