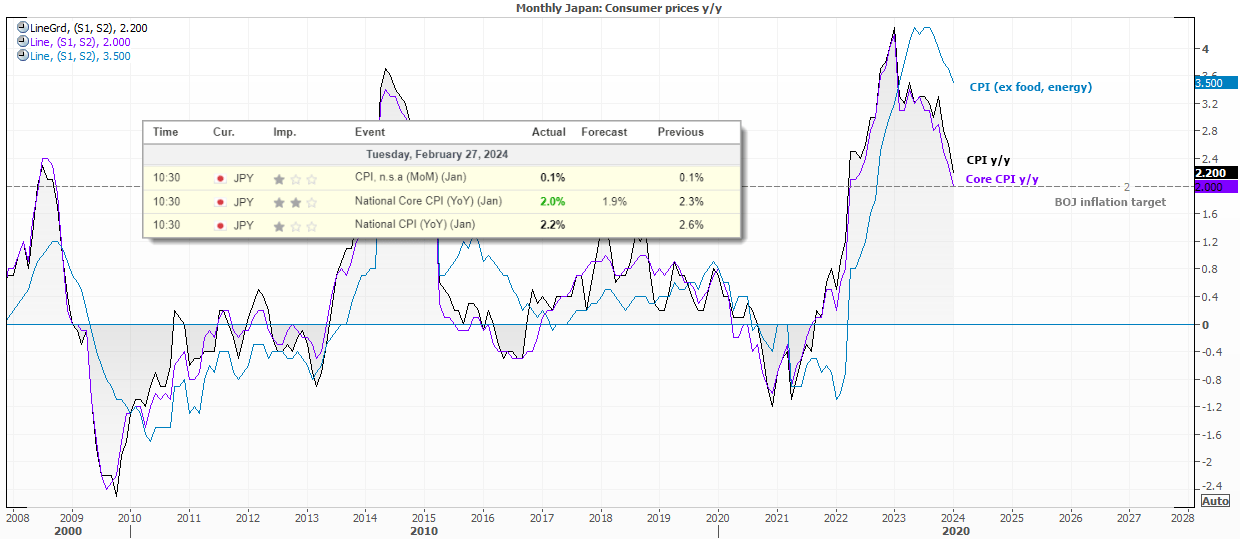

There were hopes that core CPI for Japan was to fall below the BOJ’s 2% target, given Tokyo’s annual rate of core CPI slowed to 1.6% y/y (1.9% expected). Yet it was not meant to be, with core CPI at the rate of the BOJ’s target of 2% y/y. It was at least slower than 2.3% y/y previously, yet a Reuters poll estimated a drop to 1.8%.

CPI is still above their BOJ’s target at 2.2% y/y, and clearly fresh food and energy remain a sticking point for consumer prices having risen 3.5% y/y. It therefore seems unlikely the BOJ will want to hike rates as soon as Q2 with some measures of inflation remaining elevated. Besides, annual wage negotiations are still underway in Japan and that is arguably the bigger headline to watch given its potential to drive consumer prices higher.

Japan’s fiscal year begins in April, and spring wage negotiations (or “Shunto”) are underway. A trade union official for Rengo has said they’re pushing for a 5% wage increase for their members, which is already more than twice the rate of inflation. Honda have agreed to increase wages by 5.6% alongside a bonus equivalent to seven months pay, whilst Mazda look set to increase ages by 6.8%.

And if such figures are to be widespread across Japan’s economy, it certainly builds the case for the BOJ to finally hike interest rates.

