USD/JPY, EUR/JPY, GBP/JPY Talking Points:

- USD/JPY set a fresh 10-month high after the FOMC rate decision yesterday.

- GBP/JPY has set a fresh monthly low after this morning’ Bank of England rate decision.

- Later today brings the Bank of Japan and given the recent rise of comments aimed towards intervention or Yen-weakness, the question remains as to whether the BoJ will begin to signal any change to their uber-loose monetary policy.

It’s already been a big week and we still have some important drivers remaining on the calendar. The FOMC rate decision yesterday has led to a spike in yields, and this has had ramification in a number of related markets. This helped USD/JPY to drive up to another fresh 10-month-high ahead of the Bank of Japan rate decision scheduled for later this evening.

For that meeting the same question remains that’s been present for the past few BoJ meetings: Will the bank begin to signal any form of change on the horizon? Inflation has continued to build in Japan and with USD/JPY pushing back towards the 150 level that brought out an intervention last year, we’ve started to hear commentary from Japanese policymakers alluding to such.

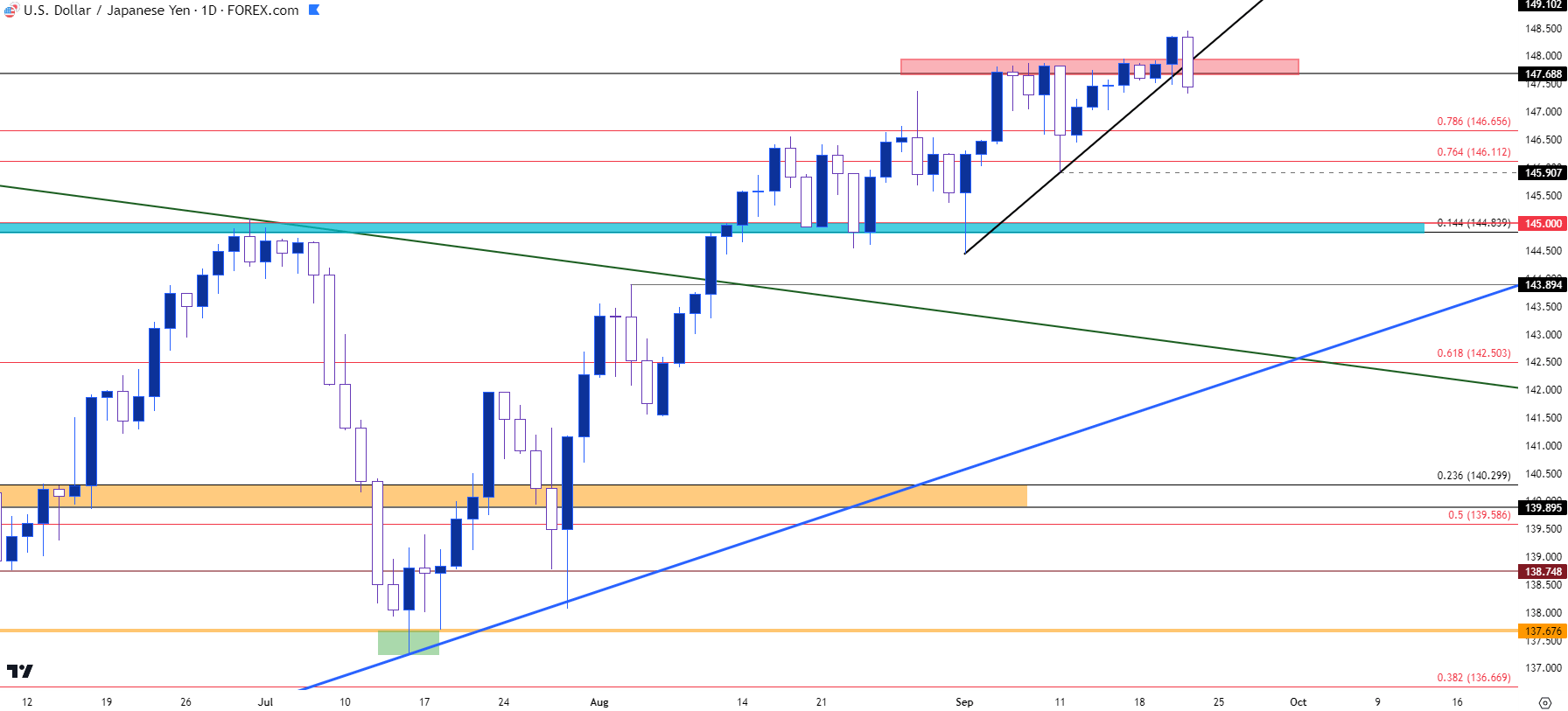

We saw the first instance of this re-appear on a Friday two weeks ago, and it sent USD/JPY down for a support test at 146.65. That was quickly met with strength and buyers pushed right back up to resistance at 147.69. The next Monday brought another pullback, this time helped along by the mere mention of higher rates from BoJ Governor Kazuo Ueda. That pullback ran a bit deeper, setting a fresh low at 145.91.

But with little additional innuendo on the horizon, and with the carry remaining decisively tilted to the long side, bulls came back to push price right back to resistance in that same 147.69 area. Yesterday’s FOMC rate decision gave buyers a shot-in-the-arm, and this was likely helped along with the move in yields. But, so far today we’ve seen the entirety of that move pared back and the daily bar in USD/JPY is showing as a bearish outside day.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

