The USD/JPY rebounded off its overnight lows, with the big rally in Bitcoin and DAX helping to reduce the yen’s haven appeal somewhat. But the pressure remains amid speculation that the Bank of Japan will hike interest rates at its upcoming policy decision on December 19, while dollar traders are looking forward to the release of US non-farm payrolls report on Friday, inflation data next week and the Fed’s own interest rate decision on December 18. So, the USD/JPY outlook is subject to change significantly in the next two weeks.

Yen loses some momentum after BoJ rate hike speculation

In the last few weeks, the yen has been gaining momentum against most major currencies, especially commodity dollars, the euro and to a lesser degree the US dollar. Investors have been piling into the yen amid speculation that the Bank of Japan could raise interest rates at its final 2024 meeting later this month.

But overnight, the BOJ’s Toyoaki Nakamura delivered dovish-leaning remarks, calling for policy tightening to proceed at a cautious pace. Toyoaki also expressed doubt about the sustainability of wage growth.

In as far as the US dollar is concerned, well until last week, the dollar had been on the ascendency amid the Trump trade, but the further big gains in risk assets like cryptos and stocks have helped to ease the pressure on some of the risk-sensitive currencies like the GBP and EUR, and this has helped to weigh on the dollar somewhat. This week’s weaker-than-expected ISM services PMI has also helped to put some downward pressure on the dollar.

Attention turns to US jobs report to shape near-term USD/JPY outlook

This week’s US economic indicators have been mixed. While the ISM manufacturing PMI at 48.4 beat expectations and showed an improvement from 46.5 the previous month, the ISMs services PMI was sharply below forecasts at 52.1 vs. 56.0 last. The JOLTS report was quite good at 7.74 million vs. 7.51 million eyed. Yet the latest weekly claims figures, released a few moments ago, was weaker, showing an unexpected rise to 224K vs. 213K eyed.

As the Federal Reserve zeroes in on employment trends, any signs of weakness in labour market reports might cement a December rate cut, currently priced with a 74% probability.

Thus, all eyes will be on the November jobs report, due Friday. This will be the headline event, before the focus turns to next week’s CPI report and the Fed’s decision the following week. After last month’s unexpectedly strong figures and the political shift from Trump’s re-election, expectations for aggressive Fed cuts in 2025 have waned. Whether the Fed decides to cut rates in the initial months of the new year could hinge on the next few employment reports, putting the focus on the NFP data on Friday.

Here is a list of key data highlights from the US on Friday, showing what is expected and what the previous readings were:

|

Fri Dec 6 |

1:30pm |

USD |

Average Hourly Earnings m/m |

0.3% |

0.4% |

|

USD |

Non-Farm Employment Change |

202K |

12K |

||

|

USD |

Unemployment Rate |

4.2% |

4.1% |

||

|

3:00pm |

USD |

Prelim UoM Consumer Sentiment |

73.1 |

71.8 |

|

|

USD |

Prelim UoM Inflation Expectations |

2.6% |

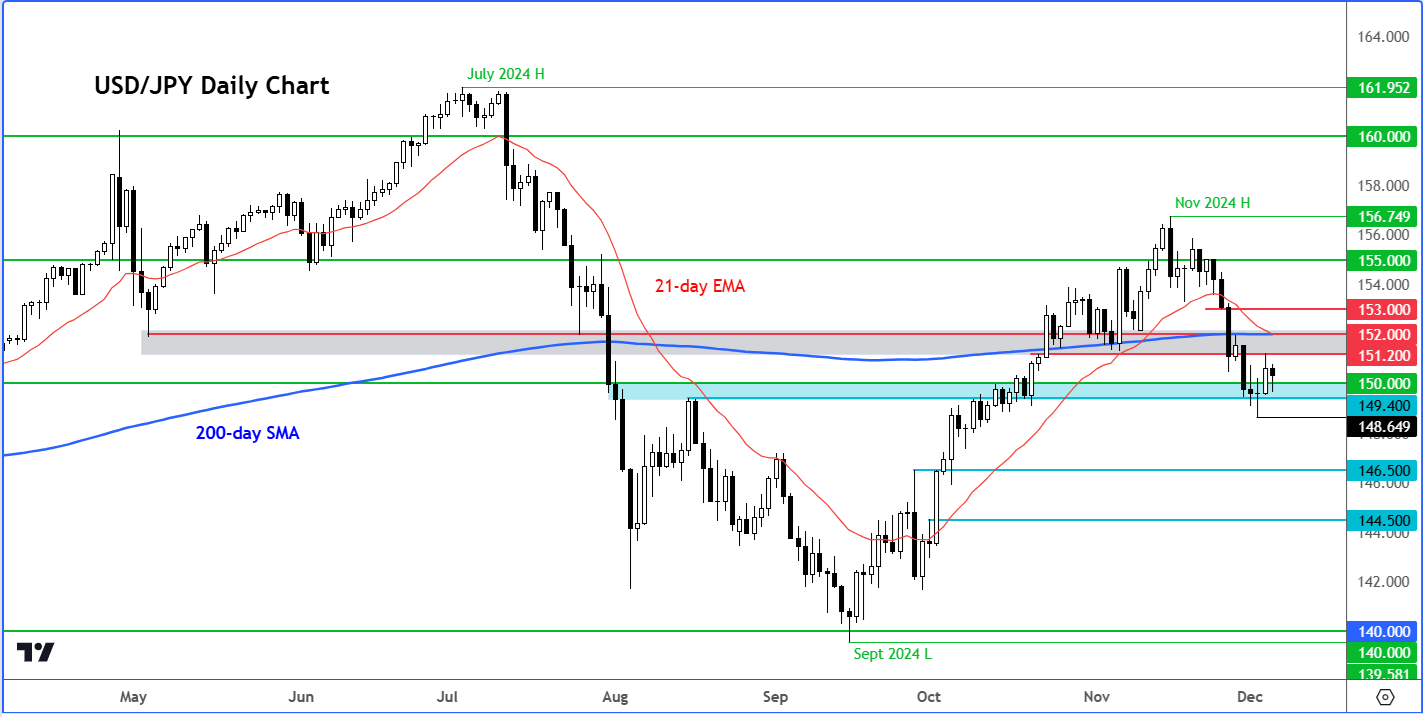

Technical USD/JPY outlook

Source: TradingView.com

The USD/JPY remains stuck inside a rock and a hard place. Resistance is provided in the range between 151.20 to 152.00, where prior support and 200-day moving average meet. Support is provided around the 149.40 to 150.00 range (shaded blue on the chart). A clean move outside this range is now needed to potentially trigger follow-up buying or selling in that direction. Given the recent bearish price action, the risks are tilted modestly towards a downside breakdown.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R