- China A50, CNH, iron ore futures reverse hard on Monday

- Reversals coincide with further weaker Chinese economic data

Hopes < Reality

The Chinese yuan and equity markets were flying last Friday, gaining ground on speculation policymakers may allow households to refinance their mortgages at substantially lower levels, unlocking a potential wave of discretionary spending that could help arrest sluggish consumer spending and reignite appetite for property. However, fast forward a few days and we’ve seen no official announcement, but what we have seen is more evidence that China’s property market downturn continues to weigh on the broader economy.

China PMIs remain historically weak

According to latest purchasing managers indices (PMIs) released by China’s National Bureau of Statistics on Saturday, manufacturing activity contracted at faster pace in August, falling to 49.1 from 49.4. Markets had expected a small increase to 49.5.

Final prices for customers continued to weaken, plunging to 42.0 from 46.3, the most widespread deflationary reading in14 months. New orders and new export orders declined leading to firms continuing to shed staff.

Activity in non-manufacturing sectors also struggled, rising 0.1 to 50.3, remaining at lows not seen outside the onset of the coronavirus pandemic when large parts of the country were locked down.

PMIs measure business activity relative to the previous month, evaluating shifts in output, hiring, new orders, exports, delivery times, inventories and overall business sentiment. A score above 50 indicates improvement while a figure below 50 points to a decline. The further away from 50, the greater the breadth of improvement or deterioration.

The soft outcomes likely reflect continued sluggishness in China’s residential property sector where around 70% of total household wealth is stored. With prices going backwards in many parts of the country, it is weighing on household spending through a negative wealth effect.

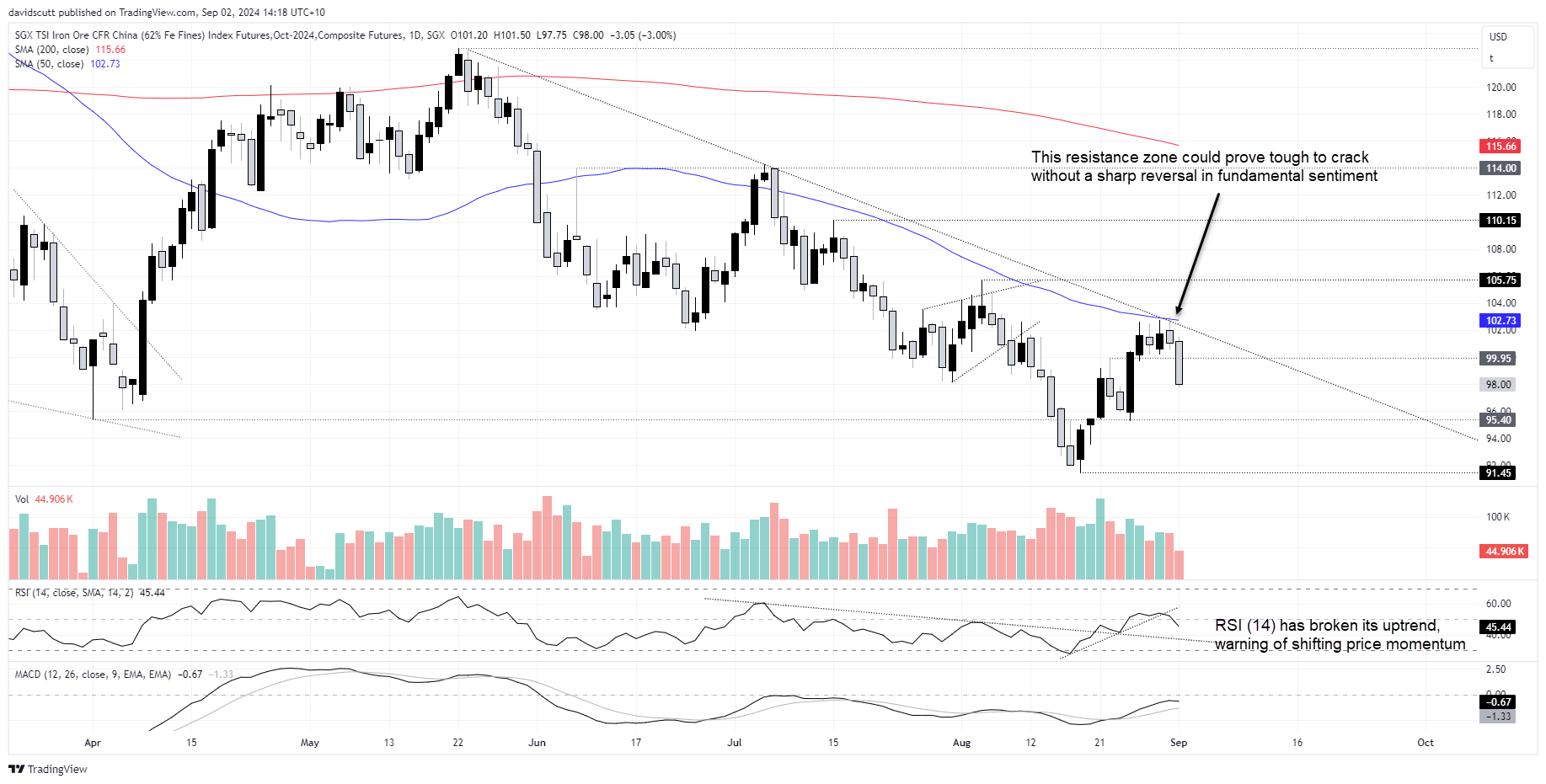

Separate data from China Real Estate Information Corporation released today revealed the value of new home sales slumped 26.8% in August relative to the same period a year earlier, accelerating from the 19.7% decline reported in July. Given Chinese residential construction was for a long period the single largest source of steel demand globally, it comes as little surprise that SGX iron ore futures have been hammered on Monday, losing 3%.

The crux of the problem

So many of China’s economic ills can be traced back to the property market, so to get excited about a meaningful bounce in Chinese stocks or yuan, it will likely require some form of circuit-breaker to dissolve pessimism surrounding the prospects for housing demand and prices. As yet, there’s no sign of that, just pockets of short-term speculation that temporarily lift the funk.

