- USD/JPY reverses sharply, reminding that two-way risks exist

- Longer-dated US Treasury yields stall near key levels

- Fed rate cut expectations pared back further

- Quiet US-Japan calendar keeps focus on price action

Overview

The sharp reversal in USD/JPY last Friday was a timely reminder that two-way risks still exist in this pair. It coincided with similar moves in other markets that had rallied hard post-Donald Trump’s victory in the US presidential election, such as stocks and US bonds.

With a light US calendar and with traders pricing the fewest Federal Reserve rate cuts seen in months, bullish momentum could struggle to extend this week. Add in signs of US Treasury yields topping out, and a retest of uptrend support can’t be ruled out in the coming days.

Fewer Fed rate cuts expected

Market pricing for Federal Reserve rate cuts continues to be scaled back across futures and swaps. A 25bps rate cut in December is now seen as a toss-up, while only three cuts are priced in by the end of 2025.

Simply put, the market has largely baked in economic resilience and the prospect of stronger growth and inflation under Trump’s administration.

Source: TradingView

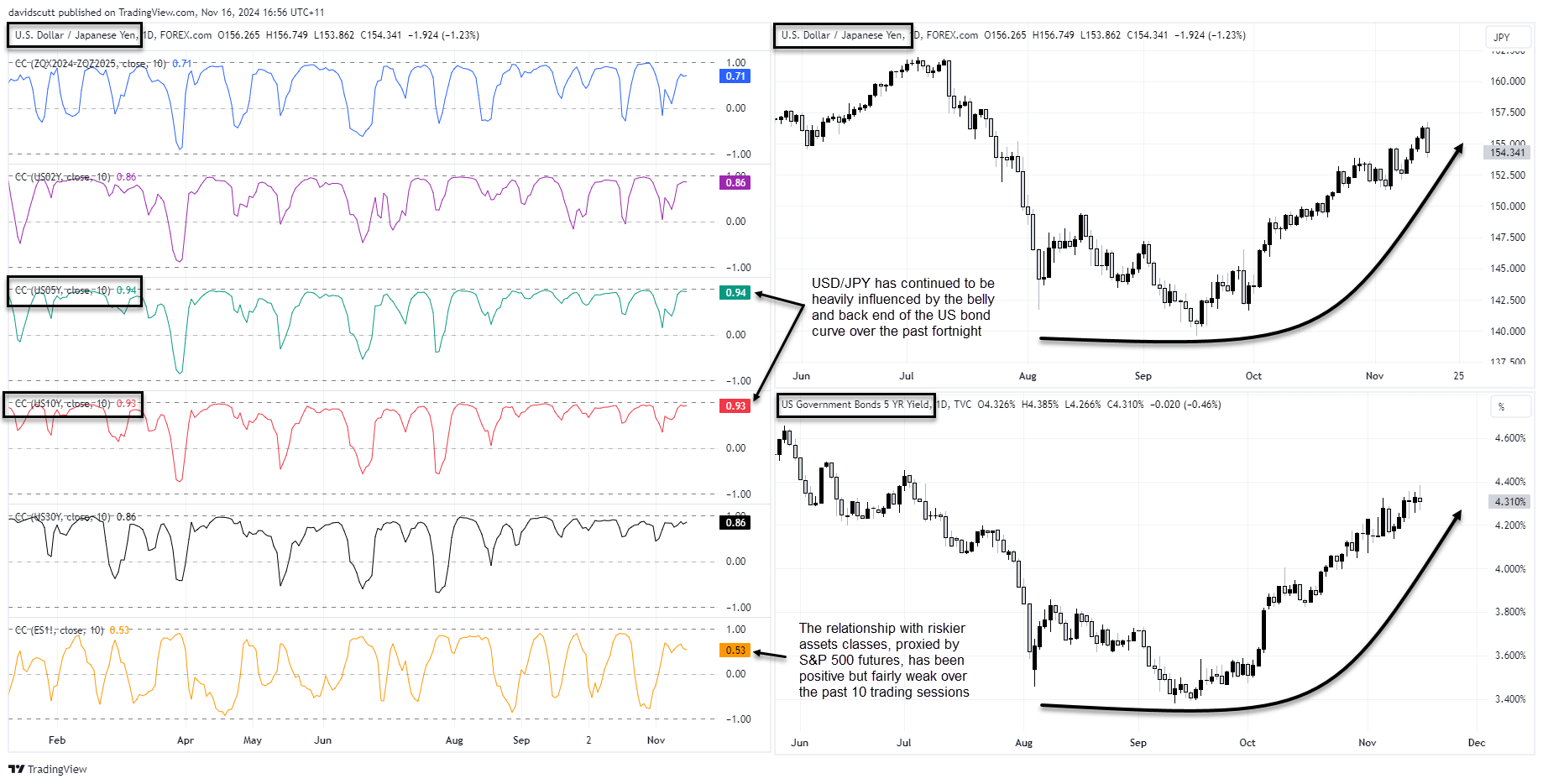

US rates dictating USD/JPY moves

The re-evaluation of the Fed rate outlook is important to remember when assessing directional risks for USD/JPY given how influential the US interest rate outlook has been on the pair recently.

US five- and 10-year Treasury yields have had the most significant impact on USD/JPY over the past fortnight, with correlation coefficients of 0.94 and 0.93, respectively. In short, they’ve almost entirely moved in lockstep.

While USD/JPY is known for being a popular choice as a funding currency for carry trades, often seeing it rise and fall in line with riskier asset classes such as stocks, right now it’s the US rate outlook that remains the dominant driver.

Source: TradingView

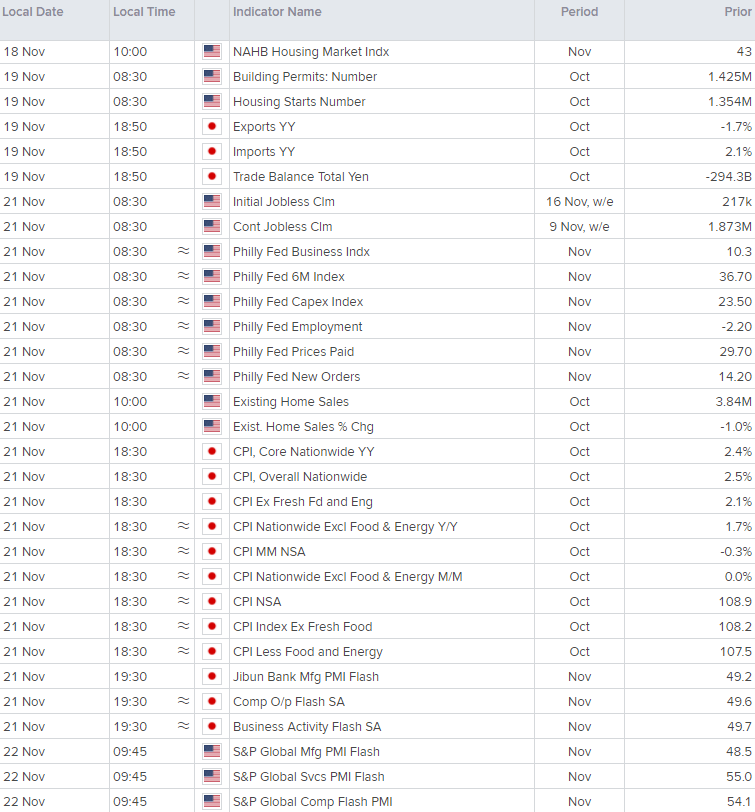

Quiet calendar points to consolidation

From a fundamental perspective, the US calendar offers little to support a move to fresh cyclical highs in interest rates this week. While there are plenty of data releases, none are pivotal to the Fed outlook.

