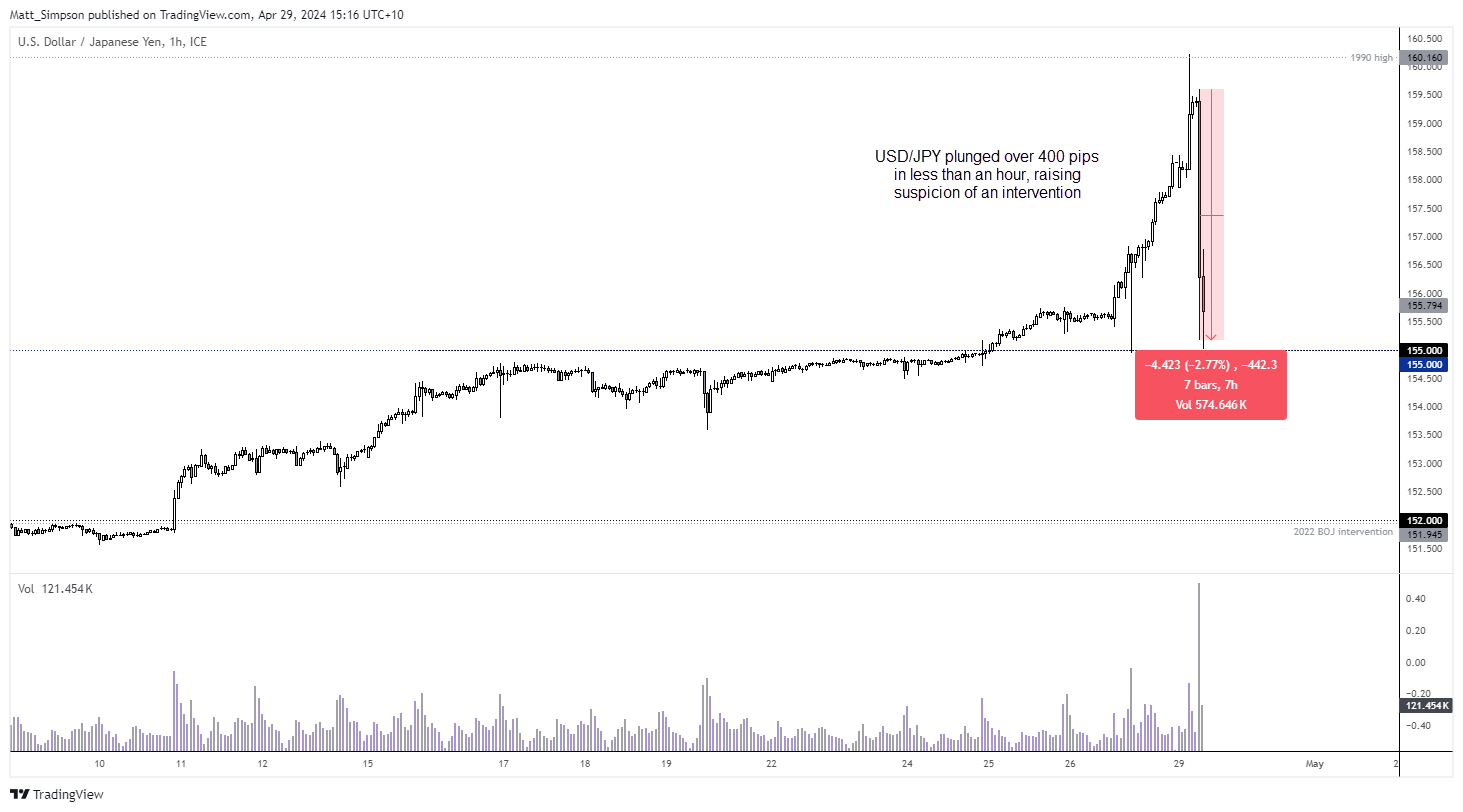

It was supposed to be another quiet Asian session with Japan on a public holiday. Yet some had other plans, with an apparent speculative punt sending USD/JPY to 160 – its highest level in 34 years. And that may have irked central authorities enough to ditch their supposed day off, intervene and send USD/JPY 400-pips lower.

We’ll find out in due course if the MOF did indeed force the BOJ to act. But for now, we can expect a slew of headlines to follow, and yen prices prattle around and generally seek liquidity.

Europe are yet to respond so perhaps we’ll see another bout of weakness for the yen. But I generally find that after such volatile and sudden moves, price action can enter what I think of as a ‘shell-shocked’ state which tends to ignore classic technical analysis and generally seek liquidity. With that said, 155 does appear to be a key level markets are focussing on.

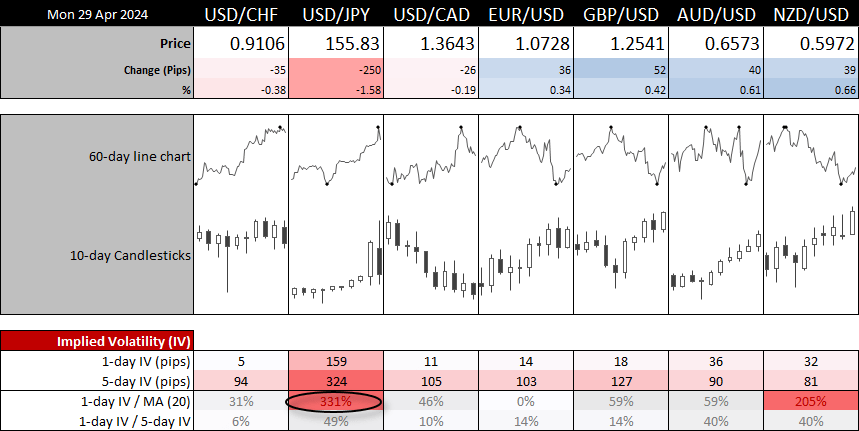

Implied volatility for USD/JPY explodes in the Asian session

Take note that the 1-day implied volatility band is 331% of its 20-day average. However, given we have already seen USD/JPY erase Friday’s CPI gains in the blink of an eye, I suspect the implied volatility is now backwards looking and reflects expensive premiums over an expectation to be so volatility 24-hours from now. Still, it does highlight a likely level of nervousness for markets, and that also means price action could be fickle and prone to quick reversals, making it a tricky time for trade.

