US Dollar Outlook: USD/JPY

USD/JPY extends the advance from the start of the week to clear the December high (158.09), but the Relative Strength Index (RSI) may show the bullish momentum abating as the recent rise in the exchange rate fails to push the oscillator into overbought territory.

USD/JPY Clears December High Ahead of US NFP Report

USD/JPY climbs to a fresh weekly high (158.43) as the US Bureau of Labor Statistics (BLS) reports that ‘the number of job openings was little changed at 8.1 million on the last business day of November,’ with the Job Openings and Labor Turnover Summary (JOLTS) revealing that ‘the number of job openings increased in professional and business services (+273,000), finance and insurance (+105,000), and private educational services (+38,000).’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

In turn, the update to the US Non-Farm Payrolls (NFP) may also influence USD/JPY as the economy is anticipated to add 154K jobs in December, and evidence of a strong labor market may put pressure on the Federal Reserve to alter the path for monetary policy as the economy shows little signs of an imminent recession.

In turn, a positive development may generate a bullish reaction in the US Dollar as it raises the Fed’s scope to pause its rate-cutting cycle, but a weaker-than-expected NFP report may drag on the Greenback as it fuels speculation for lower US interest rates.

With that said, swings in the carry trade may continue to influence USD/JPY as the Federal Open Market Committee (FOMC) pursues a neutral stance, but the exchange rate may further retrace the decline from the 2024 high (161.95) as it clears the December high (158.09).

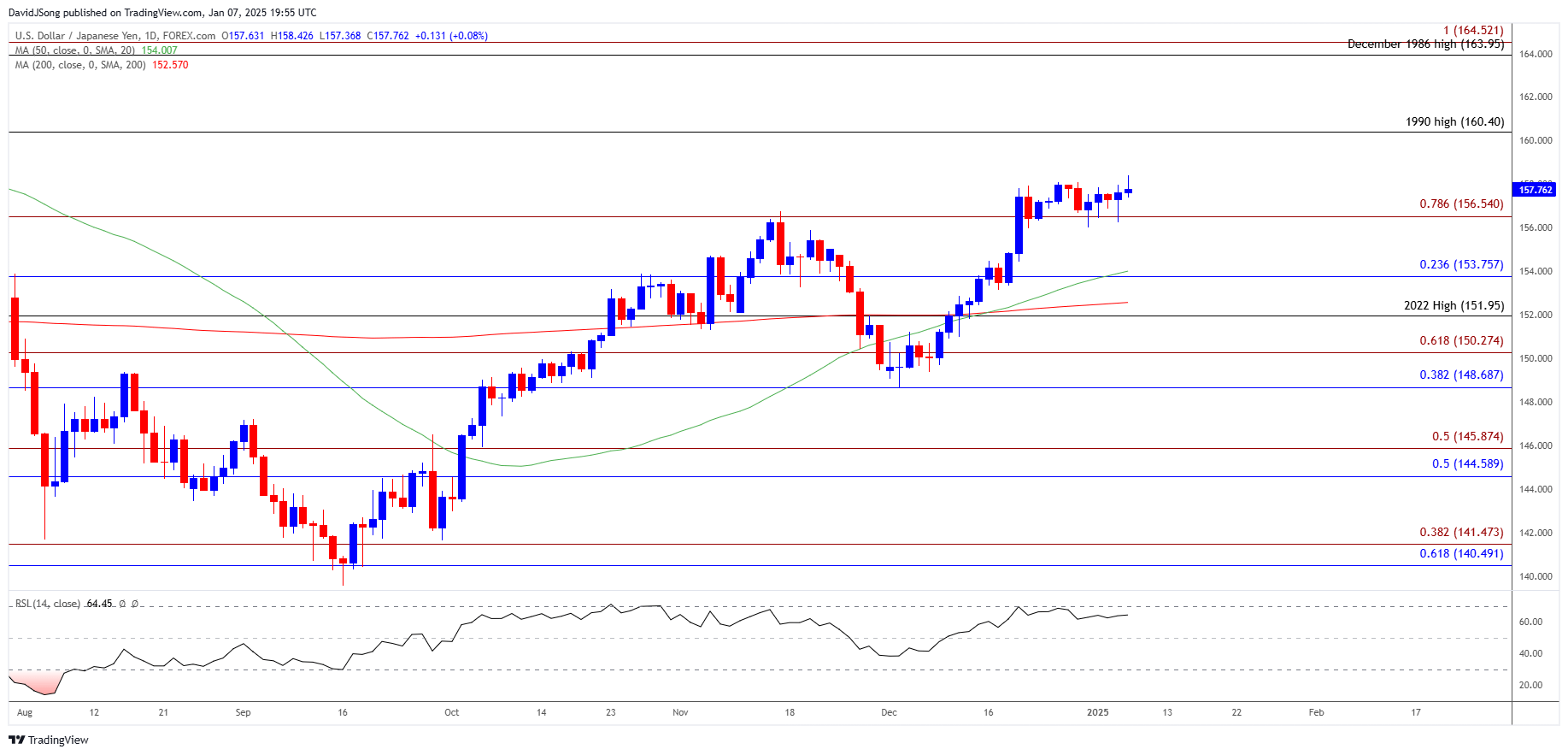

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY trades to a fresh weekly high (158.43) following the failed attempt to close below 156.50 (78.6% Fibonacci extension), with a move above 160.40 (1990 high) bringing the 2024 high (161.95) on the radar.

- Next area of interest comes in around the December 1986 high (163.95), but USD/JPY may hold within last year’s range should if struggle to extend the recent series of higher highs and lows.

- A close below 156.50 (78.6% Fibonacci extension) may push USD/JPY back towards 153.80 (23.6% Fibonacci retracement), with a break/close below 151.95 (2022 high) opening up the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone.

Additional Market Outlooks

GBP/USD Recovery Keeps 2024 Range Intact

US Dollar Forecast: AUD/USD Approaches November 2023 Low

USD/CAD Pullback Keeps RSI Below Overbought Territory

US Dollar Forecast: EUR/USD Attempts to Halt Five-Day Selloff

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong