US Dollar Forecast: USD/CAD

USD/CAD attempts to extend the advance following the Bank of Canada (BoC) rate cut as it trades to a fresh monthly high (1.3869), and the Relative Strength Index (RSI) may show the bullish momentum gathering pace as it continues to flirt with overbought territory.

USD/CAD Rally Eyes August High as RSI Pushes into Overbought Zone

USD/CAD may further retrace the decline from the August high (1.3947) as the BoC reveals that ‘if the economy evolves broadly in line with our latest forecast, we expect to reduce the policy rate further,’ but the exchange rate may consolidate over the remainder of the month as Canada Retail Sales is expected to increase for the second consecutive month.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Canada Economic Calendar

Retail spending is projected to increase 0.5% in August following the 0.9% expansion the month prior, and a positive development may keep USD/CAD within the weekly range as it puts pressure on the BoC to pause its rate-cutting cycle.

At the same time, a weaker-than-expected Retail Sales report may encourage the BoC to implement another 50bp rate cut at its next meeting on December 11, and the Canadian Dollar may face headwinds over the remainder of the month as Governor Tiff Macklem and Co. now state that ‘the timing and pace of further reductions in the policy rate will be guided by incoming information and our assessment of its implications for the inflation outlook.’

With that said, USD/CAD may stage further attempts to test the August high (1.3947) the BoC endorses a dovish forward guidance, but the RSI may show the bullish momentum abating if it struggles to hold above 70.

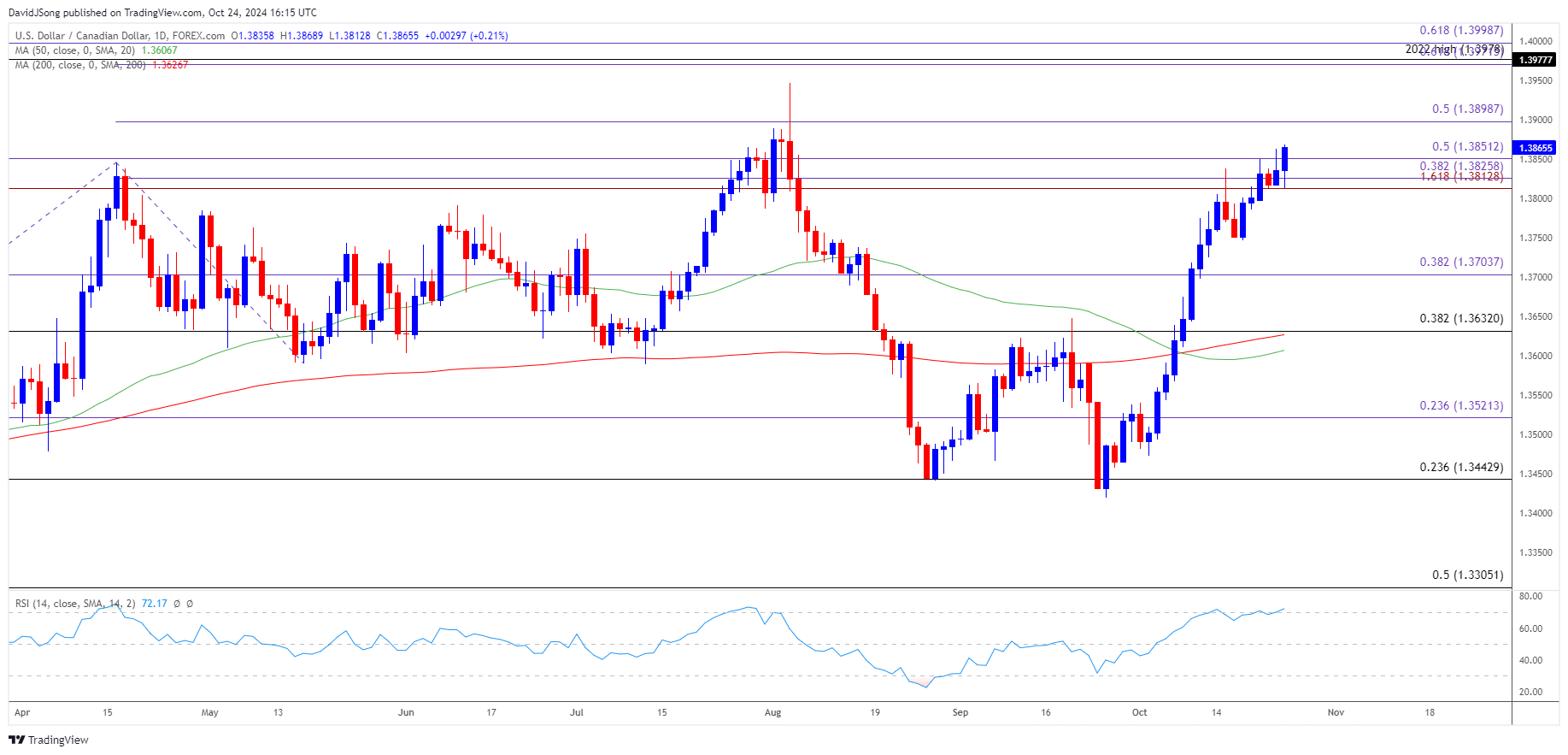

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may continue to trade to fresh monthly highs as long as the Relative Strength Index (RSI) holds in overbought territory, with a close above the 1.3810 (161.8% Fibonacci extension) to 1.3850 (50% Fibonacci extension) region opening up 1.3900 (50% Fibonacci extension).

- Next area of interest coming in around the August high (1.3947) but the recent advance in USD/CAD may unravel if it struggles to close above the 1.3810 (161.8% Fibonacci extension) to 1.3850 (50% Fibonacci extension) region.

- Failure to defend the weekly low (1.3798) may push USD/CAD back towards 1.3700 (38.2% Fibonacci extension), with a breach below 1.3630 (38.2% Fibonacci retracement) bringing 1.3520 (23.6% Fibonacci extension) on the radar.

Additional Market Outlooks

GBP/USD Vulnerable as Bearish Price Series Persists

US Dollar Forecast: USD/JPY Rally Triggers Overbought RSI Signal

EUR/USD Weakness Pushes RSI Back into Oversold Zone

US Dollar Forecast: AUD/USD Falls Toward September Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong