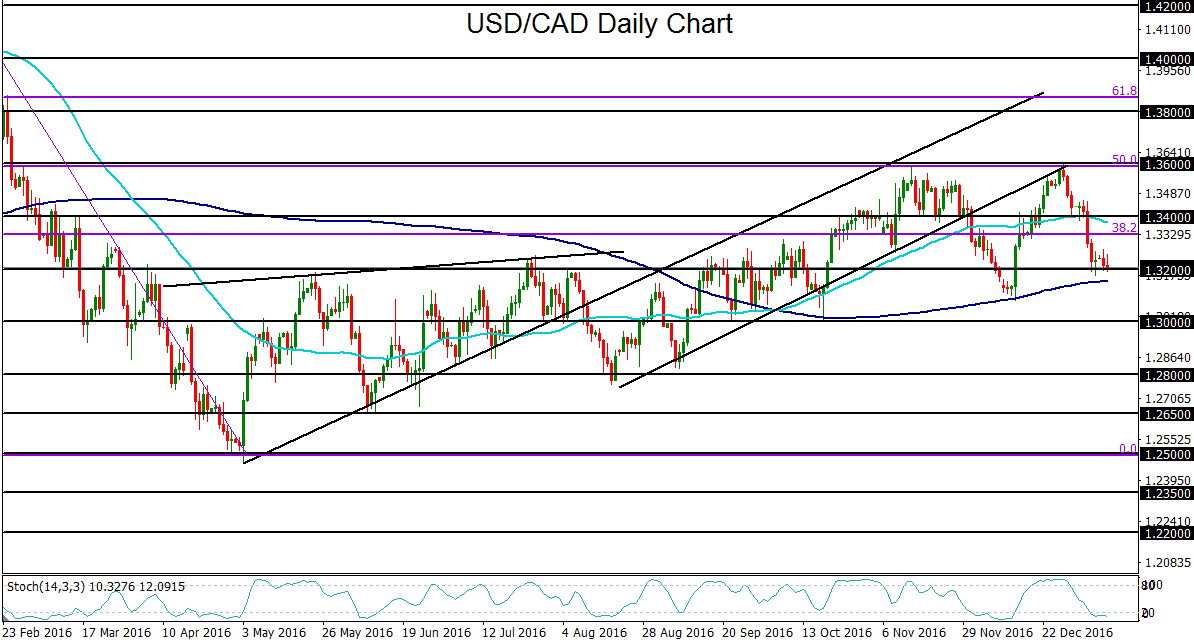

Up until late last week, USD/CAD had been falling sharply from the key 1.3600 resistance level as the US dollar’s strong uptrend had begun to falter and the Canadian dollar had been boosted by surging crude oil prices. Market optimism that the new year would bring lower oil production among major OPEC and non-OPEC oil producers was prompted by successful agreements reached late last year to coordinate output cuts. This optimism led to a strong rally for crude oil prices throughout much of December, which helped push up the oil-linked Canadian dollar and pressure USD/CAD.

Fast forward to the second week of 2017 – the US dollar continues to stall, keeping USD/CAD grounded for the time being, while optimism over the production deal has already begun to meet some challenges. As widely suspected during last year’s talks among oil-producing countries to cut output, a major obstacle to effectively stabilizing oil prices under the deal would be the key factor of US and Canadian production. This is especially the case since the incoming Trump Administration has been strongly supportive of increased US energy production. Indeed, US drilling companies added rigs for the 10th consecutive week last week. This was on top of the substantial increase in rigs seen in Canada.

Therefore, there has been a clear indication that despite the OPEC deal having been reached, the US and Canada are more than ready and willing to pick up the slack as oil prices rise, or at least remain elevated. And this is on top of the fact that there is still much uncertainty as to how well participants of the OPEC agreement can or will adhere to their end of the deal. This potentially creates a fundamental barrier to much higher oil prices that has thus far prompted a sharp pullback in the crude oil benchmarks this week.

Partly as a result of this pullback, the rally in the Canadian dollar has stalled, and USD/CAD has tentatively paused its slide at key support around the 1.3200 level. This also places the currency pair just above support provided by its 200-day moving average. If the markets continue to express concern over the effectiveness of the OPEC deal, and the US dollar remains relatively well-supported on the anticipation of higher interest rates under the new Trump Administration and a more hawkish Federal Reserve, USD/CAD could see a bounce from around its current support structure. In the event of such a rebound, a key upside target resides around the 1.3400 resistance level. In a contrasting scenario, however, any major technical breakdown below 1.3200 support on renewed crude oil optimism could send the currency pair down towards 1.3000 psychological support.

Fast forward to the second week of 2017 – the US dollar continues to stall, keeping USD/CAD grounded for the time being, while optimism over the production deal has already begun to meet some challenges. As widely suspected during last year’s talks among oil-producing countries to cut output, a major obstacle to effectively stabilizing oil prices under the deal would be the key factor of US and Canadian production. This is especially the case since the incoming Trump Administration has been strongly supportive of increased US energy production. Indeed, US drilling companies added rigs for the 10th consecutive week last week. This was on top of the substantial increase in rigs seen in Canada.

Therefore, there has been a clear indication that despite the OPEC deal having been reached, the US and Canada are more than ready and willing to pick up the slack as oil prices rise, or at least remain elevated. And this is on top of the fact that there is still much uncertainty as to how well participants of the OPEC agreement can or will adhere to their end of the deal. This potentially creates a fundamental barrier to much higher oil prices that has thus far prompted a sharp pullback in the crude oil benchmarks this week.

Partly as a result of this pullback, the rally in the Canadian dollar has stalled, and USD/CAD has tentatively paused its slide at key support around the 1.3200 level. This also places the currency pair just above support provided by its 200-day moving average. If the markets continue to express concern over the effectiveness of the OPEC deal, and the US dollar remains relatively well-supported on the anticipation of higher interest rates under the new Trump Administration and a more hawkish Federal Reserve, USD/CAD could see a bounce from around its current support structure. In the event of such a rebound, a key upside target resides around the 1.3400 resistance level. In a contrasting scenario, however, any major technical breakdown below 1.3200 support on renewed crude oil optimism could send the currency pair down towards 1.3000 psychological support.

Latest market news

Today 05:30 PM

Today 04:41 PM

Today 04:30 PM

Today 02:15 PM

Today 02:07 PM