U.S. Dollar / Thai Baht - USD/THB

View indicative pricing, trading opportunities, latest research and market insights for USD/THB.

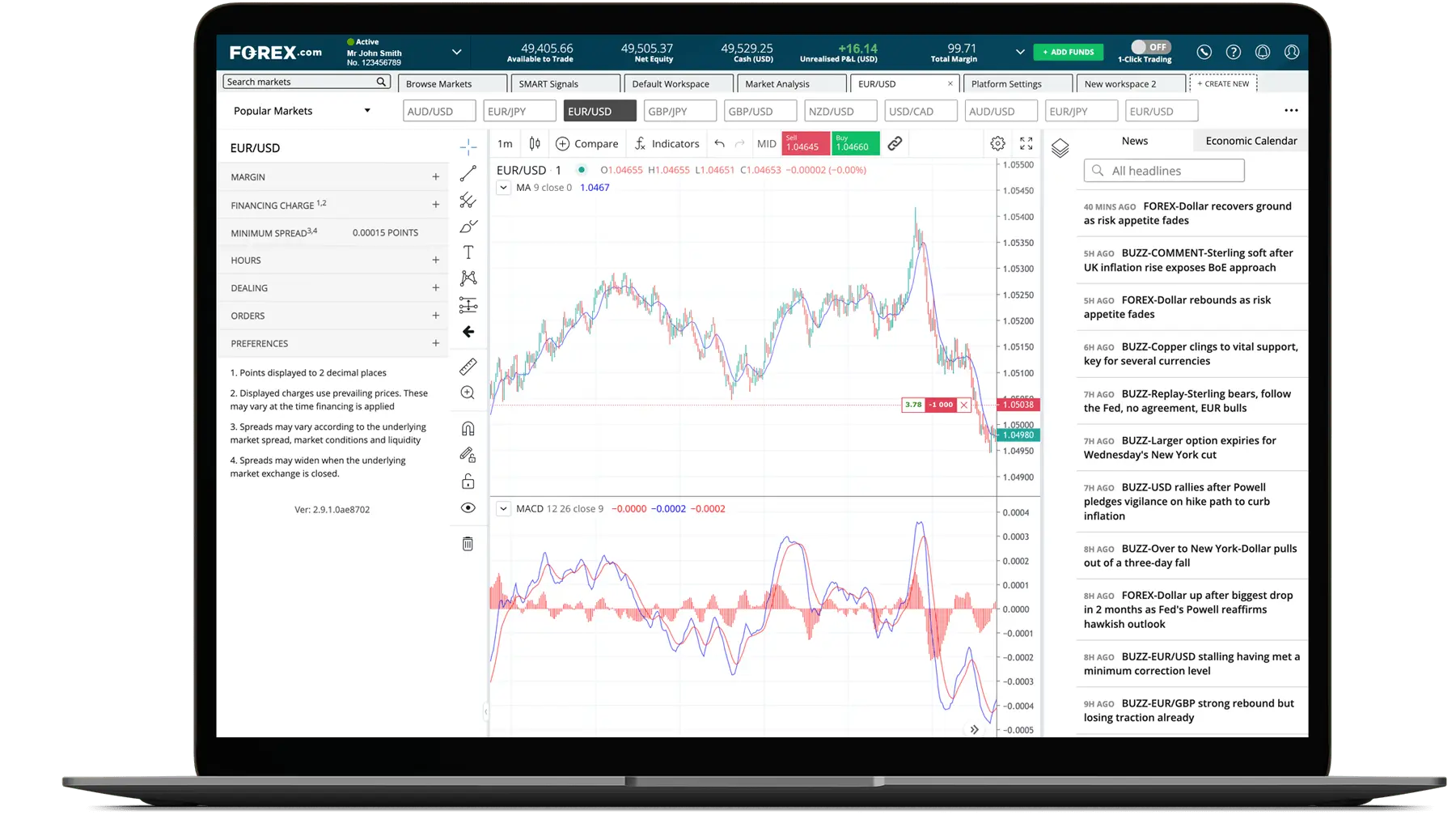

USD/THB rate chart

Forex is the process by which traders can buy one currency and simultaneously sell another, with the goal to profit from the direction price is likely to take in the future. With a daily trading volume of more than £5.1 trillion, the forex market is the most traded in the world, and is open 24 hours a day, five days a week, between Sunday 5PM EST to Friday 5PM EST for banks, institutions and individuals worldwide.

People trade forex for a range of reasons, including the unmatched liquidity of the market, the ability to trade on leverage, the opportunity to take positions in both rising and falling markets, the lack of hidden fees or commissions, and the accessibility of markets being open 24 hours a day, five days a week, between Sunday 5PM EST to Friday 5PM EST.

In order to trade forex, there are a few key steps to follow. First, you need to select a currency pair. Many traders choose a major pair such as EUR/USD due to high liquidity. Next, analyzing the market is key to understanding the technical and fundamental drivers that may affect price. Once you understand how to read the quote, it's time to open your position by going long or short.

You'll need to monitor your trade, with many traders using technical indicators to make better sense of price action, and features such as stops and limits to manage risk. Finally, you can close your position when the market hits a price at which you want to exit.

If you have more questions visit the Forex Trading FAQ section or start a Chat with our support team.

Looking to learn more about forex trading? Visit our trading academy and use our resources to become market-ready.