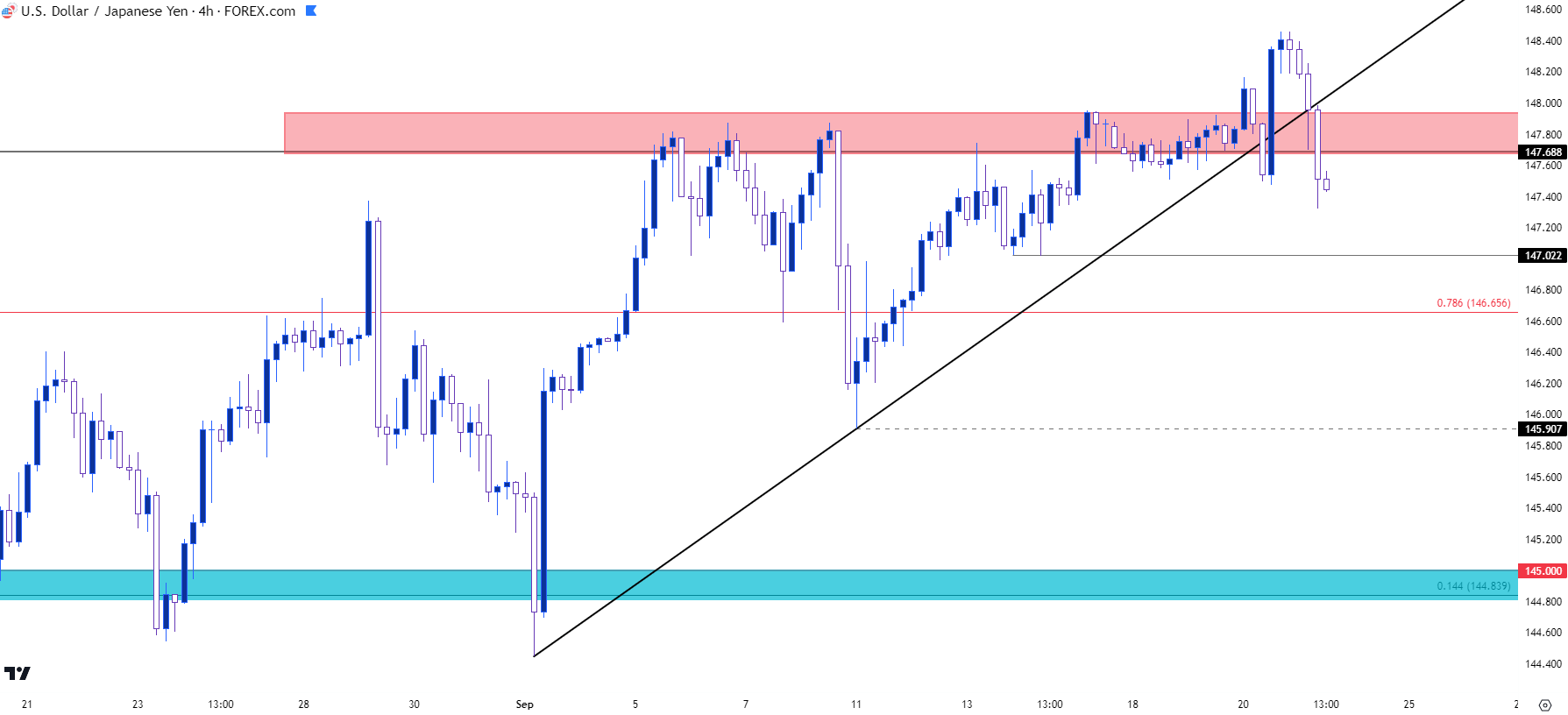

USD/JPY Shorter-Term

In the US, there remains the very real possibility of additional rate hikes and that’s what’s helped to keep the US Dollar as relatively strong of late. But, elsewhere, it appears that the door for more hikes is closing, and this can make for some interesting opportunity in Yen-pairs such as EUR/JPY and GBP/JPY. For those looking to work with scenarios of Yen-strength, those cross pairs may have more attractive backdrops at the moment and I’ll look at that below the next chart.

In USD/JPY, the question is whether Ueda can sooth bulls’ fears enough at the rate decision later today to keep the long side of the trend moving. At this point, price is testing a fresh weekly lose after trading below that 147.69 level. There’s follow-through support potential around a prior swing at 147, followed by the Fibonacci level at 146.65. and then another prior swing at 145.90.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

