US futures

Dow futures +0.38% at 36460

S&P futures +0.18% at 4705

Nasdaq futures +0.05% at 16361

In Europe

FTSE -0.1% at 7297

Dax -0.09% at 16026

Euro Stoxx -0.11% at 4357

US infrastructure bill passed

US stocks are heading higher as investors continue digesting Friday’s strong October employment report and lifted by the passing of the US infrastructure bill.

Late on Friday, the House of Representatives passed the long-delayed infrastructure spending bill worth around $1 trillion. The bill includes spending on roads, bridges broadband access and water systems and is expected to give a boost to economic growth and create more jobs.

Prior to the bill passing US non-farm payroll numbers come in ahead of expectation of at 531k, and September’s payroll was upwardly revised to 312k. The data was a move in the right direction but not strong enough to prompt expectations of a sooner hike by the Fed.

Looking ahead Fed speak will be in focus with Fed Chair due to speak later today. Investors will be listening for clues on the timing of a rate hike.

Tesla drops as Musk considers selling 10% of stake

Tesla is trading over 4% lower pre-market after Elon Musk indicated that he could sell 10% of his stake. This is just the latest big swing in the stock which has been on a rollercoaster ride over the past few weeks. The stock surged 12% on news of an order from Hertz EV’s before paring some of those gains on a tweet from Musk that he hadn’t signed such a deal. The latest tweet from Musk comes following a Democrat proposal to tax unrealized stock gains.

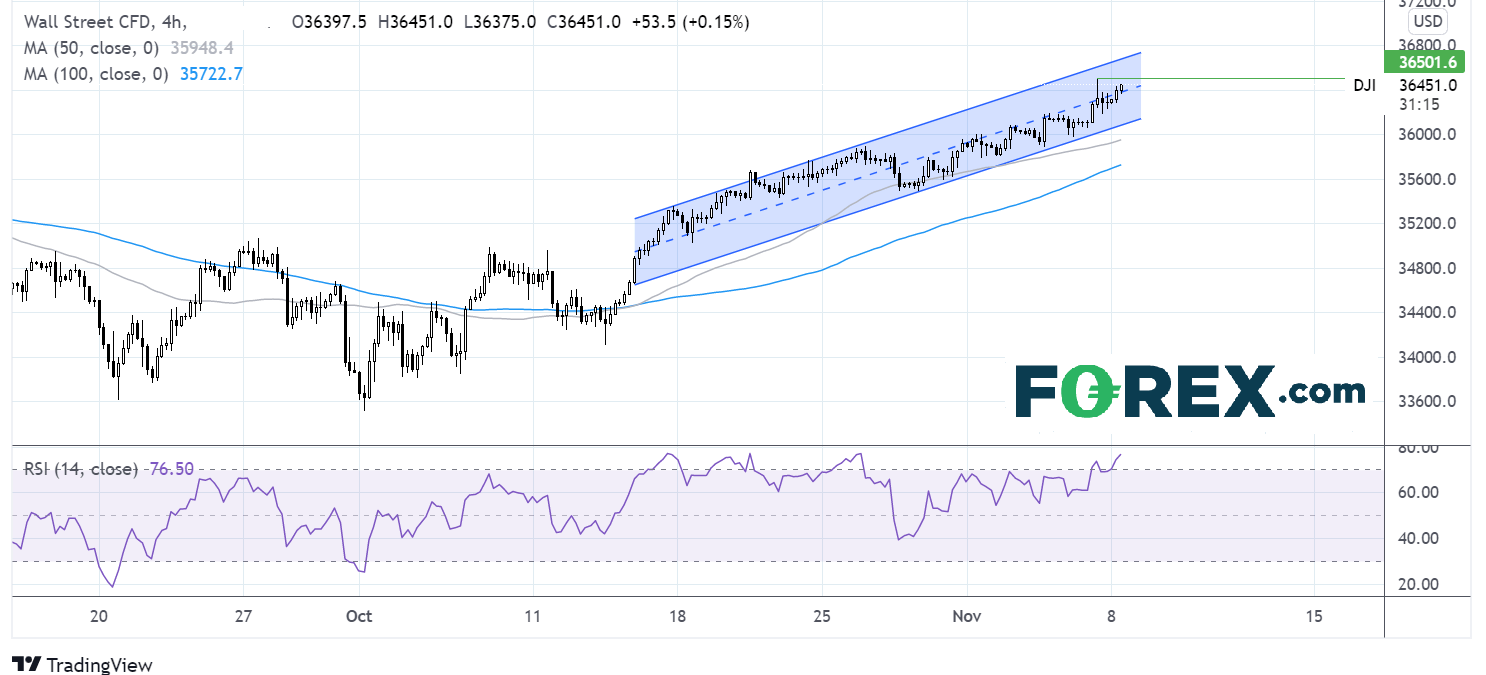

Where next for Dow Jones?

The Dow Jones is trading within an ascending channel pushing to fresh all time high. The RSI is in overbought territory on the 4 hour chart so there could be some consolidation or an ease back in the price. Resistance can be seen around 36500 the all time high ahead of 36700 the upper band of the rising channel. Support is seen at the 50 sma around 36000 it would take a move below here to negate the near term uptrend.

FX – USD extends gains, GBP eyes 2021 low

US Dollar is easing lower paring gains from the previous week after US non-farm payroll beat forecasts with 531k jobs added in October and an upward revision to September’s NFP to 312k. Yet the USD drifts lower on the Fed’s insistence that the rise in inflation is transitory. Fed speakers are in focus.

EUR/USD is trading relatively flat despite Eurozone investor confidence rising after 3 straight months of declines. Investor sentiment rose to 18.3 rebounding a from 16.9 a six month low. It would take a move over 1.16 for buyers to take control

GBP/USD +0.25% at 1.3531

EUR/USD +0.09% at 1.1576

Oil rises on global growth signals

Oil prices are on the rise amid upbeat signs regarding the global economy. Firstly the passing of the US infrastructure bill is expected to bring with it a boost for economic growth and lift fuel demand. Furthermore, China, the world’s second largest economy reported record export data suggesting that global demand is high, another encouraging sign for the global economy.

Meanwhile state-owned producer Saudi Aramco raised the official selling price of its crude amid expectations of tight supply continuing.

WTI crude trades +0.65% at $80.81

Brent trades +0.4% at $82.85

Looking ahead

N/A

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.