- USD/JPY, Nikkei 225 trade sharply higher after Monday’s rout

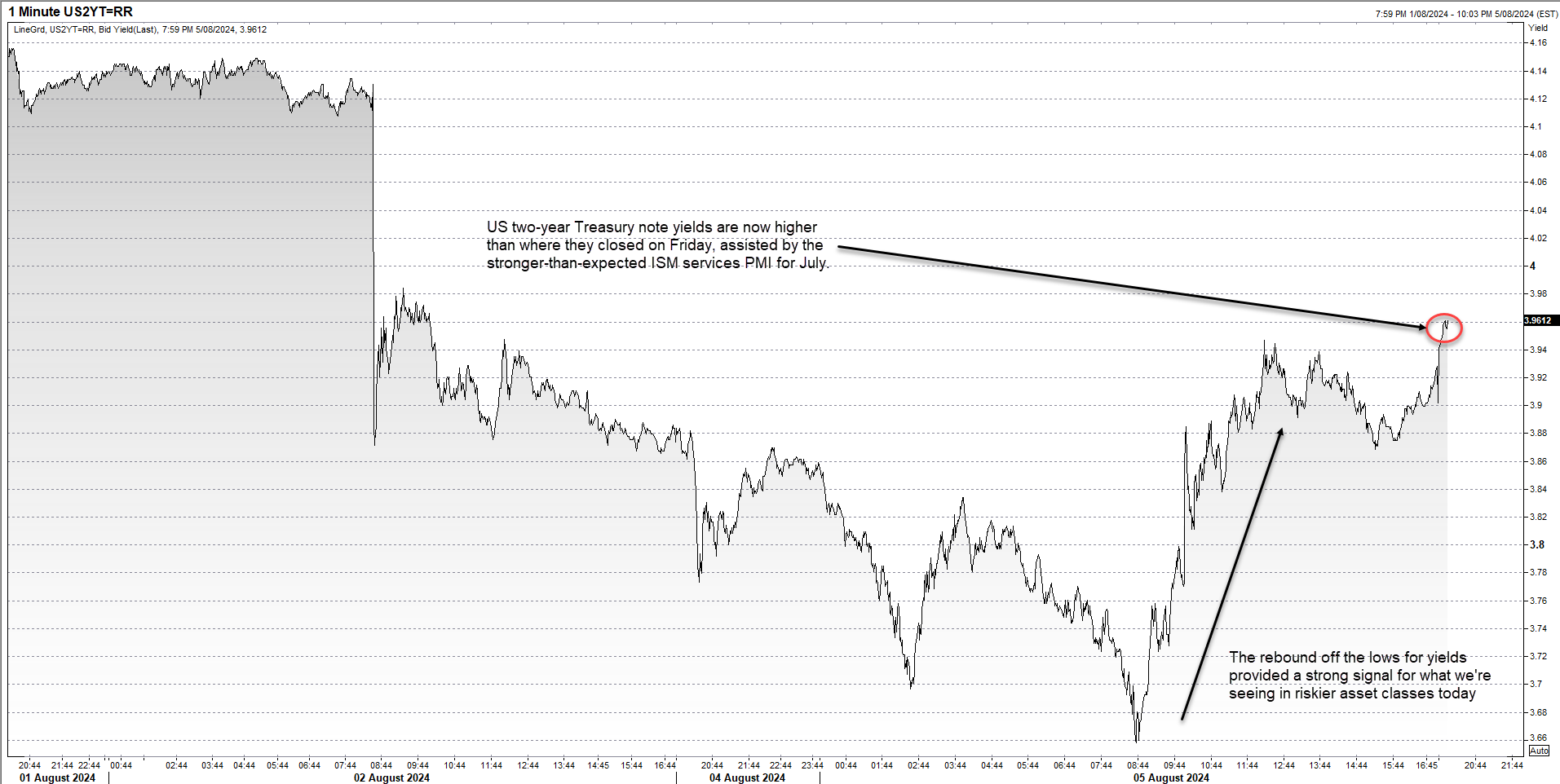

- US two-year Treasury note yields suggest recession fears have dissipated

- Two-year US yields bottomed well ahead of risker asset classes

- Volatility begets volatility, so watch yields for clues on when it may lift again

Cut out noise to avoid panicking

I don’t blame traders for panicking in markets like these. There’s so much noise and so much hysteria, usually accompanied by countless charts resembling waterfalls. But one thing experience brings you is the ability to step back and look at the things that matter to gauge whether the panic is justified. I don’t know whether we’ve seen the lows, but I know what i'll be watching for clues regarding the answer.

Trust reliable market indicators for signal

In markets such as these, it pays to look at indicators that are proven signal generators over several market cycles. For me, that’s two-year US Treasury notes, one of the most reliable indicators you can watch for clues on how other asset markets may fare. It’s liquid, a safe haven and it’s been leading many of the moves we’ve seen over the past week.