EUR/JPY

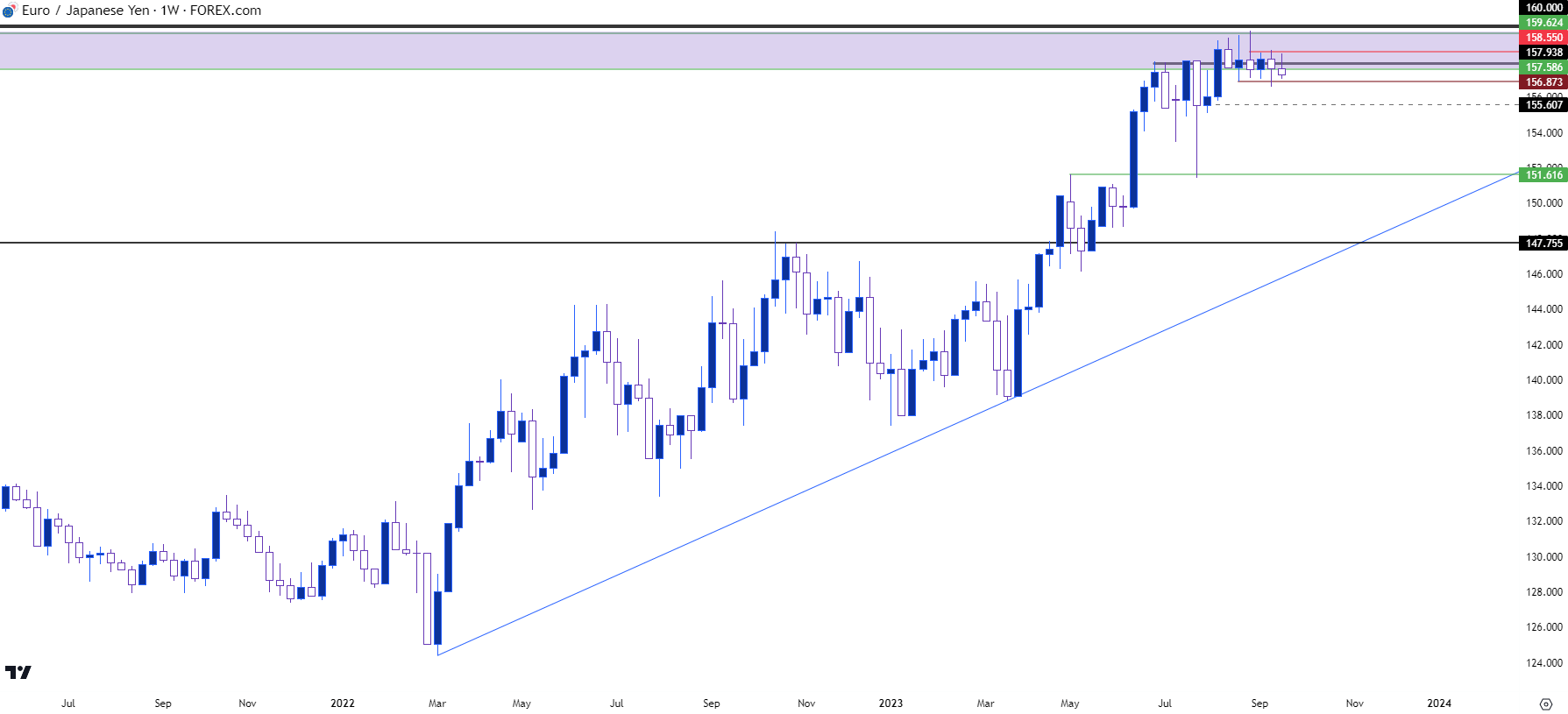

While there remains expectations for more hikes out of the US, that question is more complicated around Europe and at last week’s ECB rate hike it was widely-thought that it may have been the last such hike for the bank in this cycle.

The bullish breakout that ran so loudly in the pair as both the ECB was hiking and the BoJ was standing pat ran well into the summer, with a fresh 15-year high in the pair showing just a few weeks ago.

But – that breakout has now been stalled for over a month. I talked about that in an article on the Yen a couple of weeks ago, and that stall remains in-place today. Last week’s ECB rate decision did help bears to test support at the prior swing low, albeit temporarily, as price remains in the same range that’s been in-place for six weeks now.

