Key Events

- ADP Non-Farm Employment Change

- Unemployment Claims

- US ISM Services PMI Non-Farm Payrolls (Friday)

- FOMC Member Remarks (Friday)

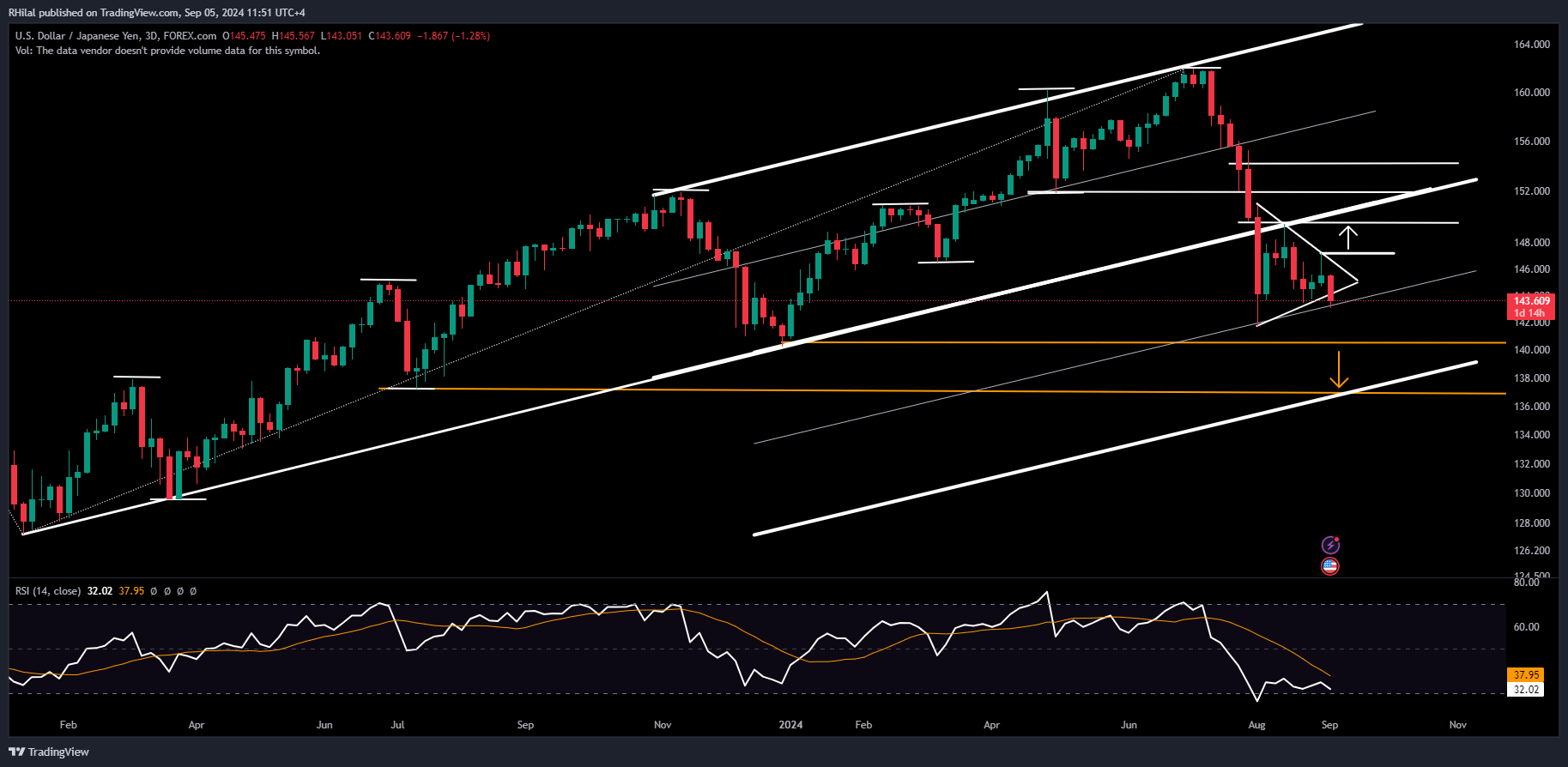

The USDJPY chart is hovering near its 2024 lows, with bearish risks amplified by increasing expectations for a 50bp rate cut in the US, coupled with a potential rate hike by the BOJ in September.

Recent data from the JOLTS Job Openings indicator, which provides an early glimpse into the labor market and economic activity, recorded a drop just above April 2021 lows. This has heightened concerns about the cooling labor market, especially as monetary policy effects typically lag. The upcoming Non-Farm Payroll reports on Friday are expected to clarify whether the US economy is headed for a soft or hard landing as the Fed prepares to initiate its easing cycle.