I explain more in this quick video, adding to the research note released Monday prior to the plunge in Japanese markets. If risk assets are starting to look shaky again, short-end yields will tell you whether to respond on most occasions. If they decline sharply, it’s a sign risk assets may soon follow suit, and vice versus.

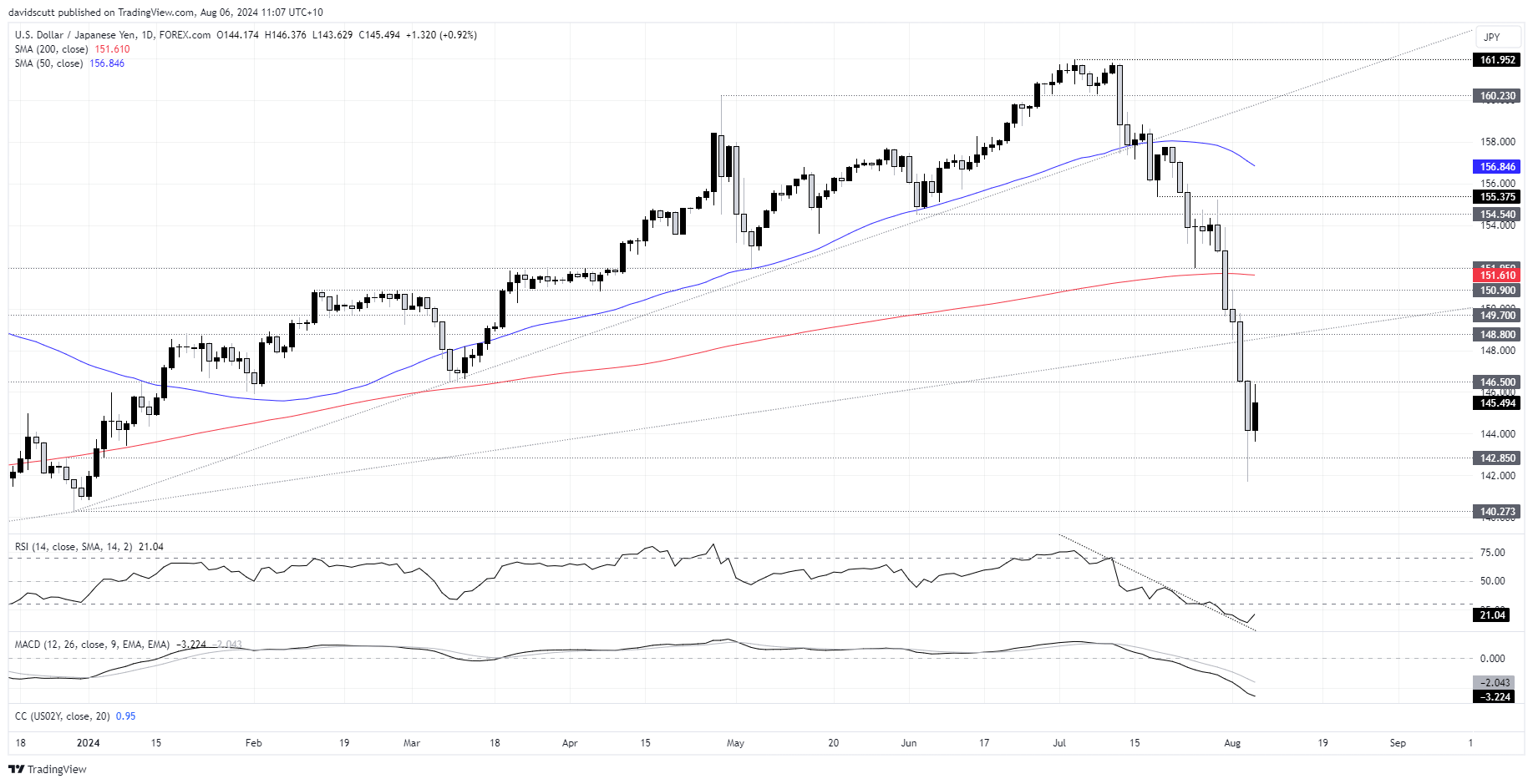

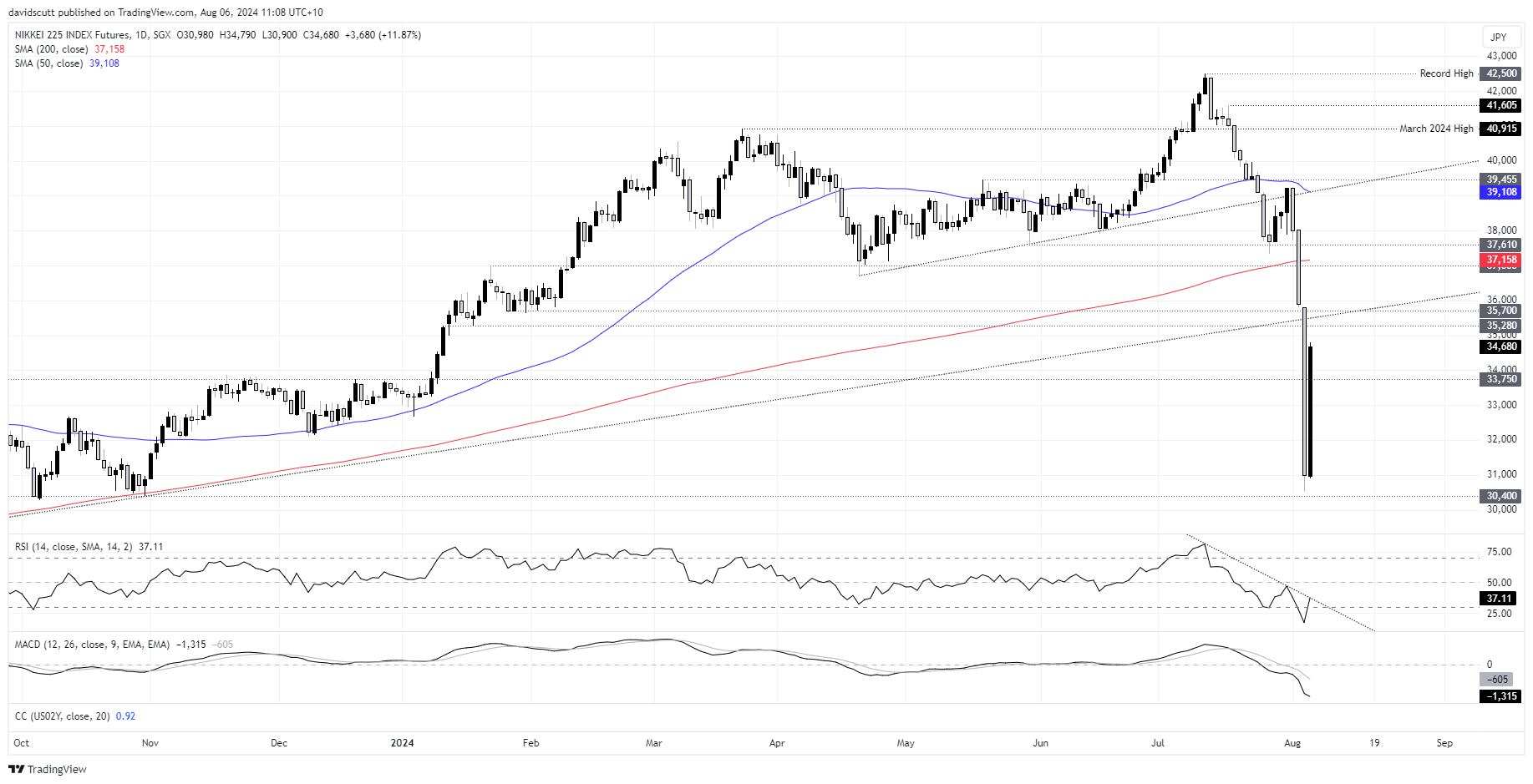

Short-end yields been especially influential on USD/JPY and Nikkei 225 futures over the past month, sitting with scores of 0.95 and 0.93 respectively on a daily timeframe. Based on the early price action on Tuesday, there’s no sign of the relationship weakening with yields up nearly 35 basis points from the lows struck on Monday, coinciding with reversals of Monday’s moves.

With fundamentals and technicals taking a backseat to liquidity and sentiment in the near-term, it’s a better filter than most to help screen out the noise.

Source: Refinitiv

USD/JPY tracking US yields higher

Looking at the technical picture for USD/JPY, we’re yet to see a definitive bottoming pattern on the daily chart despite the latest bounce.

Interestingly, the recovery stalled at 146.50 before reversing, coinciding with the release of strong Japanese wages data which provided a reminder that the Bank of Japan may not shed its hawkish feathers entirely should concerns abroad calm down. That’s the first topside level of note with 148.80 after that. Unless we see a major curtailment of Fed rate cut bets beyond that already seen, it will be hard for USD/JPY to push beyond those levels.

On the downside, the pair found buyers on dips below 142 on Monday in Asian, European and North American trade. Unless we see a sharp decline in US two-year yields, it’s difficult to see significant further downside towards 140.27 today.

From a momentum perspective, RSI has broken its downtrend and remains very oversold on the daily timeframe, adding to the risk of short squeezes should risk appetite hold up.

Nikkei enjoying weaker JPY again

Turning to Nikkei 225 futures, we’ve seen an enormous snap-back after Monday’s rout, resulting in the price pushing back towards former supports that may now act as resistance at 35280, 35700 and former uptrend dating back to early 2023. The Nikkei will likely need further USD/JPY gains in the near-term to break above this zone.

Having cleared 33750 during the latest bounce, it may now act as support should we see a pullback given it acted as strong resistance for large parts of last year. Momentum indicators are yet to provide a bullish signal, although RSI is testing the downtrend it’s been in since the early parts of July and is no longer oversold.

-- Written by David Scutt

Follow David on Twitter @scutty