Over the past three sessions, USD/MXN declined by more than 2%, benefiting the Mexican peso. The growing bearish momentum stabilized after the release of inflation data in the United States.

The Effect of CPI

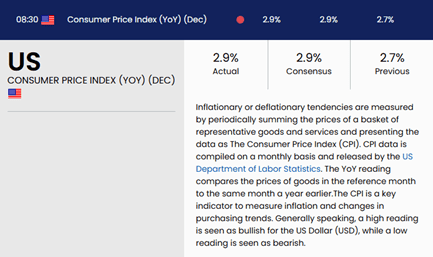

During the session, the official Consumer Price Index (CPI) data for the United States was released, showing a rate of 2.9% y/y in December. This figure matches the forecast and is slightly above the previous 2.7% reading. Also, the Core CPI m/m showed a 0.2% marking a slight miss from the forecasted number in 0.3%. The immediate effect on USD/MXN was a bearish movement favoring the Mexican peso in the short term. This can be explained by the temporary optimism in the market regarding moderate inflation levels, which could ease the Federal Reserve’s tight interest rate policies.

Source: Data - FxStreet

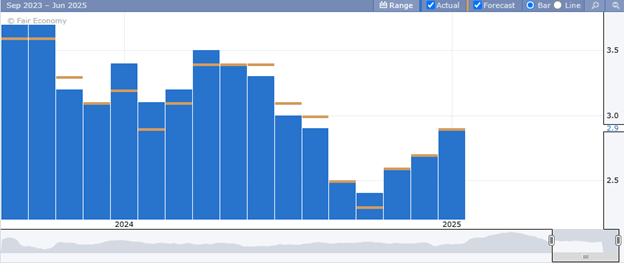

However, the current 2.9% figure remains far from the 2% target that the Federal Reserve considers as a moderately stable inflation range. Inflation trends remained steady until October 2024, when a 2.4% reading was recorded. But now, an upward trend has reemerged, with significant increases observed in the November, December, and January reports.

Source: ForexFactory

It is important to note that the central bank may not be satisfied with the CPI’s increase over the past three months. This could influence the January 29 decision, where there is a 97.3% probability that the rate will remain stable at 4.5%, according to CME Group. Without a significant reduction in the CPI toward 2%, rate cuts are likely to be constrained, favoring the US dollar against the Mexican peso in the long term, which would eventually undermine the MXN’s momentary confidence following the CPI data release.

Bank of Mexico

In its last decision on December 19, 2024, the board cut the interest rate to 10%, given that inflation had eased and now stands at 4.21% annually. In its statement, members expressed that rate cuts could continue if inflation levels keep decreasing. The pace of these cuts could even accelerate in 2025, supporting a dovish outlook.

Despite the current 10% rate in Mexico being higher than the 4.5% in the United States, this has not been enough to prevent the US dollar from appreciating against the peso in recent months. This is due to the higher risk associated with fixed-income securities in Mexico, leading the market to favor safer securities with lower rates in the United States. Additionally, the trend of lower rates for the peso and constant rates for the dollar could continue to exert bullish pressure on the USD/MXN in the long term.

