USD/JPY Talking Points:

- It was a fresh yearly low for USD/JPY after the weekly open with the pair testing below the 140.00 level.

- With the Fed set to start a rate cutting cycle on Wednesday, the longer-term carry trade gets less and less attractive. But this doesn’t mean that moves will show linearly, as we’ve seen over the past month-and-a-half with the pair.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

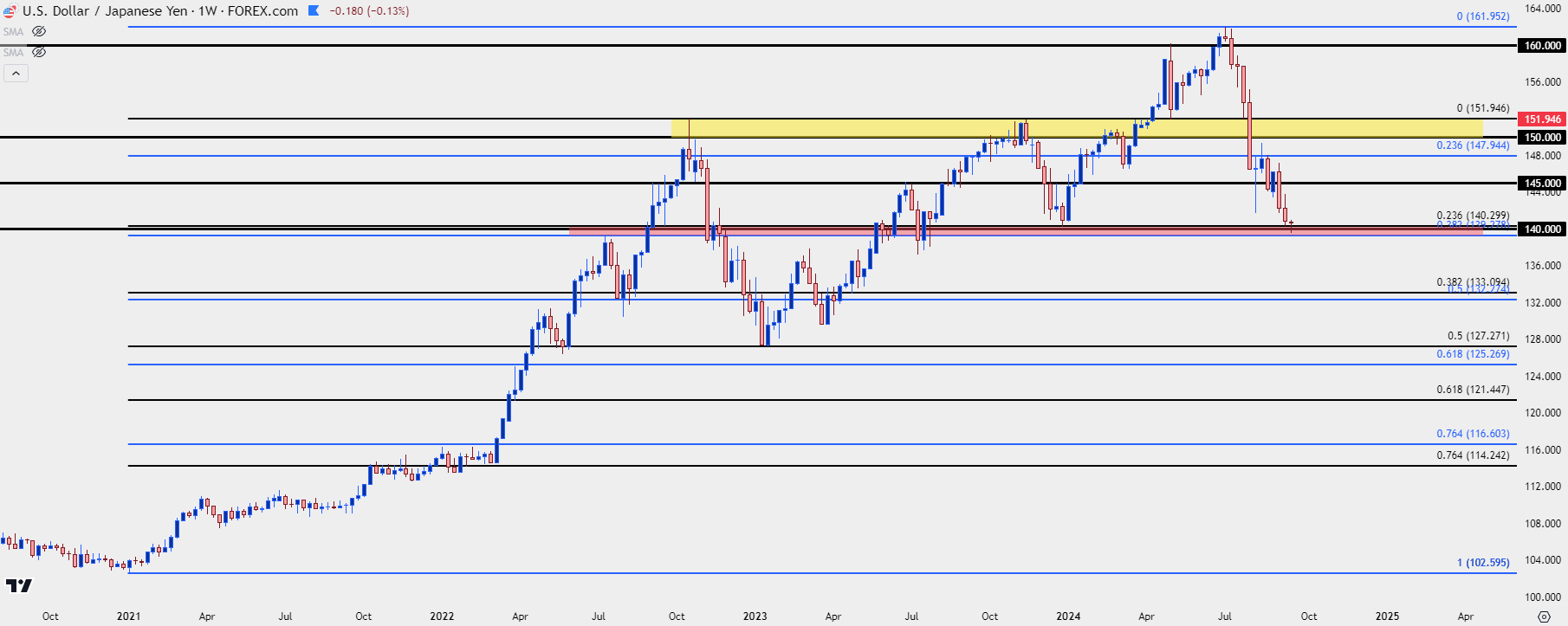

USD/JPY set a fresh yearly low after the weekly open. As looked at on Friday USD/JPY has started to encounter a big zone with longer-term importance around the 140.00 level, with 140.30 which set the low on Friday coming from the 23.6% retracement of the 2021-2023 major move (as well as setting a swing-low last December), and 139.28 as the 38.2% retracement of the 2021-2024 trend.

On the fundamental side of the matter USD/JPY put in a historic rally on the back of the carry trade. Starting in 2021 as US inflation began to tick-higher, the pair rallied from below 103 up to a high above 160 in July of this year. The fundamental backdrop justifies that move, as well, with the FOMC tightening rates significantly and we can see the trend getting a major boost in March of 2022 as hikes began.