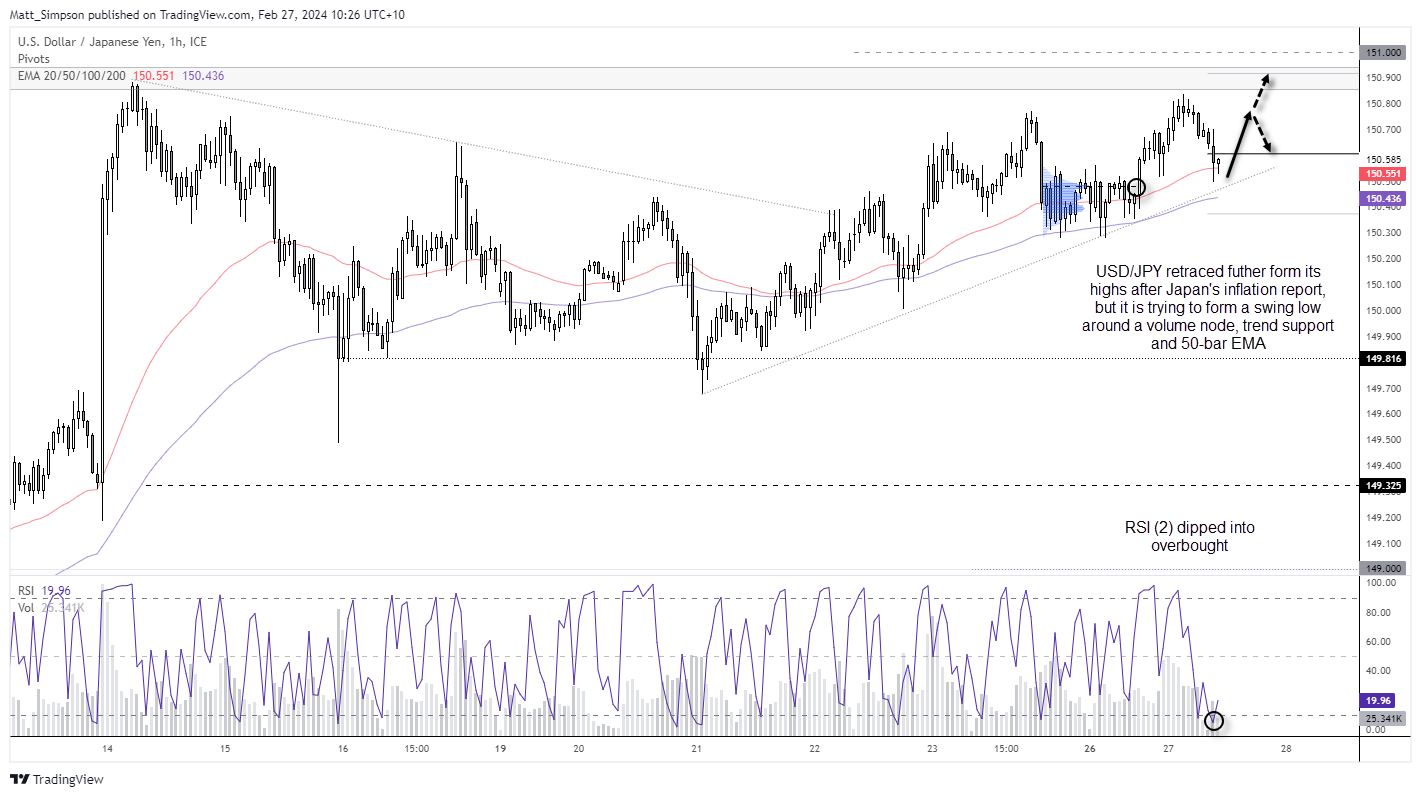

USD/JPY technical analysis:

Source: TradingView, ICE / Intercontinental Exchange, Inc

The above-estimated CPI print saw USD/JPY fall ~20 pips, which is by no means a particularly big move. But it has helped the pair retrace further from its highs as we head closer towards the key US PCE inflation report later this week. Technically, I am now seeking evidence of a swing low for a potential swing trade long on the 1-hour chart.

Prices remain trend support, and today’s low stalled just above a volume node from a prior congestion zone. Low-volatility retracements towards today’s low could be appealing for dip buyers, who anticipate for prices to break above the weekly pivot point.

