FY 2025 Equities Forecast

2025 Forecast for U.S. Equities

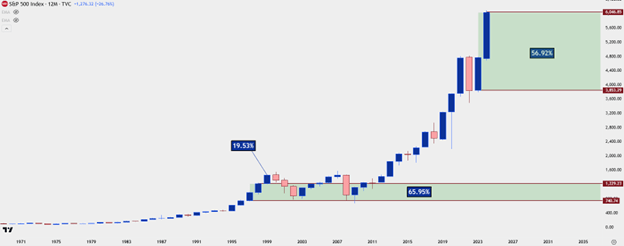

The S&P 500 gained 23.95% over 2024 (from 4745.20 to 5881.63, source: Tradingview), slightly beating out the 2023 rally of 23.79% (from 3853.29 to 4769.82, source: Tradingview). That extends the two-year gain for the index to a whopping 52.64% (3853.29 to 5881.63, source: Tradingview). That would be the largest two-year advance for the S&P 500 since 1997 and 1998, when SPX rallied by 65.95% (from 740.74 to 1229.23, source: Tradingview) over that two-year period and continued to rally into 1999 before finally pulling back in the year 2000 as the tech bubble burst.

SPX Monthly Chart

Chart prepared by James Stanley; data derived from TradingView

To be sure, one of the dominating factors of the equity rally over the past two years was the pricing in of eventual rate cuts, which started in September. The only red year that we’ve seen for SPX in the past six years was the 2022 episode, in which rate hikes drove a 19.6% sell-off for the index and erased pretty much the entirety of gains from the 2021 rally before bouncing into the end of the year (SPX 2022 open: 4778.14, 2022 close: 3839.49).

But it wasn’t only rate cut hopes that drove stock prices over the past couple of years, helping US indices to recover from the Q4 2022 lows, and this is something that shares resemblance to the 1997-1998 market that led into a strong 19.53% rally in 1999; and that is hope behind tech. In the prior episode it was the dominance of the world wide web and the promise of the internet driving a market rally that eventually turned into a bubble. In the more recent version, it’s been Artificial Intelligence, which started to get attention around the same time that US equities built that support than two years ago.

Chat GPT was introduced in November of 2022 and the low in SPX was in October of that same year. As hopes for rate cuts came into the picture on the back of a Fed that started to soften their speech around inflation and rate hikes, so did a bid for technology stocks that had dealings with AI. NVDIA traded at a split-adjusted $15 a share in November of 2022 and the stock hit $150 a share two years later, a literal 10x return for a large cap company that helps to illustrate this drive.

NVDA Weekly Chart

Chart prepared by James Stanley; data derived from TradingView

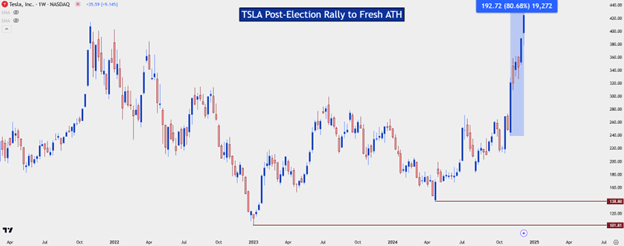

But it’s not only NVDIA that’s gained on the back of AI hopes, as Meta is up more than 567% from the 2022 lows (2022 Low 87.75, 2024 Close 585.51, source Tradingview, NASDAQ), and even companies that were massive in scope before the AI rally, Microsoft and Google, are up more than 100% from those 2022 lows (GOOG 2022 Low: 83.15, 2024 Close 190.44, 129.03%, MSFT 2022 Low: 209.39, 2024 Close: 421.50, 101.29% source: Tradingview, NASDAQ). Tesla, a company that was beaten down coming into 2023 (2023 Low of 101.81 source: Tradingview, NASDAQ) and even to a degree in 2024 (2024 Low of 138.80 source: Tradingview, NASDAQ), finished the year up more than 296% from those early 2023 lows (2023 Low of 101.81 to 2024 close of 403.84, source: Tradingview, NASDAQ), and this may be one of the more active manifestations of AI employment as the company uses the technology in a product that’s already producing revenue.

Low rates can help to drive risk-on and nothing excites risk-on like the promise of new tech. This is precisely what built the tech bubble in 1999 that became the tech bust in the year 2000; unbridled hope for a better tomorrow, helped along by easy borrowing costs that incentivized investors to take on risk in stocks and away from bonds. And as more risk taking took place, so did price rallies, thereby incentivizing even more investors to jump in and bid stocks to higher and higher valuations. markets are manifestations of social activity, after all, and nothing creates a crowd like a crowd.

