Oil prices have been on an absolute tear since bottoming around Christmas: West Texas Intermediate (WTI) has gained more than 50% over the past 15 weeks, with Brent experiencing a 41% rally of its own over the same period.

From a fundamental perspective, concerns over supply have been rising amidst increasing tensions between the US and Iran, Venezuela’s ongoing unrest, and an outright civil war in Libya. Meanwhile, OPEC and Russia have reigned in supply this year, despite a recovery in global demand after the turn-of-the-year slowdown.

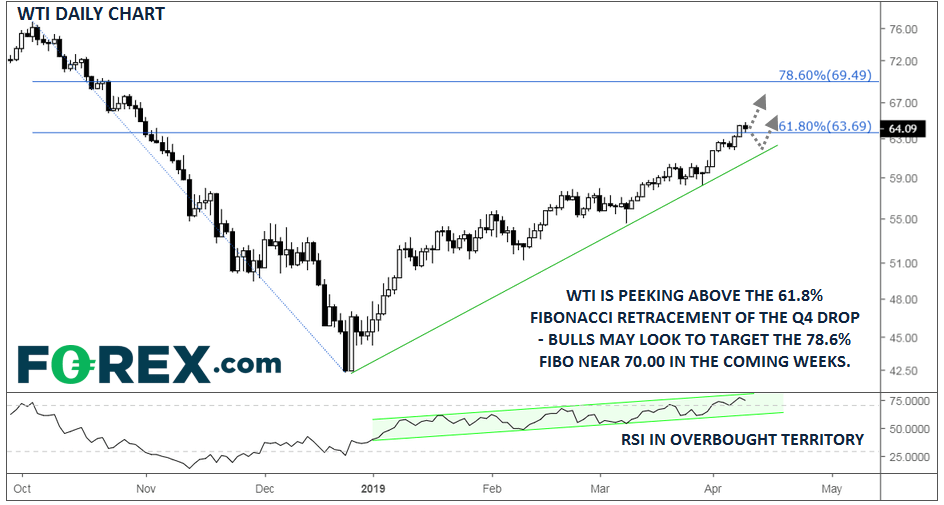

Technically speaking, WTI remains in a clear uptrend off the December trough. As of writing, prices are holding above the widely-watched 61.8% Fibonacci retracement of the Q4 swoon at 63.70. That said, the RSI indicator is in overbought territory, increasing the likelihood of a pullback over the rest of this week.

Source: TradingView, FOREX.com

Oil prices are nudging lower today after Russian President Putin indicated that Russia was comfortable with oil prices at present, clouding the outlook for the next planned production cut. In any event, the medium-term momentum is clearly with the bulls (likewise with seasonality, as my colleague Matt Simpson noted earlier this month) with traders potentially looking to buy up any near-term dips, targeting the 78.6% retracement just below 70.00 in the coming weeks.