What are wide ranging bars?

- Wide ranging, or long, bars occur when there is a bar that is at least 2-3 times longer than normal bars on the chart.

- Often are the result of a major news announcement although this is not always the case.

Why are wide ranging bars important?

- Wide ranging bars signal strong momentum in the direction of the bar.

- May signal that there is little buying interest in a bar down, and little selling interest in a bar up.

- Can signal that possible support and resistance will not hold

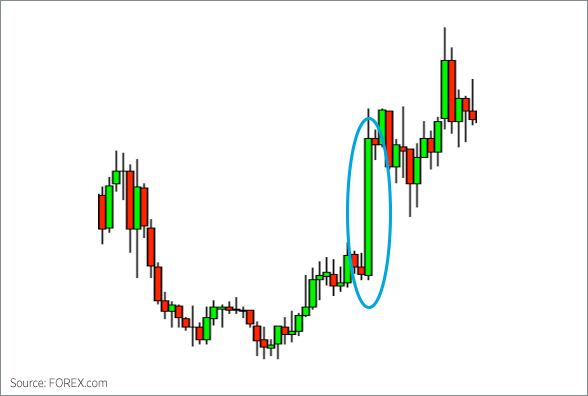

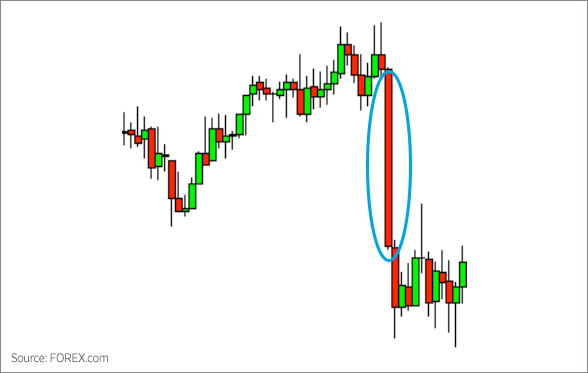

So how do I use wide range bars?

If there is a wide ranging bar, generally that is a signal to stay out of the market. Our technical reports generally look for short term reversal points. If there is a wide ranging bar going into our entry, it may be a signal that the pattern being traded will not hold. In this case, we may simply cancel the trade.

Example 1: Bearish wide-range bar formation on a USD/CHF, 30 minute chart

Example 2: Bullish wide-range bar formation on a EUR/CHF, 30 minute chart