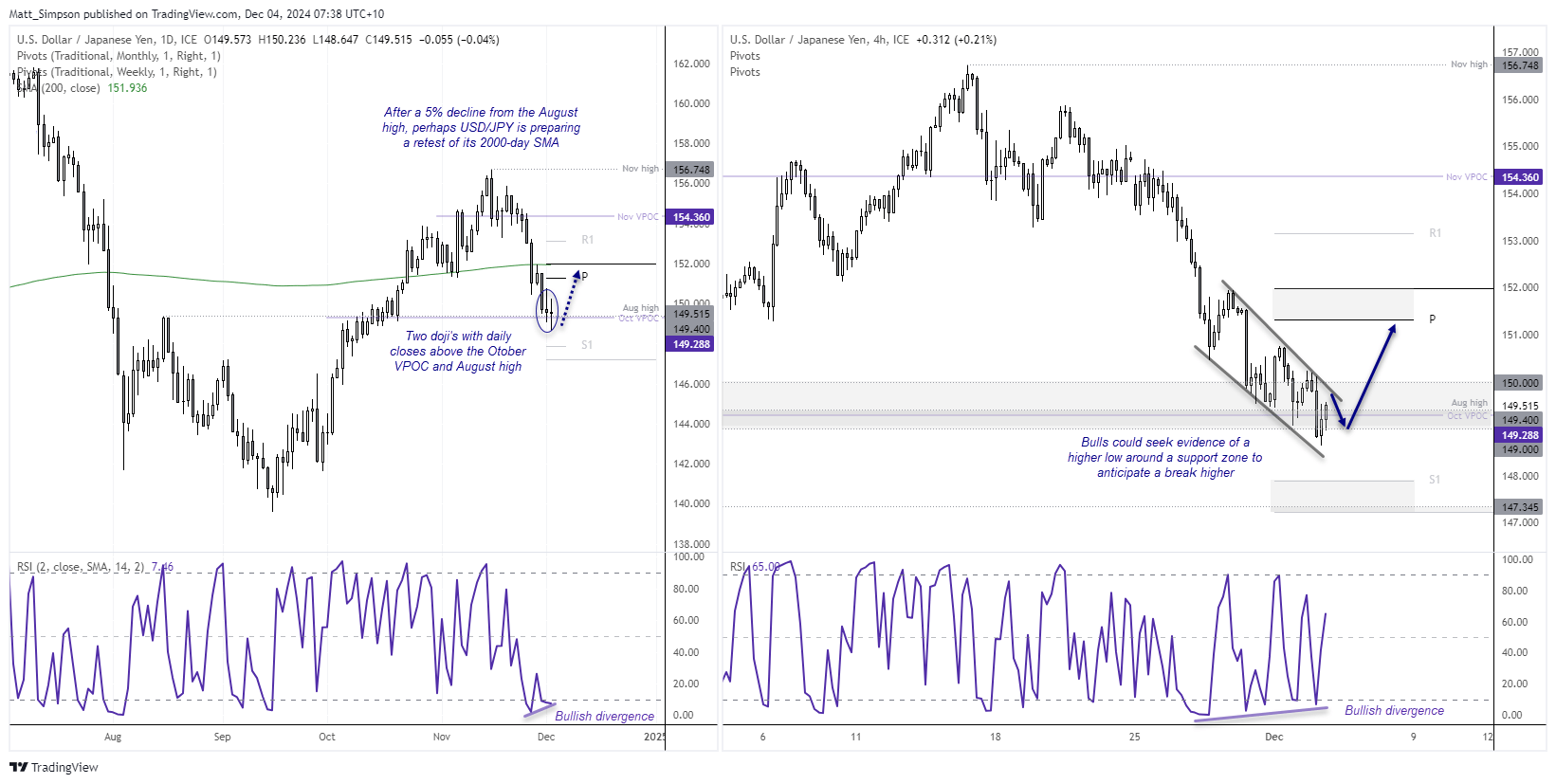

USD/JPY technical analysis:

Since the November high, USD/JPY has fallen over 5% and printed just three bullish candles over the past 12. That alone suggests the move lower may be nearing an inflection point, but there are other clues too. A second consecutive doji formed on Tuesday, and both printed daily closes just above the August high and October VPOC (volume point of control). Bullish divergences have also formed on the daily and 4-hour RSIs in the oversold zone.

While there is no immediate indication of a price action low, I suspect one could be close. What I would ideally like to see now is evidence of a higher low on the 4-hour chart (or even the 1-hour chart) to indicate a trough has formed, in anticipation of some bullish mean reversion to at least 151. Also note the weekly pivot point (151.3) and monthly pivot point (151.99) and of course the 152 handle near the 200-day SMA, which could also make a viable target for bulls over the near term.

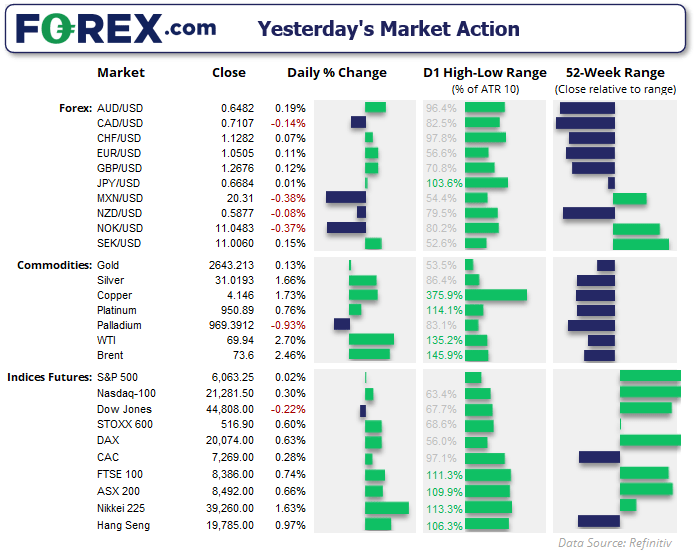

Economic events in focus (AEDT)

If this week’s domestic data is anything to go by, Australia’s GDP could come in slightly soft. With that said, the consensus estimate is for growth to have risen 0.5% q/q (up from 0.2% in Q2) and 1.1% y/y up from 1%). In either case, I doubt it will move the needle much for the RBA who seem poised to keep rates at 4.35%.

- 09:00 – AU construction, manufacturing and services index (AIG)

- 11:00 – AU Q3 GDP, commodity prices, capital expenditure

- 11:30 – JP services PMI

- 12:45 – CN manufacturing PMI (Caixin)

- 19:55 – DE PMIs (final)

- 20:00 – BOE Bailey speaks

- 01:45 – US PMIs (final)

- 02:00 – US ISM non-manufacturing PMI, durable goods orders

- 02:30 – ECB President Lagarde speaks

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge