- USD/JPY and Nikkei 225 futures continue to track moves in short-end US yields

- Very little US economic data arrives next week, proving room for recent moves to extend

- Jackson Hole symposium looms as a nothing burger, even though it carries potential to generate renewed volatility

- USD/JPY has reclaimed long-running uptrend support

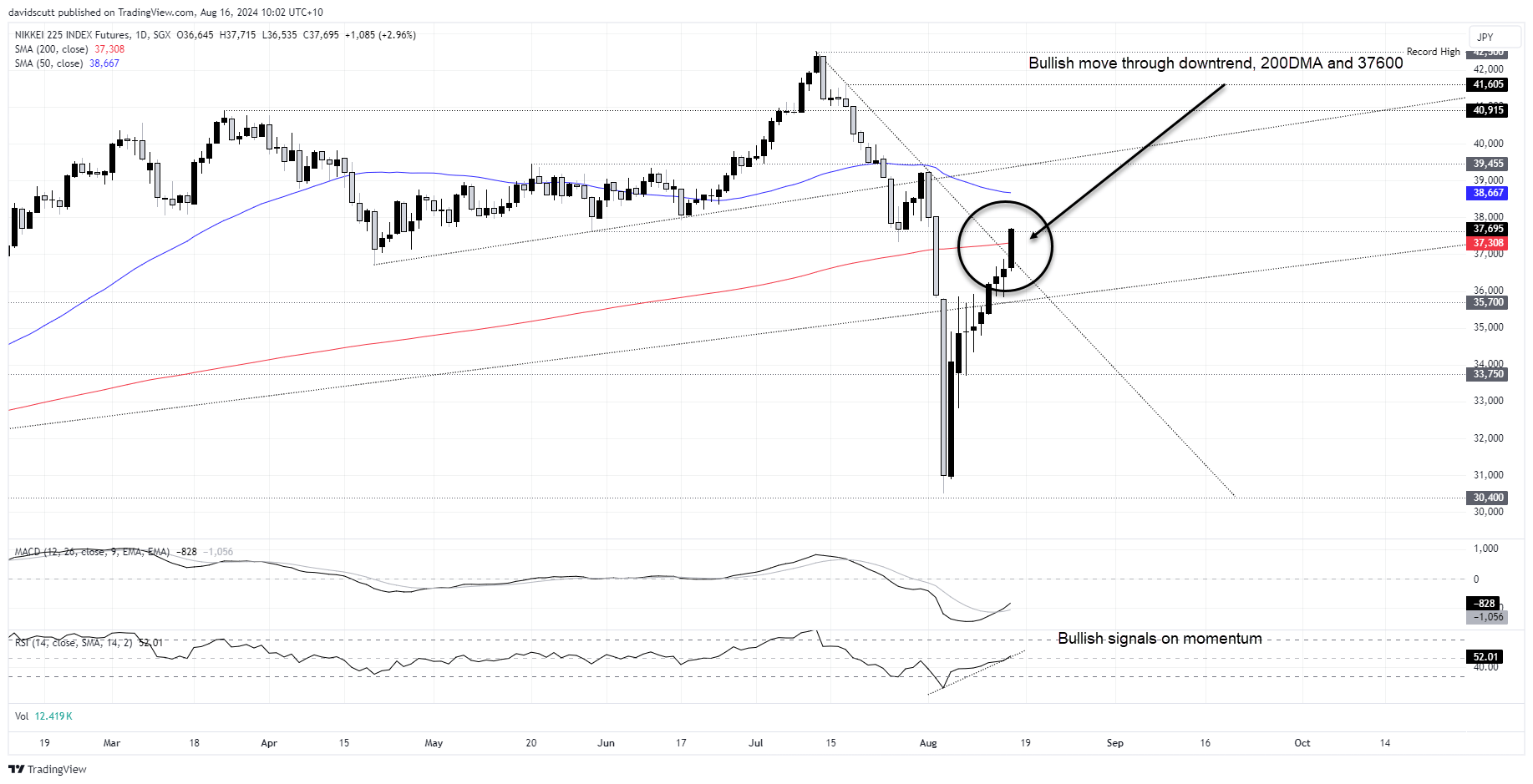

- Nikkei 225 futures stage bullish breakout, further upside eyed

USD/JPY and Nikkei 225 have reclaimed important levels, benefitting from mounting evidence that fears over a looming US recession may have been premature. With the onus now on the data to prove the US economy is entering recession rather than isn’t, and with no major data out next week, you get the sense recent bullish moves may extend in the days ahead.

Markets pare US recession trades

The strong lift in US retail sales last month and continued decline in initial jobless claims comes across as anything but recessionary, making the case for the Fed to remain data dependent and measured when it comes to signaling on rate cuts. Markets are slowly coming round to the idea that the Fed is unlikely to kickstart its easing cycle with a supersized 50 basis point move or more.

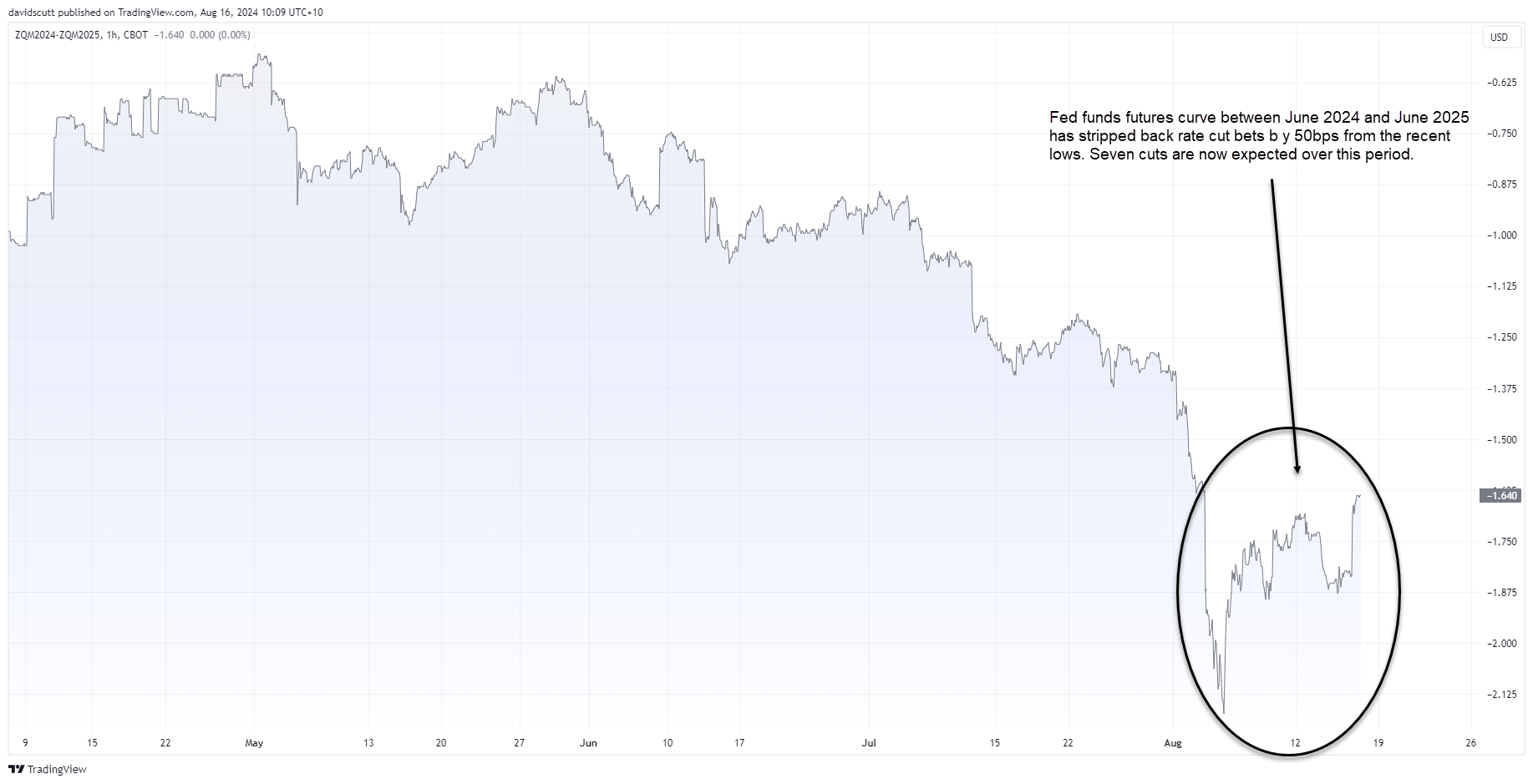

The Fed funds futures curve has already unwound 50 basis points worth of cuts from the lows hit last Monday during Japan’s market meltdown, returning to levels seen before July’s payrolls report amplified recession concerns. For now, that report comes across as an aberration rather than start of a trend, meaning there’s a risk traders may further pare the seven rate cuts they have priced by June next year.

US two-year yields, USD/JPY and Nikkei pushing higher

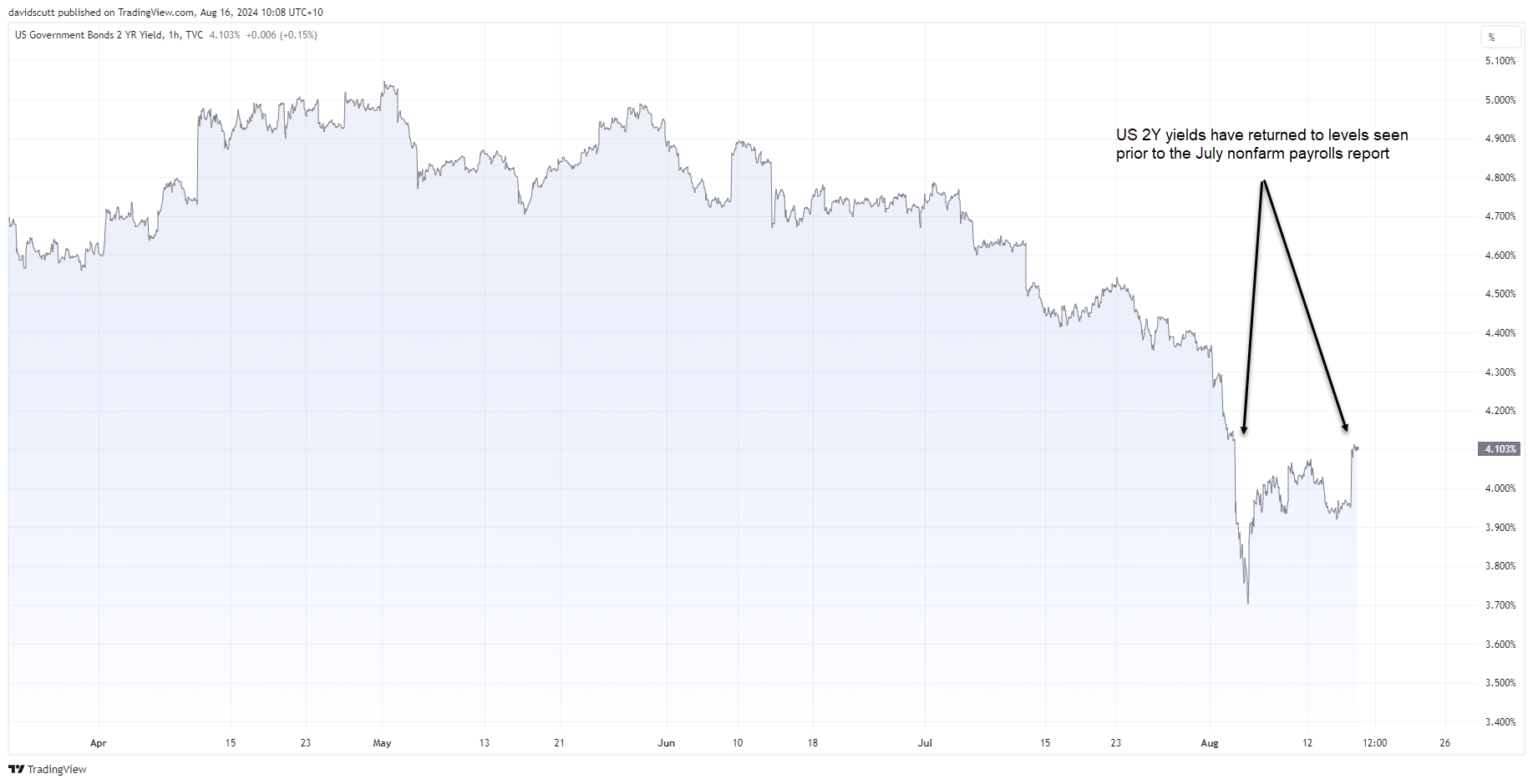

The shift at the front of the US yield curve has acted to drag yields higher for longer durations, including two-year yields which have been highly influential on moves in Japanese markets over recent months.