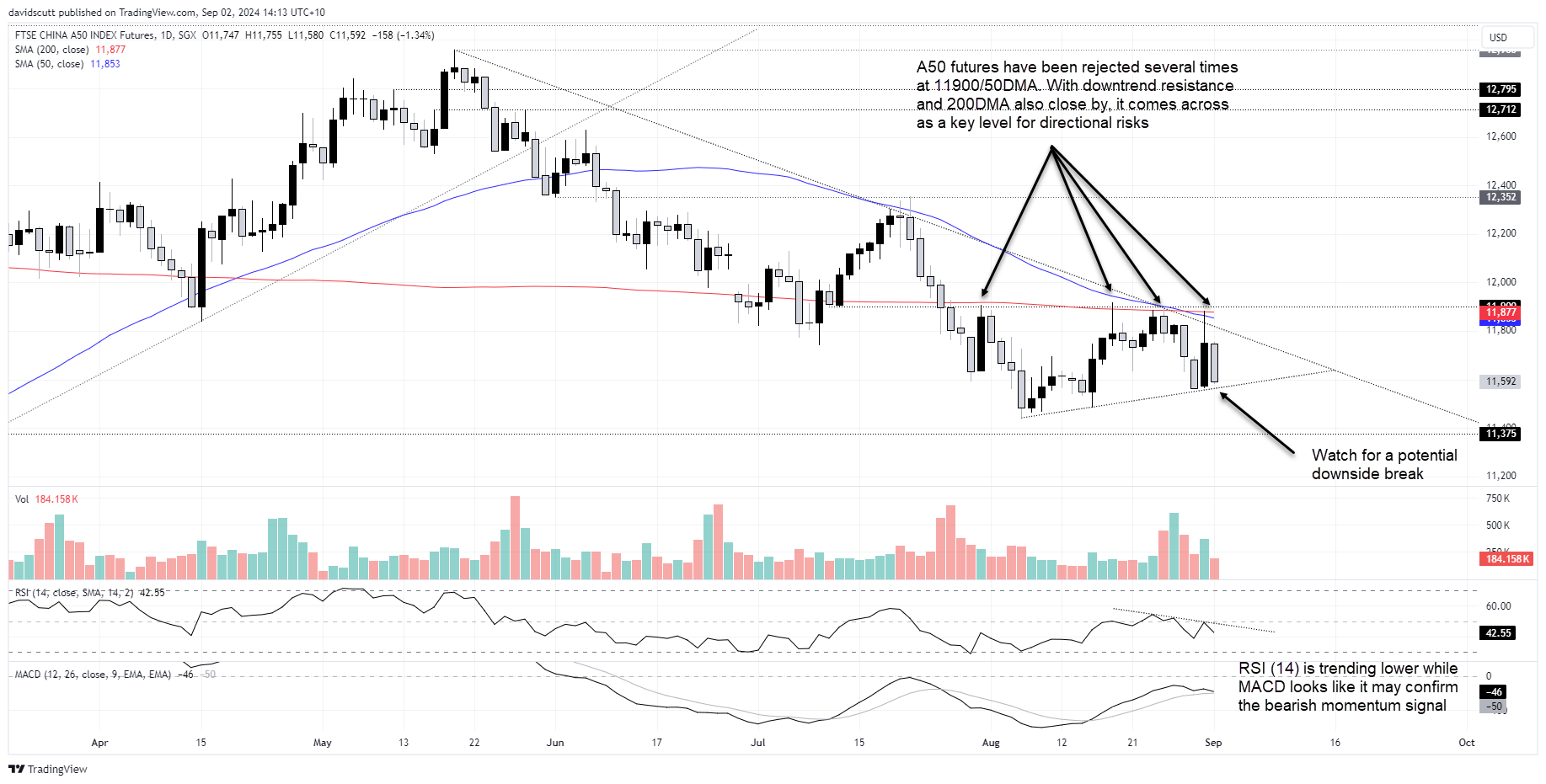

China A50 reverses hard from key zone

The rejection of China A50 futures at the 50 and 200-day moving averages following the failed bullish breakout last Friday likely contributed to the selling pressure we’ve seen on Monday, seeing the price move back towards minor uptrend support. The reversal on the back of big trading volume, while not outright bearish from a signaling perspective, suggests sellers are parked around 11900, a view bolstered by the rejection of previous bullish advances earlier in the year.

With RSI (14) in a downtrend and MACD looking like it may soon confirm the signal, traders should be on the lookout for a downside break of uptrend support, bringing a potential retest of the August 6 low of 11440 into play.