EUR/JPY Weekly Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

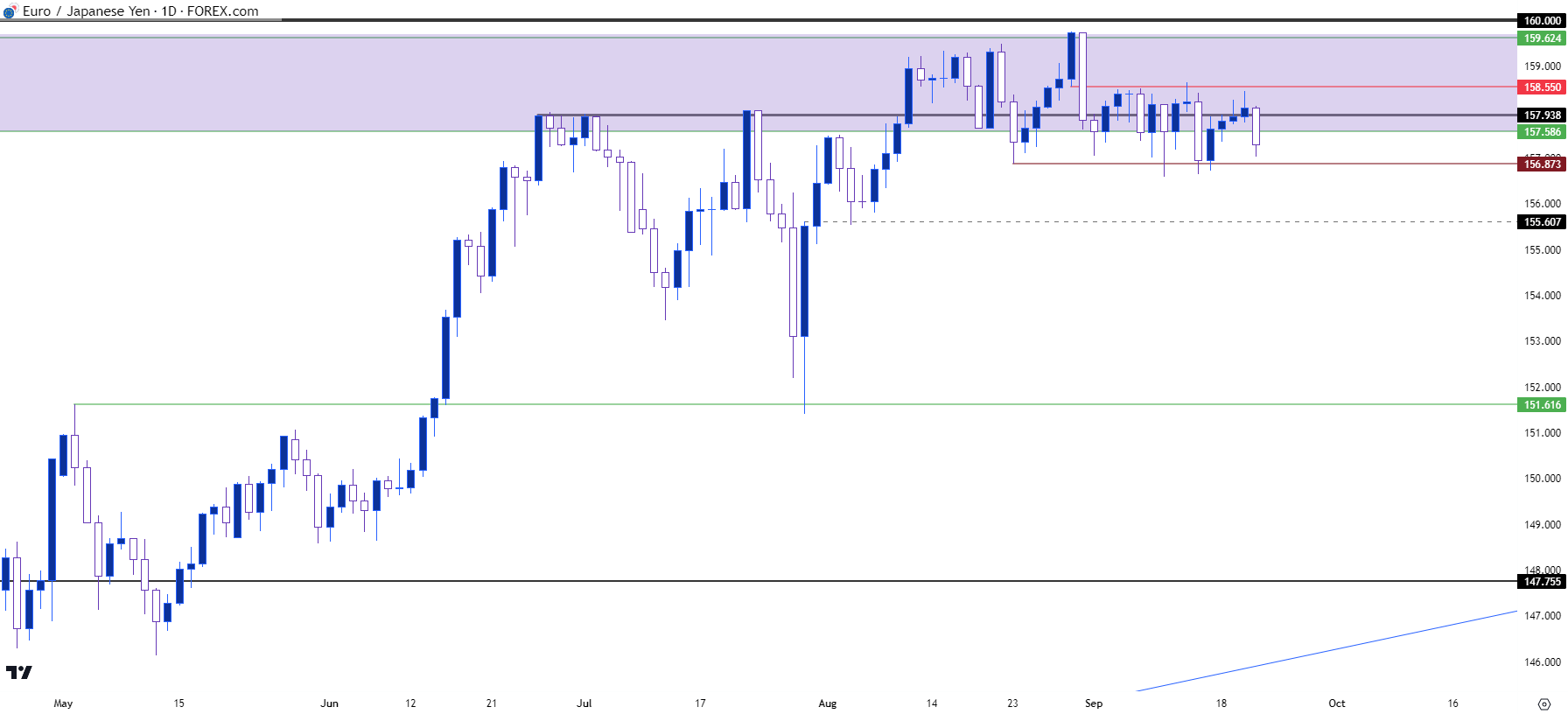

EUR/JPY Daily

From the daily chart of EUR/JPY we can see a recent hold of a lower-high inside of that previously set 15 year high. The lower high is at 158.55 and this keeps the door open for bears. The next support that I’m tracking from the daily chart is at 155.61.

EUR/JPY Daily Chart

Chart prepared by James Stanley, EUR/JPY on Tradingview

GBP/JPY

The theme pushes a bit deeper here…

While the ECB hiked and markets are expecting that to be the last, and the Fed held while markets continue to look for more, the Bank of England held and markets carrying the very real question as to whether the Bank of England is finished with hikes.

The response to that hold at the BoE rate decision earlier this morning was a brutal move in the British Pound, with GBP/USD taking out a number of supports. GBP/JPY, on the other hand, has started to fill in with a bearish lean and this can open the door a bit wider for reversal themes than what was looked at above in EUR/JPY.

