Key Events for Today

- Tokyo CPI Inflation

- US Core PCE

Key Events for Next Week

- BOJ Policy Meeting (Wednesday)

- Fed Rate and FOMC Meeting (Wednesday)

- Non-Farm Payrolls (Friday)

The latest Tokyo CPI Inflation metric recorded an uptick from the previous 2.1%, in line with the expected 2.2%. With inflation rates trending upwards, the chances of tightening monetary policies are increasing. With the dollar facing the chances of a rate cut, the USDJPY pair is retesting May 2024 lows.

Today's release of the Fed’s favored inflation gauge, the Core PCE, will be closely monitored to assess the direction of FOMC and Fed rate impacts on the markets next week. Following a stronger-than-expected US advance GDP on Thursday, the markets experienced a slight sense of relief regarding recession risks.

Upcoming BOJ Meeting

The market anticipates tighter policies at the next BOJ policy meeting. While rate hikes are not guaranteed, the meeting will outline debt operation plans towards reducing bond purchases and testing the sustainability of current rates.

Upcoming FOMC Meeting, ISM Manufacturing PMIs, and Non-Farm Payrolls

Following the BOJ decision on Wednesday, polls are still inclined towards the start date of a Fed rate cut in September. Given a stable rate, the FOMC meeting is set to ripple volatility considering recent economic updates on disappointing earnings, recession risks, and inflation rates. The ISM Manufacturing PMI and non-farm payroll growth will be watched afterwards for assessing the US economy’s outlook.

Technical Outlook

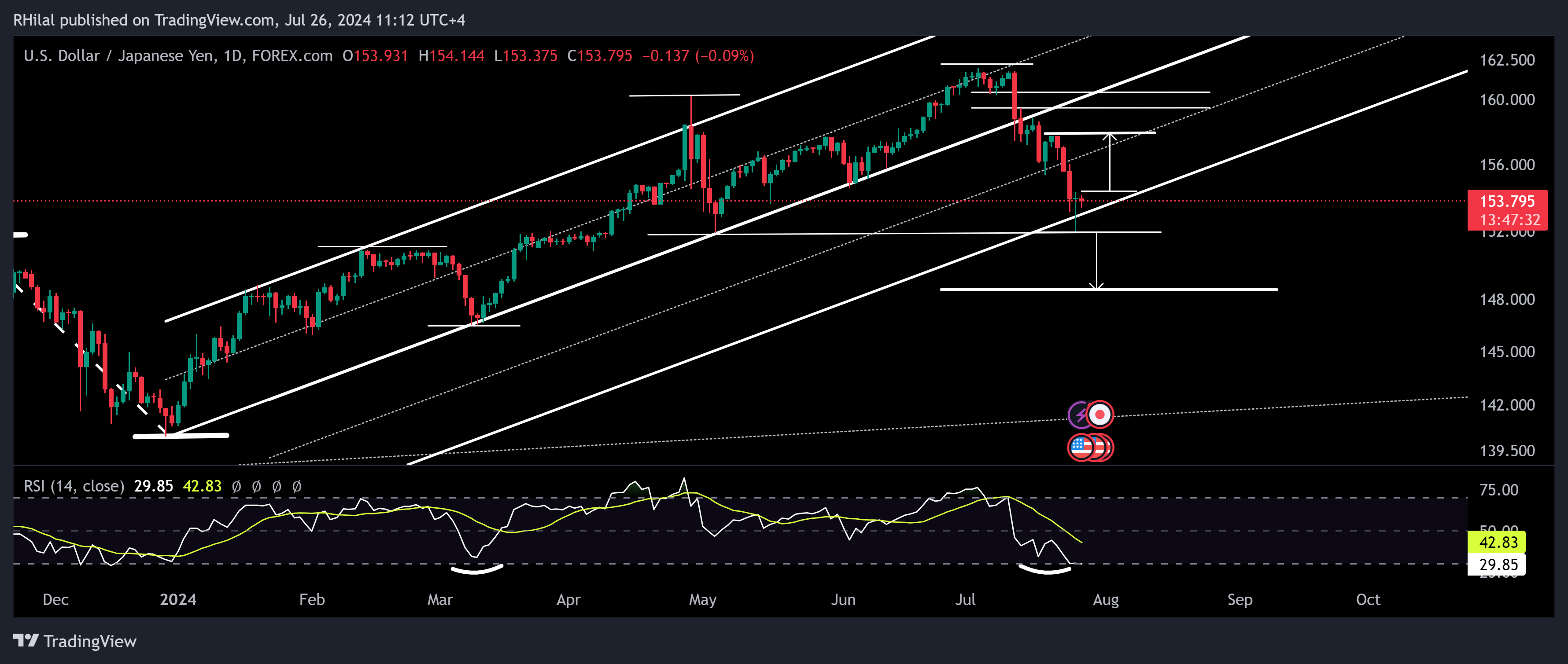

USDJPY Forecast: USDJPY – Daily Timeframe – Log Scale

Source: Tradingview

Bullish Scenario

The USDJPY daily RSI is deeply oversold, retesting December 2023 lows. From a price action perspective, the latest low aligns with the May 2024 low and the bottom end of the projected parallel channel from the year’s primary trend, forming a dragonfly doji candlestick pattern.

The dragonfly doji, a reversal pattern, has no body but an extended lower wick, reflecting the bears' inability to sustain the latest lows.

A reversal from the latest 151.94 low could potentially realign with the 157.80-158 zone and 160 levels.

Bearish Scenario

A close below 151 can potentially drag the trend towards the January 2024 high and the 0.618 Fibonacci retracement of the yearly trend near 148.80.

--- Written by Razan Hilal, CMT