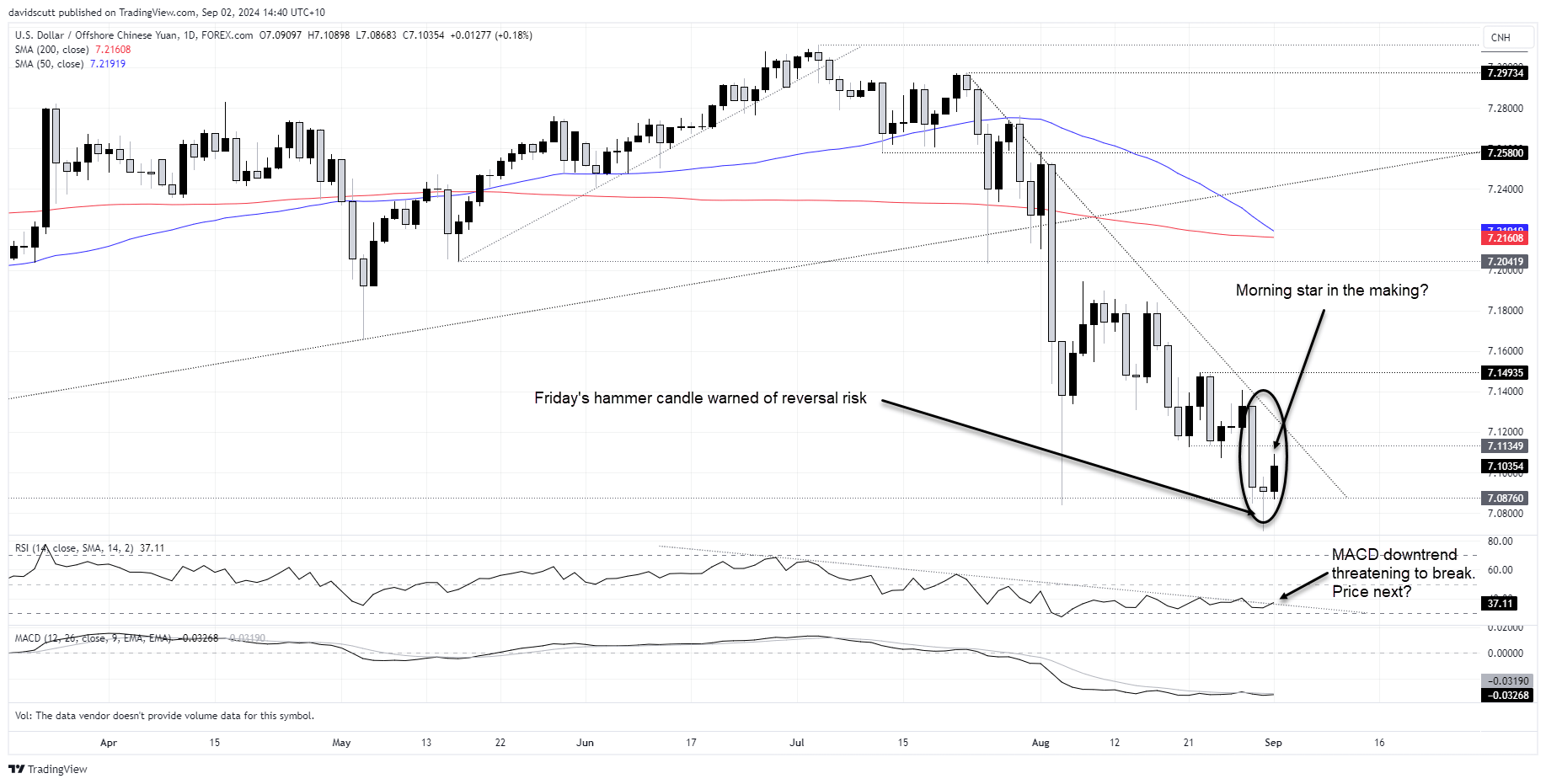

Bottoming signals emerge for USD/CNH

Much like Chinese stock futures, the reversal in USD/CNH last Friday likely contributed to the price action we’ve seen today. The big bearish candle from Thursday followed by a hammer candle on Friday has been followed by another bullish candle today, delivering what’s bordering on becoming a morning star pattern often seen around market bottoms. With RSI (14) threatening to break the downtrend it’s been in for the past two months, traders should be alert for a potential bullish breakout for price.

If it manages to break and hold above the downtrend dating back to mid-July, 7.14935 would be the first level of note for longs. Above, the price stalled above 7.1800 on multiple occasions in August, making that a resistance zone of note, with 7.20419 the next topside level after that. On the downside, the price has been bought on each of the past four occasions that 7.0876 has been breached, making that the first level of support.

SGX iron ore rejected at 50DMA

SGX iron ore futures have opened the new week on the backfoot, sliding heavily upon the resumption of trade in Asia after closing flat on Friday evening. With RSI (14) generating a bearish signal on price momentum, the break of $99.95 today may open the door to a deeper flush towards $95.40 or even the August 19 low of $91.45.

The constant rejection of the price last week on advances towards the 50-day moving average, coinciding with the location of downtrend resistance dating back to May, warns that bullish moves above this level may be difficult to achieve in the absence of a sharp turnaround in fundamental sentiment.

-- Written by David Scutt

Follow David on Twitter @scutty