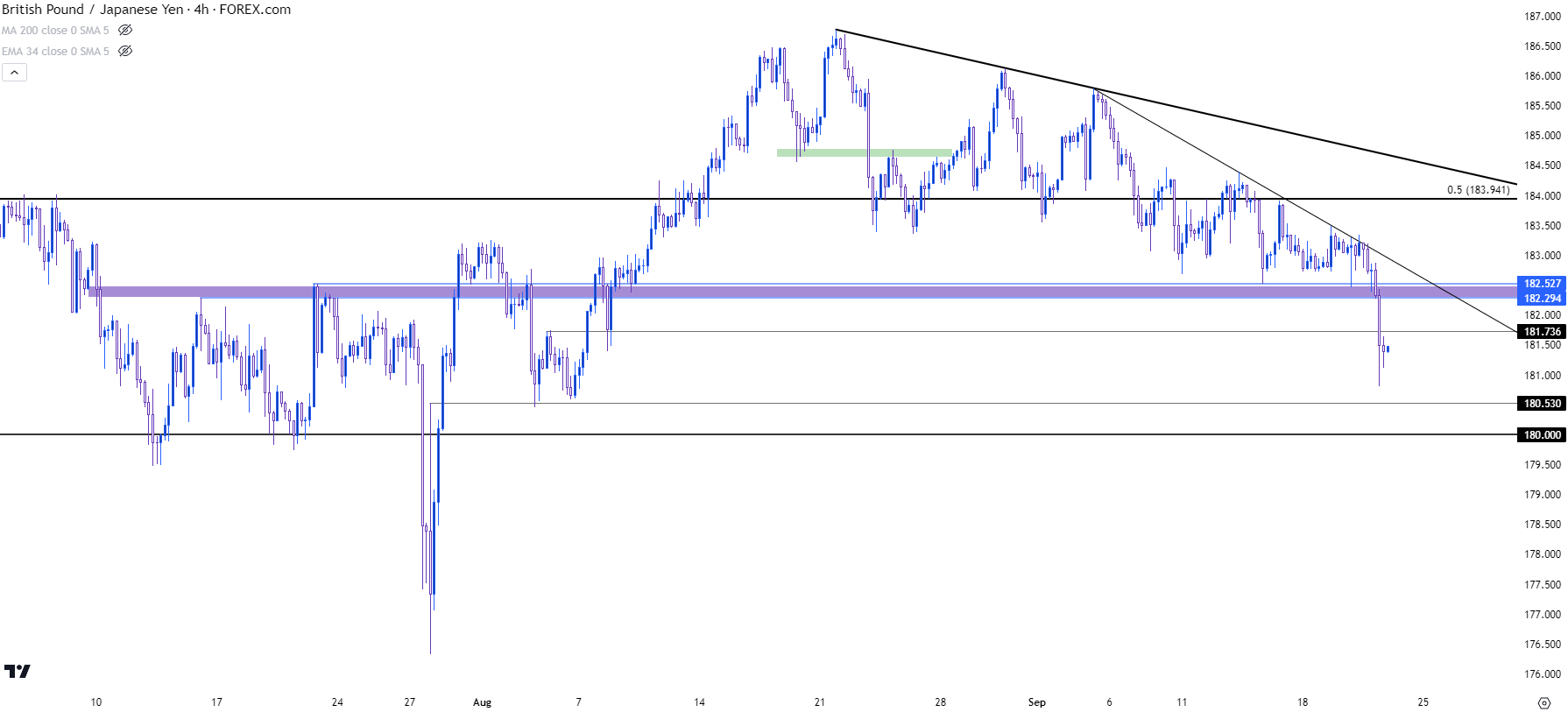

While EUR/JPY is still holding that previously established support, GBP/JPY has broken a key spot of support setting up a descending triangle formation. I had looked at this setup yesterday ahead of the BoE rate decision this morning.