Technical Forecast for USD/MXN

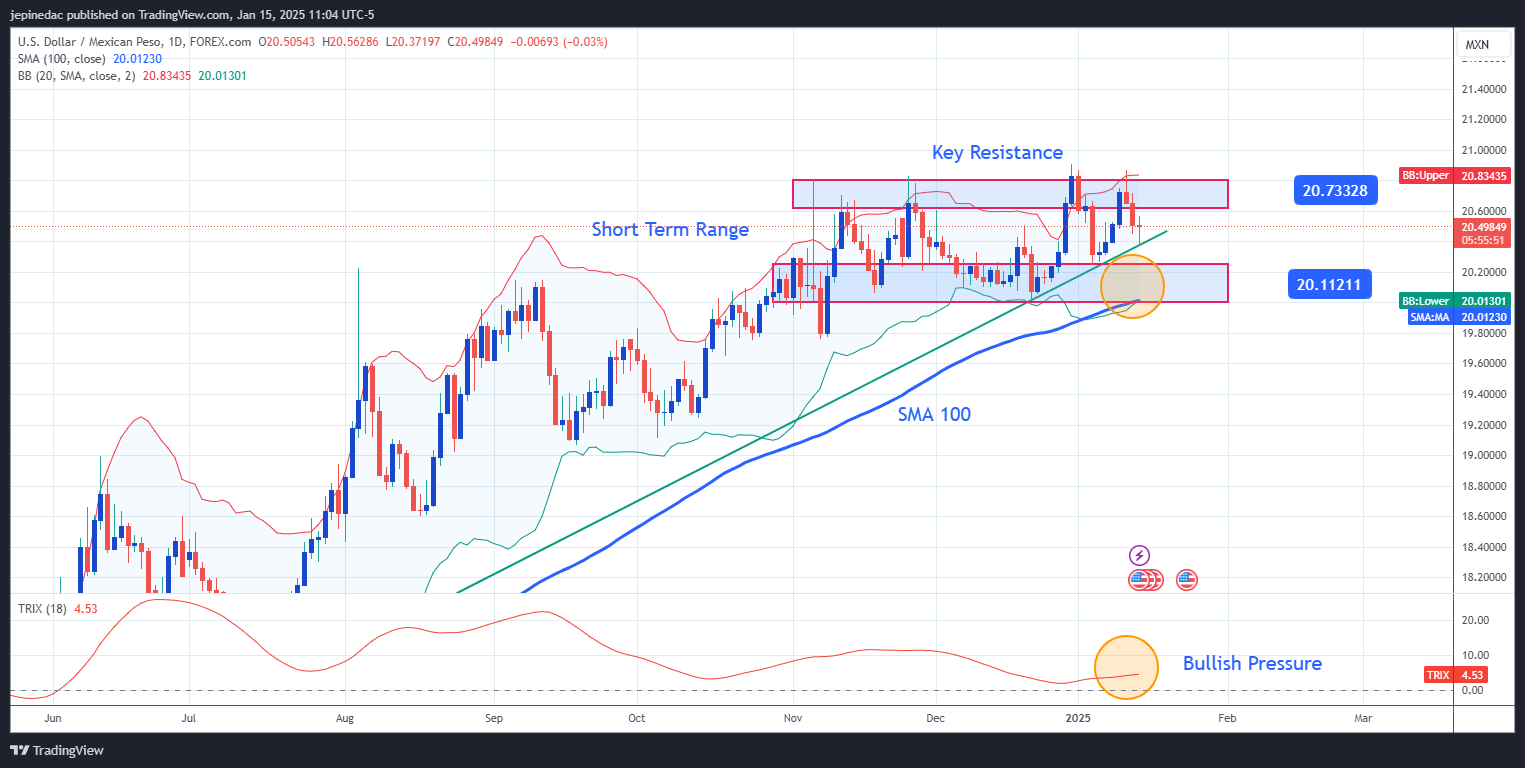

Source: StoneX, Tradingview

- Sideways Range: After maintaining a long-term trend line, the price is now in a constant range between the ceiling of 20.73 pesos per dollar and the zone of 20.11 pesos per dollar. Currently, the price shows a bearish movement trying to challenge the upward trend line in the middle of the range, but the pressure remains insufficient to reach the key support level.

- TRIX: The TRIX indicator line continues to oscillate above the neutral level of 0, indicating short-term bullish pressure for USD/MXN. If it stays above 0, it is unlikely that significant selling pressure will break the long upward trend line and the sideways range.

Key Levels:

- 20.73: An important resistance zone. Breaks above this level would disrupt the current neutrality and could mark a new high in favor of the US dollar, increasing expectations of an upward trend.

- 20.11: A crucial support level. This coincides with the lower part of the sideways range, along with the 100-period simple moving average and the lower Bollinger band. This level acts as a significant barrier, and if the price breaks below this point, it could trigger a significant shift toward bearish momentum, impacting both the sideways range and the long-term upward trend of USD/MXN.

Written by Julian Pineda, CFA - Market Analyst