The Japanese calendar is similarly uneventful, barring an unlikely shock in inflation data.

Source: Refinitiv

After Jerome Powell made it clear on Thursday that the pace of Fed rate cuts may slow in the coming months, it’s likely other Fed members will fall in behind the same message in the week ahead.

Source: Refinitiv

Being honest, there are no genuine signal-shifters this week.

Assessing JPY intervention risk

Japan's Finance Minister Kato issued a fresh warning to traders last Friday about the threat of intervention, stating that authorities would take action if the yen weakens excessively. Kato emphasised the importance of stable currency movements that reflect fundamentals, noting recent "one-sided, sharp" moves in the market.

While Japanese officials are closely monitoring the yen, the Bank of Japan is only likely to intervene on behalf of the Ministry of Finance if dollar strength isn’t accompanied by rising US Treasury yields. If yields remain subdued, the case for intervention becomes stronger to curb speculative moves, but if yields climb in tandem, authorities might be more hesitant to step in.

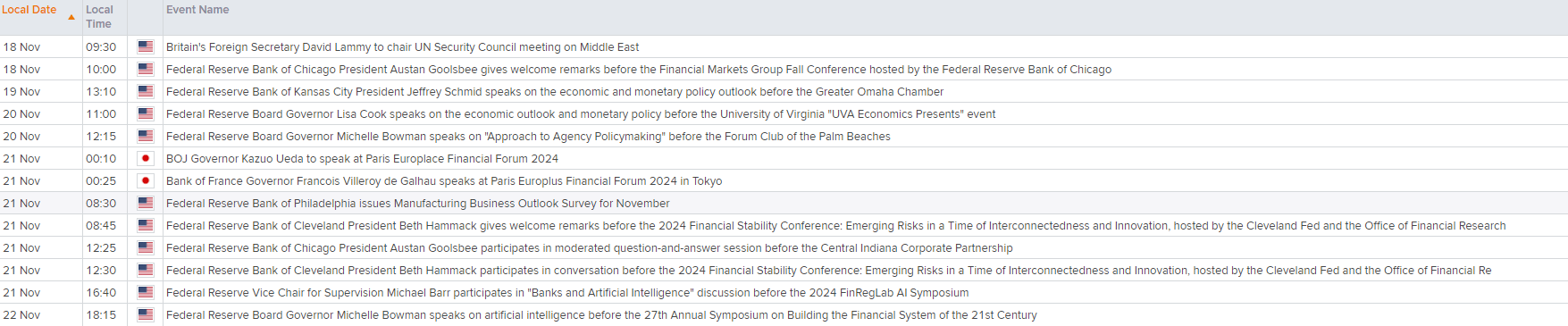

US rates may struggle to push higher

Adding to the sense that it may be difficult for US Treasury yields to push higher this week, the technical picture for US 10-year Treasury note futures continues to point to the presence of dip buyers, as annotated in the chart below.

Source: TradingView

Sure, the price signal provided the week before last proved to be false on directional risks for 10-year Treasury yields last week, seeing them briefly hit multi-month highs, but the dip below 112 was again bought, continuing the pattern seen this year.

Given recent price action and the quiet economic calendar, will traders be willing to probe even deeper lows in the near-term? Maybe, but the risk-reward does not screen as great despite momentum indicators continuing to favour a bearish bias.

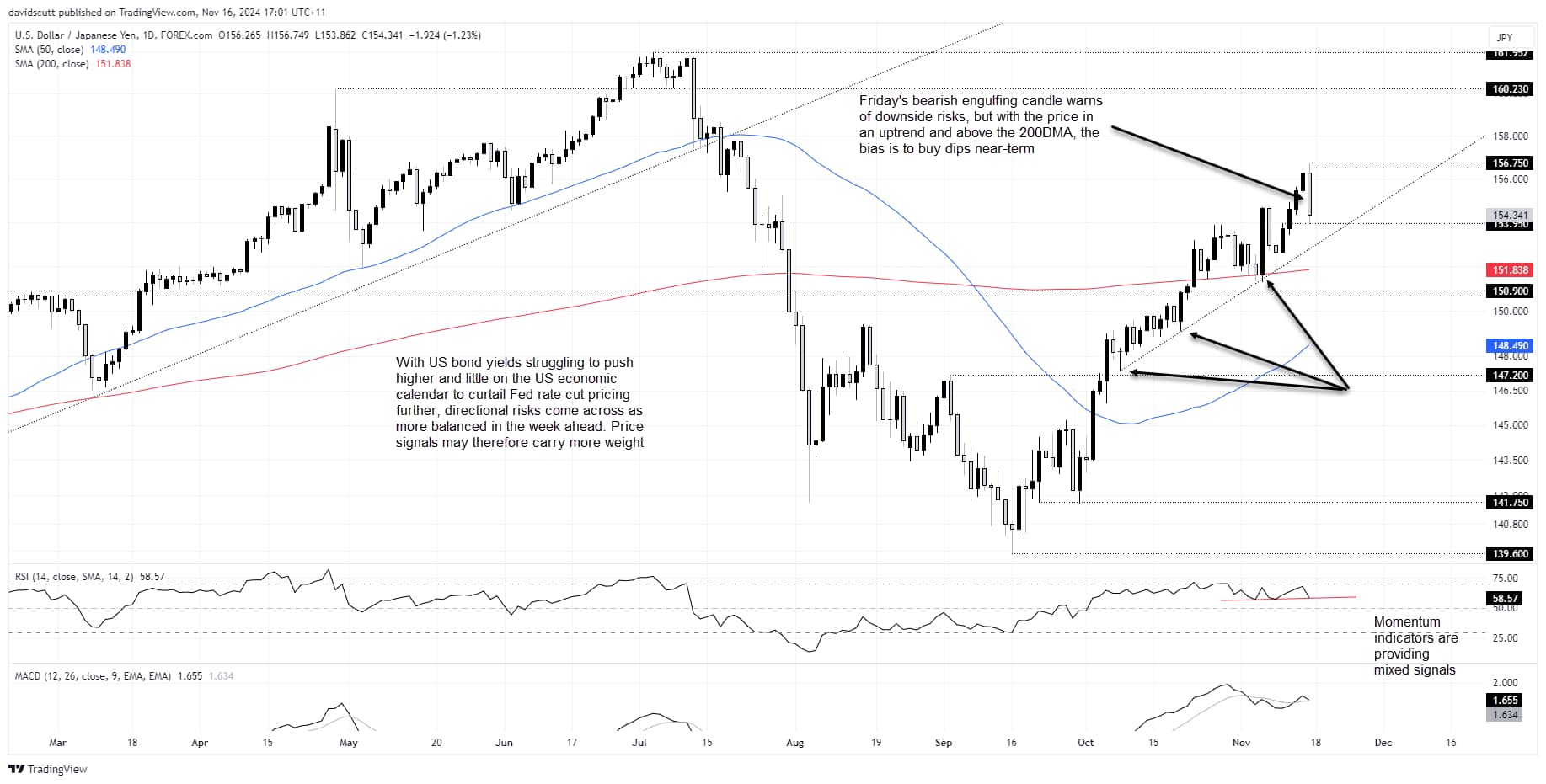

USD/JPY: buying dips preferred

Source: TradingView

Despite Friday’s bearish engulfing candle on the USD/JPY daily chart, the bias remains to buy dips near-term with the price remaining in an uptrend, above the 200-day moving average, and with momentum indicators providing no definitive signal.

With a quiet calendar, more weight should be put on price signals this week.

Key levels to watch include:

Support: 153.95, uptrend support around 153, 200-day moving average and 150.90

Resistance: 156.75, 160.23, 161.95

-- Written by David Scutt

Follow David on Twitter @scutty