Technical Outlook

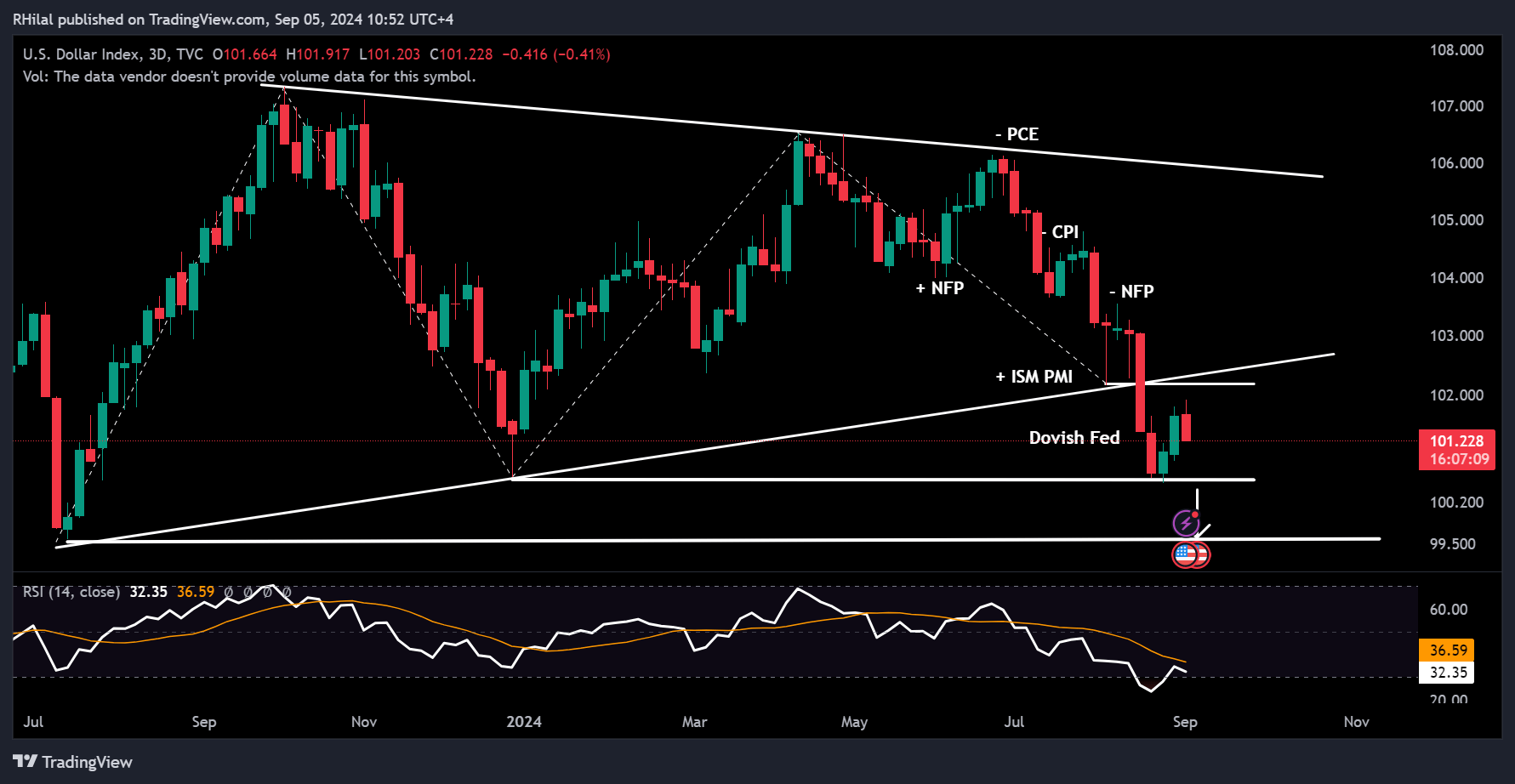

USDJPY Outlook: DXY – 3-Day Time Frame – Log Scale

Source: Tradingview

The US Dollar Index is navigating critical levels that could determine whether the trend favors a bullish reversal or continues its bearish trajectory. A bullish bias could emerge with a close back above the 102 barrier and inside the primary consolidation range.

Conversely, a close below the December 2023 lows would confirm a drop towards the July 2023 lows. The upcoming ISM Services PMI and US employment indicators are poised to play a decisive role in determining the trend direction, which will significantly impact the broader market.

USDJPY Outlook: USDJPY – 3 Day Time Frame – Log Scale

Source: Tradingview

In August, the USDJPY chart traced a contracting consolidation pattern, marked by lower highs and higher lows, printing the 2024 low at 141.70, aligned with the mid-level of the duplicated channel from the primary 2024 trend.

Current price action is showing signs of weakness against the yen, but final confirmation of a bearish trend requires a break below the 140-barrier. Should this occur, the bearish scenario points towards the 137 level, with risks of a sharper decline towards the 130-128 zone. On the upside, levels at 147.20 and 149.20 present short-term resistance for bullish corrections, while 152 and 154 could serve as longer-term resistance levels.

Key levels are being closely watched for a breakout, likely in alignment with upcoming monetary policy decisions. As the saying goes, "Don’t fight the Fed."

--- Written by Razan Hilal, CMT – on X: @Rh_waves