Gold Outlook Q2 2024

After a sluggish start in January, gold finally found a bottom by mid-February, before staging a sharp rally to reach a fresh record high by March. Gold’s latest rally to an unchartered territory came on the back of a record-setting 2023, when it had hit two all-time highs: once in May, and again in December. Unlike last year, gold’s latest surge saw it break cleanly away from the key $2000 technical level where it had previously sold off on multiple occasions. With a favourable macro backdrop and technical indications pointing higher, I expect to see new records in gold prices in the second quarter of 2024 and beyond, with many central banks outside of Japan looking to ease monetary policy. That said, the road ahead could be a bumpy one as the potential for inflation to accelerate again could discourage the Fed to pursue an aggressive easing cycle.

What factors have propelled gold to record highs?

The cost of living surged worldwide in recent years, causing a significant tightening of interest rates. Fiat currencies lost substantial value from 2021 to 2024, raising physical demand for gold and other alternative stores of value (such as tech stocks and Bitcoin). Still, gold initially struggled to rise due to increasing bond yields resulting from high interest rates. Yields on 10-year bonds rose from near zero to about 5%, raising the opportunity cost of holding assets like gold and silver with no yield. So, gold has endured periods of intense selling pressure from time to time within its overall bullish trend.

Years of high inflation have increased physical demand for gold as an inflation hedge, but demand for paper gold has been healthy too, especially since the global disinflation process began around the middle of 2022, before rising further once it became apparent that many central banks, including the Fed, had reached peak interest rates. Towards the end of 2023, it became evident that inflation and interest rates had peaked, prompting central banks to adopt a less hawkish stance and eventually a slightly dovish tone by the end of the year. Inflationary pressures eased globally, leading investors to anticipate rate cuts, initially expected by the end of Q1 2024 but later postponed due to sticky US inflation and a strong economy. This kept gold prices restrained until investors looked ahead to mid-2024 and anticipated global central banks to initiate policy easing by then. This helped to drive gold to a new record high by March.

In summary, gold was supported in 2023 and early 2024 by both inflation hedging and expectations of interest rate cuts, among other factors (such as continued physical purchases of gold by central banks), which are likely to continue influencing gold as 2024 progresses.

Gold outlook Q2 2024: Major central banks to start rate cuts in June

As a result of potential rate cuts starting by around June from major central banks, we anticipate a robust second quarter and year for gold in 2024. Let's explore the reasons behind our bullish forecast and the main caveats associated with it.

The Federal Reserve decided to retain its dot-plot guidance for three cuts this year despite signs of sticky inflation earlier in the year. This helped to fuel a short-lived rally in gold to a new record high at $2222. But it's no longer certain that the US central bank will take the lead among the world's major institutions.

In fact, the Swiss National Bank, known for its propensity to deliver significant surprises, has already seized the initiative with an unexpected rate cut. Meanwhile, disappointing Eurozone data increased market bets that the European Central Bank will follow suit fairly promptly. In the UK, the Bank of England's remaining hawks have relented in light of slowing inflation, and officials have explicitly stated their willingness to reduce rates.

This shift puts rate cuts in June on the table for the Fed, BoE and ECB, with market expectations closely aligned for all three. Such a scenario appeared unlikely earlier in the year, when the US was presumed to be the frontrunner.

The actual timing and extent of the rate cuts will depend on incoming data. But as we saw how much of a lift the price of gold obtained from expectations of rate cuts, we could well see significant gains later in 2024 when central banks actually start loosening their polices and yields move lower. There’s undoubtedly a lot of pent-up demand for gold given how hot inflation has been in recent years. Fiat currencies have lost significant chunks of their values. Gold, which some see as a true store of value, should find support on any substantial short-term weakness.

What are the major caveats to our bullish gold outlook?

Among other factors, the key risks to our view that gold will hit new highs in the second quarter and beyond is to do with the US dollar. Recent inflation reports suggest the decline in prices are posing a more challenging path in the US compared to elsewhere. This has increased the likelihood of the Fed lagging behind rather than leading the cycle when it comes to policy loosening. At the time of writing, the US dollar index was on course to close higher in March, following a positive first two months of the year. If the dollar continues to find support in the months ahead, then this could help to keep gold undermined.

That said, the dollar’s strong showing has so far not caused a sharp pullback in gold prices in 2024. Some would argue it hasn’t had much of an impact at all. But should the dollar rally accelerate drastically because of the lack of a significant reduction in the Fed interest rates, owing to a strong economy, then in this situation, bond yields might not fall back as much. This, thereby, could underpin the appeal of fixed income and undermine the upside potential of zero-yielding assets like gold.

