US futures

Dow futures +0.23% at 33819

S&P futures +0.5% at 4036

Nasdaq futures +0.97% at 11913

In Europe

FTSE +0.47% at 7777

Dax +0.14% at 15109

US Q4 GDP rises 2.9%

US stocks are rising, recovering from weakness in the previous session, thanks to a Tesla-inspired tech bounce and as investors digest the first look at how the US economy performed in Q4.

Tesla’s record numbers have provided some much need respite after Microsoft’s’ dire sales outlook and weak revenue growth. This changes the narrative slightly, and while earnings haven’t been great, they haven’t been completely disastrous either, which has helped buoy the market mood.

Meanwhile, today’s US data dump showed that the US economy was faring better than expected at the end of 2022.

US Q4 GDP grew 2.9%, down from 3.2% in Q3 but ahead of forecasts of 2.6%. Durable goods also jumped in December, rising 5.6%, up from -1,7%.

While the US economy is proving to be stronger than expected, it doesn’t appear to be resetting expectations of a more restrained Federal Reserve, as stocks hold onto gains. This could be because personal consumption, which is the largest part of the economy, rose at a slower-than-expected 2.1%. This points to some signs of stress for US consumers amid high inflation and rising interest rates.

Investors will look towards tomorrow’s core PCE data for further clues over the Fed’s next steps.

Corporate news

Tesla trade 7% higher premarket after reporting record quarterly results. The EV maker reported EPS of $1.19 ahead of the $1.13 forecast and posted a 37% rise in revenue YoY. Elon Musk said that the firm could deliver up to 2 million vehicles this year, thanks to price cuts and despite the challenging economic backdrop.

IBM reported Q4 results with EPS of $3.60, which was ahead of estimates of $3.58. This was achieved on revenue of $16.7 billion, ahead of the $16.13 billion forecast. Shares trade 3% lower pre-market.

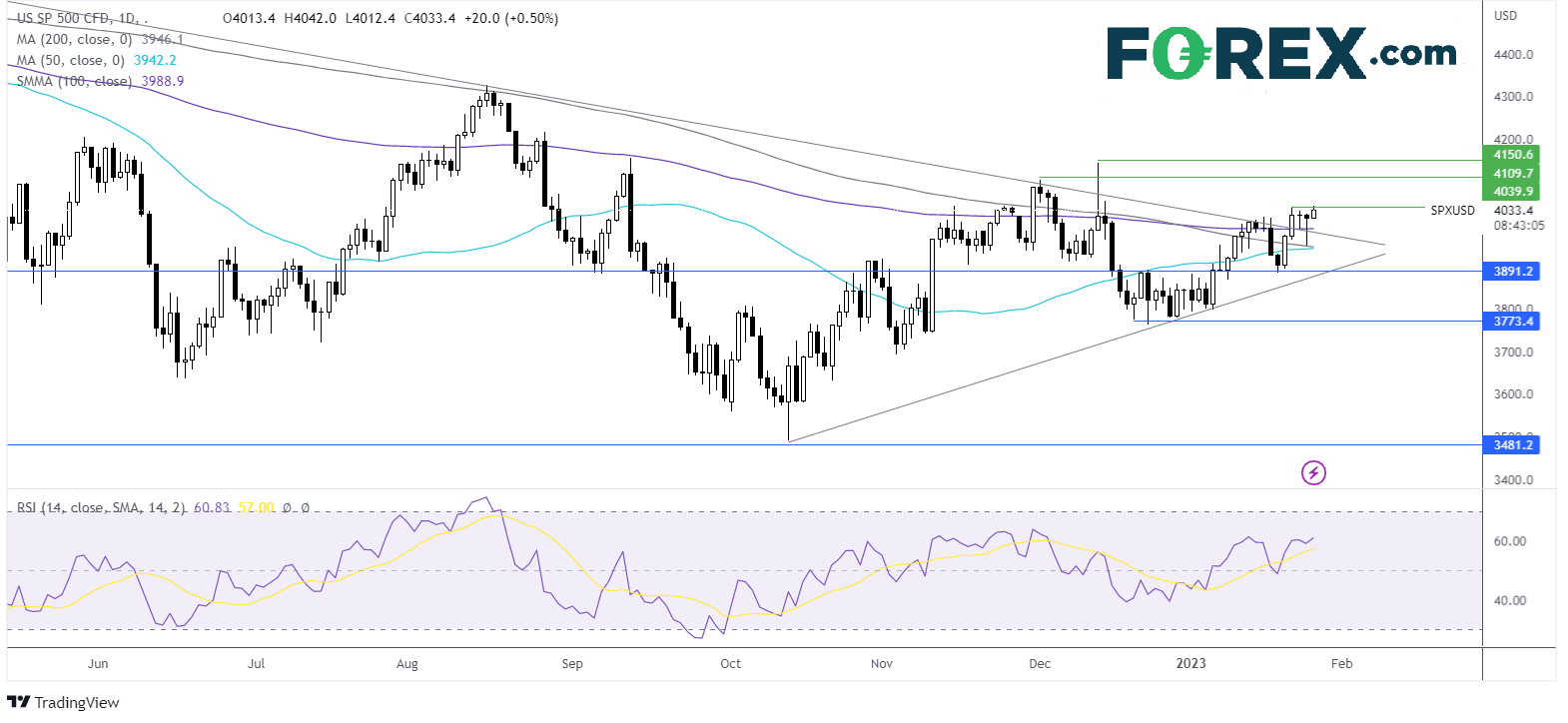

Where next for the S&P500?

After finding support on the 200 sma yesterday, the price has rebounded higher and is testing the 2023 high of 4040. The long lower wick on yesterday’s candle suggests that there was little appetite at the lower price, which along with the bullish RSI keeps buyers hopeful of further upside. A break above 4040 could see the price look towards 4110, the December 1 high, ahead of 4150 the December high. Sellers could look for a fall below 3985, the multi-month falling trendline, ahead of the 200 sma at 3945.

FX markets – USD rises, EUR falls

The USD is rising as investors digest the latest GDP data and look ahead to tomorrow’s core PCE inflation print.

GBP/USD trades just below 1.24 as investors look ahead to the BoE interest rate decision next week. The central bank is widely expected to raise rates by 50 basis points as inflation remains in double digits.

EUR/USD is heading modestly lower but continues to hover around 9-month highs. A quiet eurozone economic calendar and rising geopolitical tension are limiting the upside for the euro. News that the allies are providing tanks to Ukraine could see tensions with Moscow escalate.

AUS/USD +0.63% at 0.7088

EUR/USD -0.2% at 1.0868

Oil rises after inventories rise by less than expected

Oil prices are rising amid ongoing optimism that the reopening of the Chinese economy will lift oil demand and after US crude inventories rose less than expected.

The China reopening story has helped oil prices rise From the December low of $70 a barrel to current levels of just over $80 a barrel. Should the reopening prove to be orderly, and cases not spike too high following the lunar new year travel, there could be some more upside for oil.

US crude inventories rose by 533,000 barrels to 448.5 million barrels in the week ending January the 20th. This was below the expected 1,000,000 barrel increase.

Attention will now be turning toward the OPEC meeting, which is due to take place on February the first. The group of oil producers is not expected to adjust output.

WTI crude trades +1.3% at $81.00

Brent trades at +1.05% at $87.17

Looking ahead

15:00 US New home sales