2025 Euro Outlook: EUR/USD Bears Charge Parity

Key points for the Euro 2025 outlook

- Euro set to close 2024 down more than 6.2%- three-month reversal plunges to fresh yearly low

- FOMC outlook trims expectations for aggressive rate cuts in 2025- USD bulls in control into yearly cross

- ECB concerns shift from inflation to growth in 2025- geo-political instability, trade war concerns

- EUR/USD approaching technical downtrend support into yearly close- Parity hangs in the balance

balance Euro is poised to close 2024 just off the yearly lows with EUR/USD plunging nearly 7.9% off the highs in just eight short weeks. The decline puts parity within striking distance into the 2025 open and with the FOMC signaling a slower pace of rate cuts next year, the US Dollar may be poised for continued strength.

Federal Reserve in the Spotlight

In December, the Federal Reserve cut interest rates for the third time in 2024 (100bps total) but signaled the potential for a slower pace of cuts heading into 2025. While one could strongly argue the strength of the US economy puts into question whether any additional cuts are even necessary, the central bank continued to suggest the potential for two-more cuts with the committee projecting the Federal funds rate at 3.9% for next year.

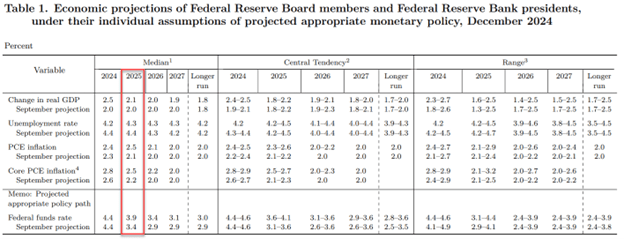

The shift into the close of the year suggests the FOMC expects inflation to remain sticky into 2025 and may limit the central bank’s scope to further normalize rates. Indeed, the updated Summary of Economic Projections showed a dramatic increase in both headlines and core inflation next year with unemployment and growth improving slightly. From an economist point of view, the projections highlight a difficult environment to justify additional easing and IF inflation does persist, the markets may need to further adjust interest rate expectations, to the benefit of the US Dollar.

FOMC Summary of Economic Projections

Source: FOMC

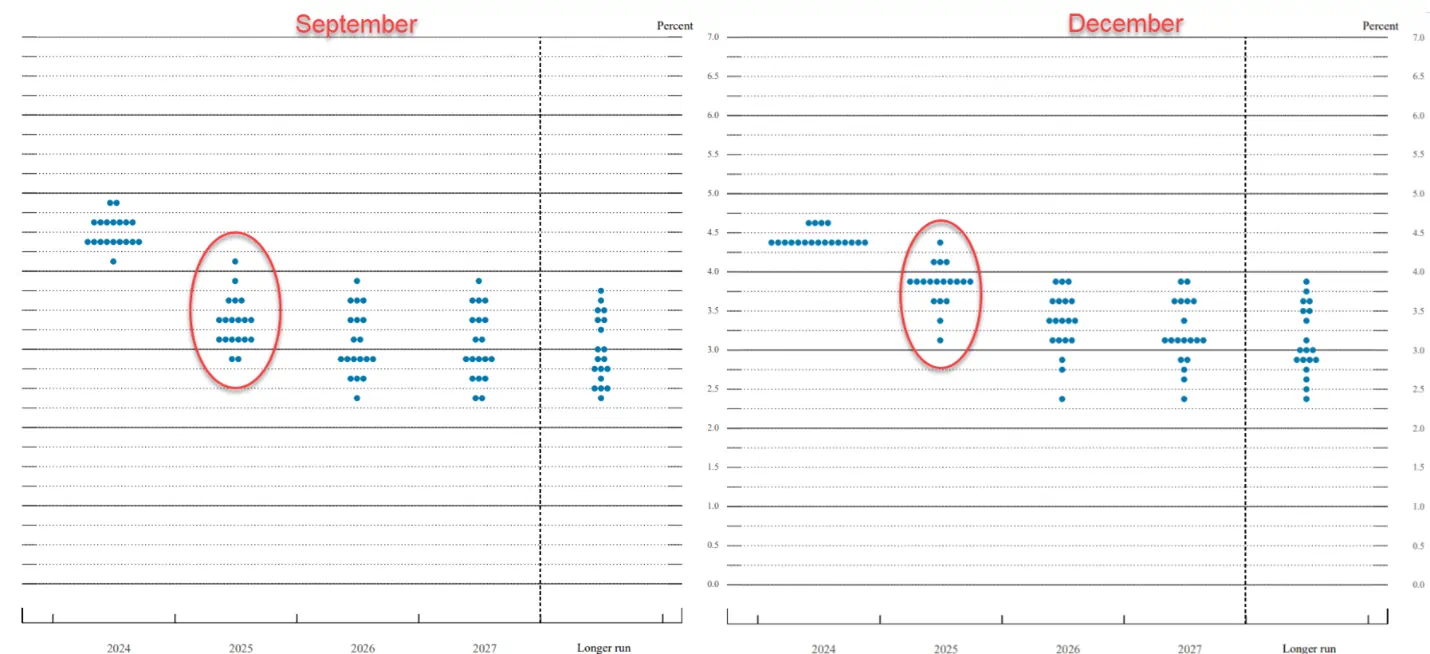

Note that the central bank’s interest rate dot plot shows a marked increase in for the appropriate level of rates into 2025 from the last update in September. The move fueled a shift in the expectations for the first quarter with the Fed Fund Futures now pricing in a 50% probability for a March rate cut.

FOMC Interest Rate Dot Plot

Source: FOMC

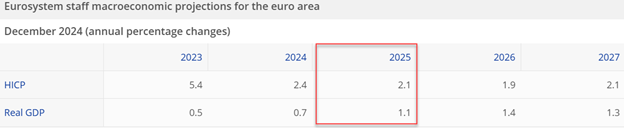

ECB 2025 Outlook Characterized by ‘Uncertainty’

The ECB cut interest rates for a fourth time in December with the President Christine Lagarde noting an abundance of uncertainty heading into 2025. With inflation largely expected to return to the central bank’s 2% target early next year, the focus now shifts to downside risks to growth as ongoing political instability in the Eurozone and the rising threat of a new U.S trade war cloud the 2025 outlook. With more easing expected as early as January, the interest rate differential may continue to bolster the greenback into next year with the broader outlook for monetary policy still favoring the EUR/USD bears for now.

Source: ECB

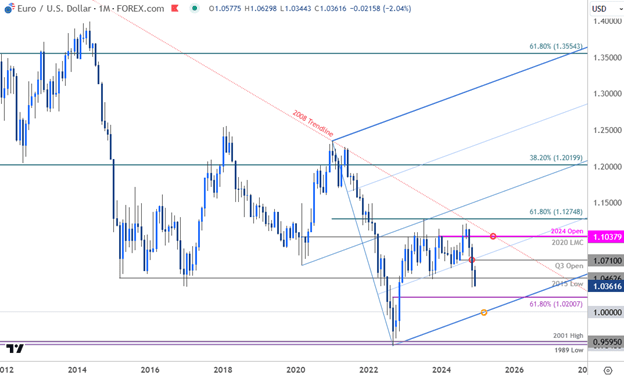

Euro Price Chart – EUR/USD Monthly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Euro continues to trade within the confines of an ascending pitchfork formation extending off the 2022 low with the April advance faltering just ahead of resistance at 1.1275 into the close of Q2. The subsequent reversal was poised to close a third-consecutive monthly loss as of late December with EUR/USD attempting to mark a close below support around the 2015 low at 1.0463- looking for clear inflection off this mark into the yearly cross.

Note that monthly momentum readings have reached the lowest levels in over a year and an RSI reading sub-forty into the close would suggest a larger shift in the momentum profile favoring the bears. Critical support rests with Parity while key resistance (bearish invalidation) for the broader downtrend is eyed with the 2020 low-month close (LMC) / the objective 2024 yearly open at 1.1032/38.

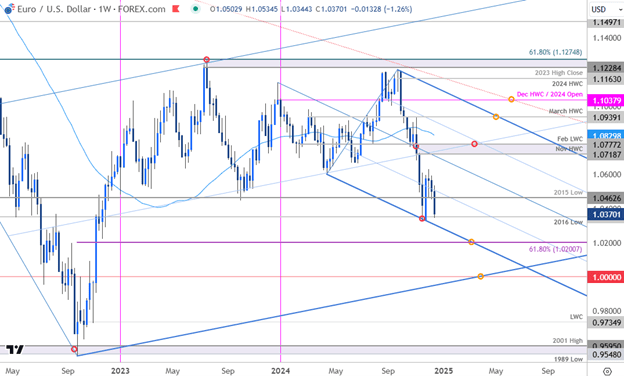

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

A closer look at the weekly chart shows the November rebound off the lower parallel of a descending pitchfork we have been tracking off the September highs. Initial weekly support rests with the 2016 swing low at 1.0352. Ultimately, a break below the lower parallel would threaten the next major leg of the decline towards the 61.8% retracement of the 2022 advance at 1.02 and parity- both levels of interest for possible downside exhaustion / price inflection IF reached.

Weekly resistance stands with the November high-week close (HWC) / February low-week close (LWC) at 1.0719/77- a breach / close above this threshold would be needed to suggest a more significant low is in place / a larger trend reversal is underway. Subsequent resistance eyed at the March HWC a 1.0939 and the December HWC / 2024 yearly open at 1.1038- both levels of interest for possible topside exhaustion / price inflection IF reached.

Bottom Line:Euro remains vulnerable to further losses heading into the 2025 open and the focus is on an exhaustion low in the first half of the year. From a trading standpoint, the threat remains weighted to the downside while below 1.0777 – look for a larger reaction on stretch towards the lower parallel for guidance with a closer below 1.02 needed to fuel the next major leg of the decline. The onus is on the bulls to try to secure a low ahead of parity IF the 2022 advance is to remain viable in the coming year. The EUR/USD battle lines are drawn heading into 2025.

-- Written by Michael Boutros, Sr. Technical Strategist

Follow Michael on X: @MBForex