In 2024 a new variable entered the equation; or, more accurately, re-entered the equation, and this gave another shot-in-the-arm to already stretched equity valuations. The hope of a business-friendly administration in the United States with a GOP supermajority in government helped to extend rallies, particularly in large cap tech. Elon Musk and Tesla enjoyed a massive move in response to the election as his proximity to President-elect Trump was thought to be beneficial for his companies, particularly the AI exposure of Tesla. Full self driving, which uses neural nets for decision making, is probably the most active usage of AI and as Musk had said earlier in 2024, even before Trump was elected, “If somebody doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor in the company.”

Tesla Daily Chart

US Equity Fundamentals

Low rates can help to drive risk-on, and nothing excites risk-on like the promise of new tech. This is precisely what built the tech bubble in 1999 that became the tech bust in the year 2000; unbridled hope for a better tomorrow, helped along by easy borrowing costs that incentivized investors to take on risk in stocks and away from bonds. And as more risk taking took place, so did price rallies, thereby incentivizing even more investors to jump in and bid stocks to higher and higher valuations. Markets are manifestations of social activity, after all, and nothing creates a crowd like a crowd.

In 2024 a new variable entered the equation; or, more accurately, re-entered the equation, and this gave another shot-in-the-arm to already stretched equity valuations. The hope of a business-friendly administration in the United States with a GOP supermajority in government helped to extend rallies, particularly in large cap tech. Elon Musk and Tesla enjoyed a massive move in response to the election as his proximity to President-elect Trump was thought to be beneficial for his companies, particularly the AI exposure of Tesla. Full self-driving, which uses neural nets for decision making, is probably the most active usage of AI and as Musk had said earlier in 2024, even before Trump was elected, “If somebody doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor in the company.”

US Equity Fundamentals

Perhaps one of the more dominating factors of the past two years has been the Fed’s insistence of dovishness even considering inflation remaining above their 2% target. Core CPI remained above 3% all year in 2024 yet that didn’t stop the bank from cutting rates by 50 bps in September, and another 25 in November just days after the election.

Given the massive rally that showed from the Q4 2022 lows, right around when the Fed started to signal a more passive demeanor, it becomes obvious that Fed stance and innuendo is a major factor here. And at this point, I have little expectation that the Fed will remain as dovish until they can’t any longer.

I think the ‘implied third mandate’ of the Fed is notable; and it would be nonsensical to dismiss out of hand because it does make sense. ‘The wealth effect’ was first discussed in 1947 and while it seemed to play little role in markets into the early 2000’s, as game theory became a more common topic around the Fed so too did the appeal and focus of the wealth effect. Put simply, the wealthier that an individual feels, the more likely they are to spend. And the more that consumers spend, the better that companies perform, the more they hire, and the more upward force there is on wages and, in-turn, inflation.

Rising stock prices are certainly a boost to the wealth effect, and this is something that gives the Fed reason to consider asset prices when making monetary policy decisions. It’s likely why they were slow to hike rates in 2021 and 2022, continually saying that inflation was ‘transitory’ and supply chain-related until, ultimately, they had to hike rates in 2022. And then when they did hike in 2022, they did so fast and aggressively and were soon talking about and forecasting rate cuts even well-before inflation was anywhere near target.

I’m not saying that this is a great way to run monetary policy; but the fact seems to be that the Fed would prefer stock prices going higher rather than lower, and if they have any say in the matter they’ll bias towards upside. I’m expecting that to continue into 2025 although perhaps to a lesser degree than what showed in the prior two years. I think this could follow the 1997-1998 template well, which could support stock prices into and perhaps even through 2025 trade, until inflation becomes a bigger talking point at the Fed around the 2026 open.

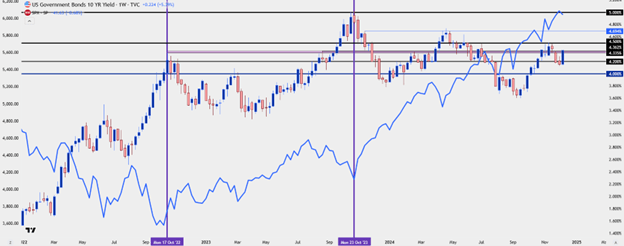

Notably, Jerome Powell’s term is finished in May of 2026 and there’s already been some uncomfortable reference to dynamics between the FOMC Chair and President-elect Trump. But as we’ve seen over the past administration, it may be the performance around the U.S. Treasury Department that matters even more regarding equity valuations and as long-term rates have remained somewhat subdued, there’s been less of an opportunity cost for investment capital. But, if that changes at some point in 2025, like we saw in 2023 when the 10-year ran up to 5%, there could be a legitimate reason for capital to leave stretched valuations in stocks and seek the safe harbor of bonds.