Gold outlook: Key levels to watch

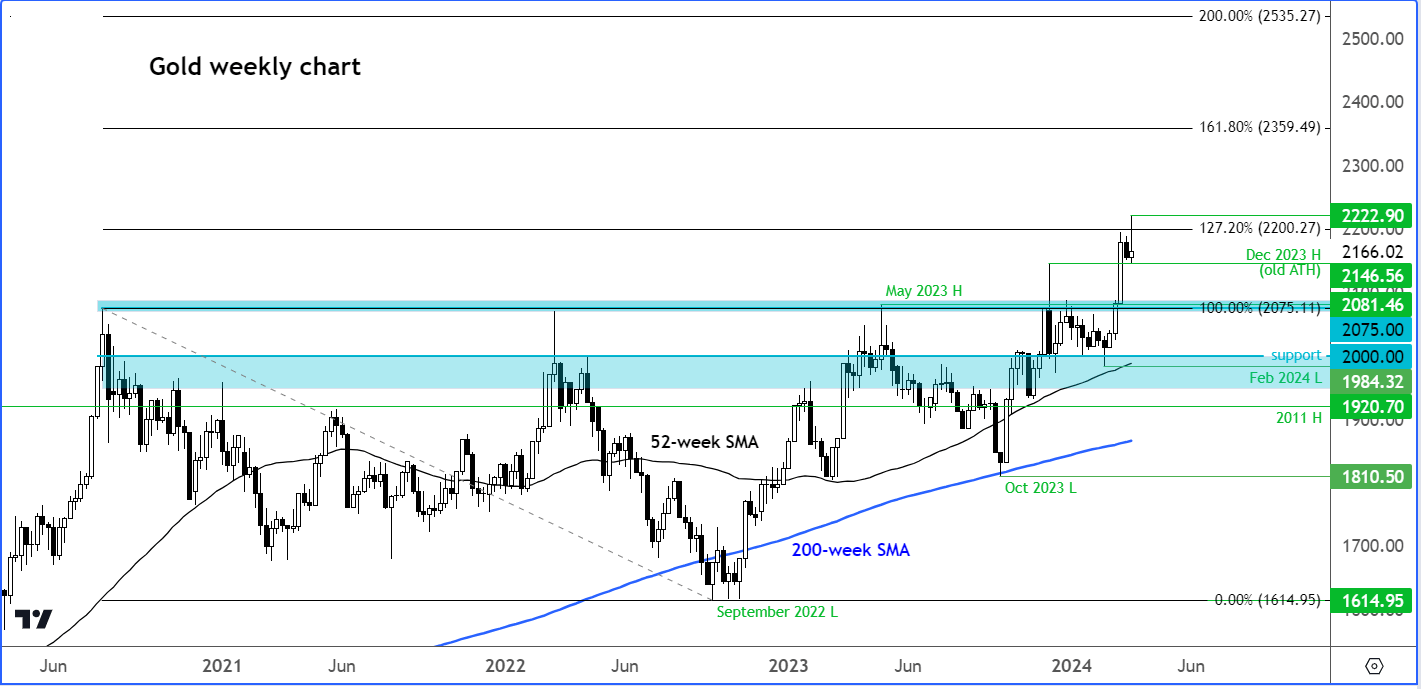

Source: TradingView.com

With gold breaking out of a 3.5-year consolidation pattern to the upside, there is no doubt about gold’s long-term trend direction, despite looking a little ‘overbought’ in the short-term outlook. The precious metal has formed several higher lows and higher highs before breaking out to new record highs, and this sequence has to end before we become bearish on gold from a longer-term tactical point of view. The most recent higher low was formed in February 2024 at $1984. So, this is the level that needs to be breached to signal an end to gold’s long-term bullish trend.

Standing on the way of that pivotal $1984 level are several key former resistance levels that may turn into support on a potential re-test from above in the coming weeks and months, given the fact that the trend has been bullish. Among these, the area between $2075 to $2081 is very important to keep a close eye on. Here, gold had formed a high in 2020, 2022 and on a couple of occasions in 2023. Once strong resistance, this is now the most important support zone to watch.

An additional support level that needs to be watched closely is the December 2023’s high at $2146.

In terms of key resistance levels to watch, well there are not many given that gold has only recently reached a record high. This is where Fibonacci extension levels come handy. On the chart, we have plotted the extension levels of the downswing that took place between August 2020 to September 2022. The 127.2% Fibonacci extension level of this price swing comes in at $2200, while the 161.8% extension level is at $2360. The former level was tested in the week when this report was written, triggering a bit of profit-taking.

But what if gold goes much higher than that? Well, considering the fact that between August 2020 to September 2022, gold shed some $460, we can use this figure to come up with a measured move target for gold. Adding $460 to the top of the range at $2075 gives us a projected target of $2535 for the breakout from the 3.5-year range. This is our ultimate bullish target, although that’s not to say gold will necessarily get there in 2024.

Therefore, my upside gold objectives for 2024 are at $2200 (already tested) and $2360, followed by $2535. Will it get to these targets? I wouldn’t bet against it, that’s for sure.