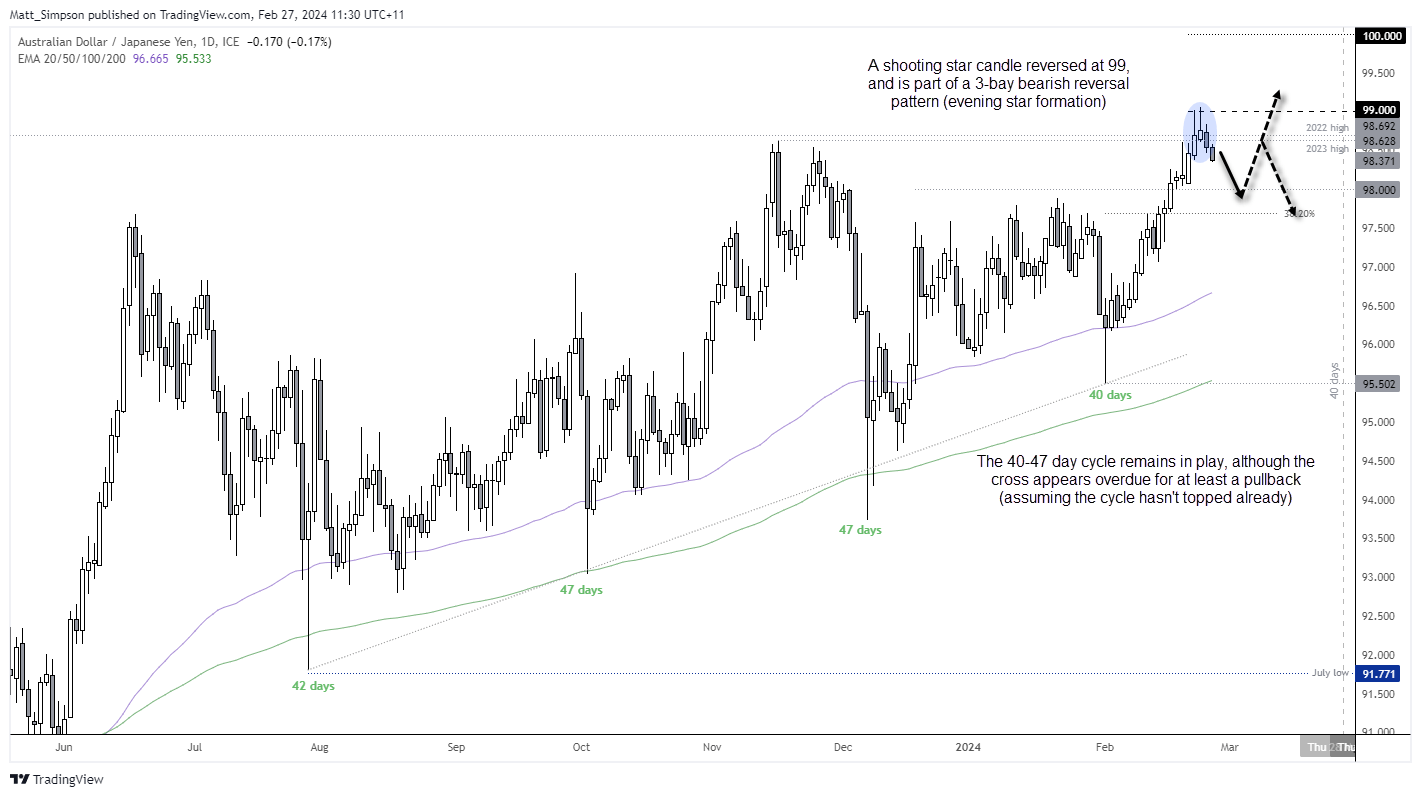

AUD/JPY technical analysis:

The 40-47 day cycle on AUD/JPY remains alive and well, although its relatively straight rally into 99 suggests it could be due a pullback. A shooting star day reversed at this key level and forms part of a 3-day bearish reversal pattern (evening star formation). Momentum has turned lower for a second day, as a retracement lower now seems to be underway. Bulls could either step aside and seek evidence of a swing low around 98 or the 38.2% Fibonacci level. Alternatively, countertrend bears could seek bearish continuation patterns on intraday timeframes and seek to trade the actual reversal lower. Any low volatility rises to the 2022/2023 highs could also be monitored for evidence of a wing high / lower high on a lower timeframe for a potential short.

Source: TradingView, ICE / Intercontinental Exchange, Inc

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge