There is no greater influence on the USD/JPY than yield differentials between the United States and Japan, meaning a trade involving the pair is essentially the same as taking a directional view on the path for US bond yields. As long as the Bank of Japan persists with yield curve control – anchoring 10-year Japanese government bond (JGB) yields within 100 basis points of 0% -- it’s likely to remain that way for the foreseeable futures.

You can see the close relationship between the USD/JPY, shown in orange in the chart below, against the yield spread the United States enjoys over the Japan for benchmark government bonds in black. It’s not a perfect relationship by any means, but influential nonetheless.

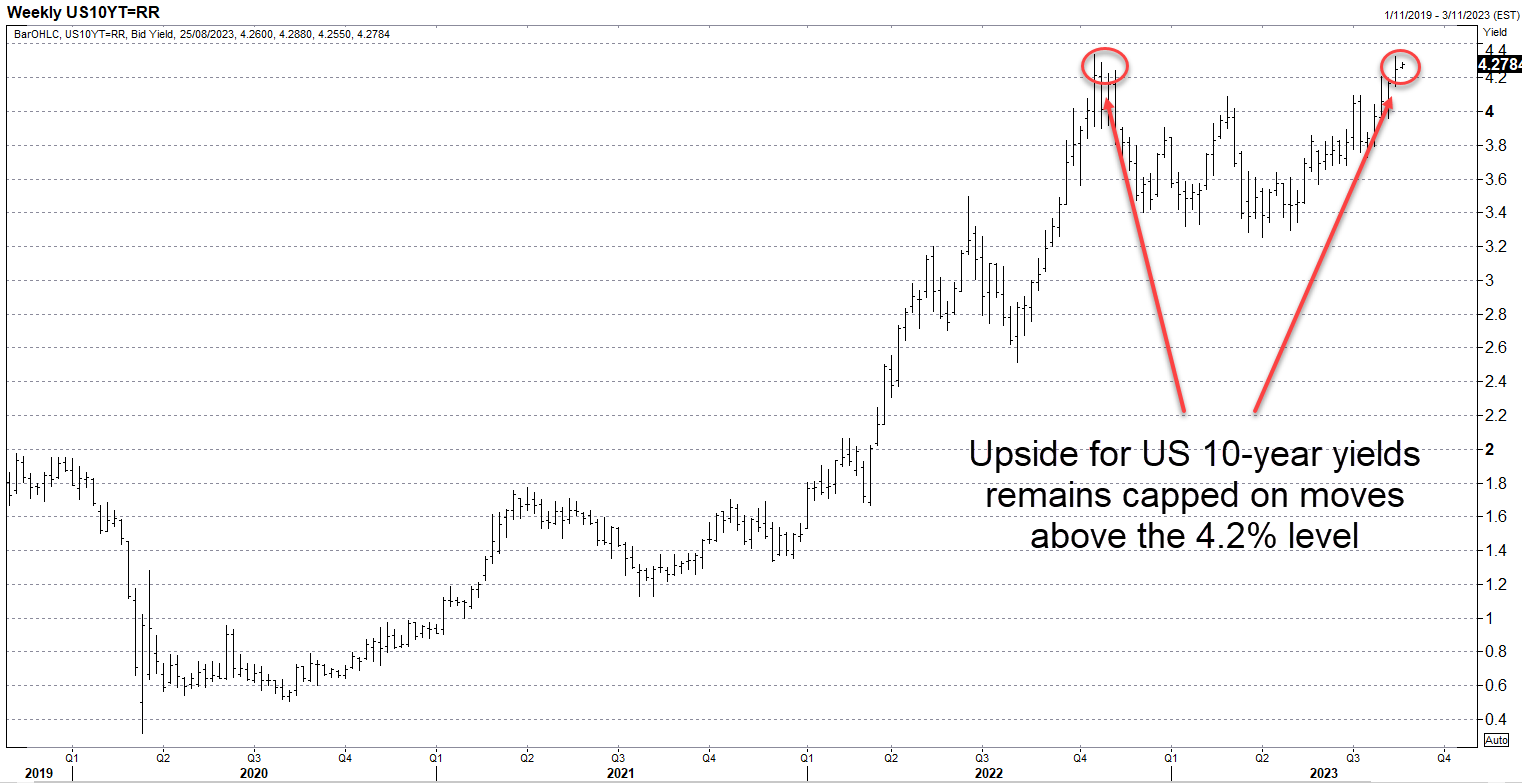

2 and ten-year US bond yields have yet to hit fresh highs

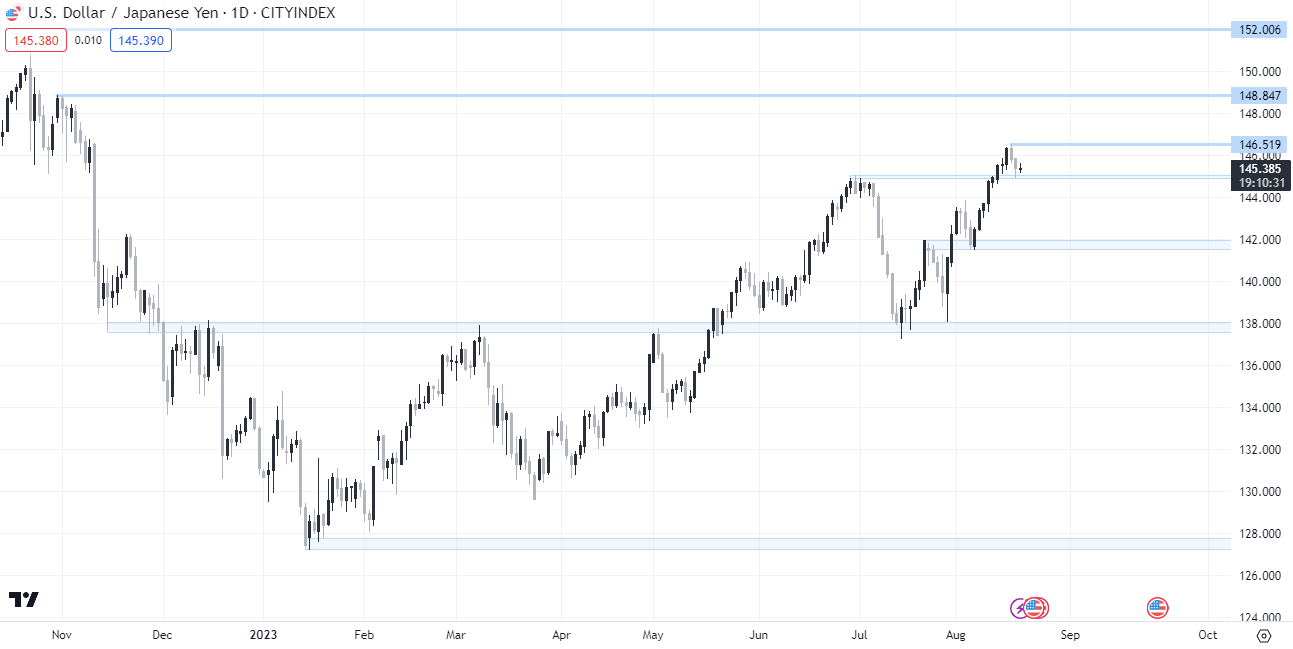

Having risen from around 0.5% during the peak of the coronavirus pandemic market panic to above 4.3% last week, helping to propel the USD/JPY from just above 101 to within touching distance of 147 last week, the question FX traders should be asking themselves is where are the directional risks for US Treasury yields now after such a dramatic move?

There’s clearly no shortage of bond bears out there right now, highlighting risks such as a reacceleration in US inflationary pressures, a deluge of new debt issuance, along with attempting to rollover vast amounts of existing debt into a far higher interest rate environment.

But even with these concerns, at time when the Federal Reserve is draining liquidity from the financial system by pursuing quantitative tightening, yields on US Treasuries are yet to break to fresh highs outside the extreme longer-end of the US curve. Two-year yields – highly influenced by shifts in sentiment towards the outlook for the Fed funds rate – remain capped on probes above the 5% level. Similarly, benchmark 10-year yields – shown in the chart below – tried to break to fresh highs last week but failed.

Further upside for yields, USD/JPY may be hard won

While yields for these tenors may eventually push higher, especially given the strong prevailing trend, recent price action suggests further upside for USD/JPY may be hard won. It also suggests that longer-term directional risks for both yields and UDSD/JPY could be skewed to the downside, not upside.

For USD/JPY traders, monitoring developments in US two and 10-year yields will complement your trading strategies, providing an additional filter when determining when to go short or long.

Jerome Powell’s Jackson Hole speech looms large

In the near-term, USD/JPY upside is likely to be capped at last week’s high around 146.50. On the downside, a support layer starting at 145.0 prevented a more meaningful reversal on Friday. Should we see a narrowing of US-Japanese yield differentials, a break of that level may lead to a decline to 144.00 and potentially 142.00. Given the sparse economic calendar, Federal Reserve chair Jerome Powell’s Jackson Hole speech on Friday looms large as a potential catalyst for a breakout in either direction.

-- Written by David Scutt

Follow David on Twitter @scutty