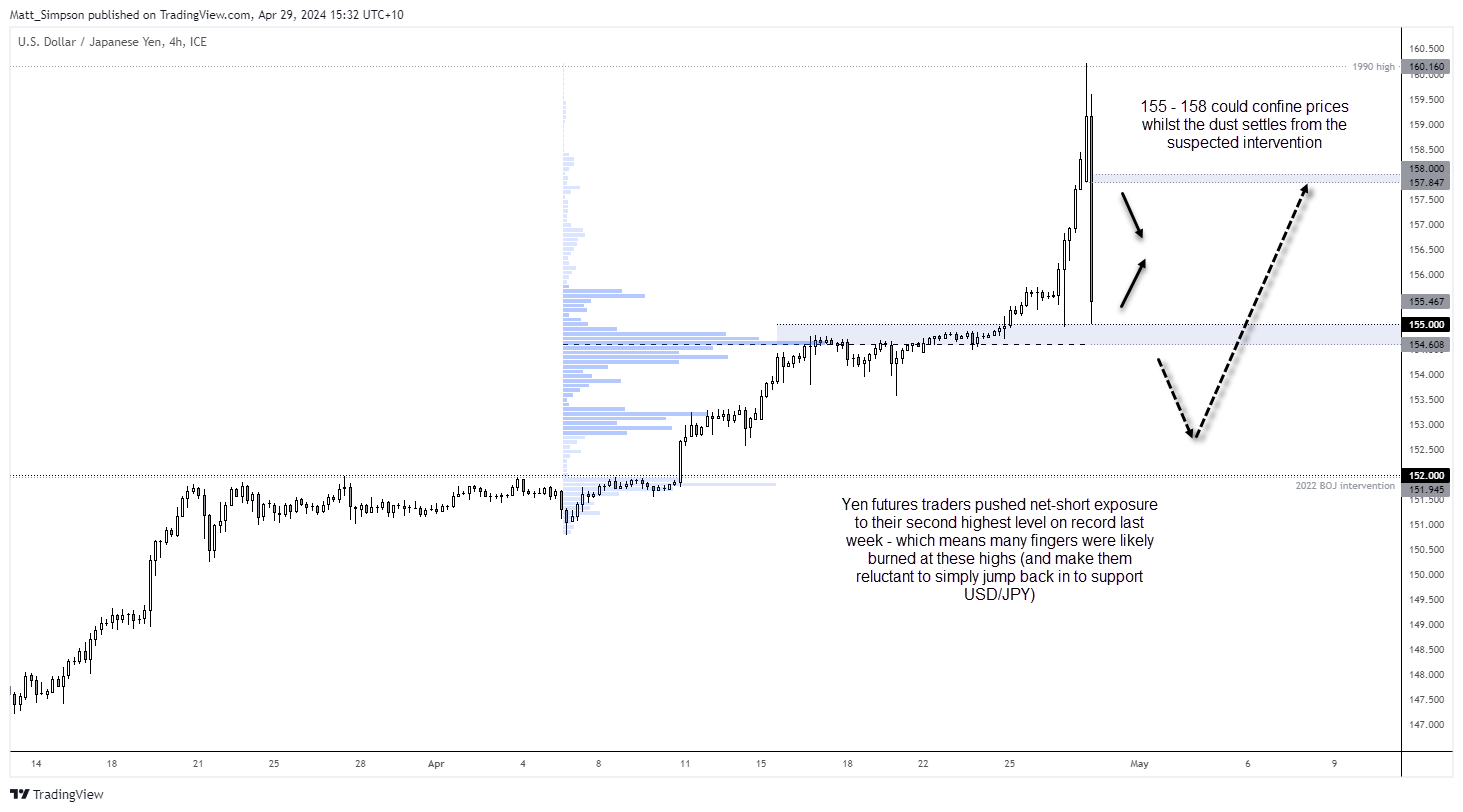

USD/JPY holds above 155

The 4-hour chart shows the swift reversal of prices, yet the fact its low perfectly respected the 155 level before retreating higher suggests it is a level of importance over the near term. Also note that there is a cluster of volume just beneath 155 which suggests the 154.50 – 155 area could hold as support. Yet on the same token, I doubt trades have the appetite to simply bid USD/JPY above 158, let along 160. And that could see prices trade in smaller ranges between the 155 – 158 area, which is still a healthy 300-pip range to toy with.

But with futures traders having pushed net-short exposure to JPY to their second highest level on record last week, plenty of bearish fingers have been burned around these highs and they may be reluctant to jump in. Even if the fundamentals point to a weaker yen (higher USD/JPY) further out. So that also leaves the potential for a move below 155, where perhaps traders may have more appetite to toy with the BOJ’s patience and enter long once more for another assault on 160.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge