Key Events:

- Japanese National Core CPI Rises to 2.7%

- Japanese Business Activity Expands at the Fastest Pace Since May 2023

- BOJ Governor Ueda Signals Potential for Further Rate Hikes

- Dovish Outlook Expected from Powell’s Jackson Hole Speech

Week Ahead:

- US Durable and Core Durable Goods Orders

- BOJ Core CPI y/y

- US Prelim GDP

- Tokyo Core CPI y/y

- US Core PCE m/m

BOJ Speech Highlights:

With Japanese inflation statistics rising, particularly the national core CPI approaching 2024 highs, BOJ Governor Ueda has not ruled out the possibility of another rate hike, contingent on upcoming economic data aligning with BOJ forecasts. This stance could lead to further tightening if the data supports it.

Powell Speech Expectations:

The market has largely priced in a September rate cut, with bearish sentiment prevailing for the US dollar. Powell's upcoming speech will be closely watched for insights into the state of the US economy and the trajectory of the Fed’s easing monetary policy for the remainder of 2024. The favored inflation gauge, set for release next Friday, will be crucial in determining the magnitude of future rate cuts, marking the first such cuts in four years.

Week Ahead:

Following the Fed’s outlook today, the BOJ’s position on a potential rate hike will be influenced by the upcoming BOJ Core CPI and Tokyo CPI indicators. Although the previous hike caused significant turmoil in global markets, Governor Ueda has emphasized the importance of transparency in the BOJ's future policies to avoid surprising the markets.

With the BOJ’s potential transparency and the US deflator and Core PCE indicators on the horizon, these metrics are critical for determining the policy path, especially given ongoing concerns about the US economy. The Fed’s favored inflation gauge is still to provide more clarity on the likelihood and magnitude of rate cuts before the year’s end.

From a Technical Perspective

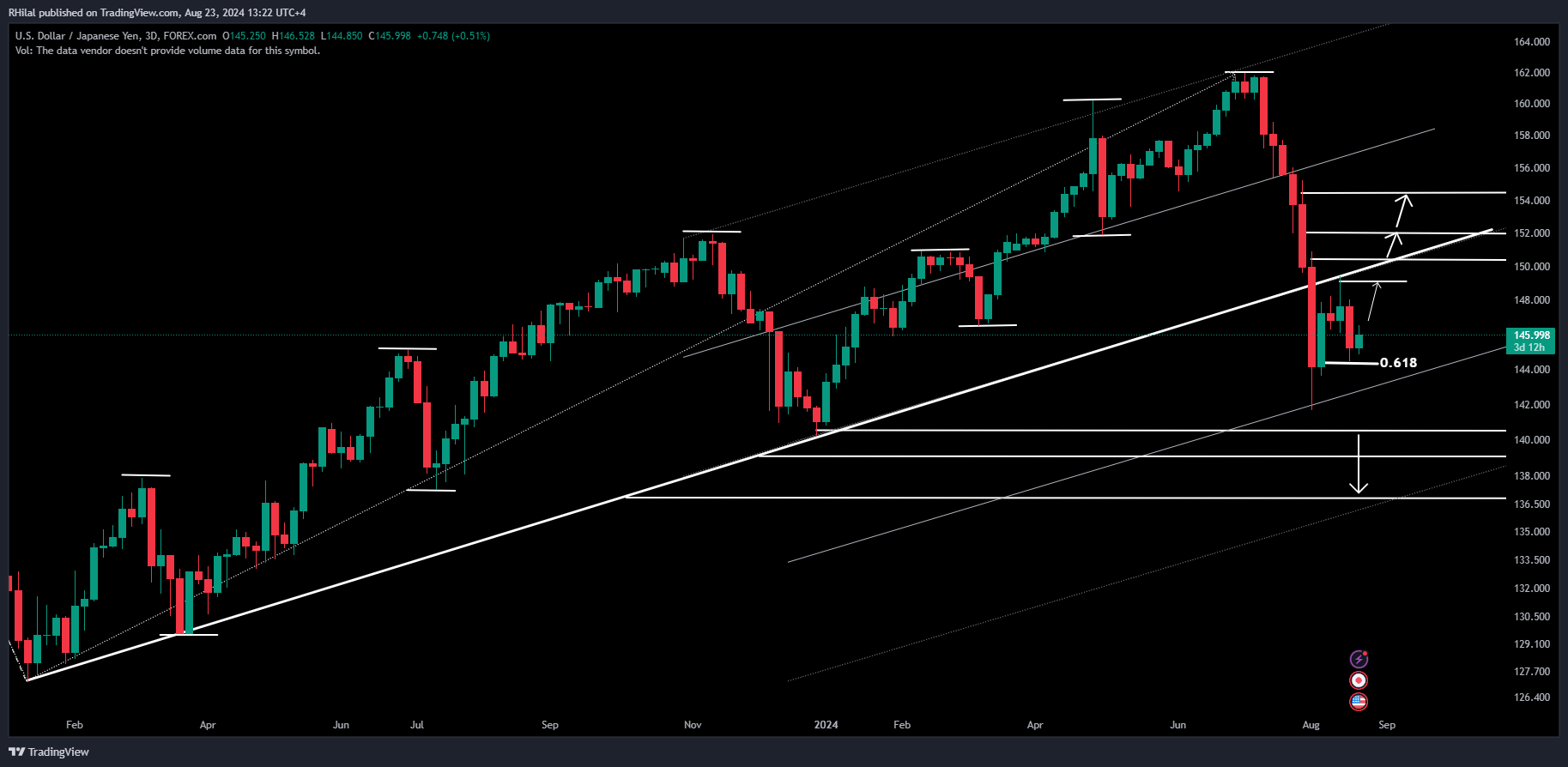

USDJPY Outlook: USDJPY – 3-Day Time Frame – Log Scale

Source: Tradingview

The latest bullish rebound on the USDJPY chart, spanning from the 141.70 low to the 149.40 high, has traced a golden 61.8% Fibonacci correction toward the 144.45 mark. This opens the possibility of another retest of the lower boundary of the primary trendline, connecting the consecutive lows of 2023 in January, March, and December, around the 149.40 and 150.60 levels.

From a longer-term perspective, closing above this trendline and the 150.60 zone could realign the trend towards the 151.80 and 154 levels.

On the downside, if dovish expectations for the Fed intensify and the BOJ maintains its hawkish stance, a break below the 140-mark could lead to further declines towards the 139 and 137 levels, respectively.

--- Written by Razan Hilal, CMT – on X: @Rh_waves