The USD/JPY came off its earlier highs on Friday after rising to a new multi-decade high above 161 handle. There was no intervention to be seen despite officials from Japan again threatening to do so. This kept the pressure on the yen against all other major currencies. Is so far as the USD/JPY is concerned, there was some attention on the May Core PCE index. But this data failed to move the markets much as it was bang in line with the estimates. More US economic data is to come in the next couple of weeks, with the June non-farm jobs report due on Friday, followed by the CPI report on July 11. But this weekend, there is a more pressing issue: French elections. Whether this will impact the USD/JPY forecast remains to be seen. Thus, the more likely source of support for the yen is likely to come from BoJ/MoF intervention, until such a time that the BoJ tightens it policy more aggressively.

French election uncertainty undermines French stocks

Ahead of Sunday's French elections, European markets, particularly in France, were underperforming compared to a tech-driven Wall Street. The S&P 500 reached a new record high and was on track to finish up for the fourth consecutive week. Month- and quarter-end flows in high-performing tech stocks were helping to keep US equities buoyant as we approach the second half of the year. In contrast, French stocks were under pressure as the weekend approached, with the benchmark CAC index testing its lowest levels since January. However, if the election results indicate increased support for the far-right RN party, the market could experience instability at the open in the week ahead

Could the French election impact the USD/JPY forecast?

Will this trigger a sharp move in the FX space and cause the yen to reverse its trend? Well, judging by price action in the EUR/JPY, which has basically mirrored the USD/JPY in breaking higher to multi-year high, we doubt that the yen will receive much benefit from any haven flows. However, we can’t ignore the potential for a shock outcome.

USD/JPY forecast: technical analysis

Source: TradingView.com

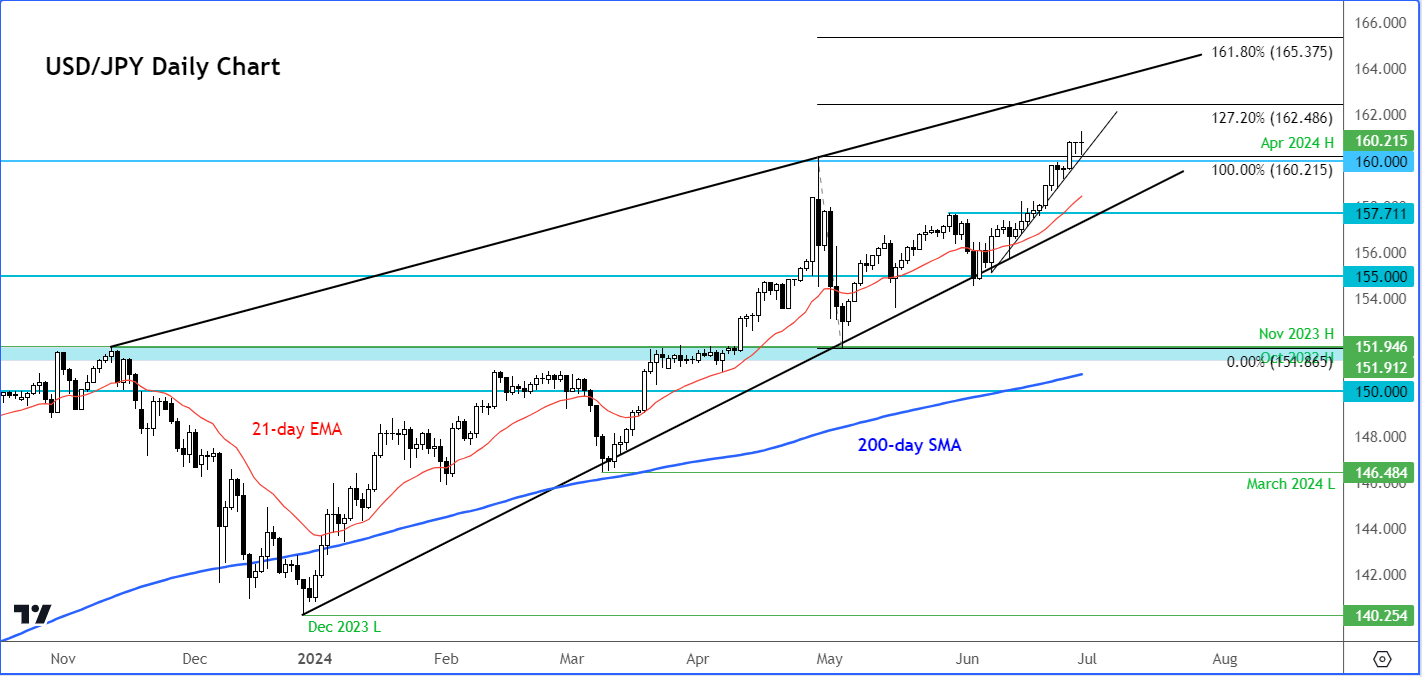

The USD/JPY reached a 38-year high after breaking above both the MOF intervention level set on April 29th and the 160 psychological handle. With the EUR/JPY and GBP/JPY rising to 32 and 26-year highs respectively, and AUD/JPY reaching a 17-year high, the pressure is intense on the yen. It will take something big to reverse this trend. Thus dip-buying in the USD/JPY and other JPY crosses remains the dominant trade.

With 160.00 broken, this is now the first line of defence for the bulls, followed by the bullish trend line at 157.70 - 158.00 area. There are no obvious resistance levels to monitor. So, watch round handles like 161.00, 162.00, etc. Meanwhile, the 127.2% Fibonacci extension of the April-May drop, near 162.50 is an additional bullish target to monitor.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R