The recent price action in the US dollar has been interesting to say the least.

Since the start of 2018, the greenback has benefitted from a relative yield advantage over its G10 rivals, as well as its status as the world’s reserve currency, making it a beneficiary of “safe haven” flows during times of global economic stress. Now though, the pro-dollar tide may be shifting as traders start aggressively pricing in (at least) one rate cut by the Fed this year.

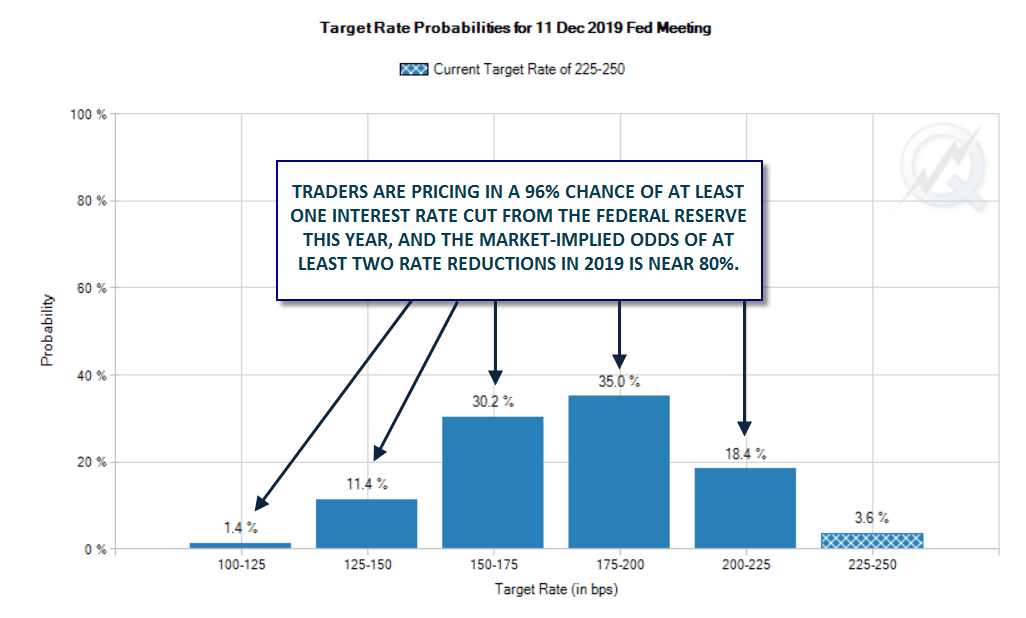

After last week’s developments, traders are now pricing in a 96% chance of at least one rate cut by December, according to the CME’s FedWatch tool. In fact, traders are pricing in a nearly 80% chance of two interest rate reductions this year:

Source: CME, FOREX.com

While the Fed does meet later this month, the central bank hasn’t laid the groundwork for a move yet, so the next major meeting to watch will be in late July. As it stands, the market has discounted a roughly 50/50 chance of a rate cut at that meeting; those odds, and by extension the US dollar’s strength, will be very sensitive to economic data and Fed comments over the next six to eight weeks.

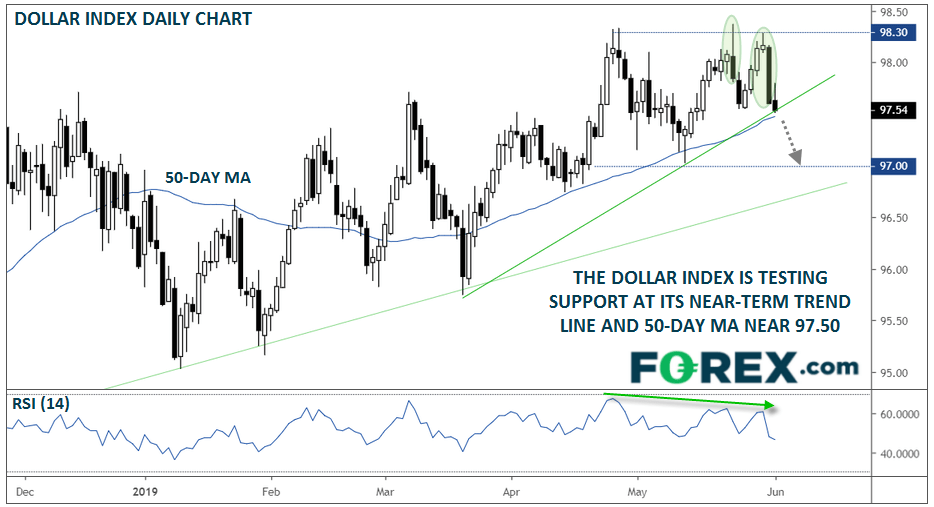

Technically speaking, the US dollar index has found a strong level of resistance near 98.30. The index has peaked on three separate occasions at that barrier, with prices forming textbook reversal patterns (bearish engulfing candle and an evening star setup) over the last two tests. Combined with the triple bearish divergence in the daily RSI indicator, there’s growing evidence that the dollar index has formed a durable top.

Source: TradingView, FOREX.com. Note this product may not be available to trade in all regions.

For this week, the key level to watch is near 97.50, where the 50-day moving average and near-term bullish trend line converge. A break and daily close below this support area could clear the way for a deeper retracement toward 97.00 or the mid-96.00s next. In terms of the major currency pairs, this could correspond to a move up toward the upper-1.12s in EUR/USD, 1.2750 in GBP/USD, and a drop toward 107.50 in USD/JPY.