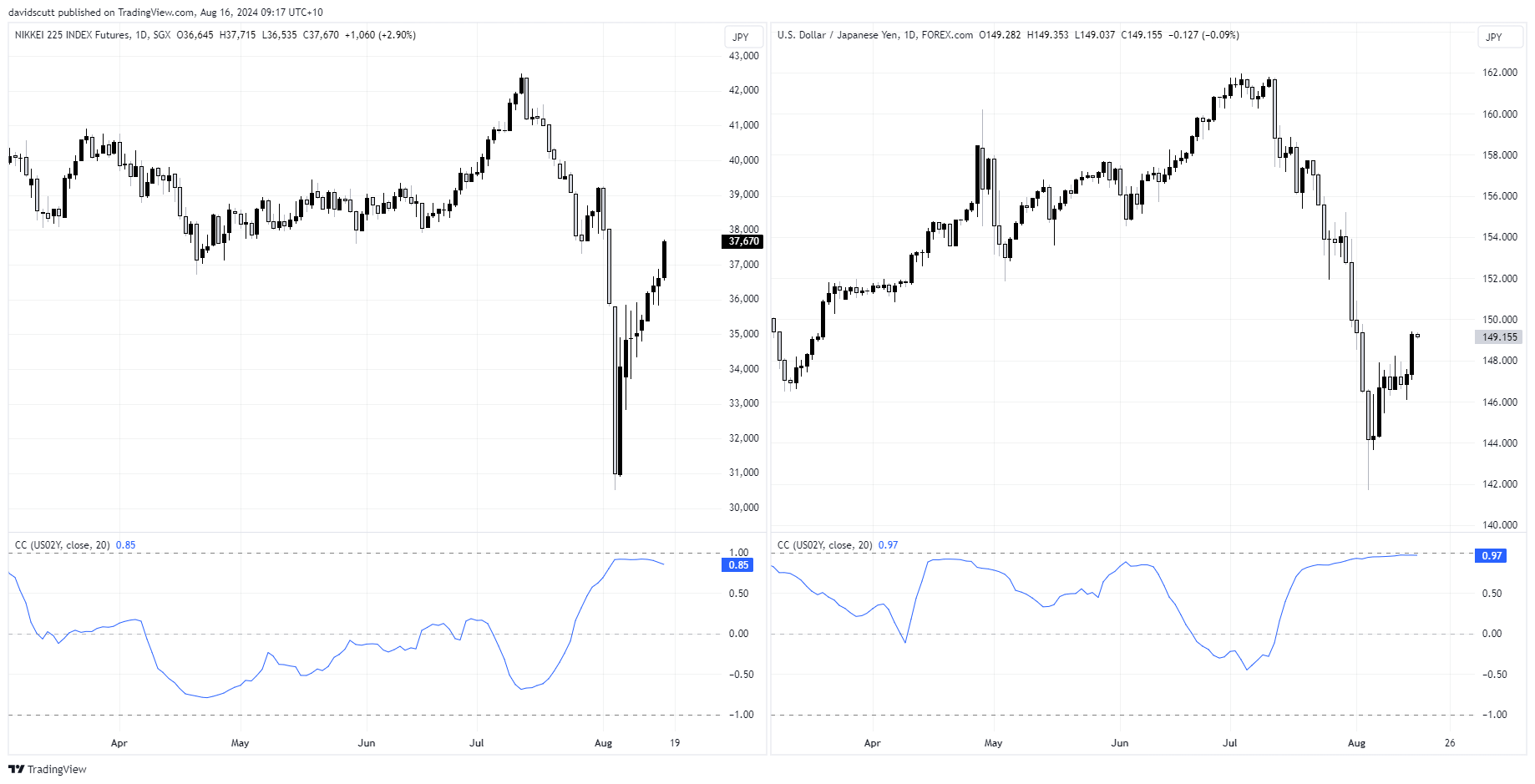

The daily chart below shows Nikkei 225 futures on the left and USD/JPY on the right, with the rolling 20-day correlation with US two-year yields in the bottom pane.

With scores of 0.85 and 0.97 respectively, it’s obvious that sentiment towards the US economy, and how the Fed may respond with monetary policy, is being highly influential on Japanese markets, especially the yen. The weaker yen makes Japanese exports more competitive while rate differential remain the key driver of moves in the yen, so the strong correlations make perfect sense.

Recent moves have room to run

That’s important because markets will receive no top-tier economic information next week. Jobless claims, S&P Global composite PMI, along with new and existing home sales, are unlikely to meaningfully shift rates pricing after the adjustment already seen, suggesting sentiment, and potentially momentum in short-end yields, may be sustained in the days ahead.

Yes, the Jackson Hole economic symposium is on, an event that has heralded big policy shifts in the past. But what are the Fed going to signal? We know they’re data dependent and they have made no attempt to alter market pricing away from a rate cut in September. It screens as a nothing burger, as does the release of the Fed’s July FOMC meeting minutes which already look dated.

As such, it may be hard for two-year yields to reverse meaningfully lower, an outcome that may keep USD/JPY and Nikkei futures buoyant in the coming week.