GBP/JPY Four-Hour Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

GBP/JPY Longer-Term

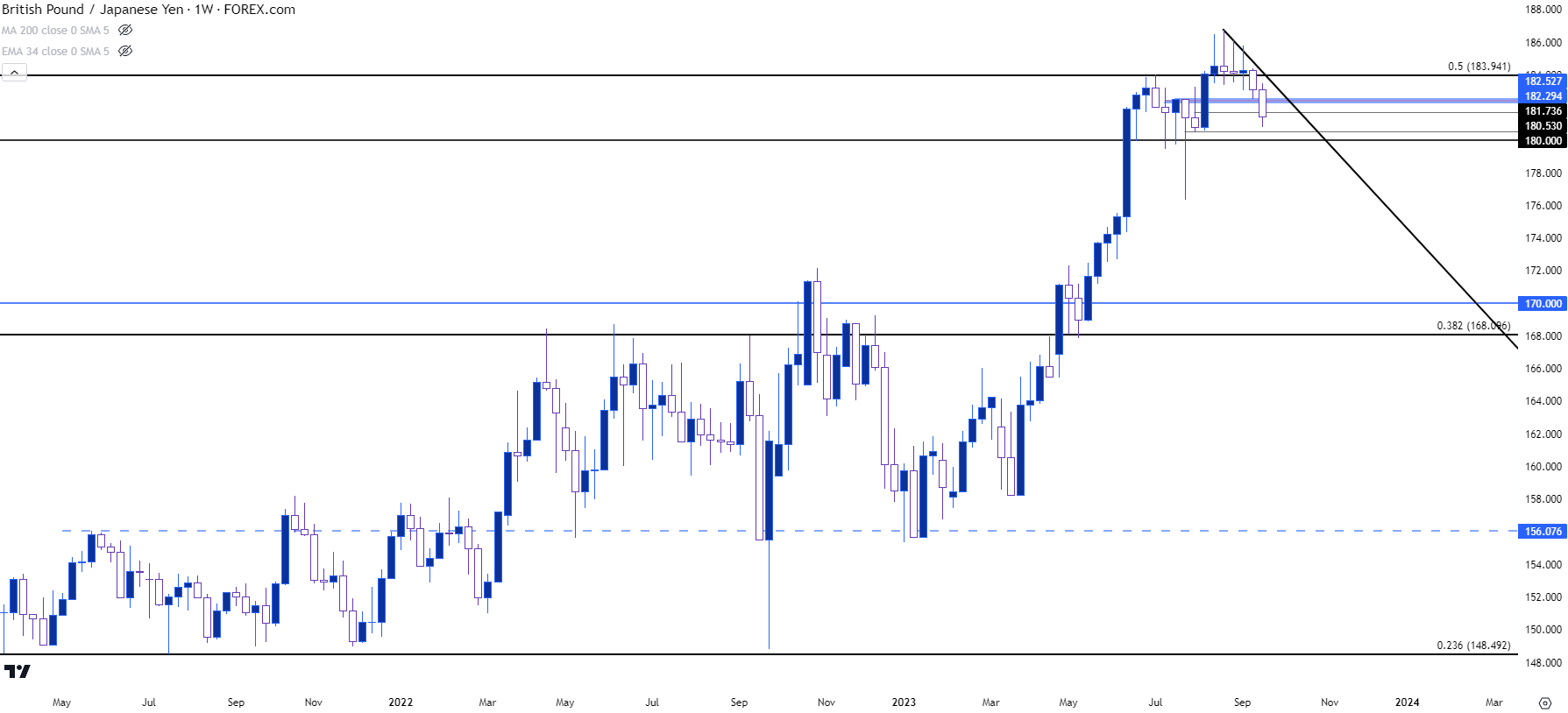

Like EUR/JPY above, GBP/JPY had seen its bullish breakout stall in mid-August when a large level of longer-term resistance came into play. In GBP/JPY, this was a 50% Fibonacci level from the 2007-2011 major move.

From the weekly chart, we can get a better view of that stall and of note is the fact that four consecutive dojis printed with support at 183.94, with the three final candles of that series showing lower-highs which have now led to tests of lower-lows.

The 180 level is of massive importance for bears as we can see multiple iterations of prior support showing at that price. If they can take it out in the near-term it’ll give even more attraction to reversal themes in the pair.

If the Bank of England is truly done hiking and if rates are on their way down in the UK, this could remove some of the bullish drive that was behind the carry that supported that prior breakout. And as we’ve seen already multiple times with Yen-pairs during this rising rate cycle, if the prospect of carry is offset by the fear of principal losses, we can quickly see the situation devolve into a ‘down the elevator’ type of theme.

GBP/JPY Weekly Price Chart

Chart prepared by James Stanley, GBP/JPY on Tradingview

--- written by James Stanley, Senior Strategist