But, with the Fed set to start a cutting cycle at their rate decision on Wednesday that fundamental case is growing dimmer and reasonably speaking, there’s probably still quite a few carry traders still holding positions, as we haven’t yet seen a 38.2% retracement of the 2021-2024 major move. That level plots at 139.28, with the 140.00 level above that and then the 140.30 level over that.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

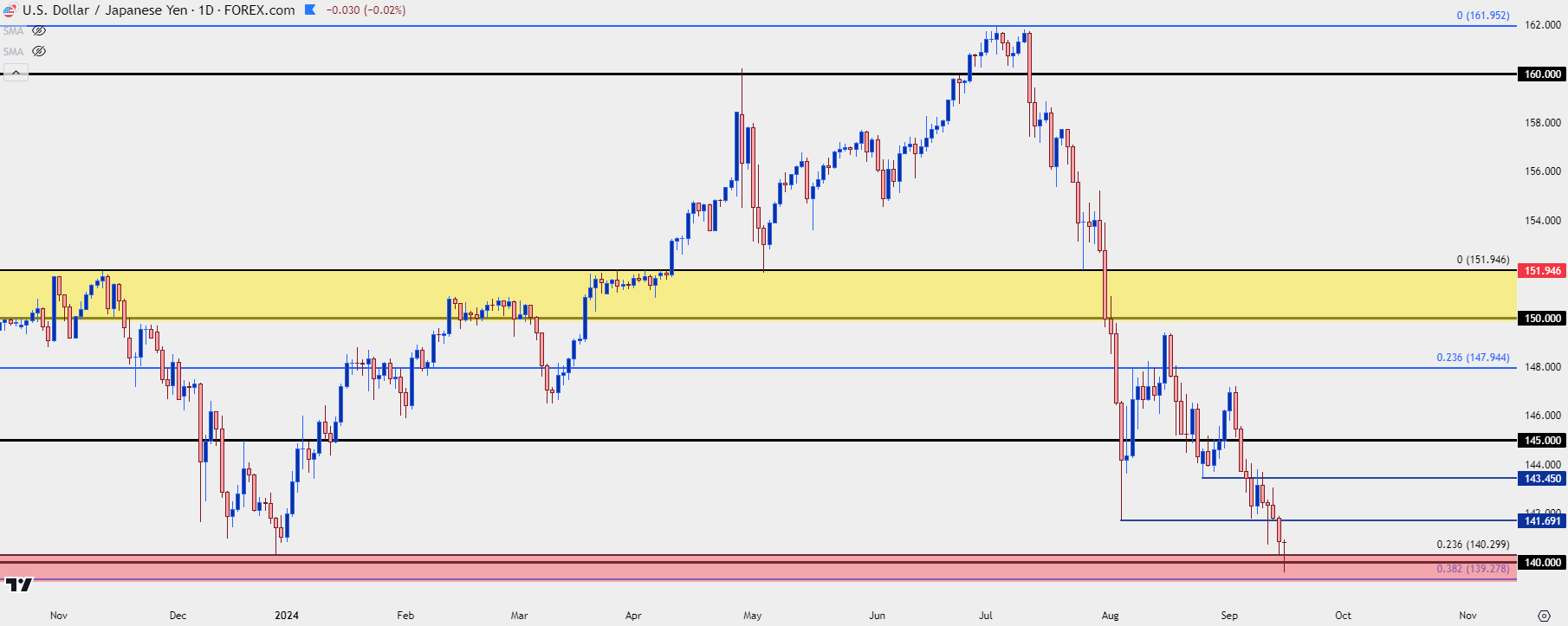

USD/JPY Strategy

While the longer-term trend hasn’t yet seen a 38.2% Fibonacci retracement, shorter-term themes have been far more aggressive on the opposite side as sellers have continued to push. There’ve been attempts to bounce but each has been short-lived, and this can be explained by the prospect of longer-term longs using those bounces to close positions.

But Wednesday will be a big test – and depending on how aggressively the Fed plans to lean into rate cuts, there could be even more motivation for carry traders to close positions. And if the Fed takes a more-cautious approach, with a 25 bp cut on Wednesday and a couple more into the end of the year, and then a couple more for 2025, there could be a short-covering scenario given the pace of recent trends.

The bigger question is whether any short-covering bounces could turn into anything more than another lower-high. For resistance, the 143.45 level that I looked at last week ended up helping to hold the high. The August 5th swing low is now a potential level for a lower-high and that plots at 141.69. If we do see a larger pullback scenario play out, then 145 comes back into the picture as a price of importance.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist