This is an excerpt from our full 2025 USD/JPY Outlook report, one of nine detailed reports about what to expect in the coming year.

Monitoring for turning points

After essentially moving in lockstep with US yields early in 2024, the strong relationship abruptly disintegrated mid-year. During this period, USD/JPY was more correlated with riskier asset classes such as stocks, suggesting carry trade flows were pushing the pair higher. Declining US yields were ignored as USD/JPY rose, but as the BoJ continued to lift rates and US economic growth faltered, it sparked an aggressive USD/JPY unwind.

This doesn’t mean it will happen again, but if USD/JPY disconnects from US Treasury yields next year, it may signal an eventual reversal.

Rate futures useful for assessing setups

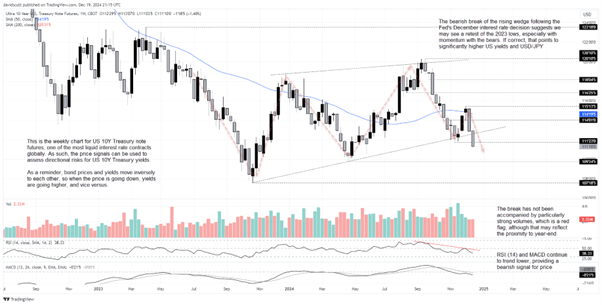

Given the impact US 10-year Treasury yields had on USD/JPY last year, it’s worth assessing directional risks for yields moving forward. US 10-year Treasury note futures, one of the most liquid contracts globally, is useful for this purpose.

The signals can be used to anticipate price shifts like any other market, offering a mechanism to gauge directional risks for prices – and yields – from both a fundamental and technical perspective.

Source: TradingView

USD/JPY bulls would have enjoyed the late-2024 price action, with futures breaking out of the rising wedge pattern they had been trading in over the past year to the downside. With MACD and RSI (14) providing bearish signals on the weekly timeframe, it suggests the break may stick, opening the door for a potential retest of the October 2023 lows. Given Treasury prices move inversely to yields, the bearish price action points to upside risks for 10-year yields.

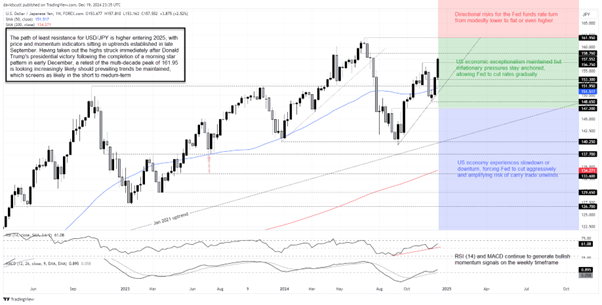

As the USD/JPY chart below reveals, the bearish break is helping fuel USD/JPY upside.

USD/JPY scenario analysis

Source: TradingView

Rather than offering an official forecast for where USD/JPY will end in 2025, it’s more useful to examine scenarios that could lead to upside, sideways range trade, or a downside reversal from current levels. Price and momentum indicators were trending higher in late December when this report was written, suggesting a bias to buy dips and favour bullish breaks if those trends persist.

As things stand, a retest of the multi-decade high of 161.95 looks probable from a technical perspective.

From a fundamental perspective, for such an outcome to materialise, Fed rate cut pricing would likely need to dwindle further, with a shift from pricing cuts to hikes offering a far more powerful force. However, if the US inflation threat discussed earlier does not materialise, it may be difficult for USD/JPY to push meaningfully higher. And if US unemployment rises sharply, it could spark a material downside move, exacerbated by increased risk of forced carry trade unwinds.

BOJ intervention threat

Finally, the threat of BoJ intervention warrants attention, as it occurred multiple times last year at the Japanese government’s request. Japanese policymakers frequently flag the risk of intervention, especially during periods of sharp yen weakness, but recent history suggests it’s not levels but the speed of moves that can prompt verbal threats to escalate into outright yen buying.

It’s important to note that intervening during a period of rising US Treasury yields is near-useless beyond the extreme short term, merely providing better levels for bulls to re-enter. The BoJ does not have unlimited foreign reserves to waste fighting fundamentals, so intervention during a period of declining US yields would likely yield far more successful and sustained market outcomes.

This is an excerpt from our full 2025 USD/JPY Outlook report, one of nine detailed reports about what to expect in the coming year.