US 10 Year (Candlesticks) & SPX (Blue line)

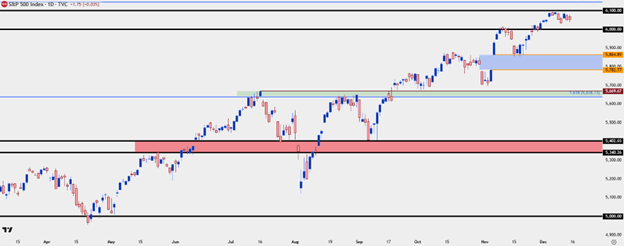

S&P 500 Technical Analysis

I’ve written the forecast for equities for the team for over a year, and over that time I’ve remained bullish throughout. It has been fairly simple for the most part, as stocks were rising for much of the time. But perhaps the more challenging was the forecast going into Q4 of 2023 as equities were, at the time, grasping on to lows near support. This was also around the time that the 10 year note was pushing up towards 5%, which you can see represented by the second purple vertical line on the above chart when 10 year yields tested the level (source: Tradingview); but as I wrote in that forecast, there was a Santa Rally to be seen and likely equities would push higher into the end of the year, and that’s precisely what happened.

Throughout 2024 I largely remained in a similar spot: Bullish equities but waiting for pullbacks first. There wasn’t much for pullbacks in Q1 but one did appear quite visibly in the first three weeks of Q2. And then in the middle of Q3 another pullback showed and that one was aggressive. So far in Q4 the pullbacks have been light, helped along by that strong bid around the US Presidential Election, but I remain of the mind that the optimal path forward is with patience – and trying to keep ‘FOMO, or fear of missing out,’ in-check.

As of this writing there remains a large gap from the U.S. Presidential election which hasn’t yet been filled. There was a test at the top of the gap but that ultimately set support and lows in mid-November before prices launched above and finally gained acceptance over the 6k handle. But filling that gap and support showing around the 5775 level that marked the close ahead of the election could offer that pullback potential.

Below that, there’s a point of prior resistance that hasn’t yet been re-tested as support. It’s about 7% away from current price, as of this writing, and I’m looking to that as a secondary spot of support potential from the 5,638-5,669 level.

I want to include a third support level for outlier scenarios given the stretched valuations that have already appeared in the post-election rally, and from the SPX chart there’s an area of interest around 5,340-5,400. This is a zone that hasn’t seen much for prior price action and there’s even some remaining unfilled gap in that zone from the August breakout. That zone is around 11% away from current prices, and the largest drawdown in SPX in 2024 was just under 10%, so I would like to go into next year with that spot on the chart circled for support potential, if we do see a larger sell-off appear after the 2025 open.

SPX Daily Chart

Nasdaq 100

Speaking to the tech-fueled euphoria that’s propelled US equities over the past two years, the Nasdaq 100 is up by more than 100% from the 2022 lows compared to the 68.45% move off the lows in the S&P 500 (NDX 2022 Low: 10,440.64, 2024 Close: 21,012.17, 101.25%, SPX 2022 Low: 3491.58, 2024 Close: 5881.63, 68.45% gain; source: Tradingview).

And if we draw back to the 1998-1999 instance, the Nasdaq 100 was up by 123.5% in 1997 and 1998 (NDX 1997 open: 821.36, 1998 close: 1836.01, 123.5% gain; source: Tradingview), which was then followed by a whopping 101.95% rally in 1999.

Percentage-wise the move from the 2022 lows through 2024 has been comparable for NDX to the 1997-1998 episode as the index has gained more than 100% in both instances (NDX 2022 low 10,440.64, 2024 close 21,012.17, a rally of 101.25%). And, if we do see the equity rally continuing into 2025 trade as I believe it will, then the Nasdaq 100 could continue to outperform the S&P 500. But, with that said, the index is flying high as of this writing, and I’d want to wait for a show of support first.

I have four zones or support levels of interest for NDX going into 2025. The first is a spot of resistance-turned-support, plotted at the 161.8% extension of the 2022 sell-off. This is at 20,673 and is just about 1.3% away from the 2024 close for the index.

Then next is the 20k level, which was a big spot of contention for the index last year and that’s currently about 4.75% away from 2024 close price.

The third zone is a little more than 12.3% away from 2024 closing price, spanning from 18,271-18,416.

The fourth zone spans from the November 2021 high up to the March 2024 swing low, from 16,764.86 up to 16,969.17, with the former level confluent with the 38.2% retracement of the 2022-2024 major move. The bottom of that zone is a little more than 20% away from the 2024 close so if it does come into play, that would be a significant test for the broader bullish trend.

Nasdaq 100 Weekly Chart

-- Written by James Stanley, Sr. Strategist

Follow James on X: @JStanleyFX