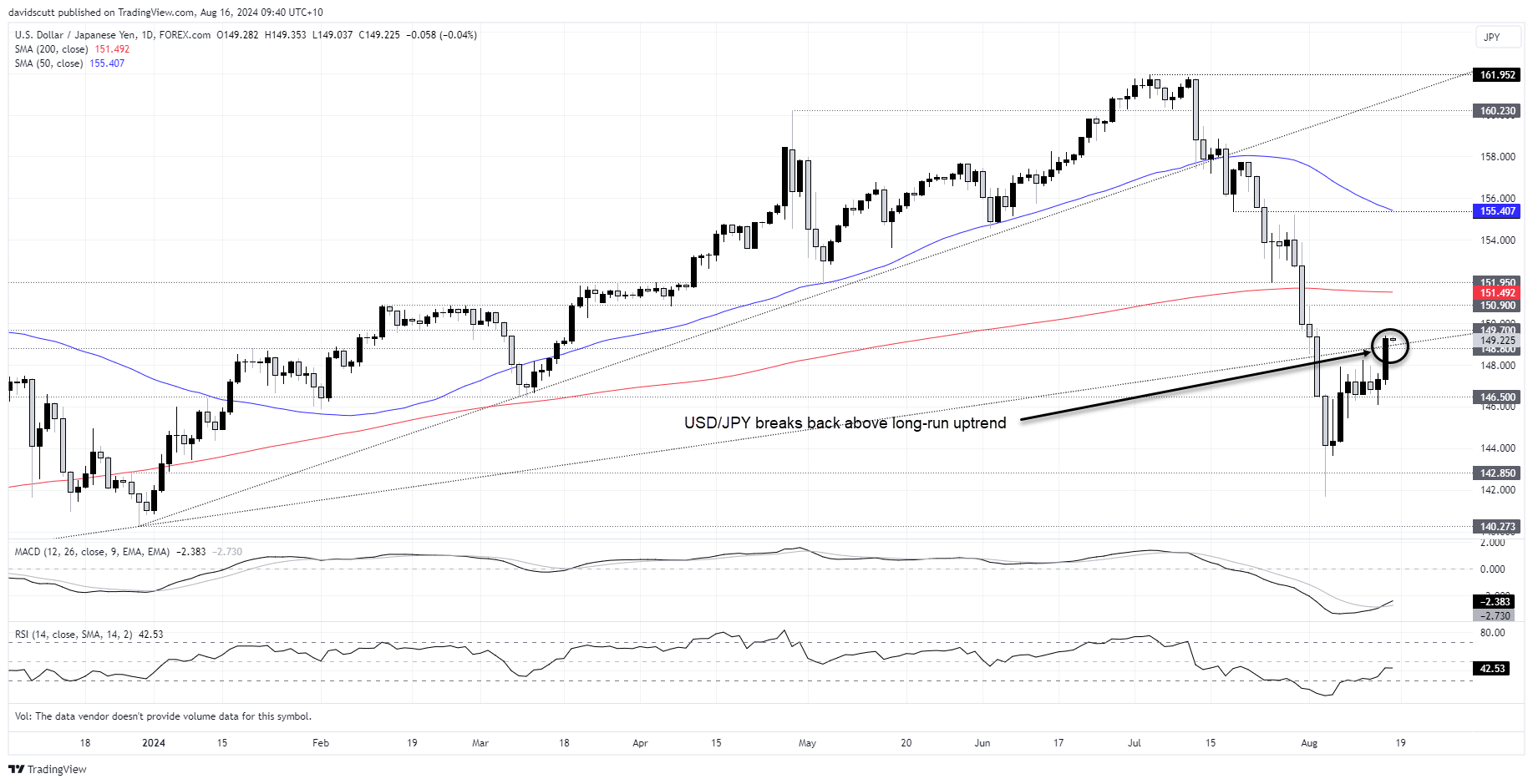

USD/JPY reclaims former uptrend

When you look at USD/JPY on the charts, buoyancy will be helpful considering the price has managed to reclaim the former uptrend it was sitting in dating back to early 2023. If it manages to hold this level, it may act as a launch pad for a push back above 150, especially with MACD and RSI (14) generating bullish signals on momentum.

On the topside, 149.70 is the first layer of resistance with 150.90 and important 151.95 level the next after that. The 200-day moving average is also located above, although recent interactions suggest the price is not always respectful. Should the price reverse back through the uptrend, 146.50 is the first support level of note.

Nikkei goes bang, bang, bang higher

With a rolling 20-day correlation of 0.83 with USD/JPY, whatever direction the dollar-yen moves it’s likely Nikkei 225 futures may follow suit. The break of the downtrend from the record highs comes across as important from a technical perspective, especially as the price managed to close above the 200-day moving average and 37600 on Thursday, two levels that have often been respected in the past. With MACD and RSI (14) providing bullish signals on momentum, the path of least resistance comes across as higher.

Should future get a foothold above 37600, traders could buy with a stop below the level for protection. Potential trade targets include the 50-day moving average or 39455.

-- Written by David Scutt

Follow David on Twitter @scutty